Table of Contents

Did you know that over 70% of actively managed funds fail to beat the market? This staggering statistic has led many investors to embrace the humble returns offered by index funds.

Index mutual fund offer a simple yet powerful way to build wealth and secure your financial future. Because of their simplicity and reliability, they’ve become a favourite choice among savvy investors.

Even Warren Buffett, one of the most successful investors of all time, recommends Index mutual funds for most people.

Whether you’re a seasoned investor or just starting, Index mutual funds offer a wide range of options to make your money work smarter, not harder.

As of June 2024, there were total of 219 index fund in India. But with so many options, how do you choose the best one?

In this guide, we’ll break down the essentials to help you discover the Top index funds for your investment portfolio.

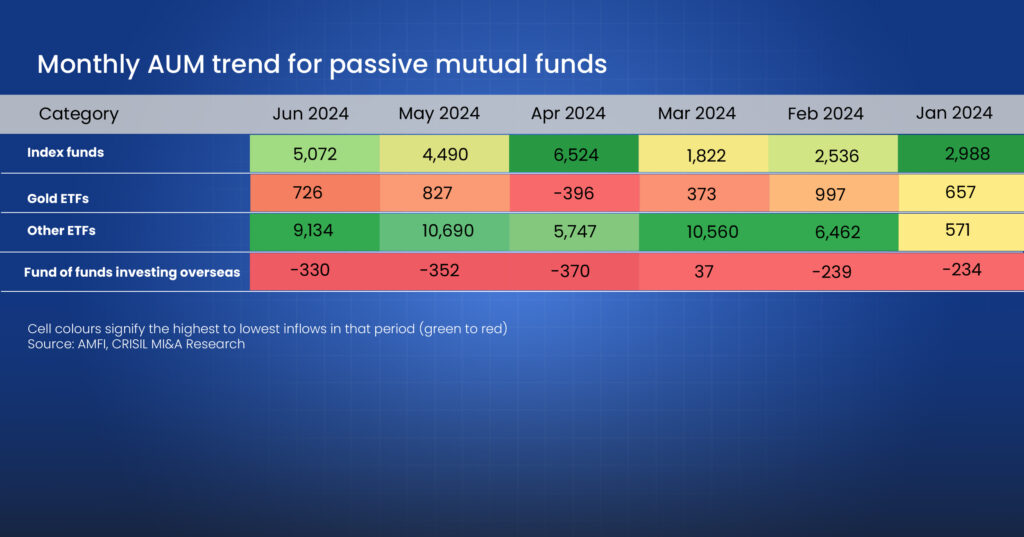

As of June 2024, the AUM of Index Funds is at an all-time high level, with assets increasing by 38.8% YoY from 1.75 lakh crore to 2.43 lakh crore.

What are Index Funds?

Index funds invest in stocks that imitate or replicate a particular index, like the NSE Nifty 50, BSE Sensex, etc. These funds invest in the same securities and the same proportion as present in the underlying index.

In simple language, Index funds offer the flexibility to invest in the entire stock market with just a single click. This also provides diversification among investors as they get access to the top companies from different sectors and industries.

Passive funds recorded the highest month-on-month increase, with asset gains of Rs 64,554 crore during the month of June 2024, hitting an all-time high of Rs 10.48 lakh crore.

Let us take a broader look at the returns generated by the major Indian equity indices.

This will give an idea of the broad market performance, and investors can set the right expectations before investing in Index Mutual Funds.

• In the context of Indian Equity markets, Nifty 50 TRI (Total Return Index) has delivered annual returns of 15.6% in the last 25 years since its inception (June 1990 to May 2024)

• In the Mid-cap category, Nifty Midcap 150 TRI has returned 18.8% annually in the last 15 years.

• Small-cap category Nifty Smallcap 250 TRI has delivered annual returns of 16.1% in the last 15 years.

Why Choose Index Funds?

Index funds are an ideal choice for risk-averse investors. Investors who lack the financial knowledge or the adequate skill to invest directly in stock markets should consider index Funds as their go-to option.

Diversification: Index Mutual Funds invest in the underlying Index, which is designed by index providers like the NSE and BSE. Index funds typically track a specific index, such as the Nifty 500, which includes a wide range of companies across various sectors.

This means your investment is spread out over many different stocks, reducing the risk associated with any single company or sector.

Lower Costs: Index funds generally have lower management fees than actively managed funds because they replicate an index’s performance rather than relying on a team of analysts and managers to pick stocks. Typically, Index Funds charge an expense lower than 0.50%. In the case of actively managed funds, expense ratios may go as high as 2%.

