Table of Contents

With India’s IPO market booming, every investor is on the lookout for the next big opportunity. One such prospect is the International Gemmological Institute (India) Ltd. (IGI India) IPO, which has caught the attention of retail and institutional investors alike. As of 2024, the global diamond industry stands at an estimated ₹8,50,000 crore and is projected to grow at a CAGR of 6% to reach ₹11,00,000 crore by 2028.

IGI India is uniquely positioned to capitalize on this growth. With over 20 state-of-the-art laboratories and a dominant 33% market share in diamond certification, it offers a compelling case for investment. But should you invest in the IGI IPO?

Let’s know more about the International Gemmological Institute (IGI) IPO Date, IGI IPO size, its fundamentals, financial performance, and competitive position.

IGI IPO is open for subscription from (13th Dec 2024) today onwards!

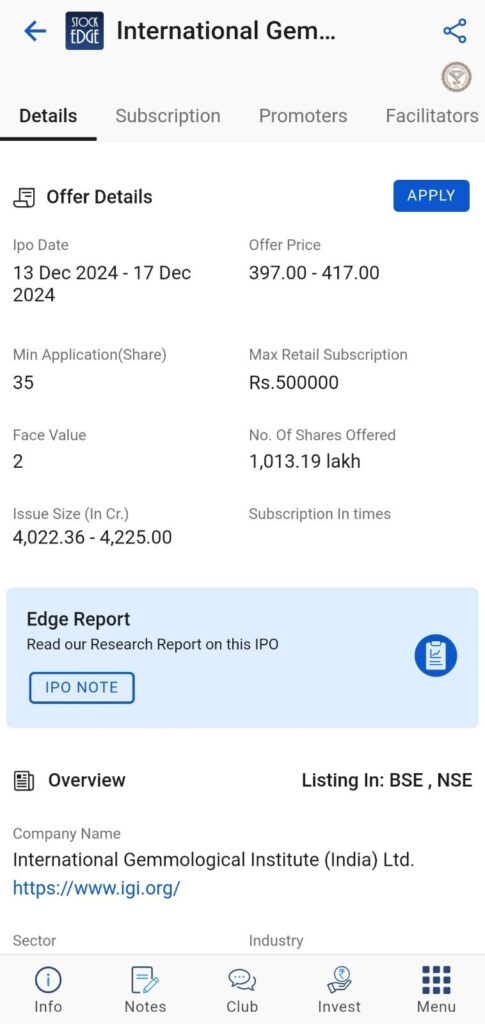

IGI IPO Details:

- IPO Open Date 13th December 2024, Friday

- IPO Close Date 17th December 2024, Tuesday

- Price Band ₹397 to ₹417 per share

- Lot Size 35 shares

- Face Value ₹2 per share

- Issue Size at upper price band ₹4225 crore (Fresh Issue ₹1475 crore and Offer for Sale ₹2750 crore)

- Listing exchanges NSE, BSE

- Cut-off time for UPI mandate confirmation by 5 PM on December 17, 2024

The tentative timeline for the IPO is as follows:

- Basis of Allotment 17th December 2024, Tuesday

- Initiation of Refunds (if not allotted) 18th December 2024, Wednesday

- Credit of Shares to Demat (if gets allotments of shares) 19th December 2024, Thursday

