Table of Contents

Key Takeaways

- India is Building Big: The government is investing heavily in roads, railways, energy, and logistics. This push is creating big opportunities for infrastructure companies to grow.

- Strong Economic Link: As India’s economy expands, infrastructure development is key. A growing GDP means more demand for transport, construction, and energy systems.

- Government Support: Projects like Gati Shakti and Bharatmala are speeding up development, ensuring consistent work and revenue for infrastructure firms.

- Why Invest: These companies offer steady growth, benefit from long-term projects, and often provide dividend income making them a smart pick for long-term portfolios.

- Top Picks:

- Larsen & Toubro (L&T)

- PNC Infratech

- Ashok Leyland

India is among the fastest growing major economies in the world.As per the Ministry of Finance, India’s real GDP is projected to grow at 7.2% in FY26, reflecting strong domestic demand, resilient services sector performance, and ongoing government capex. This has largely fueled the growth of the infrastructure sector of India. The sector is backed by numerous growth drivers like the “Make in India” initiative and “Atmanirbhar Bharat Abhiyan” Hence, infrastructure stocks are hot among investors right now! But should it be in your portfolio?

In this blog, let’s explore the investment opportunities in some of the best infrastructure stocks.

What are infrastructure Stocks?

Infrastructure stocks in India refer to the listed shares of companies engaged in the engineering and construction of roads, highways, energy plants, and other related projects. These companies also operate in transportation, logistics, and other related sectors.

Sector Outlook: Infrastructure

Right now! Infrastructure is one of the fastest growing sectors in India. Why shouldn’t it be? India’s aspiration to become a $5 trillion dollar economy must be backed by significant growth in the country’s infrastructure development. The Indian government started emphasizing the construction of highways, metro systems, renewable energy power plants, a logistics ecosystem, and low-income housing. Both the central government and several state governments have been focusing on building thousands of kilometres of roads under the Bharatmala Pariyojana as well as a transport and logistics ecosystem under the Pradhan Mantri Gati Shakti Yojana initiative. Such initiatives towards infrastructure development have fueled the growth in the infrastructure sector of India.

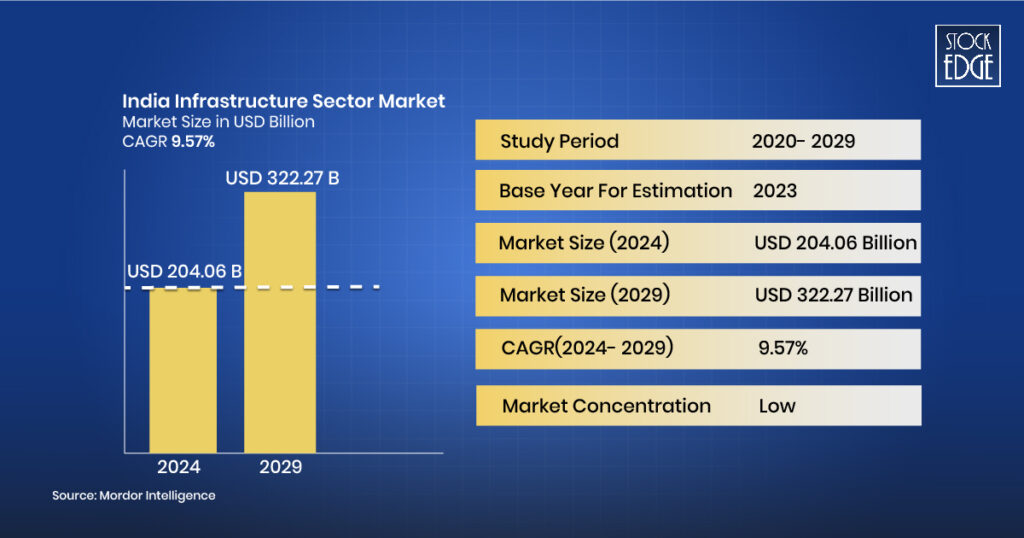

As per a report published by Mondor Intelligence, India’s Infrastructure Sector Market size is estimated at USD 204.06 billion in 2024 and is expected to reach USD 322.27 billion by 2029, growing at a CAGR of 9.57% during the forecast period (2024-2029).

