Table of Contents

After 24th March 2024, many sectors experienced substantial growth of ~100-200%. But one sector outperformed them all with an astonishing performance, soaring by nearly 480% in return as of September 3rd, 2024.

Yes, you heard that right!

From the construction of homes to the manufacture of drones, this sector is fueling economies and driving innovation on a global scale.

You guessed it—we are talking about the metal sector.

This sector has not only emerged as a top performer but has also become the backbone of India’s modern economy, which is a testament to the resilience and growth potential of India’s metal stocks. Today, the vision of the new India is “Atmanirbhar Bharat,” or self-reliant, which enhances the growth of industrial and infrastructure and creates more demand for metal stocks. Now, India is a global powerhouse in steel production, standing as the second-largest crude steel producer and the fourth-largest iron ore producer in the world.

In this blog, we will explore different segments of the metal sector, understand the key drivers of its growth, explore the top-performing metal stocks in India, and take a closer look at the future opportunities and risks that lie ahead for this industry.

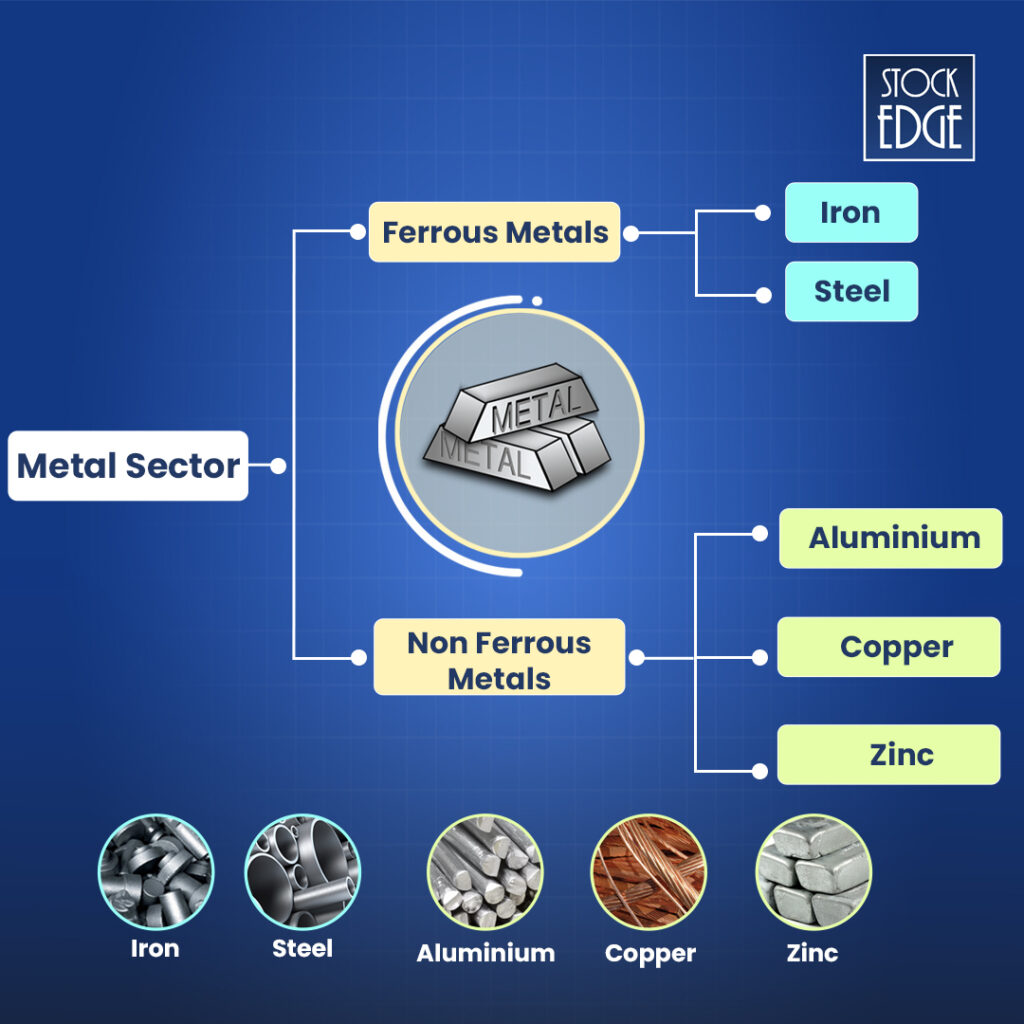

Overview of the Metal Sector

The metal sector is a broad category in itself. It’s further divided into various segments, each with its unique characteristics and uses. Let’s explore some of these key segments:

