The biggest problem in the stock market before was getting the data. Institutional investors sat in glass towers with expensive terminals, while retail investors waited for the morning paper to check stock prices.

That era is dead. We have moved from the “Information Age” to the “Intelligence Age.”

Today, we don’t face the problem of a lack of information; we’re drowning in it. Real-time ticks, Twitter sentiment, global macro news, and corporate filings hit your screen every second. In this storm of “noise,” the only competitive advantage left is the ability to filter it down to a clear signal.

StockEdge has leveraged Artificial Intelligence (AI) and advanced analytics. We are trying to interpret data for financial AI rather than just showing it to you.

In this blog, we will explore the rise of AI in finance and how StockEdge helps you prepare for the next era of financial AI.

The Rise of AI in Finance

India stands at a defining economic crossroads. The ambition is clear: Viksit Bharat, a developed India with a GDP of $8.3 trillion by 2035. Achieving this vision requires a sustained 8% annual growth rate, significantly above the current trajectory, which is projected to result in a $6.6 trillion economy.

That leaves a daunting $1.7 trillion gap.

Bridging it won’t happen through incremental reforms or cyclical growth alone. Emerging evidence shows that Artificial Intelligence is the key driver capable of unlocking $1.0–1.4 trillion in additional economic value and fundamentally changing how India grows.

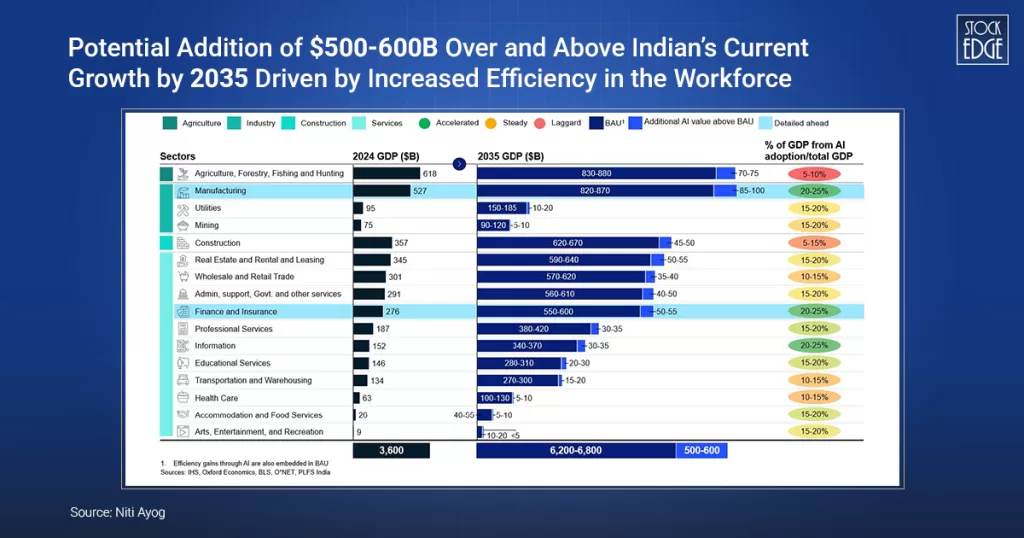

According to the NITI Aayog, AI is widely used by many industries in India, as seen below.

AI has the potential to significantly impact financial services and manufacturing sectors, potentially leading to 20-25% of their GDP by 2035, according to the report.

