Key Takeaways

- Liquid Funds: Liquid funds are debt mutual funds that invest in very short-term instruments (up to 91 days), offering stability, low risk, and fast access to your money.

- Better Than Savings Accounts: They typically deliver over 6.5% returns, significantly higher than standard savings account interest of 3-4%.

- Quick Cash Access: Withdrawals made before the cutoff time are credited the same day, making them perfect for short-term needs or emergencies.

- Risks to Know: While largely safe (investing in AAA and government papers), you should still check for credit quality, liquidity of holdings, and any interest rate exposure.

- Top Picks:

- SBI Liquid Fund

- HDFC Liquid Fund

- ICICI Prudential Liquid Fund

- Axis Liquid Fund

- Aditya Birla Sun Life Liquid Fund

Table of Contents

Looking for a safe and efficient way to park your surplus money and earn better returns than a savings account?

Unsure where to park your spare cash while earning decent returns?

Look no further, and explore Liquid Funds. Out of numerous categories in the mutual funds, liquid funds is the most well-positioned option that lets you earn a decent return over your idle cash.

Liquid funds offer a thoughtful, safer, and more rewarding option with low risk and higher returns than traditional savings. They offer inflation-beating returns while keeping your money safe and prioritizing liquidity, making them an ideal choice for meeting any short-term financial goals or emergency fund requirements.

In this blog, we break down what liquid funds are, their top benefits, and the minimal risks involved. Plus, we’ve curated the Top 5 Liquid Funds based on past performance and accurate data to help you make the most of your short-term investments.

Start earning better returns while keeping your money liquid!

What Are Liquid Funds?

Liquid Funds are a type of debt mutual fund that invests in fixed-income instruments with short-term maturity of less than 91 days. These can be treasury bills, commercial papers, certificates of deposits, or money market instruments. As they invest in papers with short tenure, they carry near to no risk, which makes liquid funds highly attractive for park surplus funds.

Key Features of Liquid Funds

One key feature of Liquid Funds is their easy liquidity for investors. Redemption requests in liquid funds are processed ahead of all other mutual funds.

High Liquidity

Liquidity refers to how fast an investment turns into cash and cash equivalents and hence liquid funds invest in short-term, highly liquid debt instruments with maturities of up to 91 days or less. The withdrawal requests are often met within 24 hours.

Low Risk

A liquid fund is a low-risk debt investment that prioritizes principal protection and generating consistent returns over a short-term horizon.

Liquid funds are very stable as they are least affected by any change in interest rates.

Change of interest rate may affect the funds long-term performance, hence liquid funds do not have any impact due to short maturities. They offer stable and steady returns in the short term.

No Lock-In Period

Unlike traditional investment options like bank fixed deposits, liquid funds have no lock-in period. They charge a very low expense ratio and have no exit load if investors redeem their investment within 7 days of the investment date, making funds easily accessible to investors.

On an average expense ratios of all Liquid Funds- Direct Plans are 0.21%

Competitive Returns

During periods of high inflation, the RBI maintains a high interest rate and tightens liquidity in the economy. Liquid funds are most preferred at these times; they offer higher returns than bank savings accounts or even fixed deposits in some cases. It provides a steady return of 7 to 7.5% annually.

Benefits of Liquid Funds

These funds are preferred by low-risk investors who prefer stability, liquidity, and a decent return over a short-term investment tenure.

The following are the benefits of investing in Liquid Funds:

Easy Withdrawal Options

Liquid Funds are a perfect option for meeting short-term liquidity needs. Out of all the mutual funds categories, redemption requests for Liquid Funds are fulfilled at earliest.

Investors placing such requests before the cutoff time, which is before 1:30 pm, will get the funds in their bank accounts on the same day.

Better Than Savings Accounts

Savings accounts offer 3 to 4% p.a., whereas liquid mutual funds offer more than 6.5%. For parking your ideal money or surplus cash, liquid funds offer better opportunities to investors than traditional investment avenues.

Diversification of Portfolio

A savvy investor would allocate his capital across all asset classes. To meet sudden cash requirements and emergency withdrawals, experts often advise keeping upto 5% of the total portfolio amount in liquid funds. Redemption requests placed before 1 pm are taken on priority and met within 24 hours.

Risks Associated with Liquid Funds

Most liquid funds have low risks as they invest mainly in government-backed papers and highly credit-worthy AAA-rated papers. Even so, there are certain risks associated with investing in Liquid Funds.