Ferrous Metals Industry:

This segment primarily focuses on manufacturing iron and steel and is led by industry giants like TATA Steel Ltd., SAIL Ltd., Shyam Metalics And Energy Ltd., and many more.

According to the Press Information Bureau (PIB), iron ore production grew significantly, from 50 million tonnes (MMT) in April-May FY 2023-24 to 52 MMT in the same period of FY 2024-25, showing a 4% growth year-on-year.

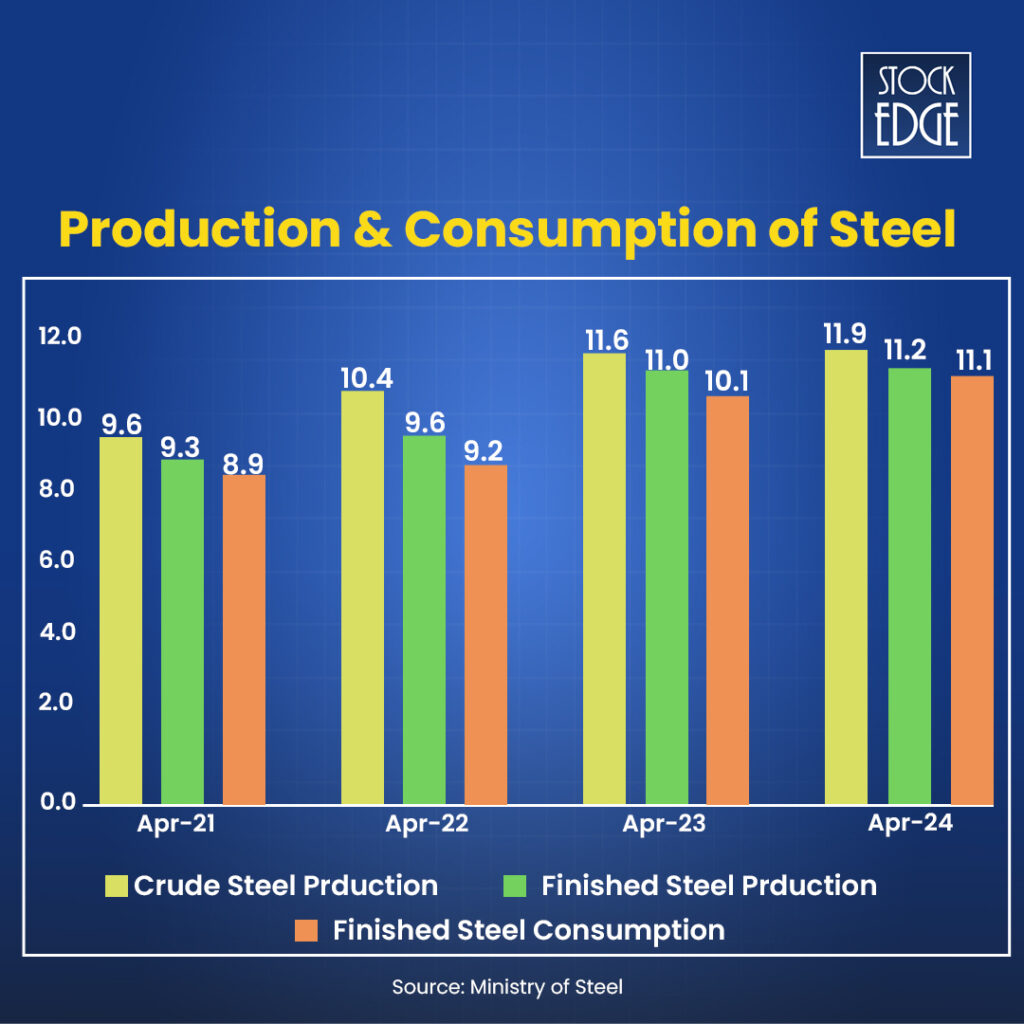

On the other hand, the production of crude steel, also known as raw steel, reached 11.92 million tonnes (MT) in April 2024, finished steel production stood at 11.26 MT, and finished steel consumption was 11.08 MT, according to the Ministry of Steel.