Therefore, investing in infrastructure stocks can be a good investment in the long term. But before we directly jump into the list of infrastructure stocks that are good for long-term investment, let’s have a brief overview of the sector and its sub-industries; what are the major growth drivers in this sector and its historical performance to understand the future outlook.

Industries in Infrastructure Sector

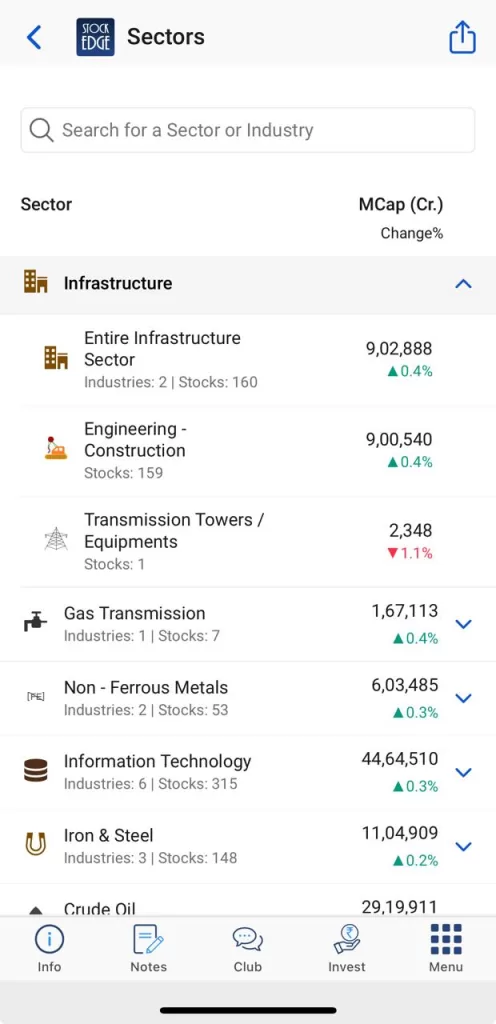

The infrastructure sector of India is vast, and therefore, in StockEdge, we have identified two major sub-industries inside the infrastructure sector of India.

As you can see from the above screenshot, the entire infrastructure sector is subdivided into two major industries. They are:

- Engineering- Construction consisting of 159 stocks

- Transmission Towers/Equipment consisting of 1 stock

Now, let’s identify the major growth drivers in the infrastructure stocks of India.

Key Growth Drivers of Infrastructure Stocks

- Infrastructure Development Needs: As per the World Bank, over 40% of India’s population, or 600 million people, will be living in urban areas by the year 2036. Considering increased demand for things like efficient road transportation, reliable power supplies, and clean drinking water, this is likely to put further strain on the already overburdened urban infrastructure and services of Indian cities.

- Government Policies: The National Infrastructure Pipeline (NIP), introduced in 2019, targets investment in crucial greenfield and brownfield projects across various economic and social infrastructure sectors. Similarly, the “Bharatmala Project,” launched in 2015, aims to develop an extensive network of 83,677 km of highways and roads, requiring an investment of approximately ₹7 lakh crore. This ongoing initiative focuses on building a robust system of roads, highways, and expressways. Likewise, the Sagarmala project is designed to enhance the water transportation network.

- Foreign Investment: The Indian government has significantly liberalized Foreign Direct Investment (FDI) rules in the infrastructure sector which allows international investment inflow into the sector to fund large-scale infrastructural developments in the country.

- Energy Transition: The government’s focus on shiftingfrom non-renewable energy sources to renewable energy like solar and wind energy has triggered growth in developing infrastructure to harness the power of solar, wind and other natural resources.

- Technology: The advancement of technology in the infrastructure sector has led to efficiency in project completion therefore expediting the growth in the infrastructure development of the country.

These were some of the major growth drivers in the infrastructure sector in India. Let’s now dive into the list of infrastructure stocks in India.