Credit Risk

Liquid funds have low default risks, but it is always suggested to assess the fund’s risk by checking the credit quality of its portfolio. If the fund invests in high-quality debt instruments, the probability of credit default becomes negligible. Opt for funds with high-rated instruments (AAA or equivalent) for lower credit risk.

Interest Rate Risk

Debt mutual funds are often exposed to interest rate sensitivity. Liquid funds, on the other hand, typically have negligible interest rate risk due to their short-duration holdings.

Liquidity Risk

Though liquid funds are highly liquid in nature, it is essential to assess the liquidity of the fund’s portfolio to ensure it can effectively meet redemption requirements. Make sure to compare the fund to its peers and check key parameters like average maturity and YTM.

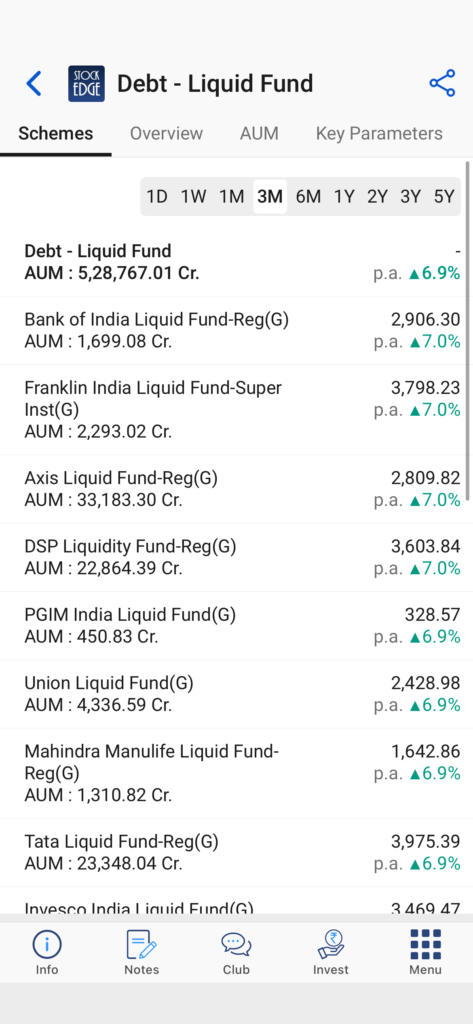

Top 5 Liquid Funds to Invest In

Here at StockEdge, we have shortlisted 5 Top Liquid mutual funds based on selection criteria such as fund track record, AMC reputation, asset size, and key financial ratios.

