Table of Contents

Welcome to our blog on Zomato shares analysis. Zomato founded in 2008 as a platform for restaurant discovery, has transformed into a tech giant. With services now available in over 25 countries, Zomato offers online ordering, table reservations, and food delivery. Their innovative use of AI and ML personalizes the user experience, while cloud kitchens offer a wider variety of food options. Zomato’s success can be attributed to their relentless pursuit of innovation and ability to adapt to changing consumer preferences. Whether you’re looking for restaurant recommendations or food delivery, Zomato has got you covered.

The company’s technology platform connects customers, restaurant partners and delivery partners, serving their multiple needs. Customers can search for and find restaurants on this platform, share their dining experiences by writing reviews and uploading photos, order food delivery, reserve a table, and pay for their meals while out to eat. However, it also offers its restaurant partners sector-specific marketing tools that help them engage with and attract customers in order to expand their business, as well as a dependable and effective last mile delivery service. Additionally, it runs Hyperpure, a one-stop shop for purchasing, which provides premium ingredients to its restaurant partners. Furthermore, it offers clear and flexible earning opportunities to its delivery partners.

According to Red Seer, it is one of the leading Food Services platforms in India in terms of value of food sold, as of March 31, 2021. During Fiscal 2021, 32.1 million average MAU visited our platform in India. As of March 31, 2021 it is present in 525 cities in India, with 389,932 Active Restaurant Listings. Mobile application is the most downloaded food and drinks application in India in each of the last three fiscal years since Fiscal 2019 to Fiscal 2021 on iOS App store and Google Play combined, as per App Annie’s estimates.

Listing Zomato Shares on the Stock Market

Zomato Limited (the ‘Company’) formerly known as Zomato Private Limited was converted from a private limited company to a public limited company, pursuant to a special resolution passed in the extraordinary general meeting of the shareholders of the Company held on April 05, 2021 and consequently, the name of the Company has been changed to Zomato Limited pursuant to a fresh certificate of incorporation by the Registrar of Companies dated April 09, 2021 and as of today’s date, this is the share price of Zomato Limited.

During the year ended March 31, 2022, the Company has completed initial public offer (IPO) of 1,233,552,631 equity shares of face value of INR 1 each at an issue price of INR 76 per share, comprising fresh issue of 1,184,210,526 shares and offer for sale of 49,342,105 by Info Edge (India) Limited (existing shareholder). Pursuant to the IPO, the equity shares of the Company were listed on National Stock Exchange of India Limited (NSE) and BSE Limited (BSE) on July 23, 2021.

During the year ended March 31, 2022, the Group (Zomato Limited and its subsidiaries) acquired the remaining 35.44% stake in Jogo Technologies Private Limited from the remaining shareholders and sold full 100% stake in Jogo Technologies Private Limited to Curefit Services Private Limited and Curefit Healthcare Private Limited for a total consideration of INR 3,750 million. For further details you can also check out our stock market analysis tool.

