Table of Contents

“Mutual Funds sahi hai” is a famous tagline you must be aware of. This campaign, which started way back in 2017 to promote household investment in mutual funds, has had an immensely positive impact on the overall mutual fund industry in India.

As of Dec 2024, the average asset under management is ₹ 69.32 Lakh Crore, an annual growth of 35.6% from ₹51.09 lakh crores. The MF Industry’s AUM has grown from ₹ 27.86 trillion as on January 31, 2020 to ₹67.25 trillion as on January 31, 2025, more than 2 fold increase in a span of 5 years.

So, are you investing in mutual funds? Or have a fear of losses or the volatility of the stock market? A smart method to lower the danger of excessive stock volatility is to diversify your portfolio of stocks and other asset classes with mutual funds. You can invest in mutual funds with very low capital, as low as ₹500 per month, through SIP, a systematic investment plan to invest in mutual funds.

We’ll talk about the Best mutual funds in India for 2025 in today’s blog. Top 5 picks in which you can start your SIP today and start your financial journey of investing in mutual funds in 2025.

Don’t worry if you are new to mutual funds; we shall be discussing SIPs, different categories of mutual funds and various asset classes you can invest in. Lastly, we will be sharing the best mutual funds in India for 2025.

Why invest in mutual funds?

Investing in mutual funds is the best way to become a part of this economic growth and ride the boom of the Indian stock market. Not everyone is prudent in stock investing, and picking up good stocks is not a cup of tea for everyone! Hence investing in equity mutual funds is the best way to invest indirectly in the stock market.

However, investing in mutual funds can be done majorly through a lump-sum investment or SIP, which is a systematic investment plan. If you plan to invest small sums regularly, then SIPs are the best way to make investments.

Why SIPs?

Here are four major advantages of mutual funds investments through SIPs:

- Rupee Cost Averaging: SIPs let you buy more units of a fund when prices are low and fewer units when prices are high, reducing the impact of market volatility.

- Disciplined Approach: SIPs promote regular investing, helping develop a habit and eliminating the need for market timing decisions.

- Flexibility and Affordability: SIPs allow small investments to start and increase gradually over time, making them accessible for individuals with limited capital.

- Power of Compounding: Regular investments through SIPs harness the compounding effect, leading to exponential growth of investments over time.

Sounds amazing. But the question is, which mutual fund is best for SIPs?

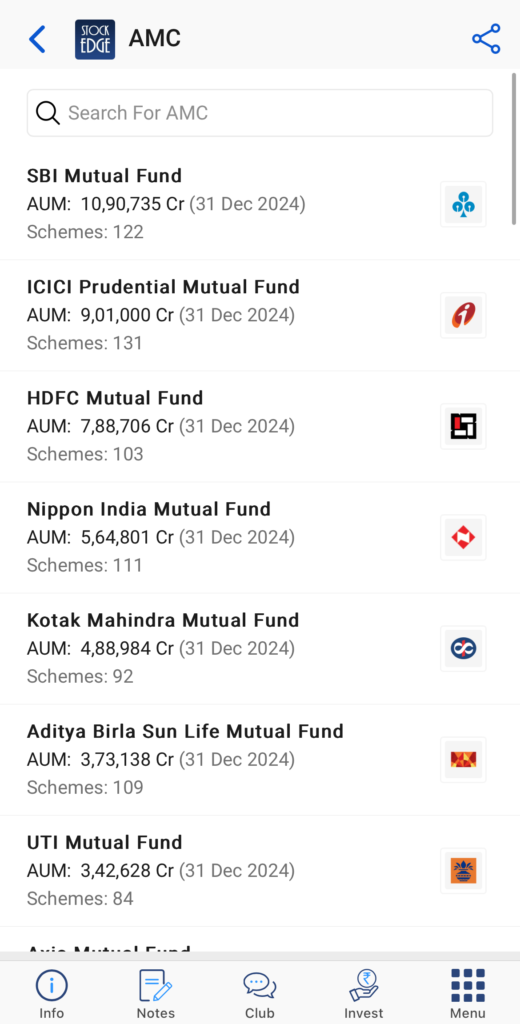

In India, there are over 44 (AMCs) Asset Management Companies in India, with thousands of mutual funds schemes of different categories. It is extremely challenging to pick just 4-5 best mutual funds in India.