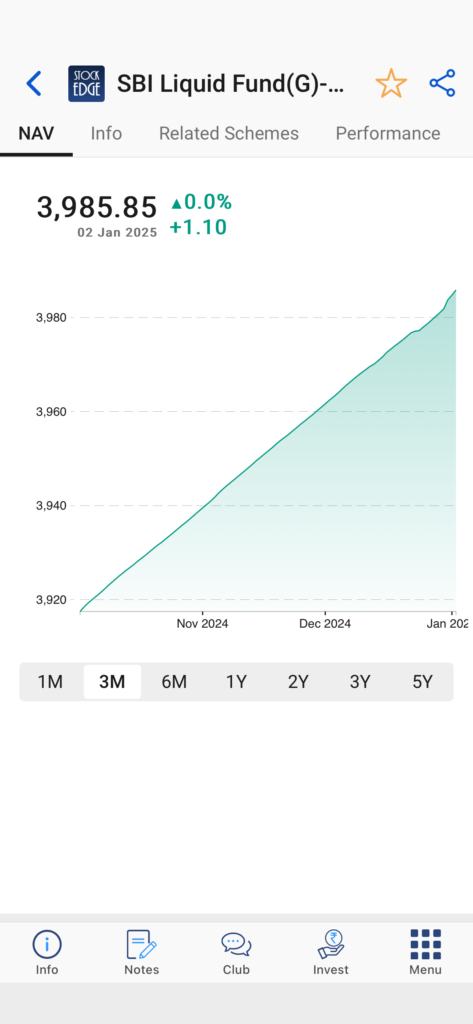

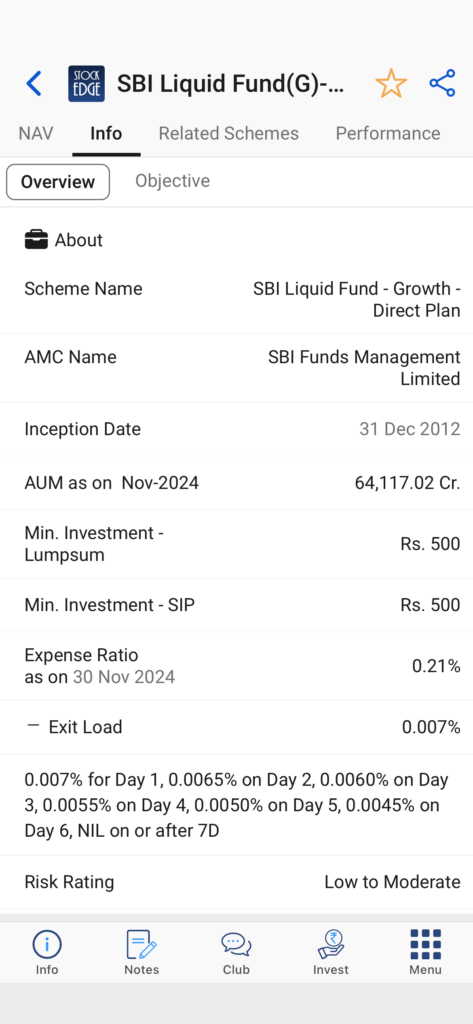

SBI Liquid Fund

SBI Liquid Fund was launched in March 2003, marking the completion of more than two decades in the Indian stock markets. Since the fund started its operations, it has delivered consistent 6.98% returns per annum every year.

NAV: Rs. 3947

AUM: 64117 crore

Expense Ratio: 0.21%

Portfolio Holding: 80% in AAA-rated papers, 20% in Sovereign papers (as of Nov 24)

Fund Manager: Rajeev Radhakrishnan and R Arun.

