Table of Contents

Today, we will discuss the best stocks to invest in India from different sectors and industries that can be a good bet to create wealth for 2023.

Before the year ends, many people reflect on the previous year and consider the changes they would like to make in the coming year. Many people set new year’s resolutions to eat healthier, be more active, and make other positive lifestyle changes.

It is important to focus on your physical and mental health, but it is also important to make financial resolutions that will help you get through the next year in good shape. Keeping that in mind, we thought to share the best stocks to invest in India which can be a good bet for 2023 for wealth creation.

So, what are the best stocks to invest in India?

Titagarh Wagons Ltd.

Since its founding in 1997, Titagarh Wagons Limited has produced and sold various products, including freight wagons, passenger coaches, metro trains, train electricals, steel castings, specialized equipment & bridges, ships, and more. The company provides services to both domestic and foreign markets. Freight rolling stock, passenger rolling stock, shipbuilding, bridges, and defense are the company’s three business segments. As of today, this is Titagarh Wagons share price and first in the list of best stocks to invest in India.

The company is one of India’s largest wagon makers, with a capacity to produce 8,400 wagons annually. With 32% (24,177 wagons) of the orders placed by the Indian Railways in May 2022, TWL continues to hold the market lead. The company operates four production plants, two in Titagarh, one in Uttarpara and Bharatpur, both in West Bengal, and one in Bharatpur, Rajasthan.

In Q2FY 2023 Company reported its highest-ever Total Income of Rs. 622 Cr., a 77% year-over-year gain. EBITDA for the quarter is Rs. 71 Cr, up 56% from Rs. 46 Cr during the same period last year. Additionally, this is a 56% increase from the same quarter last year. And also, 44% of Titagarh Firema’s equity ownership was purchased by the Italian government and a private equity investor on September 8.

Having the government on board offers the company various strategic soft benefits and financing. The company will receive a pro-rata part of the profit that will appear in Titagarh Wagons’ profit and loss statement; the second is the value of investments.

PSP Projects Ltd.

The principal promoter, Mr. Prahalad S. Patel, has worked in the construction sector for over three decades. PSP Projects Limited, an August 2008 incorporation, is a construction company in India that offers a wide range of construction and related services for commercial, institutional, governmental, residential, and residential projects. As of today, this is PSP Projects share price and second in the list of best stocks to invest in India.

Across the construction value chain, from planning and design to building and post-construction operations, including MEP work and other interior fit-outs, it provides its services to private and public sector enterprises. It is also involved in constructing two medium-sized projects in the USA through its subsidiaries.

PSP has contracts of Rs 1,344 crore as of this point in FY 2023. Thanks to a strong order pipeline, it anticipates receiving more than Rs 2,500 in orders in FY23. It has reaffirmed its estimate for FY 2023, which anticipates topline growth of 25% YoY (to about Rs 2,200 crore) and a medium-term margin in the region of 11-13%.

Currently, the government plan will cover 56% of all business verticals. The company currently has 49 active projects, with 50% located in Gujarat, 36% in Uttar Pradesh, 14% in Maharashtra, and 0.2% in Rajasthan.

Dalmia Bharat Ltd.

Dalmia Bharat, established in 1939 and distributed throughout 10 states and 14 manufacturing facilities, is India’s fourth-largest cement-producing corporation by installed capacity. It is a Dalmia Bharat Limited subsidiary with a capacity of 37.0 MnT. It prides itself on having one of the lowest carbon footprints in the cement industry globally. Its goal is to become a Pan India Cement firm with a 75 MnT capacity by FY27 and a 110–130 MnT capacity by FY31. As of today’s date this is Dalmia Bharat share price and third in the list of best stocks to invest in India.

Mahendra Singhi, named Group CEO in FY14, is the organization’s CEO. Previously, Mr. Singhi worked as the Executive Director at Shree Cement for 19 years. He played a key role in making Shree Cement one of India’s most economically viable cement companies. The company’s cost competitiveness has improved due to its appointment to the board of directors, boosting total profitability.

Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC), Portland Composite Cement (PCC), and Ordinary Portland Cement (OPC) are among the company’s product offerings. Its brands, Dalmia Cement, Dalmia DSP, Konark Cement, Dalmia InfraPro, Dalmia Infragreen, and Dalmia InstaPro, provide various cement varieties.

Dalmia has plans for medium- and long-term capacity development and is on a solid growth trajectory over the next five years. The business described its capital allocation plan for the following ten years, which called for increasing capacity at a 14–15% CAGR to reach 110–130 million tonnes by 2031 while keeping net debt/EBITDA below a 2x ratio (unless a large ticket size acquisition is made).

Additionally, it highlighted the allocation of 10% of OCFs to a green and innovation fund and 10% of OFCs to shareholders’ returns. It aims to have capacities of 75 mtpa and 110 mtpa by FY 2027 and FY 2031, to participate in the cement industry across India.

IDFC First Bank Ltd.

On December 18, 2018, the former IDFC Bank and former Capital First merged to form IDFC FIRST Bank. The bank now has a network of 641 branches in India and 719 ATMs. The bank offers products and services for investment banking, wholesale banking, and retail banking. The business provides one of the best interest rates in the nation for savings accounts at 6%. As of today’s date, this is IDFC First Bank share price and fourth in the list of best stocks to invest in India.

The IDFC First Bank MD and CEO, Mr. V. Vaidyanathan, started his banking career with Citi Bank and then at ICICI bank. Later, he acquired an NBFC and used it as a platform to build MSME and Consumer Financing businesses based on new technologies. Later this NBFC merged with IDFC Bank in December 2018, and he took over as the MD and CEO of the merged entity.