To find out the list of AMCs in India and the different types of mutual funds offered by the AMCs, you can check out the list of AMCs under the Mutual Fund Section in StockEdge.

But more than identifying the best mutual funds in India that you can invest in, it is important to understand the different classes or types of mutual funds.

What are the different classes of mutual funds?

Broadly they are divided into four major classes:

- Equity

- Debt

- Hybrid

- Others

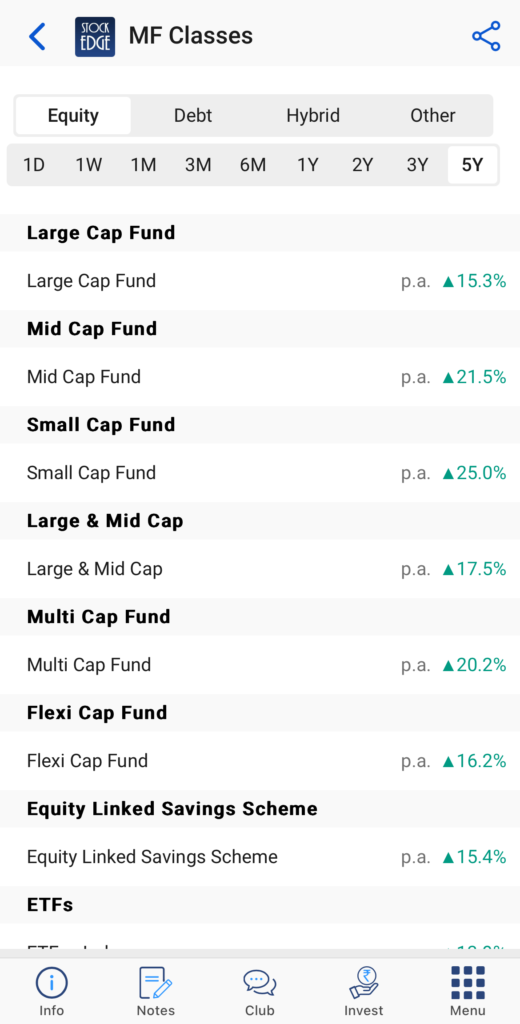

In StockEdge, you can view the different categories of mutual funds under each class of mutual funds and compare their annualized return based on your desired time frame.

In the above image, you can see the list of different categories of equity mutual funds, such as large-cap, mid-cap, and small-cap funds etc., and how they have performed in the last 5 years.

Categories of Equity Mutual Funds

As you have noticed, there are several categories of equity mutual funds. Some are classified based on market capitalization, such as:

- Large Cap Fund

- Mid Cap Fund

- Small Cap Fund

- Large & Mid Cap Fund

- Multi Cap Fund

- Flexi Cap Fund

To know more about each of them, read this blog Market Capitalization Funds – Large, Small, or Multi-cap – Which One to Invest in?

Please note that when allocating your mutual fund investments, it’s important to consider your risk profile. While equity-based mutual funds carry overall risk, large-cap funds investing in shares of top corporations are comparatively less risky than small-cap funds that invest in shares of smaller growing companies, which come with a higher risk of business failure or bankruptcy. So investing in best mutual funds in India differs from investor to investor and completely based upon your individual risk profile.

However, greater risk often accompanies higher returns, as small companies have the potential to grow faster than big corporations. Therefore, your risk appetite should guide your allocation of mutual funds across different categories.

In simpler terms, your investment choices should align with your comfort level for taking risks.

Other than this, there are different categories of equity mutual funds like Equity Linked Savings Schemes (ELSS) mutual fund, Index Funds, Focused Funds, Contra Funds, Sector Funds, Thematic Funds, and Value Funds.

Best Mutual Funds in India

Now, let’s check out the list of mutual funds that we have selected for you to start your SIP.

- ICICI Prudential Value Discovery Fund– This is an open-ended equity fund following value style of investment in a diversified portfolio of stocks. and follows a benchmark-agnostic sector allocation approach. it identifies stocks whose prices are relatively low to their historic performance, earnings, book value & cash flow potential. The AMC selects stocks based on Financial strength, business durability and management behavior.