AI vs. Traditional Analysis

The transition to the “Next Era of Finance” with financial AI necessitates a comparison between traditional analytical methods and the AI-driven approach.

| Parameter | Traditional Methods | AI-Driven Approach |

| Speed & Efficiency | Relies on manual data entry and periodic analysis; insights often take days or weeks to generate. | Delivers instant, real-time insights, enabling immediate and data-driven decision-making. |

| Accuracy & Data Handling | Prone to manual and human errors; limited ability to process large or complex datasets. | Processes massive volumes of structured and unstructured data with high precision and consistency. |

| Predictive Capability | Primarily backward-looking, focused on historical data and past trends. | Proactive and forward-looking, enabling predictive modeling such as revenue forecasting with up to 30% higher accuracy. |

| Adaptability | Static systems that require manual updates and reconfiguration. | Self-learning models that continuously adapt to new data and evolving market conditions. |

| Tools & Analytical Scope | Depends on spreadsheets (e.g., Excel) and manually prepared reports. | Uses advanced machine-learning algorithms for pattern recognition, anomaly detection, and sentiment analysis. |

StockEdge’s Intelligent Financial AI Tools

Here is how the platform acts as your personal “AI Analyst.”

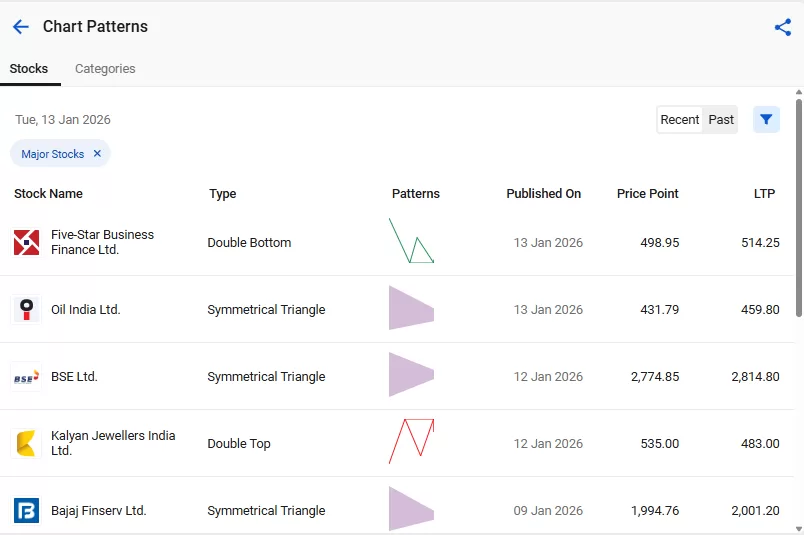

Chart Patterns

Chart patterns are distinct shapes formed by price movements on stock charts. They help traders forecast future price action by analyzing patterns of highs and lows and identifying potential breakouts, trend continuations, or reversals.

StockEdge chart patterns convert complex price movements into easy-to-identify visual structures. Instead of guessing market direction, traders can quickly understand whether a stock is in a consolidation, continuation, or reversal phase.

To know more about how to use these patterns, read our blog Chart Patterns: Holy Grail Of Stock Market Analysis

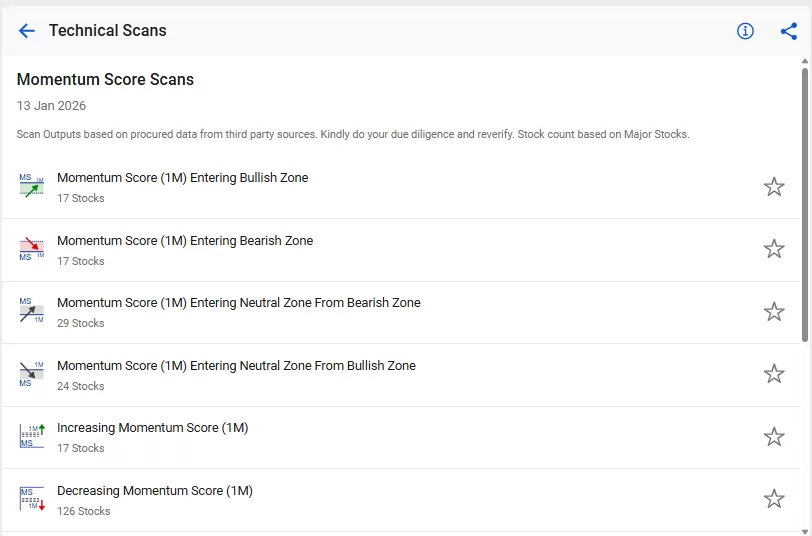

Momentum Score

Traders and investors often find it hard to know which stocks are truly gaining strength and likely to outperform. Price charts alone can be confusing, and without a clear measure of trend momentum, many end up chasing weak or fading stocks

