Check out the share trend of Vodafone Idea Ltd.

Vodafone Idea Ltd. – Highlights

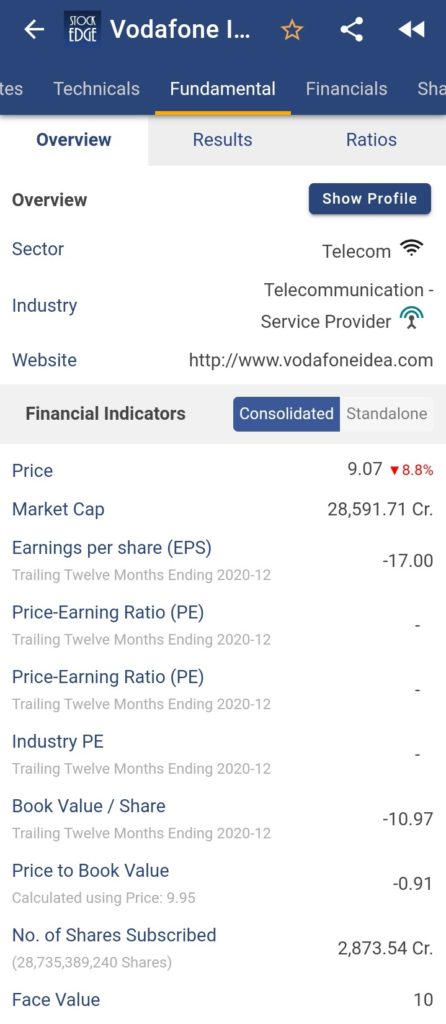

- The shares of Vodafone Idea Ltd., was trading at Rs.9.07, down by 8.84%, in today’s trading session.

- The stock price has decreased by 5.22% in last one week, while the benchmark index S&P BSE Sensex has decreased by 0.72%.

- The stock tanked after the company reported a weak operational performance in the March quarter (Q4FY21).

- Vodafone Idea posted a net loss of Rs 7,023 crore in Q4FY21, compared to a loss of Rs 4,532 crore the previous quarter (Q3FY21). The average daily revenue (ADR) was flat on QoQ basis after adjusting for the impact of Interconnection Usage Charge (IUC).

- Domestic IUC was abolished starting January 1, 2021, resulting in a revenue drop of 11.8 percent QoQ to Rs. 9,610 crore. One-off gains of Rs. 450 crore relating to IT and network expenditures helped boost reported EBITDA margins by 660 basis points QoQ to 45.9%. The adjusted margins were 41.2 percent, which was lower than expected.

- On a reported basis, average revenue per user (ARPU) fell 11.6% quarter over quarter to Rs 107, owing to the loss of IUC and a 2% like-to-like fall in ARPU, owing to the reduced number of days in the quarter.

- Vodafone Idea stated that cost-cutting efforts are underway, with a goal of saving Rs 4,000 crore in annualized operational expenditure by December 2021. On a run-rate basis, it achieved approximately 65% of the targeted opex efficiency. According to the company, it is currently in active discussions with potential investors regarding fundraising.

- Meanwhile, the company’s net debt was Rs 1.8 trillion as of March 2021, up from Rs 1.17 trillion the previous quarter, and its net worth was a negative Rs 38,228 crore, as against a negative Rs 31,243 crore in the December 2020 quarter. The sharp increase in debt is due to Vodafone’s recognition of Adjusted Gross Revenue (AGR) dues of approximately Rs 60,000 crore as debt. In Q3FY21, the same was not treated as debt.

- Vodafone Idea Limited is a joint venture between the Aditya Birla Group and the Vodafone Group. It is a leading telecom service provider in India. The company offers voice and data services throughout India on 2G, 3G, and 4G platforms. With a large spectrum portfolio to support the growing demand for data and voice, the company is dedicated to providing delightful customer experiences and contributing to the creation of a truly ‘Digital India’ by enabling millions of citizens to connect and build a better tomorrow.

For more fundamental data and analysis, click on Vodafone Idea Ltd.

Read our latest article on Laurus Labs Ltd. – A leading research-driven pharmaceutical company

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company has been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.