Table of Contents

Sharpe Ratio is a very useful ratio to monitor the performance of mutual funds. Using this ratio, investors can evaluate the relationship between risk and return of the fund.

It is used to measure the risk-adjusted returns of the fund. The risk-adjusted returns are the returns earned by an investment over the returns generated by any risk-free assets. For e.g. 90-day treasury bills. But higher returns implies extra risk. If the Sharpe ratio is higher it means greater return from an investment but with a higher risk.

How is the Sharpe Ratio calculated?

The first step to calculate is to subtract the risk-free return of the mutual fund from its portfolio return. Then we divide that subtracted number, i.e. the excess returns by the standard deviation of the fund’s return.

Consider the following example for illustration:-

| Fund A | Fund B | |

| Rate of return | 10 | 9 |

| Risk-free rate of return | 4 | 4 |

| Standard Deviation | 6 | 3 |

| Sharpe Ratio | (10-4)/6 = 1 | (9-4)/3 = 1.67 |

As per the calculation, Fund B should be considered because even though the expected return is less than that of Fund A, the volatility of Fund B is less than Fund A and thus, is less risky.

Parameters to consider a good Sharpe Ratio:-

| Sharpe Ratio | Risk rate | Inference |

| <1 | Very low | Bad |

| 1-1.99 | High | Good |

| 2-2.99 | High | Very Good |

| >3 | High | Excellent |

Funds with Sharpe ratio less than 1 does not provide high returns. But if the funds have a Sharpe ratio between 1 to 3, it provides high returns for the investors.

Importance of Sharpe Ratio :-

- It can help investors to compare their preferred fund where they want to invest with peer funds, which will help to understand the performance of the fund.

- It can help to assess the risk and return rate for funds. Funds with high Sharpe Ratio have a higher rate of returns and higher risk as well. Therefore, investors who aim to earn high returns tend to opt for funds with a higher ratio. But the additional volatility can change the equation. A fund giving 6% returns with moderate volatility is always better than a fund giving 8% returns with high volatility.

Limitations :-

- Sharpe Ratio of a fund does not incorporate portfolio risk and also does not reveal whether the fund is dealing in single or various sectors.

- Comparing the Sharpe Ratio of two or more funds only shows the risk-adjusted returns.

The Sharpe Ratio can be influenced by portfolio managers. They can try to boost their risk-adjusted returns by lengthening the time horizon for measuring the ratio. Just depending on the it alone, it is not a good strategy to evaluate and invest in a mutual fund. The ratio reveals limited information.

With more than 2500 schemes in India, selecting the right mutual fund to invest can be a tough task, especially for people with no or little knowledge. These individuals can use tools like the Sharpe Ratio to evaluate or compare the mutual funds.

One can find the Sharpe Ratios of different mutual funds easily online in our StockEdge application or the web version. StockEdge provides all the important tools and information for its users to analyze and invest in Indian mutual funds. It can act as a tool of evaluation, but it can’t be considered as the only parameter.

To analyze all the important factors of any mutual fund, one should use other measuring instruments as well. For that, all you need to do is just download the application, select the Mutual Fund tab and explore. Steps to be followed:

- Click on the M.F tab on the home screen of the application.