List of Infrastructure Stocks in India

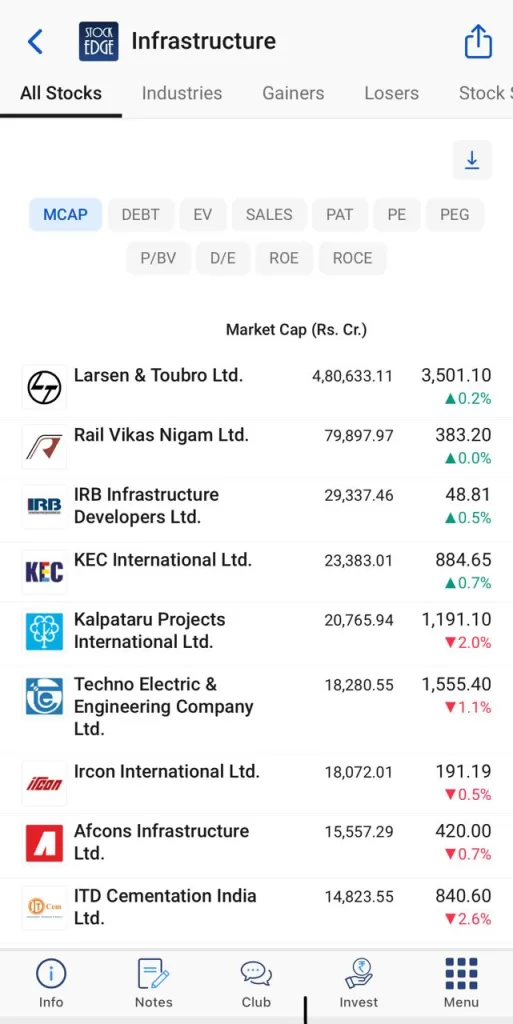

There are 160 infrastructure stocks listed in the Indian stock market as of 16th July 2025. You can view the list of infrastructure stocks in StockEdge that are sorted based on highest to lowest market capitalization. Moreover, you can make a comparative analysis of all the infrastructure stocks using important financial metrics like ROE, ROCE, PE ratio and more. You can even download the list of infrastructure stocks in Excel for further analysis. Not just that, you can even check the breadth of the sector to identify a bullish or bearish sentiment in the infrastructure sector.

A bullish or a bearish sentiment or momentum of a sector is analyzed using three types of technical indicators namely:

- Relative Strength (RS)

- Relative Strength Index (RSI)

- Simple Moving Averages (20, 50 and 100)

When the overall sentiment is bullish, the indicators show positivity, providing green shades, whereas negativity is derived with shades of red. It signals short-term momentum in the sector.

This is a very useful tool that can help you identify the right entry and exit based on the overall momentum of a sector. To learn more about the sector rotation feature, you can read Beat the street with Sector Rotation Strategy

Historical Performance of Infrastructure Stocks

The performance of infrastructure stocks can be easily tracked by tracking the Nifty Infrastructure Index. The index comprises 30 stocks from the telecom, power, port, air, road, railway, shipping, and other utility services providers in India’s infrastructure sector.

As of July 16, 2025, the Nifty Infrastructure Index has provided a staggering price return of 59% over the last 2 years.

Why should Infrastructure stocks be in your Portfolio?

It is evident as of now that adding infrastructure stocks to your portfolio can offer lucrative returns over the long term. Apart from that, legendary investor Warren Buffett said, “Do not put all your eggs in one basket”, meaning diversification of stocks reduces the risk of a portfolio. Therefore, allocating a portion of your portfolio to infrastructure stocks allows you to diversify your portfolio and, along with it, provides opportunities for higher returns over the long term. Now, before you make an investment decision, there are a few things you should know.

Factors to Consider Before Investing in Infrastructure Stocks

- Economic Growth: If a country does not have a growing economy, then infrastructure stocks can provide lackluster returns. So, analyze the economic outlook of the country before investing in infrastructure stocks. Currently, India is one of the fastest-growing economies in the world, and hence, investing in infrastructure stocks can be beneficial right now.

- Government Initiatives: Infrastructure stocks are largely driven by changes in government policies in the sector. The Indian government has taken several initiatives to create infrastructural development in the country, which is energizing the high-growth infrastructure stocks in India.

