Table of Contents

Commodity markets in August 2025 are in the middle of a significant, undeniable, uptrend. Prices of all commodities from gold and silver to platinum, copper, and obscure rare earth metals are soaring, with many at or near all-time highs (ATH).

And evidence suggests this is not the end of the story but potentially the midpoint of a “commodity supercycle”. Perhaps one that wasn’t seen previously in modern history, with the exception of major events such as world wars or the industrial revolution.

A unique combination of macroeconomic structural changes, geopolitical frictions, and massive, tech-lead demand shifts is driving this cycle forward.

Key drivers include:

- Macroeconomic forces. Higher inflation and a weaker U.S. dollar have strengthened the appeal of physical assets. Investors are hedging risk by moving into commodities, especially gold.

- Geopolitics. Trade disputes, sanctions, and export bans are playing a pivotal role in the availability of metal supply. It’s mainly China’s restrictions on technology metals that tighten supply amidst a demand boom. Add the Russia-Ukraine war that has been going on for more than 3 years and can expand into Europe, and a 7 front-war for Israel in the middle-east, and you will see instability that is unprecedented and could further deepen China’s aspirations in Taiwan.

- The energy transition. EVs, renewable power, and grid expansion require significantly more copper, nickel, lithium, and rare earths than legacy technologies. Demand is running well ahead of supply. The AI revolution has bolstered the need for microchips that rely on scarce metals like Germanium which are sourced in China.

- Supply constraints. Years of underinvestment in mining and relying on China as a supplier, have curbed domestic supply to almost nil. If you layer in resource nationalism, tariffs, and licensing requirements, global supply is almost non-existent.

Those circumstances are leading us to a situation where demand overshadows supply for almost any metal currently.