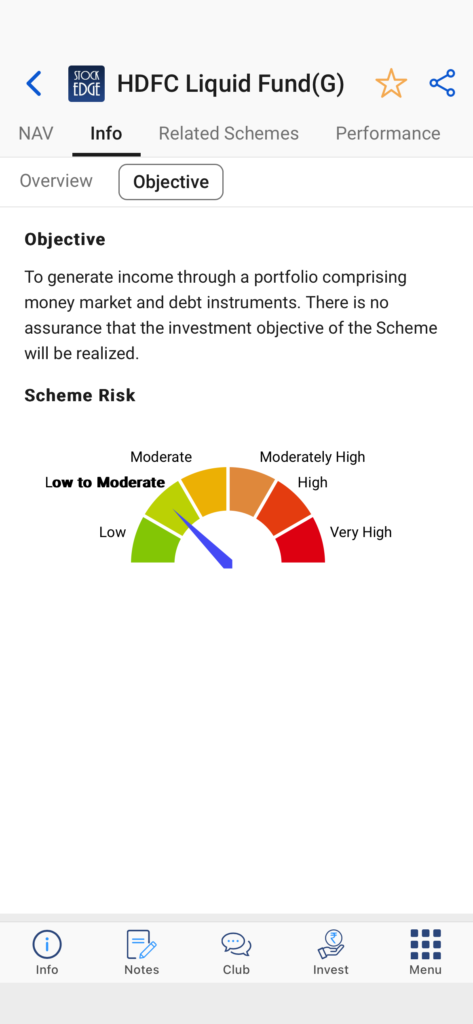

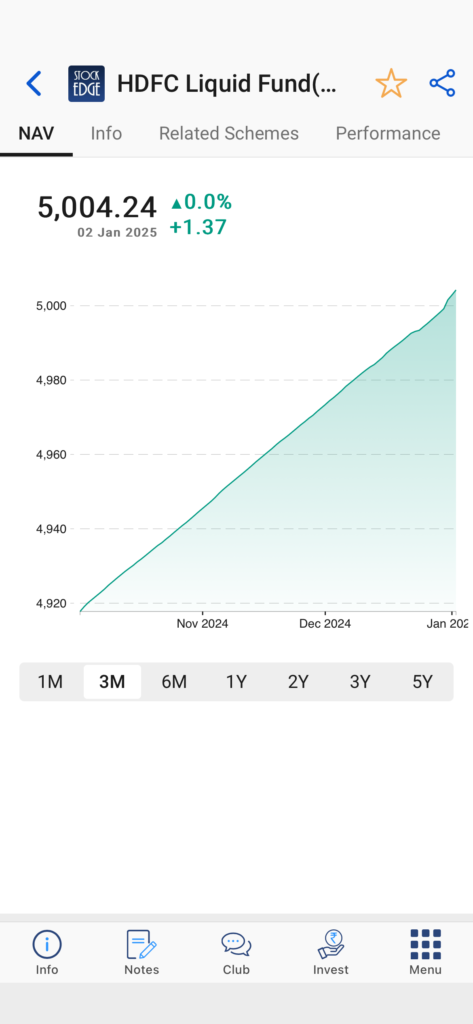

HDFC Liquid Fund

HDFC Liquid Fund was launched in October 2000, completing more than 2 decades in the Indian stock markets. Since the fund started its operations, it has delivered a consistent 6.83% return per annum for every year.

NAV: Rs. 4952

AUM: 72653 crore

Expense Ratio: 0.20%

Portfolio Holding: 80% in AAA-rated papers, 16% in Sovereign papers, 4% as cash equivalents (as of Nov’ 24)

Fund Manager: Anupam Joshi & Swapnil Jangam

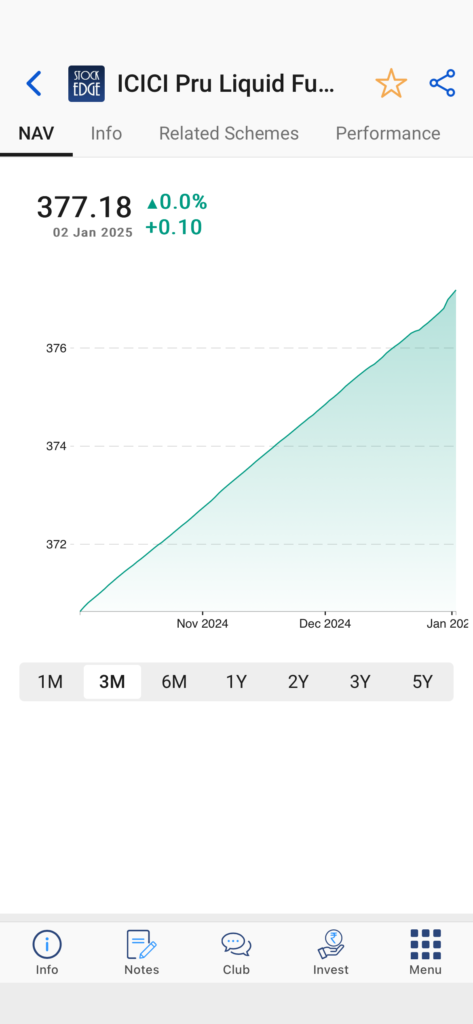

ICICI Prudential Liquid Fund

ICICI Prudential Liquid Fund was launched in November 2005

Since the fund started its operations, it has delivered a consistent 7.13% return per annum every year, which is one of the highest in the category.

NAV: Rs. 373

AUM: 50756 crore

Expense Ratio: 0.20%

Portfolio Holding: 81% in AAA-rated papers, 14% in Sovereign papers, 5% as cash equivalents (as of Nov’ 24)

Fund Manager: Darshil Dedhia and Nikhil Kabra

Axis Liquid Fund

Axis Liquid Fund was launched in October 2009. Since the fund started its operations, it has delivered a consistent 7.01% return per annum every year.

NAV: Rs. 2809

AUM: 33183 crore

Expense Ratio: 0.15%

Portfolio Holding: 81% in AAA-rated papers, 17% in Sovereign papers, 2% as cash equivalents (as of Nov’ 24)