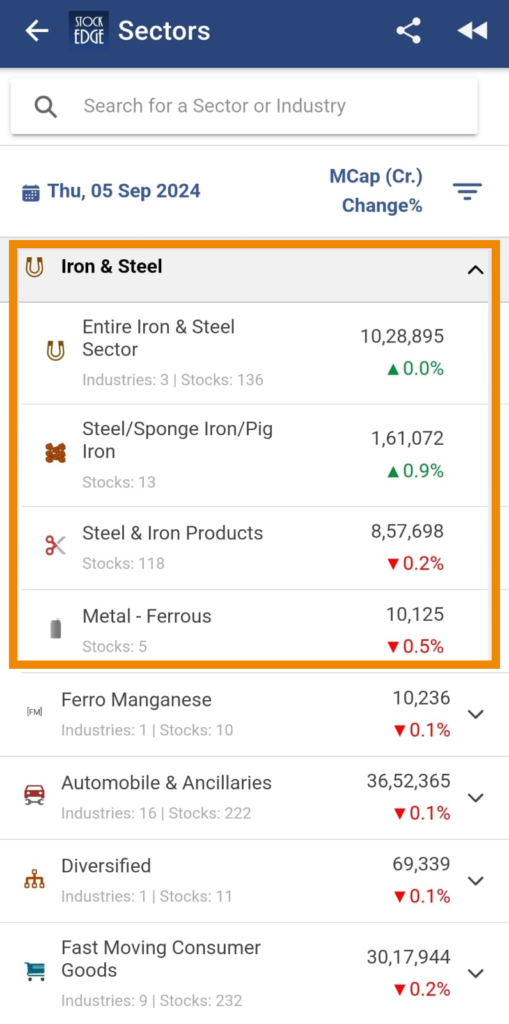

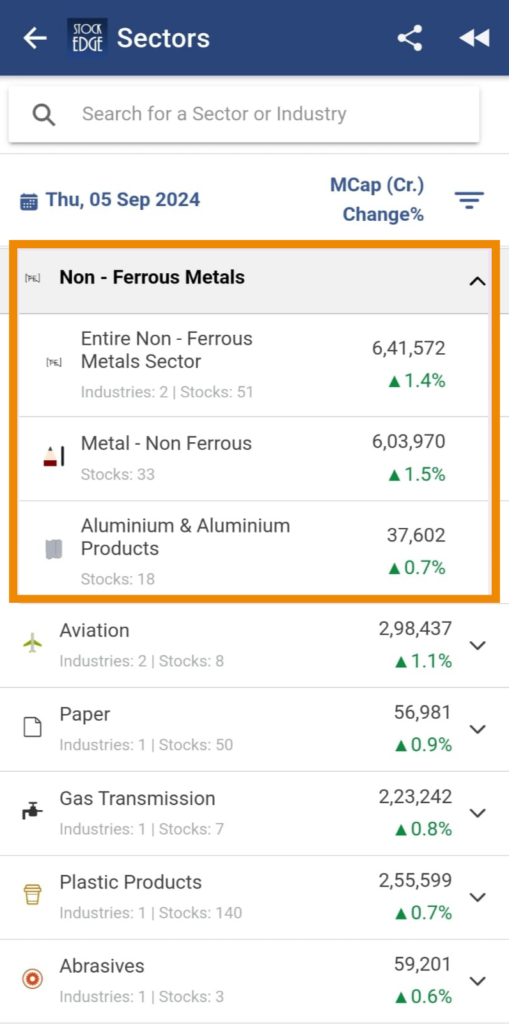

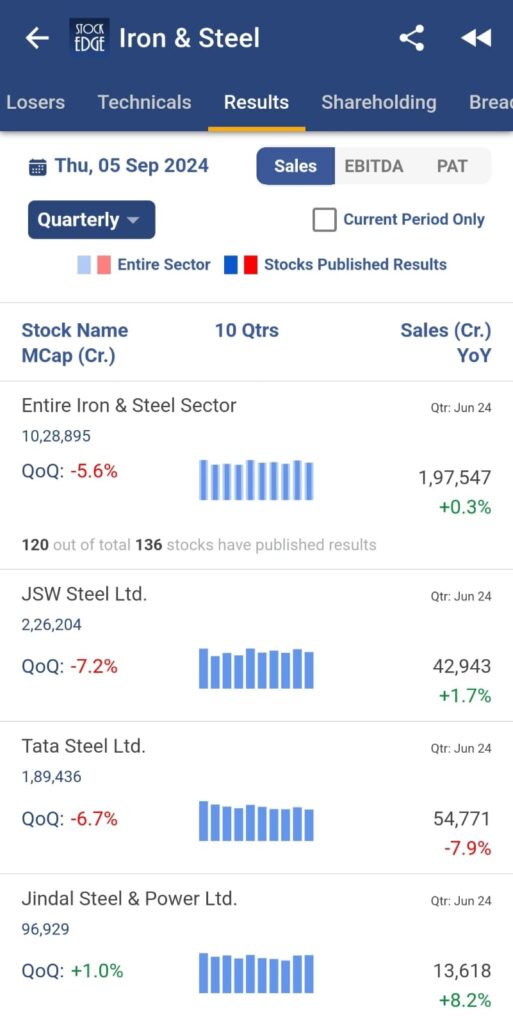

This segment is broad and is divided into three industries with 136 stocks. Using StockEdge, you can check out the list of iron and steel industries in India.

Non-Ferrous Metals Industry:

This industry focuses on manufacturing essential materials such as aluminium, copper, zinc, lead, nickel, and tin. Key players include Hindalco Industries Limited, National Aluminium Company Limited, Hindustan Zinc Limited, and many more.