You may also like our analysis on : Top 5 Blue Chip Stocks

Zomato’s Financial Statement & Overview

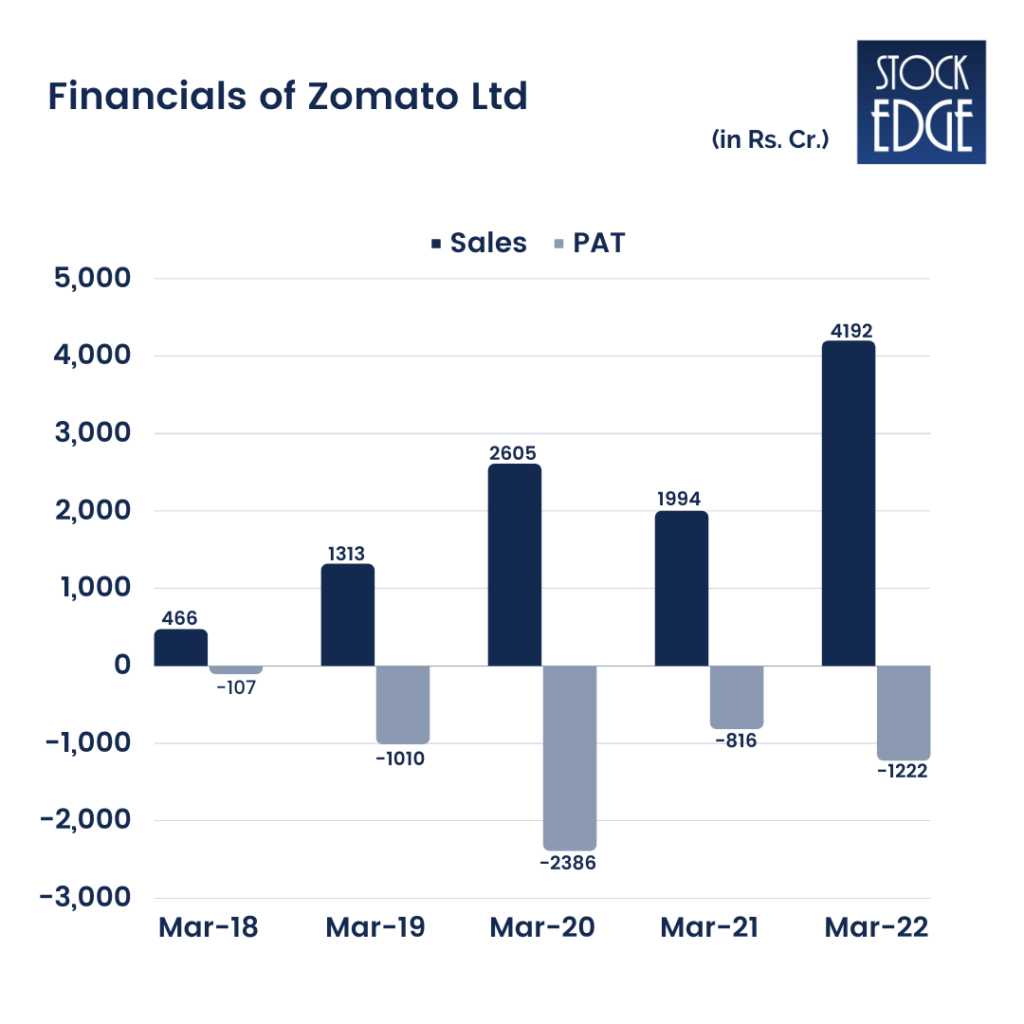

- Zomato generated total revenue of Rs 42bn (USD562mn) in FY22 — a growth of 110% YoY — and is growing at 65% YoY in H1FY23.

