Key Takeaways

- Sector Snapshot: The consumer durables sector includes companies making home appliances, electronics, and kitchen equipment, contributing meaningfully to stock market indices like Nifty Consumer Durables.

- Market Momentum: Stocks such as Dixon Technologies and PG Electroplast are showing “very bullish” technical momentum, while Blue Star, Voltas and Whirlpool remain solid picks on fundamentals.

- Growth Drivers: Rising urbanisation, growing middle-class income and demand for smart and premium appliances are boosting sector growth, alongside brand trust and retail expansion.

- Risk Factors: The sector is vulnerable to raw material price swings, intense competition, and consumer sentiment shifts, so it’s important to track operating margins, debt levels and execution capabilities.

- Top Picks:

- Blue Star

- Dixon Technologies

- TTK Prestige

Table of Contents

What are Consumer Durable Stocks?

Consumer durable stocks are shares of companies that manufacture or sell long-lasting household products items that do not wear out quickly and are used over an extended period (usually more than 3 years).

These are non-perishable goods that people purchase occasionally and use for an extended period, unlike fast-moving consumer goods (FMCG), such as soap, toothpaste, or packaged food. Consumer durables are big-ticket purchases, often influenced by income levels, financing options (like EMIs), and consumer sentiment.

Classification of Consumer Durables Goods:

Consumer durables can broadly be classified into:

- White Goods: These include large home appliances like air conditioners, refrigerators, washing machines, and microwaves. Originally, these products were white in color, hence the name. Several prominent companies are Voltas, Whirlpool of India, Blue Star, and many others.

- Brown Goods: These are smaller electronic goods like TVs, music systems, smartphones, and laptops. Most prominent companies are Dixon Technologies, BPL, Havells India, and many others.

Market Overview of Consumer Durable Stocks

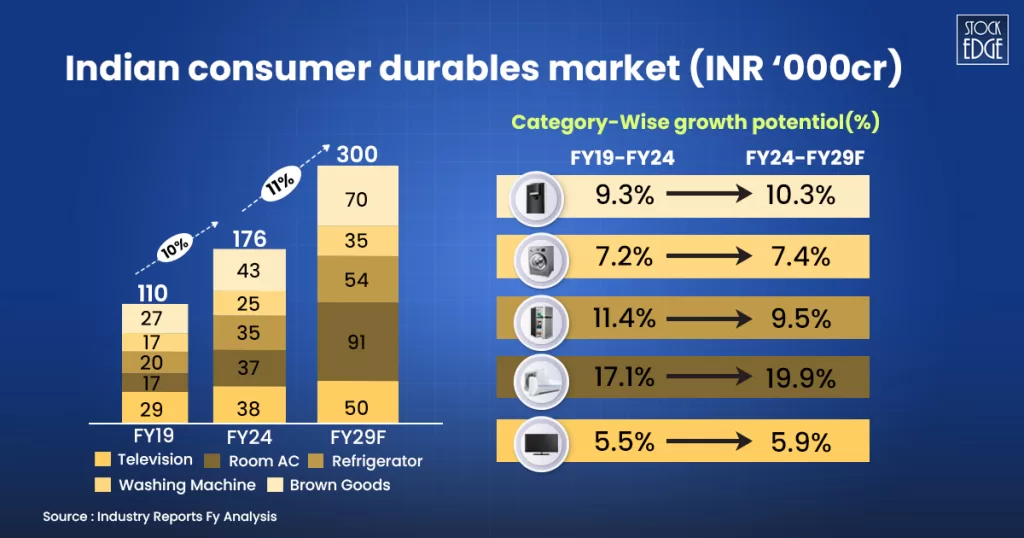

India is rapidly emerging as one of the most promising markets for consumer durables globally. According to the EY-Parthenon and Confederation of Indian Industry (CII) report titled Vision 2030: India’s Rise as a Global Force in Consumer Electronics and Durables, the sector is expected to reach a market size of INR 3 lakh crore by 2029, growing at a compound annual growth rate (CAGR) of 11%.

Currently contributing 0.6% to India’s GDP, the sector has the potential to increase its contribution by 1.5 times, driven by rising domestic demand, a push for sustainability, and strong policy support aimed at increasing local manufacturing.