The Momentum Score feature on StockEdge solves this by giving each stock a simple score (0–100) that reflects the strength of its price movement over 1, 3, and 6 month periods. A high score means strong bullish momentum, while a low score shows weakening or bearish trends.

This lets traders quickly see which stocks are building real strength and which are losing it, helping them focus on strong trends, avoid weak stocks, and make clearer entry and exit decisions.

To know more about how to use these scans, read our blog StockEdge Momentum Score

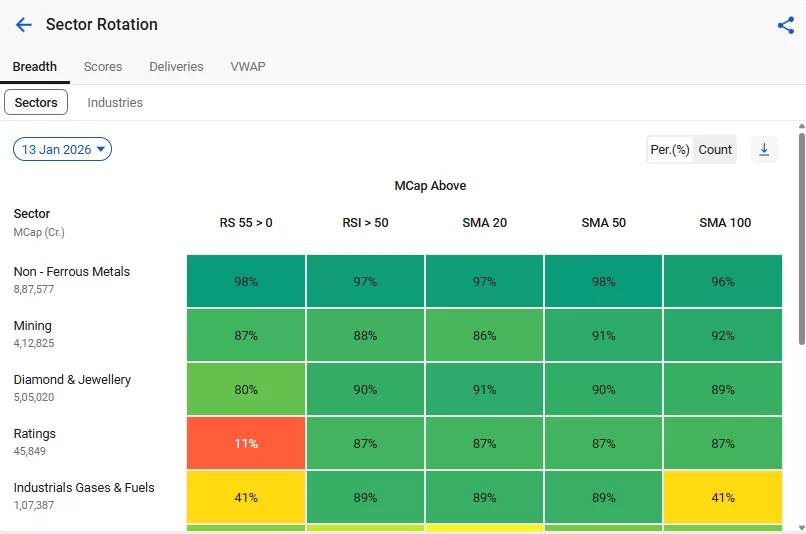

Sector Rotation

Many of you struggle to identify which parts of the market are currently leading or lagging. Even when broader indexes are rising, not all sectors perform equally, so blindly picking stocks can lead to poor returns or missed opportunities.

The Sector Rotation feature in StockEdge solves this by showing which sectors are gaining strength and which are weakening as market cycles evolve. It uses breadth, delivery, and VWAP data to rank sectors based on technical indicators like relative strength, momentum, and trend. This is a classic example of financial AI at work.

To know more about how to use these scans, read our blog Beat The Street With Sector Rotation Strategy