- Listing Date 20th December 2024, Friday

About the Company

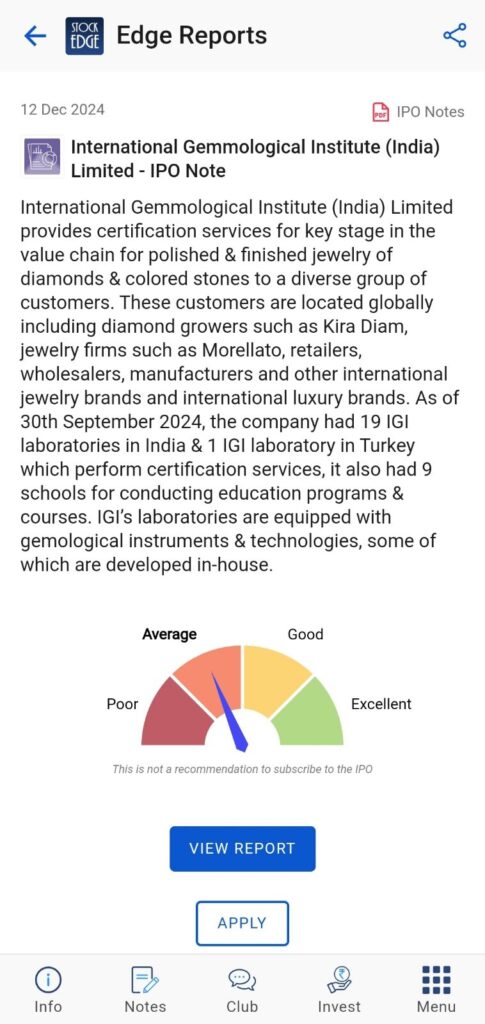

International Gemmological Institute (IGI India) Limited, incorporated in 1999, provides certification services for the key stages in the value chain for polished & finished jewellery of diamonds & colored stones to a diverse group of customers. These customers are located globally, including diamond growers such as Kira Diam, jewellery firms such as Morellato, retailers, wholesalers, manufacturers and other international jewellery brands and international luxury brands. In CY23, Indian customers contributed ~98% to the revenue from contracted customers.

As of 30th September 2024, the company had 19 IGI laboratories in India & 1 IGI laboratory in Turkey, which perform certification services. It also had 9 schools for conducting education programs & courses. IGI’s laboratories are equipped with gemological instruments & technologies, some of which are developed in-house.

Let’s look at the revenue breakup

Sector Outlook in India

The overall global diamond jewellery consumption stands at ~₹8,50,000 cr (USD 103 billion) in CY23, with ~89% contribution from natural diamond consumption. The market is expected to grow at a CAGR of ~6% to reach ~₹11,00,000 cr by CY28, with LGDs driving growth by increasing at a projected ~15% CAGR, whereas natural diamond is expected to grow at ~5% CAGR. China, India, and the USA are the world’s top 3 diamond-studded jewellery-consuming markets that combined contribute to ~77% of the market in CY23. The USA is the largest consumer of diamond jewellery with ₹4,80,000 cr. Both China and India have grown at more than ~20% CAGR to reach ~₹1,12,000 cr and ~₹78,000 cr, respectively, in CY23.

India is not only a key diamond-studded jewellery consumer but also plays a key role in the value chain – for both natural and lab-grown diamonds. India was the sixth-largest exporter of jewellery and loose stones and had a ~4% share in global exports in CY22. The total global gem-quality rough diamond production is estimated at ~61 million carats in CY23. LGD production has observed a faster growth than natural diamond production from CY20 to CY23 and has reached an estimated ~11 million carats. It is further expected to increase at a faster growth rate of 18%-22% till CY28 and is projected to reach 25-30 million carats.

In CY23, the global cut and polished diamonds (CPD) used for jewellery purposes stood at an estimated ~33 million carats, with ~28 million natural diamonds and ~6 million LGDs. These 33 million carats of cut and polished diamonds translate to 70-75 million number of diamonds – spread across various carat weights. As the studded jewellery market grows, demand for certification is likely to rise as well. The key drivers will be increasing awareness among consumers, increase in sales of lab-grown diamonds, shift towards organized jewellery retail, the rise of D2C brands and potential for expanding certification to lower-size diamonds.

Read our blog to know more about the Best Gold Stocks In India.

