Read about Escorts Ltd. and 4 other stocks below:

According to a press release issued by Escorts to the BSE, the company raised Rs 1,872.74 crore through a preferential issue of 96.64 lakh equity shares to Kubota at Rs 2,000 per share.

Kubota will make an open offer to acquire additional stakes in the company as part of the stake acquisition.

As of today’s date, this is the share price of Escorts Kubota Ltd.

“The Kubota acquisition is beneficial to Escorts because it will result in technology/new product support for the Agri and Construction Equipment divisions.” Exports may also benefit from the expansion of the product portfolio and the use of the global Kubota distribution network.

Escorts is one of India’s leading engineering conglomerates, with operations in agriculture, infrastructure, and railways.

Across its businesses, the company continues to foster collaborations, drive modernization, and implement advanced manufacturing practices in order to bring the best of the world to India and to take India’s best capabilities to the world.

The stock fell after the company announced on Wednesday after market hours that it has formed a committee of directors to evaluate and recommend a variety of options and alternatives for its aluminum, iron and steel, and oil and gas businesses, including demergers, spin-offs, or strategic partnerships.

The company’s board of directors has decided that, given the scale, nature, and potential opportunities for the Company’s various business verticals, the Company should conduct a comprehensive review of its corporate structure and evaluate a full range of options and alternatives (including demerger(s), a spin-off(s), strategic partnerships, and so on) for unlocking value and simplifying its corporate structure, Vedanta said in an exchange filing.

As of today’s date, this is Vedanta share price.

The intention is for the aluminum, iron, and steel, and oil and gas businesses to be housed in standalone listed entities, subject to a detailed evaluation, it added.

The strategic goals for carrying out such an exercise are to simplify and streamline corporate structure, unlock value for all stakeholders, create businesses that are better positioned to capitalize on their distinct market positions and deliver long-term growth and enable strategic partnerships.

According to the company, the exercise will also tailor the capital structure and capital allocation policies based on business-specific dynamics, distinct investment profiles to attract deeper and broader investor bases, and accelerate emissions reduction and strong ESG practices.

The shares of Spandana Sphoorty Financial Ltd. were trading at Rs.470.00, down by 2.4% in today’s trading session.

The stock has been falling since the company delayed the announcement of September 2021 quarter (Q2FY22) financial results, due to recent flux in management following resignation by managing director Padmaja Reddy and attrition in the information technology team.

As a publicly-traded company, the company is required to submit quarterly financial results for Q2FY22 to stock exchanges within 45 days of the quarter’s close, i.e. by November 14, 2021. However, SSFL informed BSE that it was unable to submit the aforementioned results within the time frame specified and as of today’s date, this is Spandana Sphoorty Financial share price.

The financial results for the fiscal quarter ended September 30, 2021, will be submitted with an unavoidable delay. “Our management has recently changed. Our former managing director recently resigned, as reported to the stock exchanges on November 02, 2021. Following that, our information technology team experienced attrition,” SSFL stated.

Tata Teleservices (TTSL) and its subsidiary Tata Teleservices (Maharashtra) are emerging market leaders in the Enterprise space. Under the brand name Tata Tele Business Services, it provides a comprehensive portfolio of voice, data, and managed services to enterprises and carriers in the country (TTBS).

TTBS announced the launch of Smart Internet last month, the industry’s first smart internet leased single suite combining high-speed internet with cloud-based security and greater control at an optimized cost.

TTML’s net loss for the first half (April-September) of the fiscal year 2021-22 (H1FY22) was Rs 632 crore, down from Rs 1,410 crore in the same period of FY21. As of September 30, 2021, the Company’s current liabilities exceeded its current assets and as of today’s date, this is Tata Teleservices Share price.

TTML stated that it has received a letter of support from its promoter indicating that the Promoter will take the necessary steps to prepare for any shortfall in liquidity within 12 months of the balance sheet date. “Based on the foregoing, the Company is confident in its ability to meet the fund’s requirement and continue its operations as a going concern,” TTML stated.

Shipping Corporation of India announced that the board of directors of Shipping Corporation of India Land and Assets considered and approved the Scheme of Arrangement for Demerger of ‘Non-Core Assets’ between Shipping Corporation of India (Demerged Company) and Shipping Corporation of India Land and Assets at its meeting on November 16, 2021 and as of today’s date, this is Shipping Corporation Of India share price.

The Company is taking the necessary steps to obtain all necessary approvals from the Competent Authorities in order to implement this Scheme.

Shipping Corporation Of India Ltd. is the only Indian shipping company that offers break-bulk services, international container services, liquid/dry bulk services, offshore services, and passenger services. Furthermore, the SCI operates and manages a large number of vessels on behalf of various government agencies and organizations.

Read our latest blog on Will the supernormal profits of the steel companies sustain in the 2nd half of the FY22?

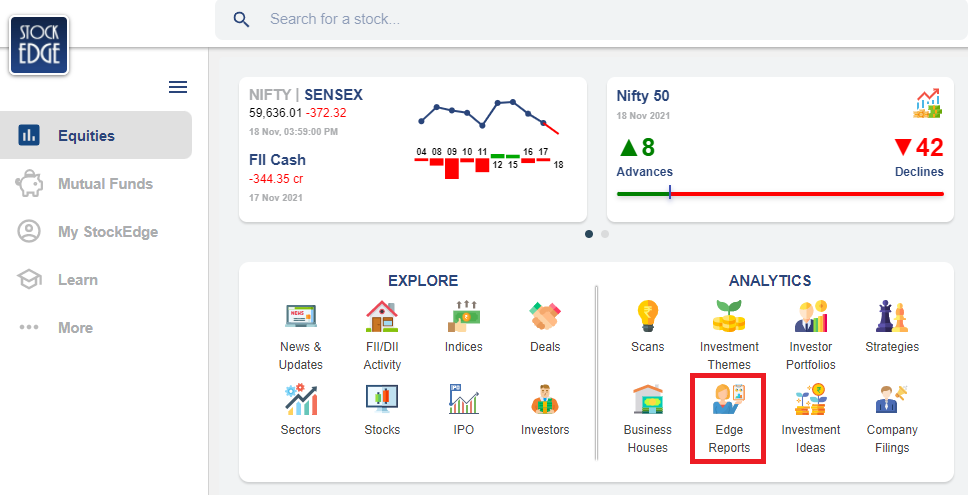

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.

Very good information.