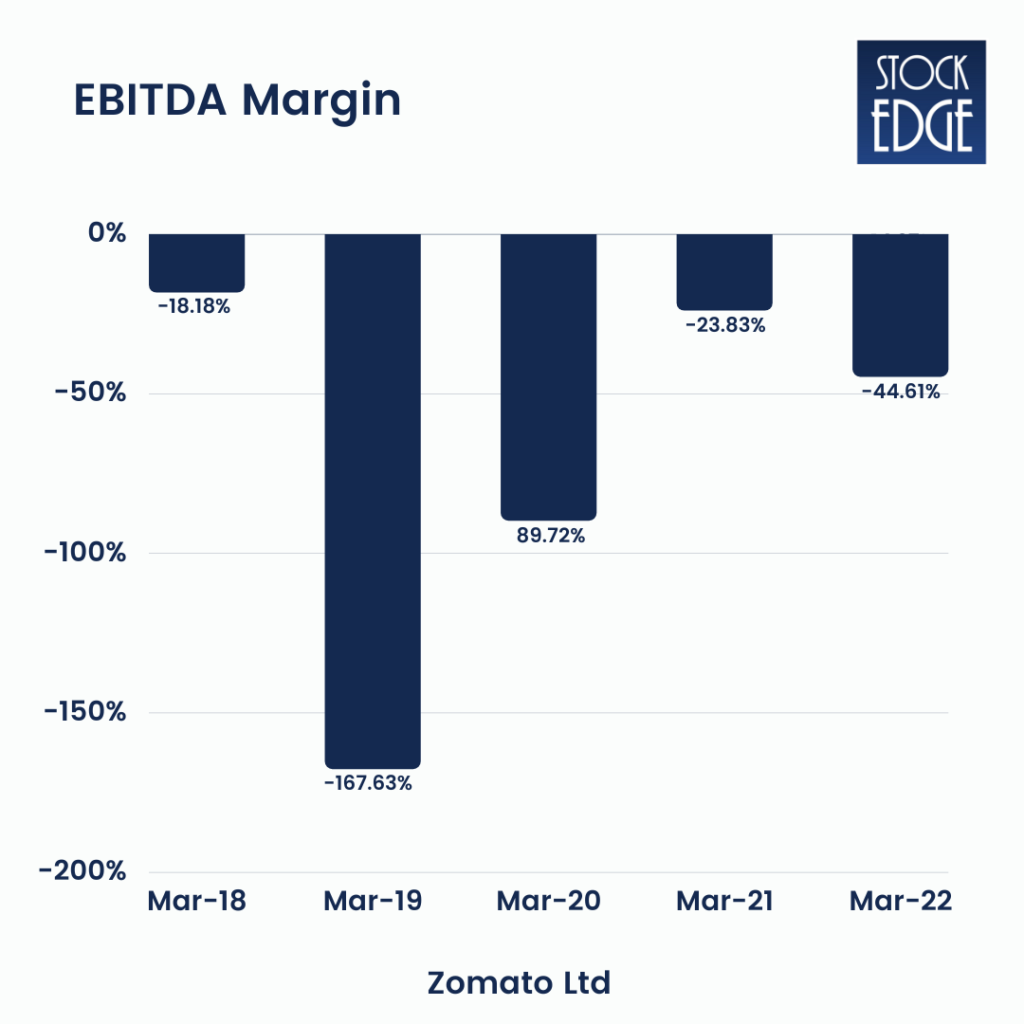

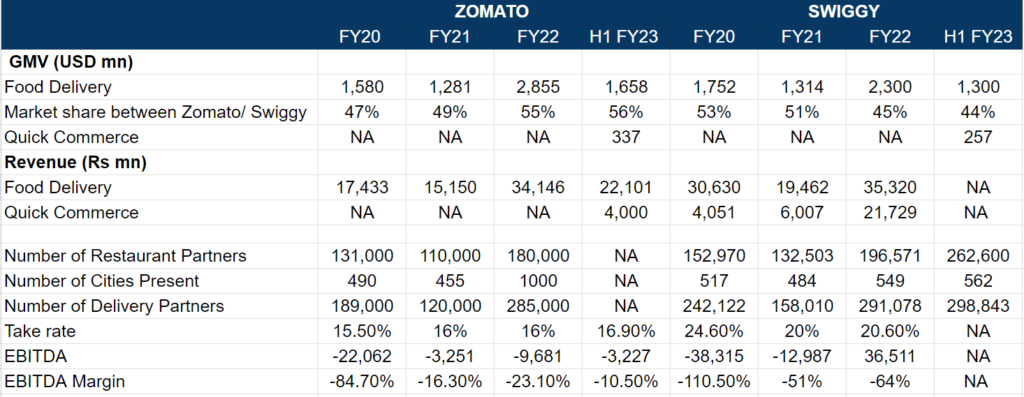

- Food delivery GMV stood at USD2.86bn in FY22, with the Food Delivery business contributing to 81% of the overall revenue. Its profitability sharply improved in FY22, with adjusted Ebitda margin standing at -14% vs -82% in FY20.

- Food delivery is Zomato’s largest business, contributing 66% of its 3QFY23 adjusted revenues after the full integration of the Quick Commerce business (Blinkit).

- Number of annual transacting users on its platform has increased from 29mn in FY19 to 58mn in CY22; while the number of monthly transacting users has increased from 5.6mn in FY19 to 17.4mn in 3QFY23.

- The platform has tie-ups with over 200,000 restaurant partners and over 330,000 delivery partners across 700+ cities in India.

- After pivoting its business model in India to focus on food delivery, Zomato’s monthly order run rate has grown over 15x, from 3.5mn orders in Jan 2018 to an average of 52.5mn orders over 3QFY23.

- The average order value has increased from ~Rs280 in FY19 to ~Rs420 in 3QFY23. Zomato’s Food Delivery business clocked a GMV(Gross Merchandise Value) of USD3.25bn in last 12 months, with its adjusted revenue (commissions plus customer delivery charges) standing at USD750mn, implying a blended take rate of ~23%.

- Zomato’s overall take rate stood at 23.4% in 9MFY23 — out of which — 6.4% was recovered from customers as delivery charges; while 17% was charged as commissions from the restaurants. The take rate is higher in smaller cities vs larger cities.

- Revenue from operations increased by 110% to INR 41.9 billion from INR 19.9 billion in FY21.Other segments revenue decreased 15% YoY in FY22, primarily on account of shut down of most of our international operations as we decided to focus only on the India business. The Company also discontinued other non-core businesses during the year.