Ease of investing: By buying a single index fund, you instantly gain exposure to a broad range of assets. This makes it easier to build a diversified portfolio with minimal effort.

You don’t need to spend time researching individual stocks or market trends because the fund automatically mirrors the performance of the Index it tracks.

Common Misconceptions:

Index Funds are Risk-Free: Index funds are well-diversified, so they are less risky than funds that focus on just one strategy, but they are not completely risk-free. They are still subject to market risk, and the value of your investment can fluctuate with the performance of the overall market.

Index Funds Always Outperform Actively Managed Funds: When invested for a long time, passive funds have outperformed many actively managed funds, mainly due to their low costs and diversified portfolios. However, actively managed funds can outperform based on the skills of the fund managers and liquidating the portfolio during a market correction period.

Index Funds are Only for Conservative Investors: Index funds can be suitable for a wide range of investors, including those with different risk tolerances and investment goals. Aggressive investors can also choose index funds that focus on growth sectors or emerging markets, as these funds offer flexibility to suit various investment strategies.

You Need a Large Sum to Invest in Index Funds: Many index fund in India have low minimum investment requirements, allowing investors to invest with a small amount, as low as Rs. 100. This makes it easy for beginners to enter the market and build a diversified portfolio over time.

What are the Types of Index Funds?

Index Mutual Funds are among the most secure sources of investment. These funds comprise a predefined basket of stocks determined by the stock exchanges.

Equity Index Funds

Equity Index Funds consist of well-established companies with a proven track record in the market. These funds include the best-performing and most stable companies, as defined by reputable stock exchanges.

Within the Equity Index, NSE Nifty 50 and S&P BSE Sensex have performed exceptionally well in the last 25 years, despite several market falls, considering the global financial crisis of 2008, the breakout of many deadly viruses, international trade wars, and geopolitical tensions, among many others. Index funds have stood higher than the fall witnessed in actively managed funds.

Index Fund in India have grown 39% year over year and have had consistent monthly inflows for the last 44 months. The index funds category’s assets are at a record high of Rs 2.43 lakh crore as of June 2024 and have surged nearly 900% in the past three years.

Here are the main types of equity Index fund in India:

Large-cap index Funds: These index funds track the largest companies in India by market capitalization. These companies are well-known and most liquid.

Mid-cap and Smallcap Index Funds: These Index funds track the performance of medium-sized and small-sized companies poised for growth, offering growth possibilities to investors.

Sectoral Index Funds: These funds track the success of specific sectors or businesses, such as banks, information technology, or drugs, allowing investors to gain focused exposure to particular market parts.

Thematic-based Index Funds: These funds track indices based on particular themes or investment strategies, such as environmental, social, and governance (ESG) factors, low volatility or income return, quality index, value stocks, momentum-based stocks etc.

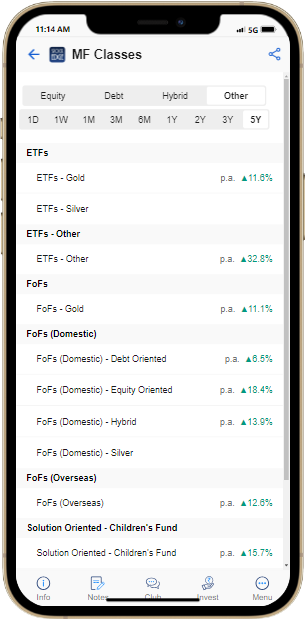

Exchange-Traded Funds (ETFs) are index funds traded on stock exchanges. These funds invest in the underlying index mutual funds, making it easy for investors to buy/sell directly through stock exchanges.

International Index Funds: These index Funds track top-performing companies around the world, such as S&P 500 stocks and developed World Indexes. This provides great opportunities to diversify investment among different regions, countries, and global leaders.

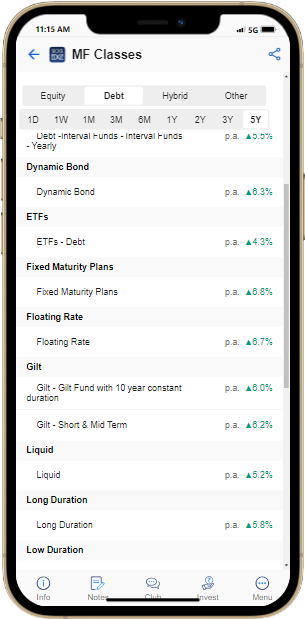

Debt Index Funds

Debt index funds in India are mutual funds that aim to replicate the performance of a specific debt market index. They invest in a diversified portfolio of fixed-income securities such as government bonds, corporate bonds, and money market instruments.