As of H1FY 2023, NII increased by 29%, with interest expenditure increasing by 24% and interest income increasing by 27% YoY. The reported net interest margin increased to 5.98% in Q2FY 2023 from 5.89% compared to the prior quarter. For FY 2023, management anticipates keeping NIM at 6%. The bank will be able to increase its margins further thanks to a decline in funding costs brought on by a reduction in high-cost legacy borrowings.

The bank has focused on retail breakthroughs to drive expansion. The bank’s gross funded asset is currently Rs. 1,45,362 crore, up 10% from Rs. 1,31,951 crore in FY22. Retail books, which are worth Rs. 1,08,228cr, were the growth’s primary driver.

Asset quality has significantly improved across the board for the loan book. The bank’s GNPA increased by 18bps sequentially to 3.18%, while the NNPA, which was at 1.09%, showed a 21bps improvement. Retail has a GNPA/NNPA of 2.03%/0.73%, making up 79.4% of the book. The overall provision coverage ratio increased from 72.2% in Q1 to 76.5% in Q2. Management anticipates a reduction in credit expenses of 1.5% in FY 2023.

Tinna Rubber & Infrastructure Ltd.

Bhupinder Kumar Sekhri, a visionary leader, launched Tinna Rubber & Infrastructure Limited (TRIL) in 1977. The company deals with End-of-life tyres and transforms them into rubber and steel, which are subsequently used for new tyres, conveyor belts, other rubber-molded items, and roadways.

The steel produced as a result of the operation is used to make steel abrasives. A prime illustration of the advantages of the circular economy is the business strategy used by TRIL. As of today’s date, this is Tinna Rubber and Infrastructure share price and fifth in the list of best stocks to invest in India.

With manufacturing plants in Panipat (Haryana), Kalamb (Himachal Pradesh), Haldia (West Bengal), Gumudipoondi (Tamil Nadu), and Wada, the company is now India’s largest integrated waste tyre recyclers and one of the world’s leaders in the manufacture of recycled rubber products (Maharashtra).

The second quarter of the fiscal year 2023 had operational revenue of Rs. 65.4 crores. Due to the high monsoon season, which affects sales in the road sector, the firm typically experiences decreased sales in Q2. Even yet, year-over-year sales rose 43%, and EBITDA was recorded at Rs 9.6 crores with a margin of 14.68%. With a PAT margin of 6.42%, the reported net profit after tax was four crores rupees.

The income for the first half of FY 2023 was Rs. 147 crores, increasing 45% from the prior year, according to the half-yearly numbers. With an EBITDA margin of 14.24%, EBITDA was Rs. 21 crores, up roughly 15% from the previous year. PAT was Rs. 10 crore for the first half, up 32% over the prior year. The company is also planning for a Green Feild Project.

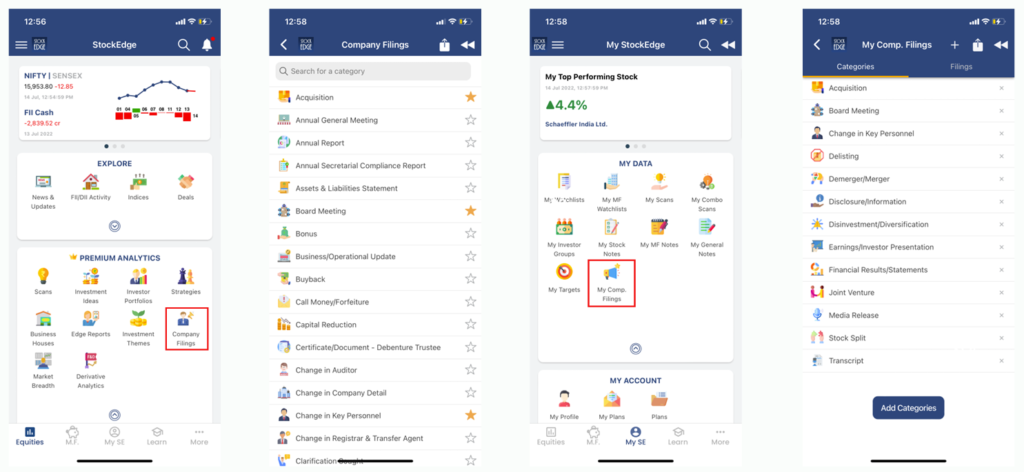

To get more detailed analysis and Reports on Stocks, join StockEdge Club by subscribing to our StockEdge plans.

Rationale

The reason for sharing these best stocks to invest in India is that they are fundamentally strong and good businesses. As we know that the Indian Government is promoting various sectors, namely Defense, railways, Manufacturing, and Recycling, etc., and all these stocks somewhere related to these themes.

As Titagarh Wagons Ltd is related to Logistics and Defense, PSP Projects Ltd and Dalmia Bharat Ltd are related to the construction industry, Tinna Rubber is one company that works in a Circular Economy and Recycling, and lastly, the economy is dependent on Banking & Finance. For that purpose, IDFC First Bank Ltd has been selected because it is transforming the Backing Sector with the help of new-age technology and Neo Banking.

However, as with such companies, there are various risks associated with them, such as volatility in raw material prices of pet coke, coal, etc., which can impact the Company’s performance.

So, we suggest you track them on a quarter-on-quarter basis in the upcoming year (2023) and also track the corporate filings section for any fundamental updates. We would also advise consulting your SEBI registered investor as the best stocks to invest in India, are from small and midcap space, so the risk would be high.

Until then, keep an eye out for the next blog on “Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

thank you for the detailed stock analysis reports.

👍👍👍👍👍👍

As I always said whatever information is provided by you and your team is awesome👍👍 we like it more than any other things,,, keep sharing such information and rhanks a lot 😊👌

Thanku for this guiding .

I’ll be thankful to you.

I would like to kindly inform you that, the stockedge app is very useful. I am learning various things and ideas.

Thanks

.