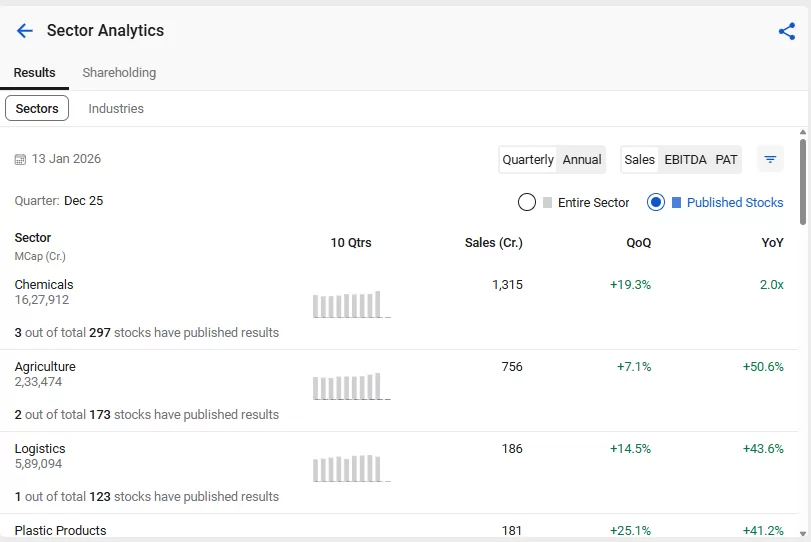

Sector Analytics

Sector Analytics is a Pro feature of StockEdge, which uses AI in finance to combine the financial performance of all stocks in a respective sector for a given period based on the outcome of the financial results of a company.

This lets you spot which sectors are expanding, compare industries within sectors, and then identify the strongest individual stocks relative to their peers.

By aggregating and visualising sector growth trends and financial strength, it helps traders and investors focus on fundamentally healthy market segments and make more informed stock selection decisions.

To know more, read our blog Sector Analytics: Find Strong Stocks In High-Growth Sectors

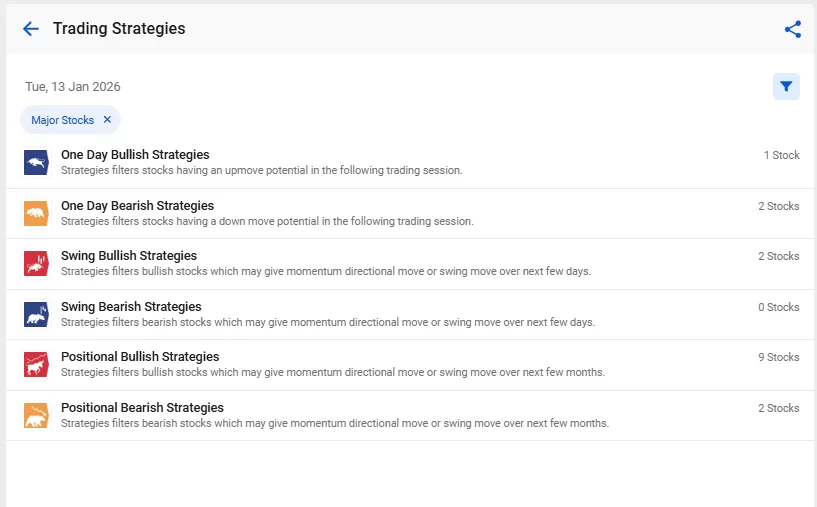

Trading Strategies

Most traders are overwhelmed by charts, indicators, news, and opinions. Despite having access to data, they struggle to convert information into a clear trading decision.

StockEdge trading strategies use AI in finance to reduce confusion, emotion, poor risk control, and inconsistency by offering structured, rule-based, and time-tested solutions that help traders move from random trading to disciplined execution.

Trading strategies are predefined combinations of scans, organized into specific categories, that help traders and investors systematically identify high-probability, winning stocks.

To understand more in detail, read our blog StockEdge Investing & Trading Strategies made more powerful

My Custom Scans

The Custom Scans feature lets users create their own scan rules using technical, fundamental, and derivative conditions. Traders can combine indicators, patterns, and volume filters exactly the way they want, and save these scans for repeated use.

This makes it easier to quickly find stocks that match their strategy, focus on high-probability setups, and spend more time trading rather than searching.

To understand more in detail, read our blog StockEdge Version 14.0 – Custom Scans

Future of Finance: AI + Human Intelligence

Artificial Intelligence is no longer a supporting layer in financial services, but it is rapidly becoming the core operating system of modern finance or financial AI. Across global markets, financial AI is redefining how capital is allocated, risks are managed, and investors are served.

The financial services industry, already one of the most data-intensive sectors, is uniquely positioned to extract disproportionate value from AI-led transformation.