Financial Performance of the IGI IPO

IGI India’s financial performance highlights consistent growth and operational efficiency. From CY21 to CY23, the company’s revenue grew from ₹365 crore to ₹639 crore, reflecting a compound annual growth rate (CAGR) of 32%. EBITDA margins also witnessed an upward trend, improving from 66% in CY21 to 72% in CY24, indicating strong operational efficiency. Net profit grew from ₹171 crore in CY21 to ₹325 crore in CY23, and it achieved a net profit of ₹326 crore in the first nine months of CY24 alone. This impressive growth is a testament to IGI India’s operational excellence and strategic market positioning.

In comparison to its peers, IGI India stands out as a market leader. Competitors like GIA, HRD, and GSI operate globally, but IGI India’s extensive network of laboratories and growing share of the certification market give it a competitive edge. The acquisition of IGI Belgium and IGI Netherlands will further increase its market share and global presence as it expands from 20 to 31 laboratories worldwide. With an EBITDA margin of 72% and a profit margin of 54.7%, IGI India’s financial strength is stronger than many of its competitors.

Objectives of the Issue

IGI IPO aims to raise ₹1,115 crore, out of which the fresh issue of ₹550 crore and ₹565 crore offer for sale. The company wants to deploy the net proceeds from fresh offerings to fund the following objects:

- Acquisition of IGI Belgium and IGI Netherlands: The company will acquire 100% of the share capital of IGI Belgium and IGI Netherlands for ₹670 crore and ₹695 crore, respectively. This will establish IGI India as a truly global certification powerhouse with a total of 31 laboratories worldwide.

- General Corporate Purposes: The remaining proceeds will be used for strategic expansion, operational upgrades, and other general purposes.

The acquisition is expected to enhance IGI India’s global footprint and drive revenue growth by allowing the company to access high-value international markets.

Now, look at the risk factors for IGI IPO.

Risk Factors

While the IGI IPO appears promising, investors should consider the following risks:

- Revenue Concentration: A significant portion of the company’s revenue (46%) comes from its top 15 customers, increasing dependency on a limited client base.

- Promoter Influence: BCP Asia II TopCo Pte. Ltd. holds a controlling stake even after the IPO, which could affect decision-making and governance.

- Market Volatility: Volatility in diamond prices, particularly for natural and LGDs, may impact demand for certification services.

- Competition: Rising competition from global players like GIA and HRD may pressure margins and market share.

- Geographic Dependence: A large portion of revenue is derived from operations in India, which increases exposure to local market risks and regulatory changes.

- Acquisition Risks: The acquisition of IGI Belgium and IGI Netherlands is significant, and any integration issues could affect profitability.

Investors should carefully evaluate these risks before subscribing to the IGI IPO.

Should you subscribe to IGI IPO?

IGI India commands a 33% share of the global gemstone certification market. In India, IGI India is the largest independent certification and accreditation services provider in terms of the number of certifications (~50% market share) for CY23. IGI India also serves 9 of the top 10 jewellery chains in India. The company operates in an industry characterized by high entry barriers due to substantial initial setup costs and dominated by a few key players, including global competitors. The acquisition will likely lead to a decline in margins. Furthermore, the promoters may also divest their stake in the company.

Before investing in the IGI IPO, it’s essential to weigh the potential risks and rewards. This blog offers a comprehensive review of the key benefits and possible challenges of participating in this IPO.

StockEdge’s expert panel has rated the IGI IPO as “Average”, reflecting a cautious but balanced outlook. To provide more clarity, we’ve prepared an IGI IPO Note, which offers a detailed analysis of the company’s financial position and a SWOT assessment, giving you a deeper understanding of its growth prospects.

Explore StockEdge’s dedicated IPO section under the Explore tab, where you can track upcoming, ongoing, and recently listed IPOs.

Join the StockEdge Club, where our team of research analysts will assist you with queries related to investments, trading, and IPOs.

Stay informed, invest smart, and happy investing!

Read Also : Top 10 Mutual Funds for SIP: Best Bets for 2024-2025