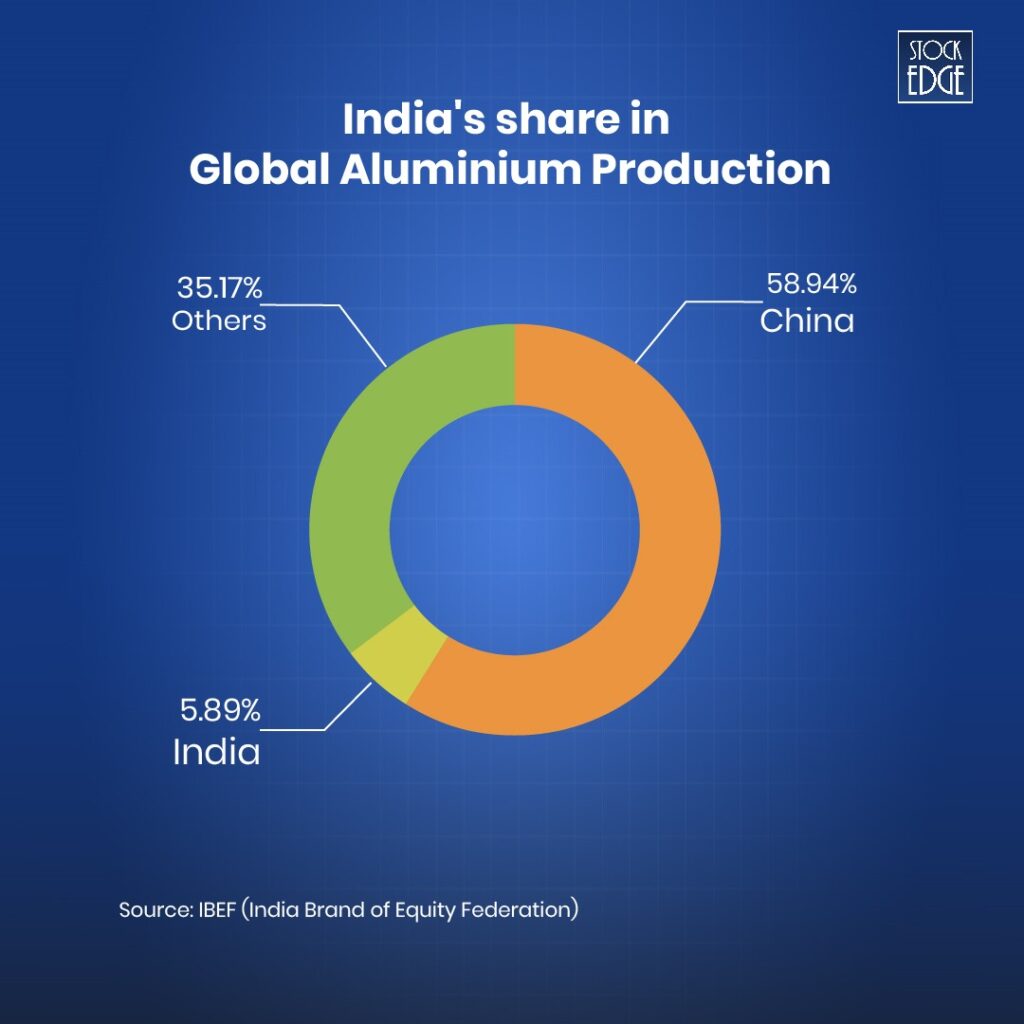

In FY23, India has the second-largest aluminium production capacity in the world, with 4.2 million tonnes per annum (MTPA). In FY24, the country produced 41.59 lakh tons of aluminium. Currently, India’s share of the world’s aluminium production is nearly 5.9%.

This sector has two industries and 51 stocks. Using StockEdge, you can check out the list of non-ferrous metals industries in India.

Key Growth Drivers of Metal Stocks

In order to identify the top metal stocks in India, it is necessary to understand the sector’s growth drivers. Here are some of the key drivers of the tourism industry:

- China suspends new steel plants: Recently, China suspended approval for new steel plants because the government observed that the demand for steel declined, destroying the sector’s profitability. This impact can be an opportunity for Indian steel companies.

- Infrastructure development: The government focuses on building highways, railways, airports, and other infrastructure projects that boost demand for steel and other metals. In the 2024 union budget, the government has allocated ₹11,11,111 crore in infrastructure development. You can read more about it in our blog on Top 5 Strong Sectors In Union Budget 2024.

- Anti-Dumping Duties on Steel: On September 11, 2023, India imposed a five-year anti-dumping duty on some types of Chinese steel, which means that importers of these specific types of Chinese steel into India would have to pay an additional tax. The duty was imposed after the steel industry raised concerns about potential dumping by Chinese sellers and after steel imports from China to India increased by 62% between April and July 2023.

- Government Initiatives: Initiatives like the PLI Scheme for Specialty Steel, the National Steel Policy, and the Mines and Minerals (Development and Regulation) Amendment Act provide policy support for the metal sector, attracting investments and reducing barriers to entry.