Precious metals: gold and silver as anti-volatility hedge

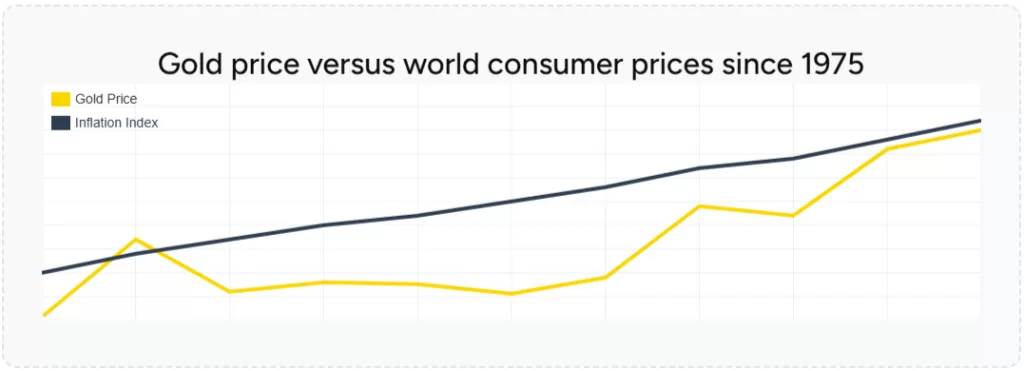

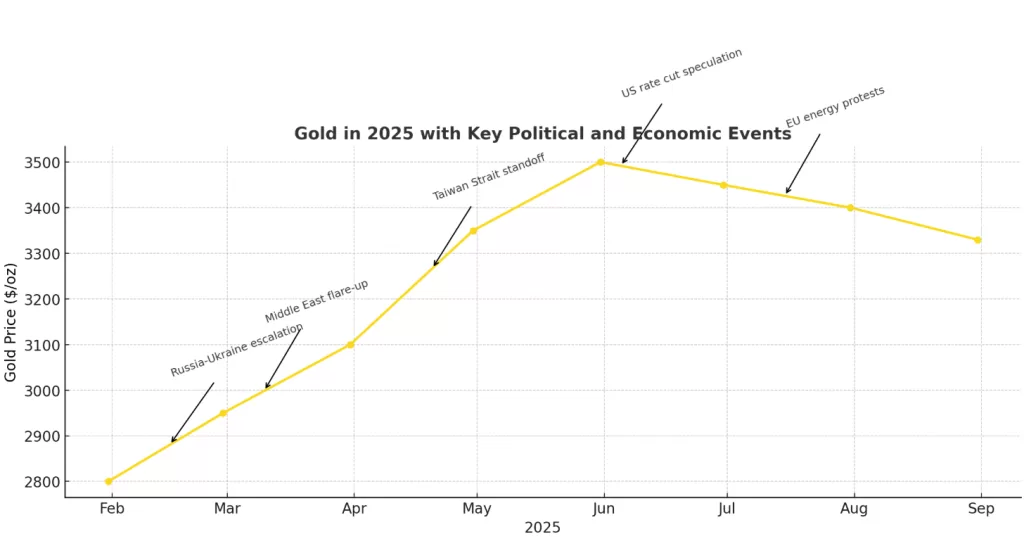

Gold has risen more than 25 percent since January and broke above 3500 dollars an ounce in spring before settling around 3300 to 3350 in August. A very strong correlation between its price and inflation, historically. Central banks are buying more, investors are holding physical gold, and demand from ETFs continues.

Gold climbing historically with inflation (source: https://earthrarest.com/precious-metals/)

Gold climbing with global instability (source: ChatGPT)

Silver has moved even faster. It started the year at 23 dollars and climbed to almost 40 in July. Today, it still trades close to that level. Silver is both a safe haven investment and an industrial metal needed in solar, electronics, and medical technology. That mix of uses has created a strong pull on supply.

Platinum group metals: following the golden path

Platinum has gained more than 40 percent this year to above 1250 dollars. Auto companies are shifting from palladium to platinum in catalytic converters, jewellery buyers are switching to platinum as gold becomes expensive, and new uses in hydrogen energy are starting to show up in the data. Palladium has fallen behind. It peaked at more than 3000 dollars in 2022 but is now closer to 1100. Its main use is in gasoline car converters and that market is shrinking as electric vehicles expand.

Other metals in the platinum group have been volatile. Rhodium rose 35 percent in July to around 7475 dollars. Iridium is still near 5200 dollars and is supported by demand for hydrogen projects and specialty electronics. Ruthenium has doubled in a year and is now about 1075 dollars as chipmakers and data storage companies buy more. These markets are small and supply is limited so even small changes in demand move prices sharply upward

Industrial metals: copper leads the electrification charge

Copper prices reached 13000 dollars per tonne in July before coming down to just under 10000. That is still higher than a year ago. The reason is simple. Electric cars need three to four times more copper than petrol cars. Data centres built for artificial intelligence consume large amounts of power which means more transformers and cabling. Wind turbines, solar farms, and charging stations all need copper as well. At the same time supply from Chile, Peru, and Panama is weak. New mines take more than a decade to build. When supply cannot keep up with rising demand, the price climbs.

Rare earths and technology metals: critical and constrained

The tightest markets today are in the technology metals that most people never thought about until now. Gallium, germanium, terbium. China controls almost all supply and has cut exports. In May there were no gallium shipments at all. Germanium exports fell by more than half in the first half of the year. In rare earths, the situation could be even more drastic as Terbium is almost impossible to buy outside China. Prices in the West have soared. Gallium is about 1100 dollars per kilo, up almost three hundred percent since 2020. Germanium is close to 5800 dollars per kilo, up 40 percent this year alone. Terbium is near 2000 dollars per kilo, also up more than 40 percent.

These metals are used in semiconductors, magnets for electric motors, wind turbines, and defence equipment. They are also essential for AI chips and high speed computing. Without them the expansion of artificial intelligence cannot continue.

This is just a mid-cycle momentum

It’s unwise wrong to think we are at the end of the cycle. Commodity super cycles in the past lasted more than ten years. The one driven by China’s industrialisation ran for well over a decade. Today the drivers are broader. Energy transition, artificial intelligence, and defence spending are all rising at the same time. Supply is slow to respond, and intentionally restricted.

That means prices that look high today can become the new normal tomorrow.