According to the KFin Technologies Ltd.’s Annual report, global private market infrastructure expands from US$16-18 billion in 2025 to nearly US$30 billion by 2030, growing at a 11–13% CAGR. AI in finance is emerging as the single most powerful growth enabler within this opportunity.

At the institutional level, AI is reshaping the front office of finance. Investment managers now use machine-learning models to scan millions of data points, corporate filings, price trends, macro indicators, alternative data, and news sentiment in real time.

In the middle office, AI is transforming risk management, compliance, and valuation. Advanced AI models are now capable of stress-testing portfolios across thousands of simulated market scenarios within minutes.

The back office of finance, traditionally seen as a cost center, is also undergoing an AI-led reinvention. Intelligent automation powered by AI is streamlining trade reconciliation, settlement, reporting, and regulatory filings.

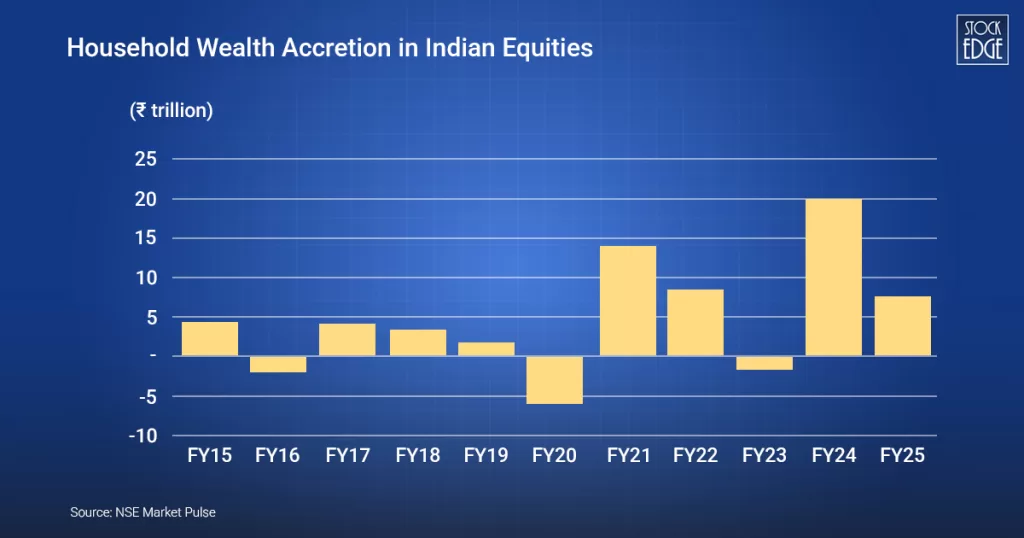

One of the most visible impacts of AI is unfolding in the Indian investment management industry. Over the last decade, India has witnessed a structural shift in household participation in capital markets.

Household wealth invested in equities through direct stocks and mutual funds has increased by over ₹45 trillion between FY 2020–21 and FY 2024–25, with more than ₹25 trillion added in just the last two years. As of March 2025, equities account for 5.8% of total household assets, up from 1.9% in 2015.

Conclusion

Looking ahead, the future of financial AI will be defined not by automation alone, but it will also by augmentation. The most successful financial institutions will be those that combine human judgment with AI intelligence using machines for speed, scale, and pattern recognition, while reserving strategic decision-making for human expertise.

As India continues its evolution from a savings-driven economy to an investment-led growth model, AI will act as the invisible force multiplier expanding participation, improving efficiency, and unlocking long-term capital formation.

Frequently Asked Questions (FAQs)

1. What is AI in finance?

Artificial Intelligence (AI) in finance refers to the use of computer systems that can analyze large volumes of financial data, identify patterns, learn from historical behavior, and support decision-making with minimal human intervention.

2. What types of AI features does StockEdge offer?

StockEdge offers features like Chart Patterns, Trading Strategies, Sector Rotation, Sector Analytics, Custom Query, Momentum Scores, and many more.