Fund Manager: Adiya Pagaria, Devang Shah & Sachin Jain

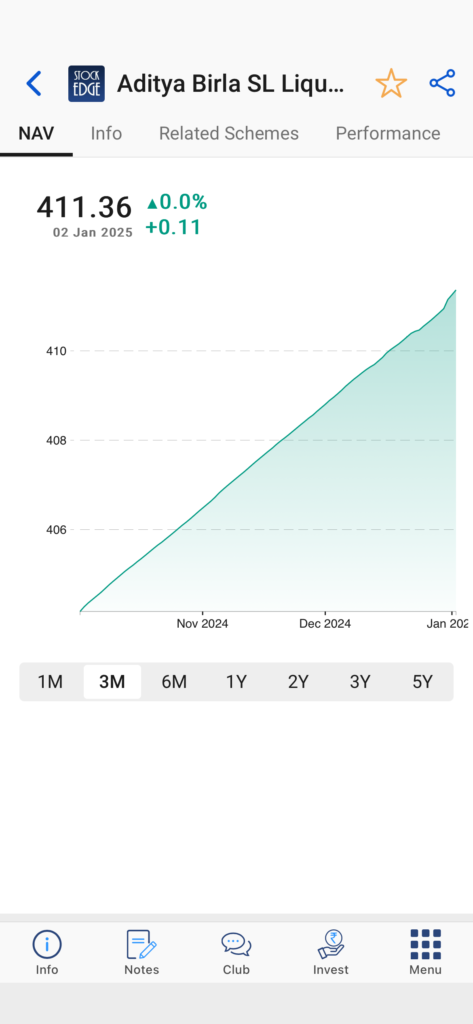

Aditya Birla Sun Life Liquid Fund

Aditya Birla SL Liquid Fund was launched in October 2000. Since the fund started operating, it has delivered consistent 6.99% returns per annum every year.

NAV: Rs. 406

AUM: 44521 crore

Expense Ratio: 0.21%

Portfolio Holding: 86% in AAA-rated papers, 10% in Sovereign papers, 4% as cash equivalents (as of Nov’ 24)

Fund Manager: Sunaina da Cunha, Sanjay Pawar & Kaustubh Gupta

How to Choose the Right Liquid Fund

The parameters below are essential to consider before investing in a liquid mutual fund. Factors like expense ratio, portfolio size and concentration, and past performance are crucial checklists to follow before you choose the right fund for you.

Expense Ratio

Managed by professionals, liquid mutual funds generally charge low costs as fees. While liquid funds across different fund houses offer a similar range of returns, it becomes necessary to compare the expense ratios charged by the fund manager. The lower the expense ratio, the higher the returns generated.

Portfolio Quality

The main objective of liquid funds is to keep the invested corpus safe and stable from the risks associated with such funds. Thus, investors should evaluate the quality of these instruments offered by different issuers.

Fund Performance

Historical returns do not guarantee future performance, and investors should not rely on past performance. However, it is essential to check how the fund has performed in previous years. If the fund is performing below the category average returns, then investors should avoid it.

Investment Goals

Liquid Funds are preferred by short-term investors. They are often preferred to cater short-term goals and provide a safe, liquid, and efficient option to manage one’s finances. Liquid funds help to achieve specific goals like building an emergency fund, saving for immediate needs, or managing idle cash. It optimizes returns without compromising on accessibility.

How to Invest in Liquid Funds

Choose a Fund

Based on the above parameters, select the right liquid fund to invest in. Then, compare it with the peer funds offered by other mutual fund companies.

Complete KYC

Investors must complete their KYC Verification either online or by physically submitting the forms to their nearest KYC locator. You can download the application form from AMC’s or the RTA’s website, or you may contact your Mutual Fund Distributors.

Invest Online or Offline

Investors can invest via any method—online or Offline. For offline submission, fill out the application form for the selected liquid fund at any Official Point of Acceptance (POA) or the Registrar & Transfer Agent (R&TA). Alternatively, Investors can visit the AMC’s or R&TA’s website.

Such an investment can be made via SIP or lump sum. If you register for SIP for a specific date, the amount will be automatically deducted from your bank account on that date.

Track Performance

Once you have invested in your desired fund, you should regularly monitor its performance to ensure that it meets your stated investment objective.

The Closure Thoughts

In summary, Liquid Funds are a safe and highly liquid investment option that focuses on short-term debt and money market instruments. They often provide better post-tax returns than traditional savings accounts, making them ideal for parking surplus cash for short periods—typically from a day to three months.

Known for their liquidity, affordability, and safety, liquid funds are a smart alternative to short-term bank deposits. These funds are perfect for short-term financial goals or as a temporary parking space while waiting for opportunities in equities or long-term investments. For anyone seeking an innovative, flexible, and low-risk option for managing idle funds, Liquid Funds are worth considering!

Read Also: 5 Best FMCG Stocks with High-Potential: A Must-Add for Your Portfolio