Here are the main types of debt Index fund in India:

Government Bond Index Funds: These funds track indices composed of government securities (G-Secs). Examples include the Nifty 10-Year Benchmark G-Sec Index, which tracks the performance of 10-year government bonds.

Corporate Bond Index Funds: Track indices that include high-quality corporate bonds. An example is the CRISIL AAA Long Term Bond Index, which tracks bonds rated AAA.

Liquid Index Funds: These funds track indices made up of short-term debt instruments with high liquidity, such as the Nifty Liquid Index. They invest in money market instruments like treasury bills, commercial papers, and certificates of deposit.

Composite Bond Index Funds: Track a blend of various types of bonds, including government and corporate bonds. An example is the Nifty Composite Debt Index, which aims to provide exposure to a mix of high-quality fixed-income securities.

Factors to consider when investing in Index Funds

Let us talk about the factors that make an index fund different from a regularly managed mutual fund.

Risk-averse investors looking to benefit from the overall market performance should consider investing in Index Funds. Index funds’ performance is more predictable compared to the often unpredictable results of actively managed funds.

Investors seeking long-term wealth creation with the objective of growth possibility will typically invest in the Equity category of Index mutual funds.

Debt Index Funds are preferred mainly by institutional investors and big corporations, who seek regular income and capital preservation. They invest for the short to medium term mainly in corporate bonds, fixed-income securities, and money market instruments.

Other factors to consider when investing in Index Funds:

Risk Tolerance

Index funds are ideal for risk-averse investors who expect predictable returns as they replicate an Index’s performance. These funds do not require extensive tracking. For example, suppose you wish to participate in top companies but prefer to avoid taking risks associated with actively managed equity funds. In that case, you can choose a Sensex or Nifty index fund.

However, Investors should be aware that Index funds are less flexible and tend to lose their value during a market downturn. Hence, a better choice is to have a mix of actively managed funds and index funds in your portfolio.

Fund Manager Reputation

It is essential to check the background and educational qualifications of fund managers as they are responsible for managing the fund and making decisions. However, in the case of passively managed Index Funds, fund managers do not play a significant role in decision-making, still it is viable to check if the fund manager is making changes at the right time.

Objective of Investment

Index mutual funds are a broad investment choice, mainly for investors wanting to invest in the total market depth. To achieve their long-term financial goals, they should opt for such funds.

Index Funds are an ideal investment choice for investors who cannot regularly track the market and want to diversify their portfolios among top companies from different sectors and industries.

These passive funds can deliver higher returns, helping people achieve long-term financial goals such as retirement, education, etc.

Expense Ratio

Investors should check the expense ratio charged by the fund. Simply put, these are the fees charged by the fund manager for managing and operating your investments. Generally, expenses in Index Mutual Funds are comparatively lower than 0.50% because of the passive style of investing.

Performance History

Unlike actively managed funds, index funds track the performance of the underlying benchmark passively. These funds do not aim to beat the benchmark but to replicate its performance. However, due to tracking errors, the generated returns may need to be at par with those of the Index. Deviations from actual index returns can also occur.

According to the conventional method, equity index funds require a minimum 5-year investment horizon, which allows investors to ride out potential market fluctuations and benefit from the fund’s long-term growth trajectory.

Best Index Funds in India for 2024

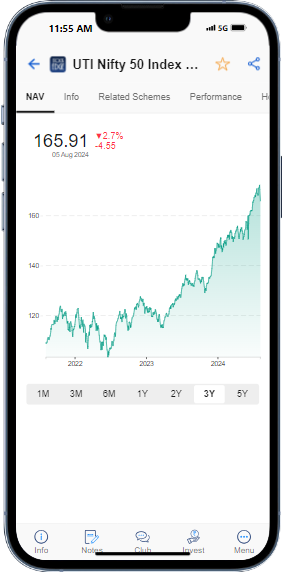

UTI Nifty 50 Index Fund- Direct:

This is the oldest index fund tracking the Nifty 50 Index. It has assets of 18345 crore and charges a very low expense of 0.18%. It has given 18.24% annual returns in the last five years.