- Other income increased by 297% YoY in FY22 to INR 4.9 billion in from INR 1.2 billion in FY21. Increase in FY22 has been primarily on account of increase in interest income from deposits by INR 3.7 billion due to increase in bank deposits of the Company from the funds raised during the IPO.

Comparison of Zomato’s financial performance with its competitors

Zomato’s four business lines operate in the restaurant food value chain, starting from food delivery (Zomato) to raw material procurement by restaurants (Hyperpure) moving on to dining-out (Gold) and Quick Commerce (Blinkit). The company plans to focus on the food consumption ecosystem, as it continues to strengthen these business lines.

In addition to food delivery, Swiggy appears to be focusing on two other offerings:

a) Dining out program called Dine-out which it recently acquired to compete with Zomato’s loyalty program (Gold or Pro).

b) Convenience buying/delivery aims to leverage its logistics network to solve use cases like daily grocery needs and delivery services.

Both players have focused on rapid geographical expansion over the past two years, augmented by their fleet of delivery partners. Zomato’s reach appears to be wider, with the company serving 775 cities in India compared with Swiggy’s 652. For both companies, the number of delivery partners — which stood at the ~50k mark in July 2018 — has increased by over 6X. Zomato’s number of delivery partners stood at ~341k in Sep-2022, while media reports suggest that Swiggy’s delivery partners stood at ~300k.

Overview: Zomato shares price movements since its listing

Zomato, the foodie’s go-to app, made its debut on the stock market in July 2021 with an IPO priced at INR 76 ($1.02 USD) per share. The market was buzzing with excitement as the stock was listed at INR 115 ($1.54 USD), a whopping 51.3% premium over the IPO price. Now, the stock price is dancing around INR 49 – INR 57, making investors wonder whether to take another bite or wait for dessert. All in all, Zomato’s journey on the stock market has been a roller coaster ride, but the company’s delicious potential in the food delivery industry keeps investors coming back for seconds.

What are the Factors that have impacted the price of Zomato shares?

Zomato share price fluctuates due to various factors. Market sentiment is vital in determining investors’ perception of the company’s growth potential and valuation. Due to the Covid-19 pandemic, Zomato has experienced both positive and negative impacts. The pandemic increased demand for food delivery services and negatively affected the restaurant industry.

The food delivery industry in India is highly competitive, and several players are vying for market share. Any changes in industry trends, such as the emergence of new players, changes in consumer preferences, and regulatory changes, can impact Zomato’s stock price. Changes in the broader tech industry, such as the rise of online platforms and e-commerce, can also impact the company’s stock price.

Growth potential for Zomato Shares in the food delivery industry:

- It expects to continue growing both on monthly transacting users (MTUs) and frequency going forward, which should drive order volumes up.

- Company has added 23 million new customers in CY22, with healthy new customer addition in Q4.

- The high-frequency users as a percentage of total annual transacting users has gone up, which is a positive sign for the company’s future.

- Blinkit can potentially be profitable at AOVs of about 20% lower, and the company expects it to be profitable in the next 2-3 years.

- Zomato is evaluating the ROIs for each of their marketing channels and continuously improving their strategy.

Potential challenges Zomato Shares may face

Zomato is likely to face several challenges in the future, including increasing competition and regulatory hurdles. Here’s a closer look at some of these challenges:

- Competition: The food delivery industry is highly competitive, and Zomato faces stiff competition from other players like Swiggy and Uber Eats. As these companies continue to innovate and expand their offerings, Zomato will need to stay ahead of the curve to remain competitive.

- Regulatory Environment: Zomato operates in a complex regulatory environment, and changes in regulations related to food delivery or e-commerce can impact the company’s operations and profitability. For example, the Indian government has proposed new regulations that would limit the commission charged by food delivery companies, which could impact Zomato’s business model.

- Operational Efficiency: As Zomato continues to expand its operations, it will need to maintain operational efficiency and cost control to remain profitable. This includes managing logistics, improving delivery times, and optimizing supply chain management.

- Consumer Preferences: As consumer preferences and behavior continue to evolve, Zomato will need to adapt its offerings to stay relevant. This could include expanding into new areas like grocery delivery or introducing new features like contactless delivery.

- Technology Innovation: Technology is a key driver of growth in the food delivery industry, and Zomato will need to continue to innovate to stay ahead of the competition. This includes investing in new technologies like artificial intelligence and machine learning to improve order accuracy and delivery times.