Nifty Metal Index

The Nifty Metal Index aims to reflect the performance of the metals stocks (including mining). It can be used for a variety of purposes, including fund portfolio benchmarking, index fund and ETF launches, and structured product development.

Compositions

The Nifty Metal Index consists of up to 15 stocks listed on the National Stock Exchange (NSE). The companies are divided into two sectors: the Metal and Mining sector (93.28% of the index) and the Capital Goods sector (6.72% of the index).

Current Trend of Metal Sectors

Now, let’s talk about the current trend in the metal index. To find out, we can use StockEdge’s “Sector Rotation” feature. At StockEdge, we offer a sector rotation model that uses key technical indicators to determine if a sector is outperforming or underperforming.

Let’s understand how.

We can see that the nifty metal index is under selling pressure due to global slowdown concerns leading to increased demand, which has been one of the key reasons for the decrease in metal stocks.

If the US Federal Reserve cuts interest rates, the metals stocks are expected to benefit. Lower interest rates can benefit metal-intensive industries like construction and manufacturing by lowering the cost of transporting and storing large commodity inventories, especially metals. This, in turn, can boost demand for metal stocks. Furthermore, a rate decrease could boost foreign institutional investor (FII) inflows into the Indian equity market since lower global interest rates make Indian banking companies more appealing.

From a technical perspective, sector rotation will be a key indicator because when technical parameters signal a bullish trend, i.e., green in colour, metal stocks are likely to outperform the market.