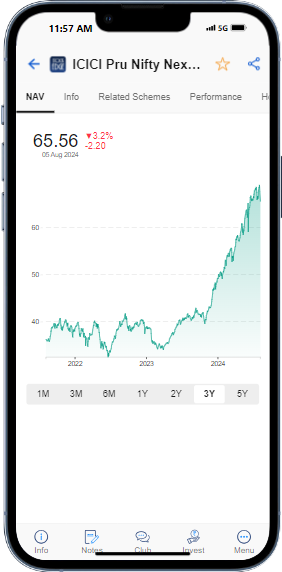

ICICI Prudential Nifty Next 50 Index Fund – Direct:

This index fund tracks the top 50 companies after the Nifty 50 Index. It has assets of 5845 crore and charges a very low expense of 0.30%. It has given annual returns of 22.94% in the last five years.

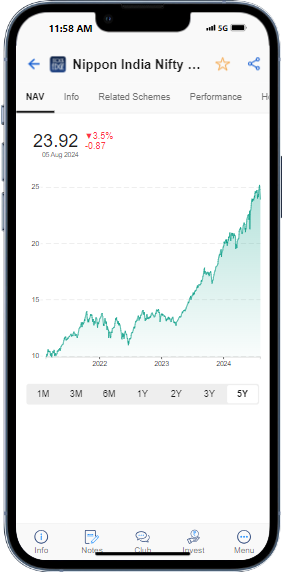

Nippon India Nifty Midcap 150 Index Fund – Direct:

This is a mid-cap-focused index fund that tracks the next 150 companies after the top 100 companies present in the Nifty 500. It has assets of 1426 crore and charges an expense of 0.3%. The fund has given annual returns of 25.59% in the last five years.

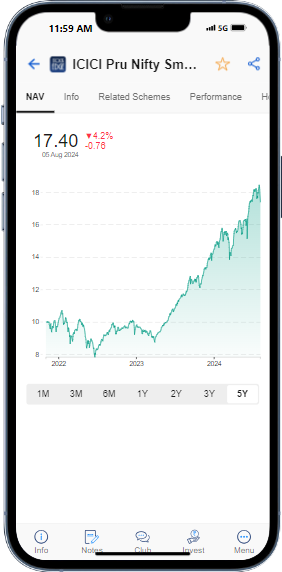

ICICI Pru Nifty Smallcap 250 Index Fund- Direct:

This is a small-cap index fund that tracks the next 250 bottom companies in the Nifty 500 Index. It currently has assets of 351 crore and charges an expense of 0.30%. The fund has returned 22.23% since its inception.

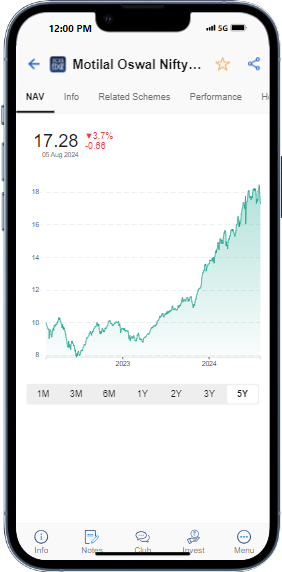

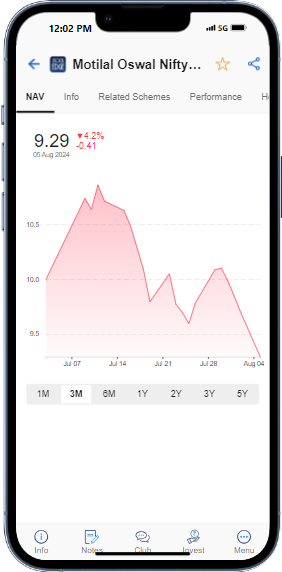

Motilal Oswal Nifty 200 Momentum 30 Index Fund – Direct:

This is a Momentum-based Index fund that invests in the top 30 companies from the Top 200 companies of India, as per market capitalization. The fund has assets of 671 crores and an expense ratio of 0.33%

Motilal Oswal Nifty India Defence Index Fund – Direct Plan:

This is a sectoral-focused Index Fund that invests in defence and aerospace-oriented companies. This is a newly launched fund in July 2024 and is the first kind of a fund in its category.

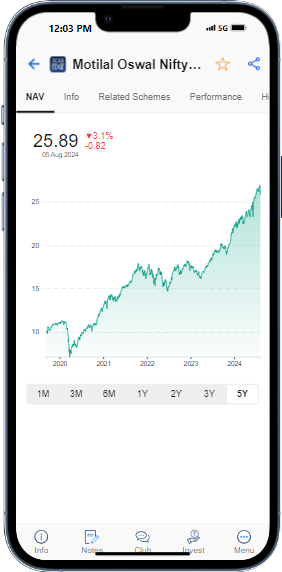

Motilal Oswal Nifty 500 Index Fund – Direct:

This Index Fund invests in all 500 companies in the Nifty 500 Index. It has an AUM of 1527 crore and charges an expense of 0.20% for Direct Plans.