- Order Book Execution: Most infrastructure stock deals with large projects from both government and private players. A healthy order book with a growing number of projects in hand suggests a company’s long-term growth. Nevertheless, not just a strong order book but executing the orders and delivering the project on time ensure smooth money flow, which can determine the financial performance of the company.

- Company Fundamentals: Analyzing the fundamentals of a company is essential before investing in a stock. This is more true for infrastructure stocks as the companies are capital intensive; you will find their debt to be slightly high on their balance sheets. The debt-to-equity ratio of infrastructure stocks is generally high. However, an above-average Debt to equity ratio can indicate financial instability. Also, you should focus more on the ROCE than the ROE of an infrastructure stock because most companies have higher debt on their balance sheet to run the projects. Therefore, ROCE is a far better metric than ROE for most infrastructure stocks.

- Peer Comparison: You must analyze a company’s position in the market relative to its competitors. Most infrastructure stocks deal in similar projects, so a company’s capability to adapt and innovate in infrastructure technologies can offer an edge.

Investment Theme: Infrastructure

At StockEdge, we have developed an infrastructure investment theme to capture the growing investment opportunities in the sector. We have curated an infrastructure stocks list which are related to the overall infrastructure theme. The infrastructure theme is based on the government initiatives “Bharatmala”

Best Infrastructure Stocks in India to Invest in 2025

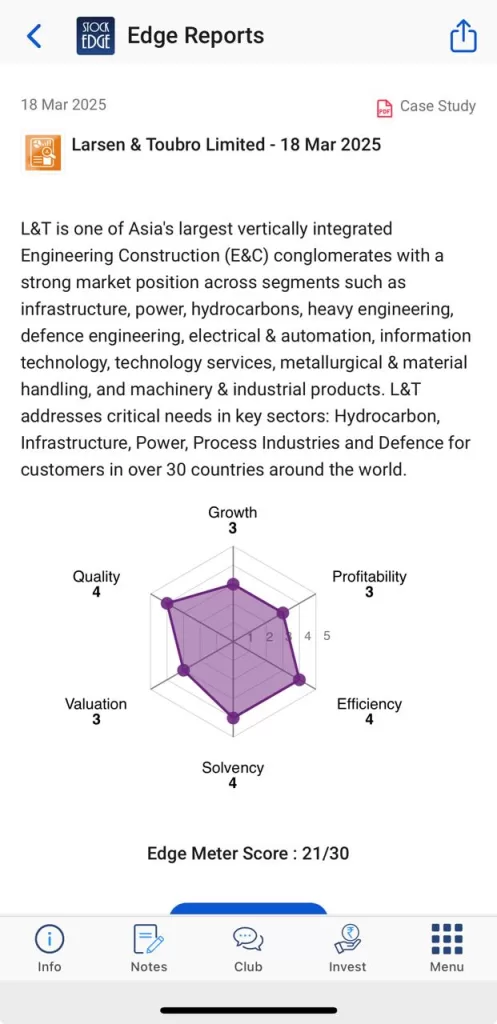

Larsen & Toubro (L&T) is an Engineering Construction (E&C) conglomerate with a strong market position across segments such as infrastructure, power, hydrocarbons, heavy engineering, electrical & automation and machinery & industrial products.

Recently, the transportation infrastructure vertical of L&T has secured an order for an Integrated Infrastructure Development project in Town Planning Schemes 2 to 7 under the Navi Mumbai Airport Influence Notified Area (NAINA) Project in Maharashtra. So, being the construction major, it is expected to benefit from such orders.

The company is fundamentally strong, and we have a research report on Larsen & Toubro (L&T), which you can refer to before making an investment decision in the stock.

A leading construction equipment manufacturing company. ACE is an established brand with a vast presence across diversified sectors like construction, infrastructure, manufacturing, logistics and agriculture.

In FY24, ACE achieved remarkable financial performance over the past year, with its revenue reaching an all-time high of ₹2,914 crores. The company also reported an impressive expansion in its EBITDA margin, to 13.84% from 10.23% the previous year. This strong performance translated into a 82% increase in EBITDA, reaching ₹403 crores, a 86% rise in PBT to ₹434 crores, and a 90% surge in PAT to ₹328 crores.