Can Zomato Shares be profitable?

Zomato shares have the potential to be profitable in the future, but it will depend on a variety of factors such as increasing revenue, cost optimization, and efficient operations. The company has already demonstrated significant revenue growth in recent years and has been taking steps to improve profitability by optimizing its operations and reducing costs.

However, the food delivery industry is highly competitive, and there are regulatory and operational challenges that could impact the company’s profitability. Additionally, Zomato has expanded into new areas like grocery delivery and cloud kitchens, which could present additional growth opportunities, but also carry risks. Ultimately, it will be up to Zomato’s management team to execute on their strategy and navigate these challenges to achieve sustainable profitability.

Summary of Zomato Shares financial performance and analysis

Summary of financial performance

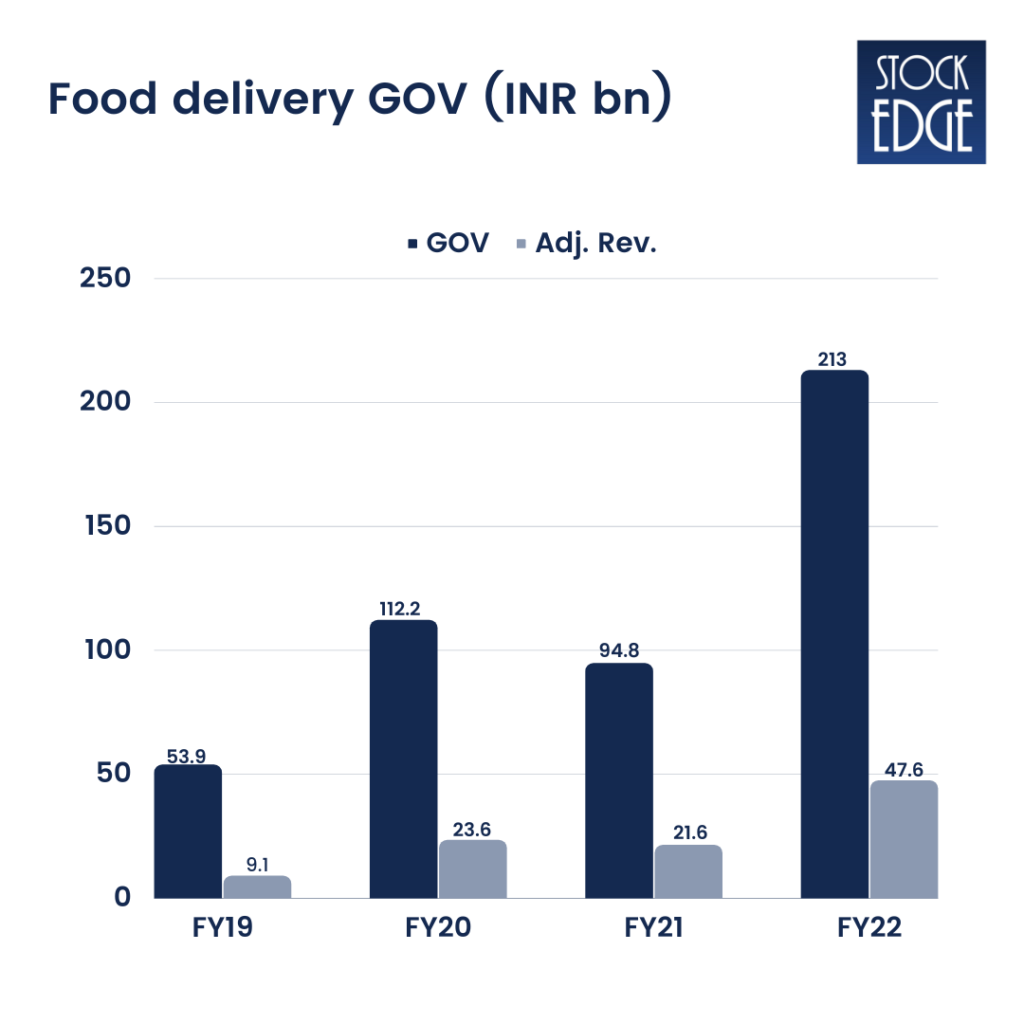

- GOV (Gross Order Value) reached INR 213.0 billion in FY22, a year-on-year (“YoY”) increase of 125% over FY21. This was driven by healthy growth in order volumes while the average order value remained stable. Adjusted Revenue has largely increased in line with increase in GOV in FY22.