What is the best way to invest in an index fund?

An ideal strategy would be not to time the market and invest via a Systematic Plan every month for a minimum period of 5 years. This strategy will hedge the portfolio against market volatility and also offer benefits like rupee cost-averaging.

Systematic Investment Plan:

Investing a fixed amount regularly every month, irrespective of timing the market, is the best strategy for accumulating long-term wealth. SIP reduces market volatility risk and allows the benefit of rupee-cost averaging. It is mainly favorable for small investors, as SIP starts from as low as ₹100.

Lump-sum Investment:

Investing a large sum of money at once is usually beneficial if you have a long-term horizon. Generally, the maturity value of policies and any exceptional capital gains arising from the sale of property are invested through one-time investments.

Historically, lump-sum investing has outperformed SIP due to the time value of money, but it involves more risk, especially in volatile markets.

Exchange-Traded Fund:

Active Investors with a demat account who are looking for a cost-effective investment option may prefer investing in Index funds through the ETF route. As we discussed earlier, an ETF can be bought and sold during market hours, making it highly flexible for investors who want to take advantage of short-term price movements.

ETFs can provide exposure to specific sectors, industries, or asset classes, catering to investors with particular investment goals or themes.

Read ‘Comprehensive Guide to ETF Investing in India’ to find a suitable index fund for your portfolio.

How to find the best Nifty 50 index funds?

Nifty 50 Index funds track the performance of the top 50 companies present in India.

To select the right Nifty 50 Index fund, investors should select schemes that have least tracking errors, charge low expense and have large AUM size, providing a cushion for better liquidity provision at the time of high redemption requests.

Other factors like renowned mutual fund houses, experience of fund managers, age of the fund and fairly in-line past performance of the fund will provide for a better selection of the fund.

What is the difference between an ETF and an index fund?

As we discussed earlier, ETF are similar to index Funds with the difference that they can traded on stock-exchanges. While Index funds have to be bought from a fund house or an AMC.

Five key distinctions between an Index Fund and an ETF are listed below:

Trading Flexibility:

ETFs are flexible. During market hours, you can purchase them simply by placing a Buy order, whereas Index Funds can be bought through a broker or directly from AMC’s website.

Minimum Investment Requirement:

ETFs do not have a minimum buying amount. It can be as low as ₹10, and multiple quantities can be bought. Index Funds generally have a minimum investment amount. For example, the ICICI NIFTY 50 Index Fund requires a minimum ₹100 for lump sum investments and ₹100 for SIP investments.

Expense Ratio:

ETFs have a very low expense ratio, generally below 0.20%. On the other hand, Index mutual funds have higher expense ratios of around 0.50%.

Transaction Costs:

As ETFs are traded on stock exchanges, they are subject to brokerage commissions, DP charges and STT charges. Index Funds don’t have any brokerage charges; however, some AMCs charge an Exit Load on early redemption, as stated by the fund.

Liquidity:

ETFs have better liquidity due to the easy tradability through stock-exchanges. They can be bought or sold throughout the market hours, making transactions quicker and more efficient. However, for Index funds, transactions are processed at the end of the trading day based on the fund’s closing NAV.

Is It a Good Time to Invest in Index Funds?

Investing in Index MFs is an effective way to grow wealth and achieve your financial goals if you’re willing to play the long-term game. By investing in an index fund, investors stand to benefit from diversification, lower expenses, access to top companies, and higher potential for growth. Investments for a long-term horizon should be made irrespective of timing the market and by regular investing via SIP.