The Future outlook is positive as management expects overall revenue growth of 15-20%, driven by approximately 30% growth in construction equipment, 15-20% growth in cranes and material handling, and around 15% growth in agriculture equipment. By FY27E, ACE aims to achieve a revenue of ₹5500-5600 crore, representing a compound annual growth rate (CAGR) of about 24% from FY24 to FY27E.

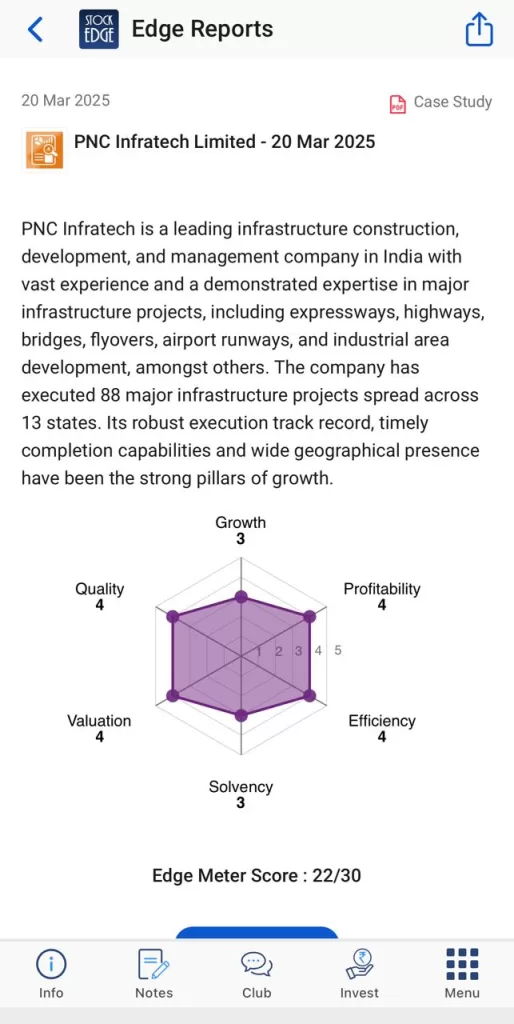

PNC Infratech Ltd is a leading infrastructure construction, development and management company with experience and expertise in the execution of infrastructure projects, including highways, bridges, power transmission lines, airport runways and other infrastructure activities.

The company has established itself as an effective and efficient player in sectors such as roads and highways, bridges and airport runways.

The company is fundamentally strong, and we have a research report on PNC Infratech Ltd, which you can refer to before making an investment decision in the stock.

Established in 2006, the core business of the company is undertaking construction projects across the country in the roads and irrigation. It specializes in constructing state and national highways, city roads, culverts and bridges.

In FY24, the sales increased by 12.86% YoY, and the growth in revenue was on the back of better execution of projects and new order wins. Also, the company bagged 6 new projects worth ₹3,602 crore towards the irrigation, water supply, roads and urban development segment in Madhya Pradesh, Rajasthan, Tamil Nadu and Goa.

The net order book as of 31st March 2024 stood at ₹17,432 crore. ~37% of the order book constituted roads & highway projects. Hence, with a majority of projects consisting of roads and highways, the company is expected to benefit from the Bharatmala initiative by the government. As the company has a strong order book, timely completion of the projects will be a key monitor in the coming quarters and in the next year.

The last infrastructure stock in our list is not directly in the infrastructure sector, as the company is engaged in the manufacturing of commercial vehicles and related components. However, it manufactures and supplies heavy vehicles, which aids the construction of highways. So, indirectly, it participates in the growth of infrastructure development routed through Bharatmala initiatives.

In FY24, the company’s revenue from operations stood at ₹45,791 crore, marking a 9.9% growth from ₹41,673 crore in fiscal year 2023 (FY23). Net profit surged to ₹2,680 crore, an impressive 98.8% increase from ₹1,348 crore in FY23. This substantial growth in profitability highlights its strategic focus on operational efficiency and expansion.