Nifty Metal Index Performance

The graph below clearly illustrates that over five years, the Nifty Metal index has significantly outperformed the Nifty 50. While the Nifty 50 provided approximately 115% returns, the Nifty Metal index soared with an impressive ~280% return.

The nifty metal index has been on a strong uptrend since COVID-19. Pullbacks from time to time over the years have created opportunities for investors to make an entry. In current times, the index has been witnessing a pullback, which could be an opportunity for investors to enter in the long run.

Now, let’s look at some of India’s metal stocks.

Top 4 Metals Stocks

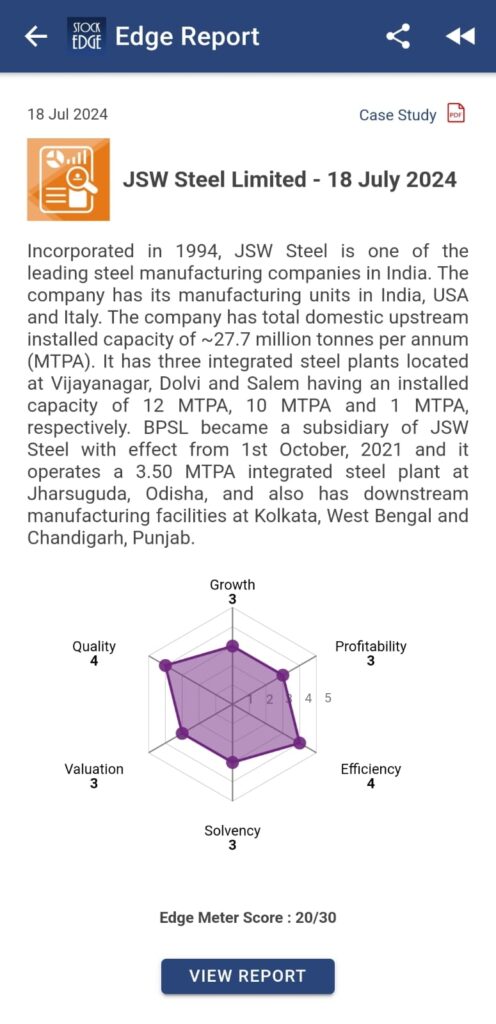

JSW Steel Ltd.

JSW Steel is one of the leading steel manufacturing companies, with production units in India, the USA, and Italy. In FY2023-24, it had the highest production capacity at 28.08 MTPA. They make a wide range of automobiles, flat and long goods to serve construction, general engineering, automobile electric appliances, and energy. They aim to expand its total capacity to 38.5 MTPA by FY25. They committed to achieving Net Zero emissions by 2050.

JSW Steel is implementing digital logistics management, IoT sensors, RFID tags, and real-time monitoring systems to enhance operational efficiency, reduce turnaround times, and enhance safety standards. In Q1FY25, their sales volume grew to 6.12 MT, up 7% YoY, driven by strong domestic demand in India and their exports contributed 14% to its total Indian steel volume.

To know more about the financial performance of JSW Steel Ltd., you can check out the investment ideas.