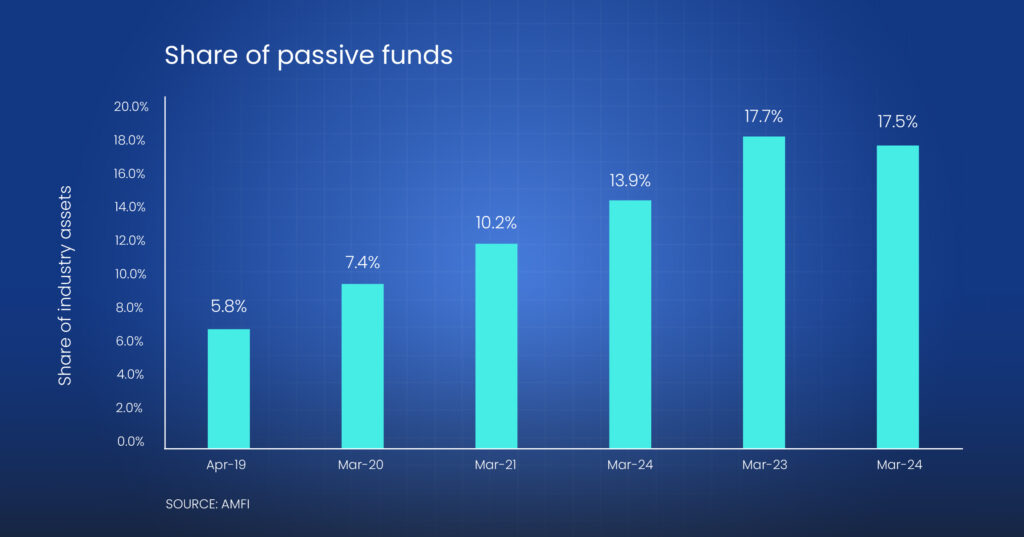

Globally, passive investing is gaining popularity. In India, too, passive funds have gathered maximum attention. At present, there are more than 200 index funds in the country. As of March 2024, the share of passive funds has increased to 17.5% of the total Industry’s AUM of 56 lakh crore from the previous share of 5.8% as of March 2019.

As we near 2024, index funds should continue to gain popularity, driven by their natural benefits and the growing demand for dormant investment choices.

Steps to Invest in Index Funds

Investing in top index funds in India has never been easier, thanks to paperless documentation and a hassle-free process. The process of investing in index funds is the same as in mutual funds:

Follow these steps to invest through StockEdge:

Step 1: Sign in to web.stockedge.com/app/mutual-funds

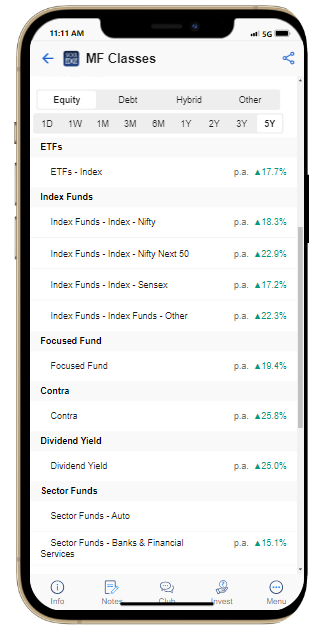

Step 2: Find the suited Index Fund using Mutual Funds < MF Classes < Equity

Step 3: Analyze your desired fund using StockEdge Index Funds Section under Equity

Step 4: Login via your mutual fund broker or AMC or MF distributor.

Step 5: Complete your e-KYC and wait for 2 to 3 business days for verification

Step 6: Search for the short-listed fund, Investment period, and SIP amount.

Step 7: Place your order, and the units will be credited within 2 to 3 working days.

How are Index funds taxed?

After the amendment of the Finance bill in Union Budget 2024, capital gains taxation for equity-oriented mutual funds has been revised. Taxation mainly depends on the Investment Period and the type of assets an investor owns.

Let’s examine the revised Holding period and Taxation for index mutual funds in the Equity and Debt categories.

Equity index Funds:

As Equity Index Funds invest in stocks of other companies, their taxation is at par with the Equity taxation.

Short-Term Capital Gains (STCG): Capital gains arising from the sale of Equity Index Funds, if held for less than one year, will be treated as STCG at a rate of 20%. Previously, it was taxed at 15%.

Long-Term Capital Gains (LTCG): Gains arising from the sale of units of Equity Index Funds, if held for more than one year, will be treated as LTCG. A tax rate of 12.5% will be charged, with gains up to Rs. 1 lakh being tax-free. Prior to the amendment, Taxation for LTCG was only 10%.

Debt Index Funds

Debt Index Funds invest in fixed-income securities mainly in government securities, corporate bonds and other money market instruments.

STCG: Regardless of the holding period, gains from units sold within three years are taxed at the investor’s income tax slab rate.

LTCG: For investments made after April 1, 2023, the gains are treated as STCG and taxed at the investor’s income tax slab rate.

In case of investments made before this date, investors enjoy the old LTCG tax rate of 20% with indexation benefits.