The company’s capex in FY24 amounted to ₹500 crore, with a projected range of ₹500-₹700 crore for FY25. However, the business is quite cyclical in nature, and you must keep a continuous check on its updates if you invest in it.

Other Ways to Invest in Infrastructure Stocks

Yes, of course, there are ways to invest in the growth of infrastructure themes in India. If you are a person who does not want to directly invest in stocks, then the best way to invest in infrastructure stocks is through mutual funds.

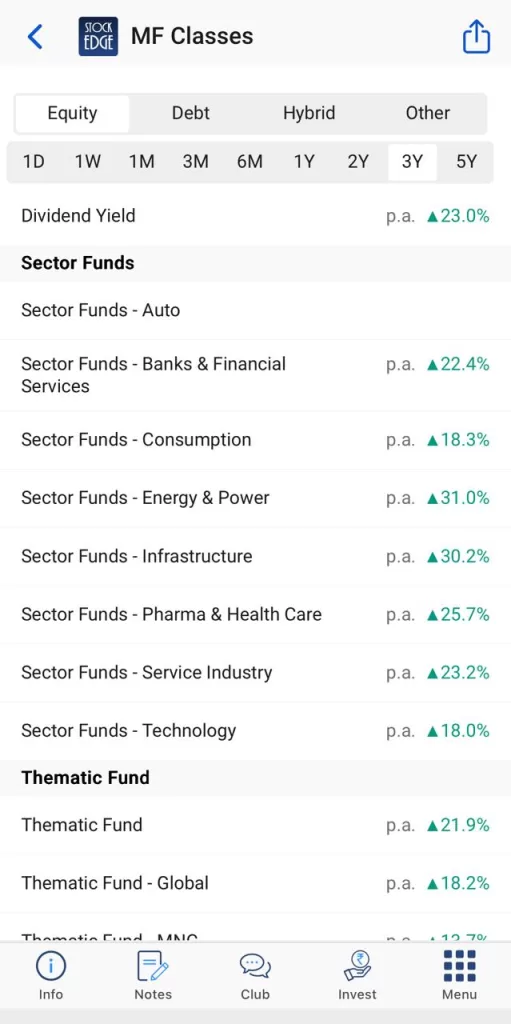

Sector Mutual Funds or Thematic Mutual Funds are great alternatives. In StockEdge, you can get the list of sectoral mutual funds for the infrastructure sector in India.

As you can see, you get a whole list of different sector funds available in the market and the Infrastructure funds have generated the highest return in the last 3 years.

The Bottom Line

In conclusion, investing in infrastructure stocks offers a promising opportunity for investors seeking long-term growth and stability. With the Indian government’s ongoing focus on infrastructure development and initiatives like the National Infrastructure Pipeline, there is a robust pipeline of projects that can fuel economic growth. Infrastructure stocks stand to benefit from this sustained investment, offering the potential for steady returns and a chance to be among the top gainers.

How safe is investing in infrastructure stocks?

Infrastructure stocks are relatively safe due to their association with essential services and government-backed projects. However, like any investment, they carry risks, so thorough research and diversification are key.

How do infrastructure stocks provide dividend income?

Many infrastructure companies generate steady cash flows from long-term projects, enabling them to pay regular dividends to shareholders, offering a source of passive income.

How can infrastructure stocks protect against inflation?

Infrastructure companies often have pricing power and long-term contracts that adjust with inflation, allowing them to pass increased costs onto consumers, thereby protecting investors’ purchasing power.

What is the future outlook for infrastructure stocks?

The future outlook is positive, especially in emerging markets like India, where government initiatives and growing urbanization continue to drive demand for infrastructure development.

How do I determine the best infrastructure stocks in India?

Look for companies with a strong track record, healthy financials, government contracts, and involvement in key projects. Analyzing industry trends and consulting financial experts can also help.

Why should I invest in infrastructure stocks?

Investing in infrastructure stocks provides potential for steady, long-term returns, diversification, and a chance to benefit from government spending on essential services and national development projects. Infrastructure stocks can become trending stocks in the near future.