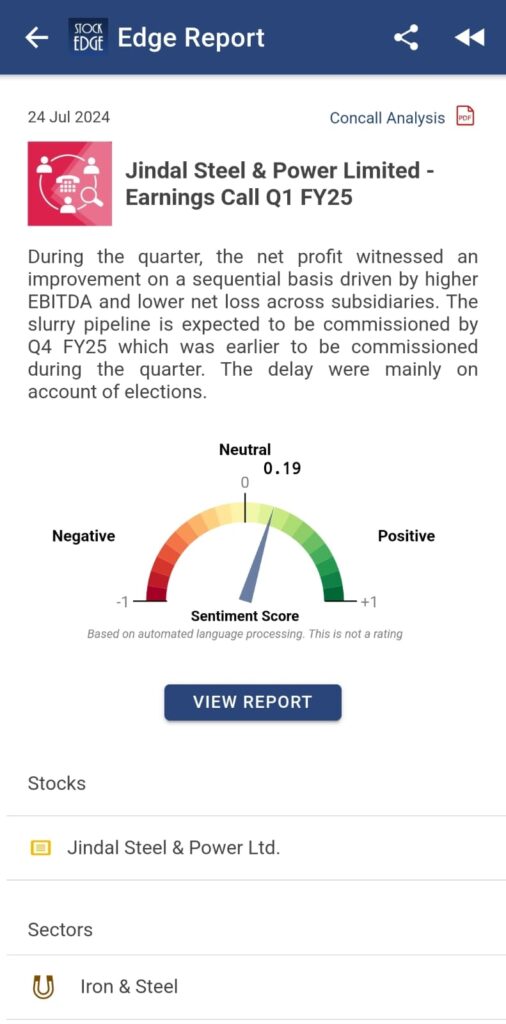

Jindal Steel & Power Limited

Jindal Steel & Power Limited is the fourth leading steel manufacturing company, with a production capacity of 9.6 MTPA. r. The Company manufactures a wide array of long products and speciality plates, serving key market segments such as defence and shipbuilding, railways, construction and projects, energy, oil and gas, general engineering, and original equipment manufacture. In Q1F25, they reported ₹13,618 crore in revenue from operations, reflecting an 8.2% increase compared to ₹12,588 crore in Q1 FY24. The company’s capital expenditure stood at ₹2,796 crore in Q1 FY25, which was allocated toward the 6 MTPA plant expansion project.

Check out the Concall analysis to know more about its financial health.

Hindalco Industries Limited

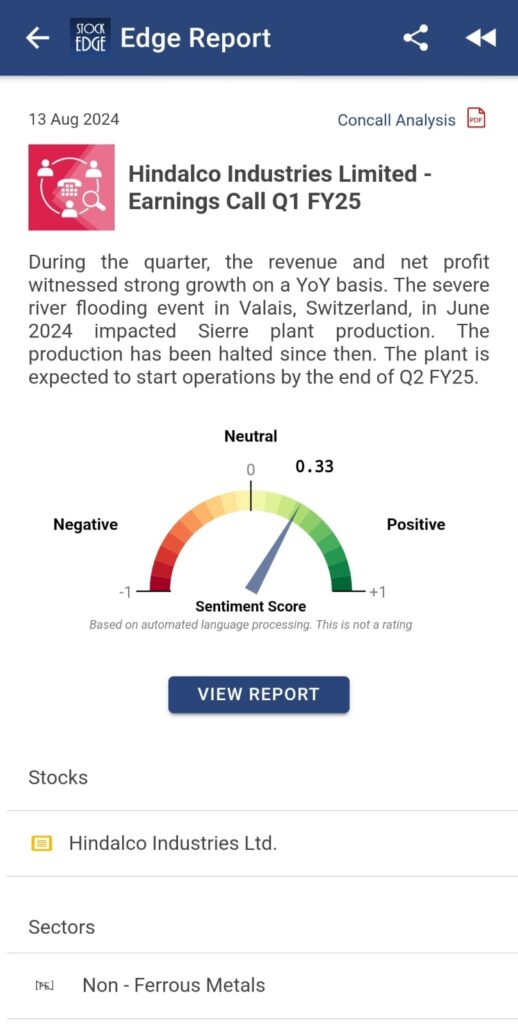

Hindalco Industries Limited is one of the largest global players in aluminium rolling and recycling. Additionally, it is a significant player in the copper sector and a leading name in speciality alumina. They serve a wide range of industries, which include aerospace, automotive, construction, defence, electronics, pharmaceuticals and packaging, energy, recycling, and more. In Q1 FY25, they reported revenue of ₹57,013 crore, a 7.6% increase compared to ₹52,991 crore in Q1 FY24.

Check out the Concall analysis to know more about its financial health.