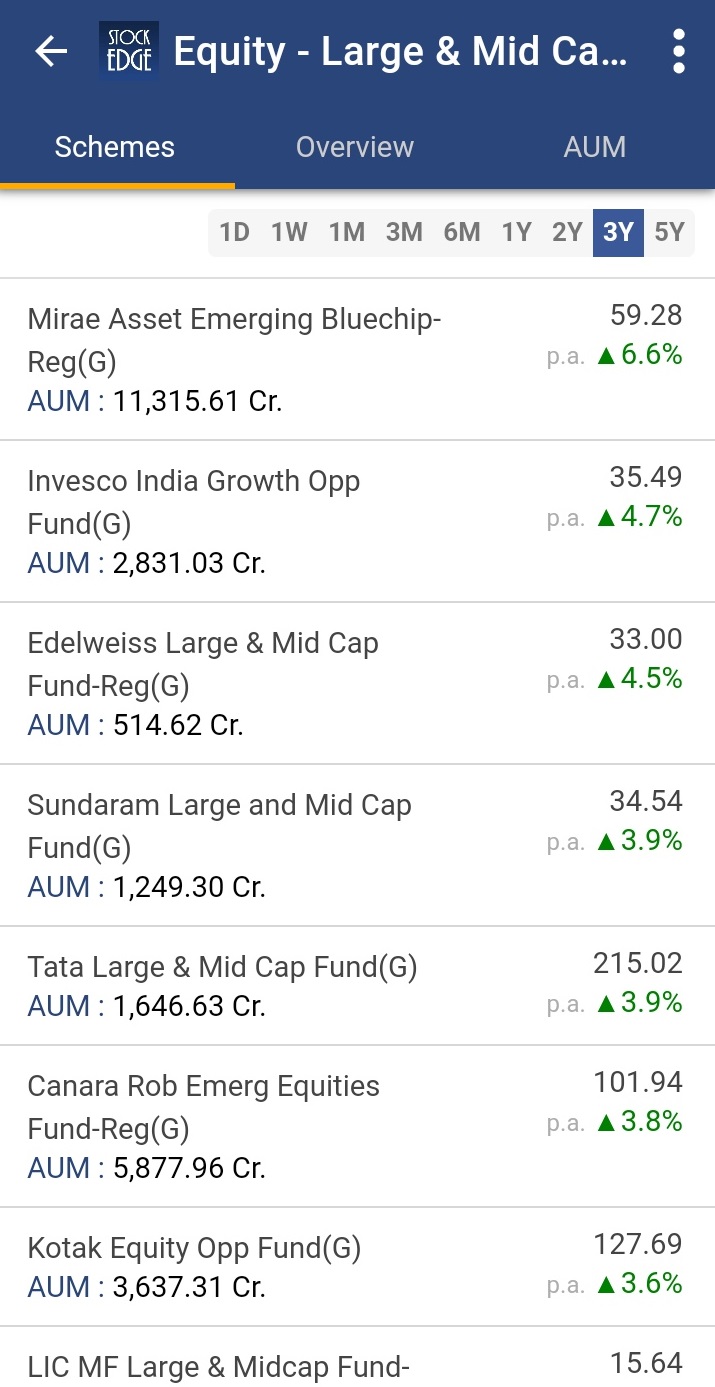

- Click on Classes and select the type (Equity, Debt, Hybrid, Others). For e.g. select Equity and select “Market Cap Fund – Large & Mid Cap”.

- Select the different schemes and compare their Sharpe Ratio like in the picture depicted below:-

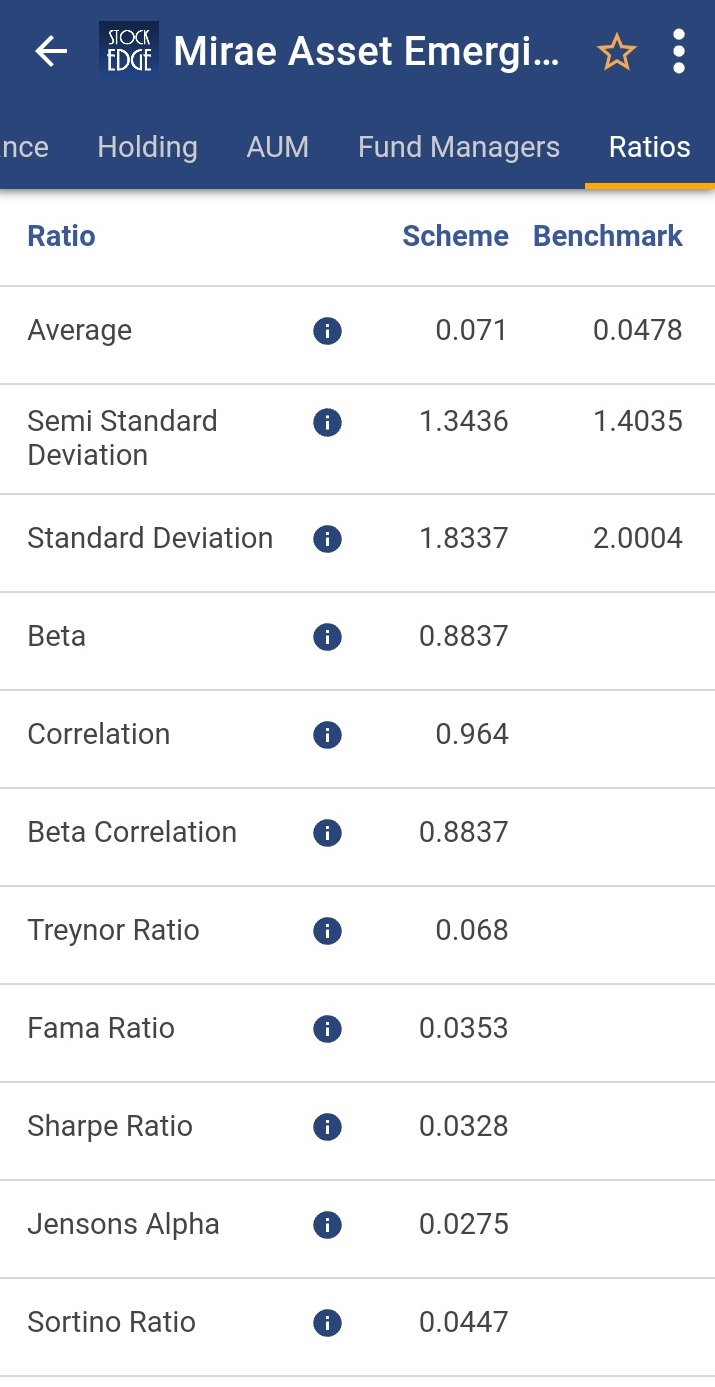

- Select the first fund and scroll towards the right to check the ratios section. Now you can compare the ratios with other funds and schemes and use this information along with other parameters. Also, you can check the holdings of the fund by clicking on the section.

Conclusion

So StockEdge is the only platform where you get filtered information, which helps in making your analysis faster, better and easier within minutes. So what are you waiting for, start using Stock and Mutual Fund Analytics today and become a profitable and smart trader cum investor.

Click here to know more about the offering of StockEdge Premium.

You can check out the desktop version of StockEdge using this link https://web.stockedge.com/

Very nicely explained. Thanks