- Kotak Emerging Equity Fund– This is an open-ended equity fund investing predominantly in mid-cap companies that are at their nascent or developing stage and are under-researched. The aim of this fund is to generate long-term capital appreciation, however, it may remain volatile in the short term, and mid-cap stocks have more potential to deliver higher growth in the long term.

- Nippon India Multi Cap Fund – An open-ended equity scheme that makes investments in small, mid, and large-cap stocks. By investing in a portfolio of stocks, the scheme’s primary goal is to generate capital appreciation and long-term growth prospects. Its secondary goal is to generate consistent returns by making investments in debt and money market instruments.

- ICICI Prudential Equity Debt Hybrid Fund– This is an open-ended scheme investing in a mix of equity and debt instruments to provide a balanced risk-return approach to investors. However, the scheme invests a majority of 65% in equity with a little exposure of 20% to 35% in debt instruments, offering a balance of growth and stability of return against the volatility of equity markets.

- UTI Nifty 50 Index Fund– This is an open-ended index fund that aims to mimic the performance of the Nifty 50 Index, with a possibility of some tracking error. Investing in these funds can assist in surpassing long-term inflation and achieving substantial returns. They are well-suited for individuals with investment goals spanning 10-15 years or even longer (with a minimum investment horizon of five years).

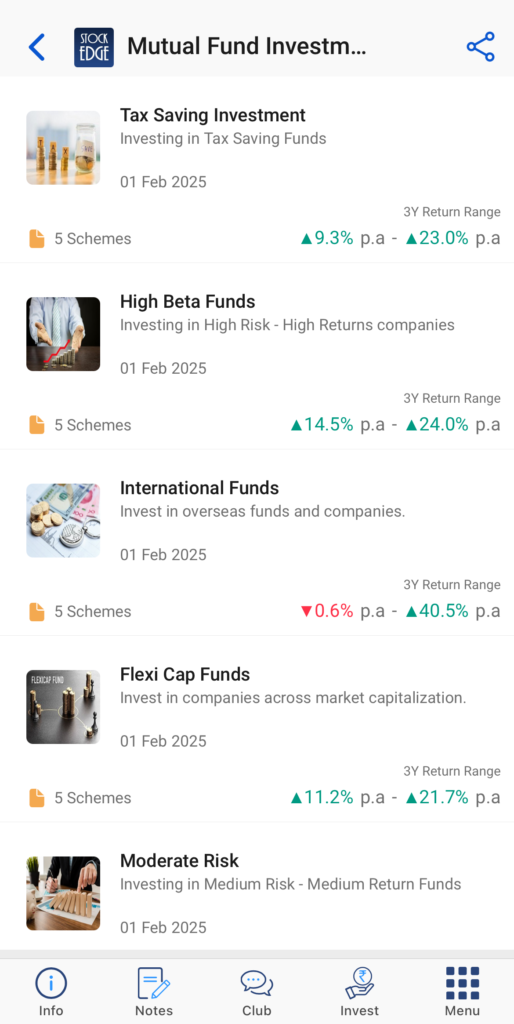

Hope investing in the list of all these schemes through SIP may generate alpha for your mutual fund portfolio. However, if that’s not enough, we have a bonus for you! Allocate a small portion of your fund in Gold in the form of a Gold Index Fund or (Gold ETFs), as Gold may act as a hedge for your equity-based mutual fund portfolio in tough times. You can check out our MF Investment Themes- Reap the benefits of Gold to find a suitable fund to invest in Gold. We also have a list of other Mutual Fund Investment Themes, which you may check out!

We believe there is potential in the above mutual funds’ schemes for long-term financial goals. Investing in these funds with a time horizon of five to seven years can be beneficial. Nevertheless, it’s important to note that these schemes do carry risks and may experience fluctuations. Therefore, fund allocation in these schemes should align with your risk profile and you must consult your advisor before investing.

You can also watch this video by Mr. Vivek Bajaj on how you can maximize your wealth by investing in mutual funds!

The Bottom Line

As individuals in India, it’s unlikely that we remember every advertisement we’ve seen. However, one phrase has been etched in our memories: “Mutual funds are subject to market risk, please read the offer document carefully before investing!” These words, spoken rapidly at the end of every mutual fund advertisement, hold true importance. Just like the advertisers, we also emphasize the significance of understanding the market risk and thoroughly reviewing the offer document before making any investment decisions.