In this blog, we will share our spotlight on Kitex Garments Ltd.

Kitex Garments Ltd. – Highlights

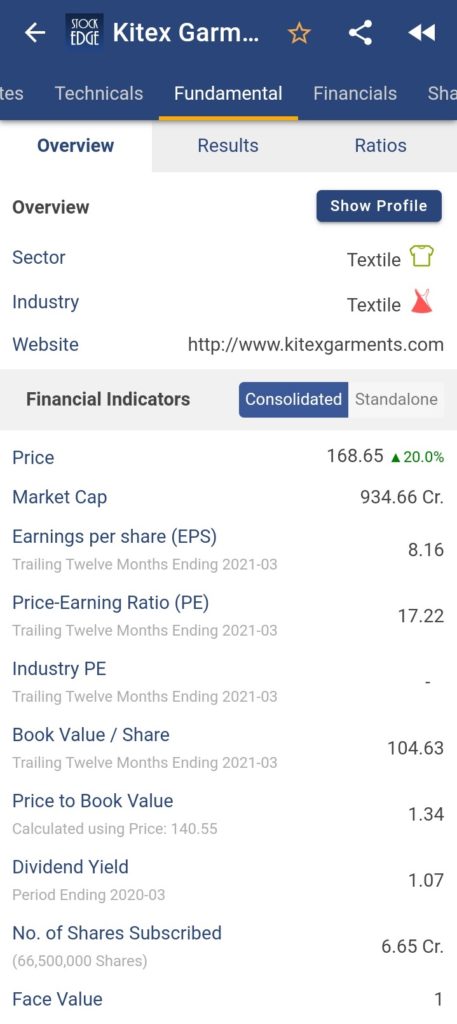

- The shares of Kitex Garments Ltd. was trading at Rs.168.65, up by 20%, hitting a 52 week high in today’s trading session.

- The stock price has increased by 48.79% in last one week, while the benchmark index S&P BSE Sensex has decreased by 0.96%.

- The stock has been rallying since the company announced a Rs 1,000 crore investment in Telangana.

- On July 9, state Industries and Commerce Minister KT Rama Rao announced that the company has entered Telangana with an initial investment of Rs 1,000 crore.

- The announcement comes just days after the company decided to withdraw from Kerala due to “harassment” by state officials.

- Sabu Jacob, chairman of Kitex Group, stated on Sunday that his company intends to invest Rs.1,000 crore in Telangana in the first phase, and that assurances to that effect have been given to the Telangana government.

- He added that after technical evaluations are completed within the next two weeks, a decision will be made on whether to increase investment there.

- Kitex Garments reported a 47 % year-on-year (YoY) decline in consolidated net profit at Rs.54.27 crore for fiscal year 2020-21 (FY21) due to lower operating income. The company’s revenue from operations fell 38% to Rs.455 crore, compared to Rs.739 crore in the previous fiscal’s corresponding quarter.

- The company is into the business of manufacturing and exporting garments. It manufactures different types of garments such as hosier’s shirts, pants, jackets, innerwear and outerwear. It also exports infant and children’s wear and jackets to the United States.

For more fundamental data and analysis, click on Kitex Garments Ltd.

Read our latest article on Balrampur Chini Mills Ltd. – India’s 2nd largest sugar manufacturer

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company has been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.