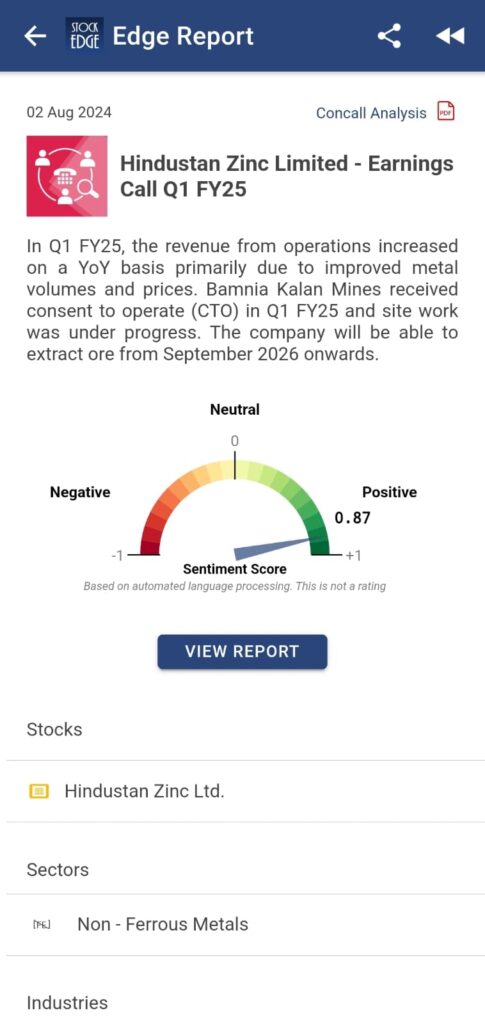

Hindustan Zinc Limited

Hindustan Zinc is the world’s second-largest integrated zinc producer and third-largest silver producer. It has more than 75% of the market share in India’s primary zinc market. Not only that, it is Asia’s first low-carbon ‘green’ zinc producer. In Q1 FY25, they reported revenue from operations of ₹7,893 crore, marking an 11% year-over-year (YoY) increase, primarily driven by improved metal volumes and prices, supported by a stronger dollar, though partially offset by lower silver volume. Their net profit for the quarter stood at ₹2,345 crore, up 19.4% YoY. The company’s EBITDA margin was substantial at 49%, reflecting efficient cost management.

To know more about it, you can visit StockEdge.

Future Outlook of Metal Stocks

- Geopolitical Tensions and Disruptions: There are growing concerns over potential supply disruptions in key metal-producing regions. For instance, tensions in New Caledonia, a significant producer of nickel, have raised fears of supply shortages. Similarly, other geopolitical risks and environmental regulations in mining regions are contributing to fears of constrained supply. To know more about the geopolitical risk in the stock market, you can read our blog, Top 3 Geopolitical Risks for Stock Market: How to tackle them?

- China Stimulus for the Property Sector: China recently introduced measures to stabilize its real estate market, which is a significant driver of metal demand. These measures include easing mortgage rules and encouraging local governments to purchase unsold homes. This is expected to boost construction activity, thereby increasing the demand for metal stocks.

- Market Momentum: As metal prices hit record levels, speculative trading has intensified. Traders and investors looking to capitalize on the rising prices are entering the market, driving prices even higher. This momentum can create a self-reinforcing cycle where rising prices attract more buyers, further pushing up prices.

- Government Initiatives: The government intensifies its focus on infrastructure development. This includes significant investments in the construction of roads, railways, airports, and other critical infrastructure projects. As these large-scale projects progress, the consumption of steel, a key material in construction, is anticipated to increase, driving up overall demand in the metal stocks.

To get an insight into the sector, check out our Sector Analytics, which provides an overview of the different sectors.

Bottom Line

According to the IBEF (India Brand Equity Foundation), by 2030–31, India hopes to reach a total crude steel capacity of 300 MTPA and a total crude steel production of 255 MTPA. The consumption across sectors of the end-user ecosystem will drive this growth, which will also be promoted by government expenditure and increasing urbanisation. Government initiatives in infrastructure development are likely to drive demand for metal stocks.

In conclusion, India’s metal stocks have demonstrated remarkable resilience and growth, emerging as a cornerstone of the country’s economic development. Infrastructure projects continue to offer significant business opportunities for metal stocks like steel, zinc, and aluminium. These metals are fundamental to the construction industry, with iron and steel being essential components in real estate development. As the residential and commercial building sectors experience robust growth, the demand for these materials is expected to remain strong. This ongoing demand is driven by increasing infrastructure investments and the expansion of urban areas, ensuring a vibrant and sustained market for metal stocks.