Table of Contents

Good news! We are happy to announce that StockEdge has released version 3.5. In this version, StockEdge has brought many new features for the free users as well as for premium members. In this article let us discuss the new features in brief:

Additions in Free Version 3.5

In the 3.5 version of StockEdge, many new and useful features have been added which will help us in filtering fundamental sound stocks.

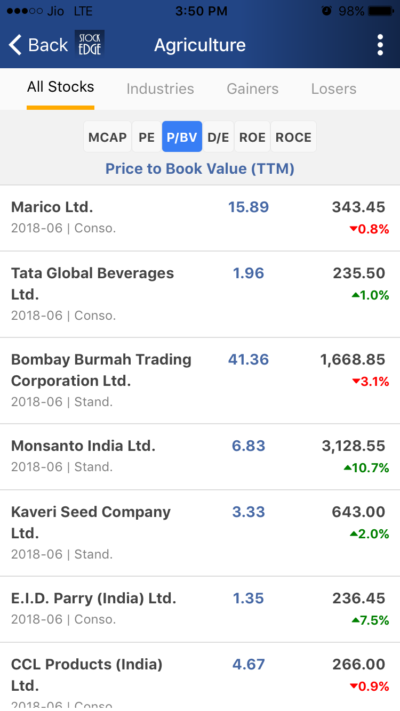

Sector Analysis

We have added few valuation tools in Sector feature like Market cap, P/E ratio, Debt-Equity ratio, RoE etc for filtering stocks based on these valuations parameters in any sector. Given below is an example from Companies in the Agriculture Sector based on Price to Book Value.

Industry Analysis

We have added the same valuation tools in Sector feature like Market cap, P/E ratio, Debt-Equity ratio, RoE etc for filtering stocks based on these valuation parameters in any Industry. Given below is an example from Rubber Industry in Agriculture Sector based on Price to Earning Ratio.

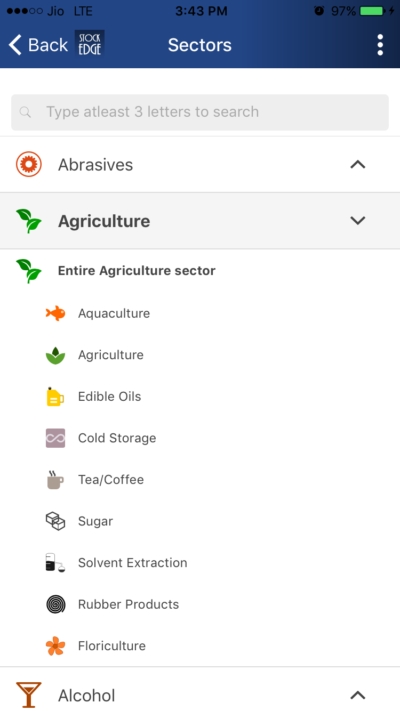

Hierarchical view of Sectors and Industries

This feature helps you to find the names of the various Industries in a particular sector which helps you to understand which industries belongs to which Sector and thus helps you to identify different Industry under same Sector.

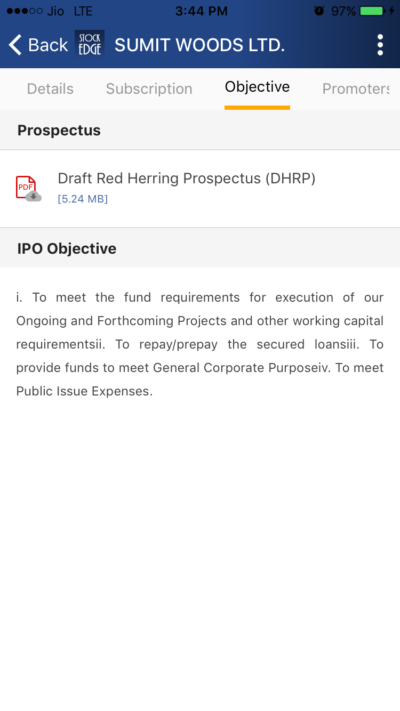

Draft Prospectus of IPO

We have added the red herring prospectus of the IPO in the IPO Objective section, to give you a detailed insight into the purpose and the working of the company coming out with an IPO. Thus this will help you take an informed decision before applying for the IPO.

Bottom Line

These added features will help you take more informed decisions at a click of a button. The fundamental indicators in the Industry and sectors will help you to track down information on any particular Industry or stock and help you take informed decisions.

Thankyou for your feedback!!

thanks for this post