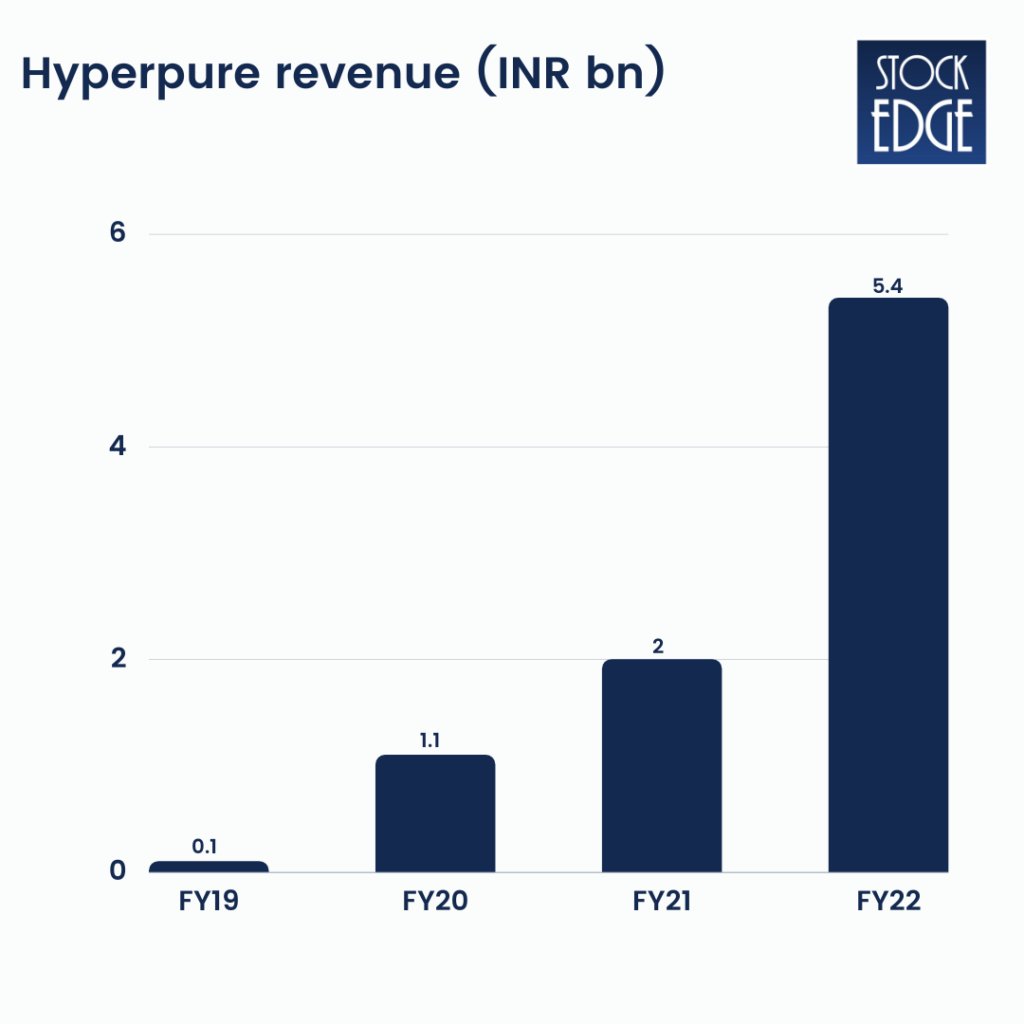

- Hyperpure revenues increased by 170% in FY22 to INR 5.4 billion primarily driven by addition of new customers and expansion into new cities. Adjusted EBITDA margin remained flattish at -22% in FY22 vis-avis -23% in FY21 due to investments in city expansion.

Final thoughts on Zomato’s future prospects and whether it is a good investment opportunity for investors.

Zomato is a leading player in the food delivery industry and has demonstrated strong growth potential in recent years. The company has expanded into new areas like grocery delivery and cloud kitchens and has been improving its profitability by optimizing its operations and reducing costs.

Zomato Gold is a very different program from Zomato Pro. Zomato Pro, essentially, had free delivery as a feature that applied to all orders whereas Zomato Gold has multiple other benefits in addition to that, and free delivery is only on certain orders.