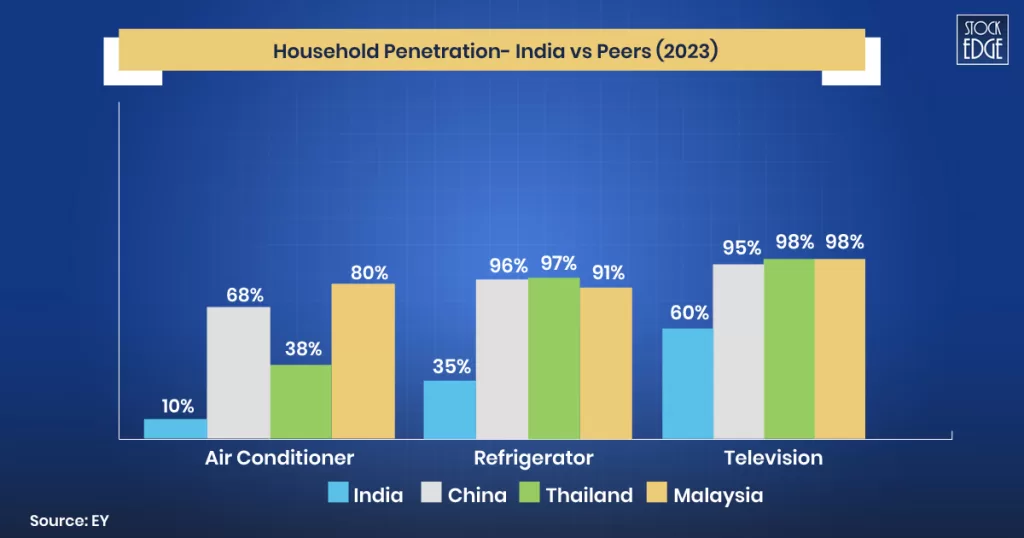

Despite being the sixth-largest consumer durables market globally as of FY24, India’s household penetration of key appliances remains far below global standards, revealing massive untapped potential. For example, air conditioners in India accounted for only about 10% of the market in 2023, a sharp contrast to countries like China (68%), Thailand (38%), and Malaysia (80%).

This low base, combined with rising income levels, urbanization, and increasing consumer aspirations, positions India as the fastest-growing major market for consumer durables. The shift towards innovative, energy-efficient products, the availability of consumer finance options like Buy Now Pay Later (BNPL), and government-backed initiatives further enhance the sector’s accessibility and appeal.

Growth Driver of Consumer Durables Stocks

Let’s look at the growth factors of consumer durable stocks as follows:

1. Rising Income and Lifestyle Aspirations

With a growing middle class and increasing urbanisation, Indian consumers are spending more on home and lifestyle upgrades. The monthly per capita consumption expenditure (MPCE) has doubled over the past decade, indicating a clear shift toward premium and aspirational products. This rising affluence is translating into a demand for better-quality, feature-rich appliances and more frequent upgrades, making the sector highly responsive to lifestyle shifts.

2. Technological Upgrades and Premiumisation

There is a strong shift in consumer preference towards technologically advanced and energy-efficient products. Smart home appliances, including IoT-enabled TVs, washing machines, and air conditioners, are increasingly gaining traction. Smart appliance penetration is projected to reach around 10% by 2028. Additionally, consumers are moving toward larger and more premium products such as 40-inch+ TVs, fully automatic washing machines, and inverter ACs, resulting in shorter product replacement cycles and higher average selling prices.

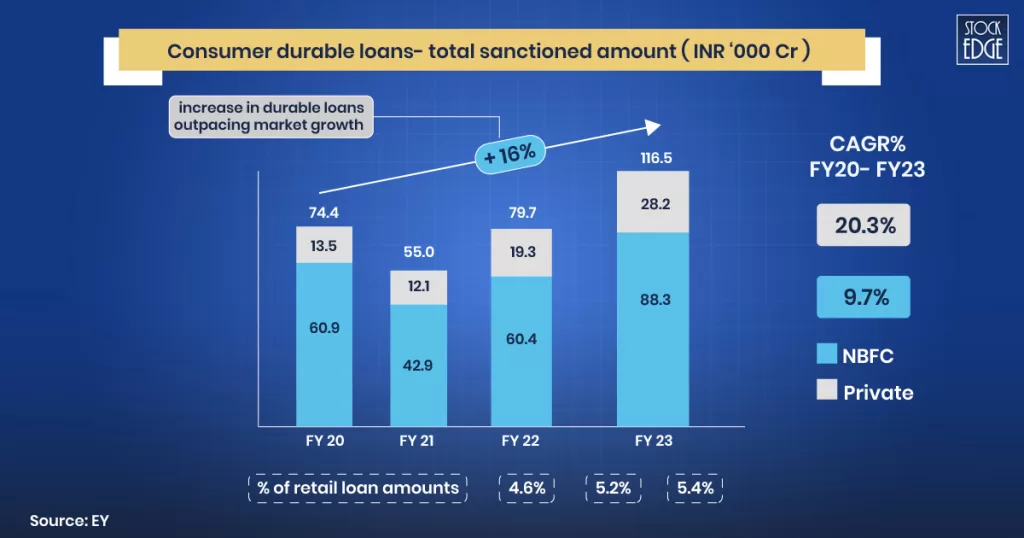

3. Easy Financing and Growing Affordability

The affordability of consumer durables has improved dramatically due to the growing availability of easy financing options. EMI schemes, Buy-Now-Pay-Later (BNPL) schemes, and pre-approved consumer durable loans are making it easier for buyers to upgrade to premium products without incurring a significant upfront cost. In FY23, loans sanctioned for consumer durable purchases rose to ₹1.16 lakh crore, with more than half of this attributed to items priced over ₹25,000. This increased accessibility is playing a crucial role in driving demand across all income groups.

4. Strong Government Support and Policy Push

The Government of India is actively supporting the domestic consumer durables industry through initiatives like Make in India, Atmanirbhar Bharat, and Viksit Bharat 2047. Production Linked Incentive (PLI) schemes across 14 key sectors, including electronics and white goods, are attracting significant investments and encouraging local manufacturing. Additionally, programs like PM Awas Yojana (affordable housing) and PM Suryodaya Yojna (solar-powered homes) are expected to further boost appliance demand by improving infrastructure and providing access to electricity.

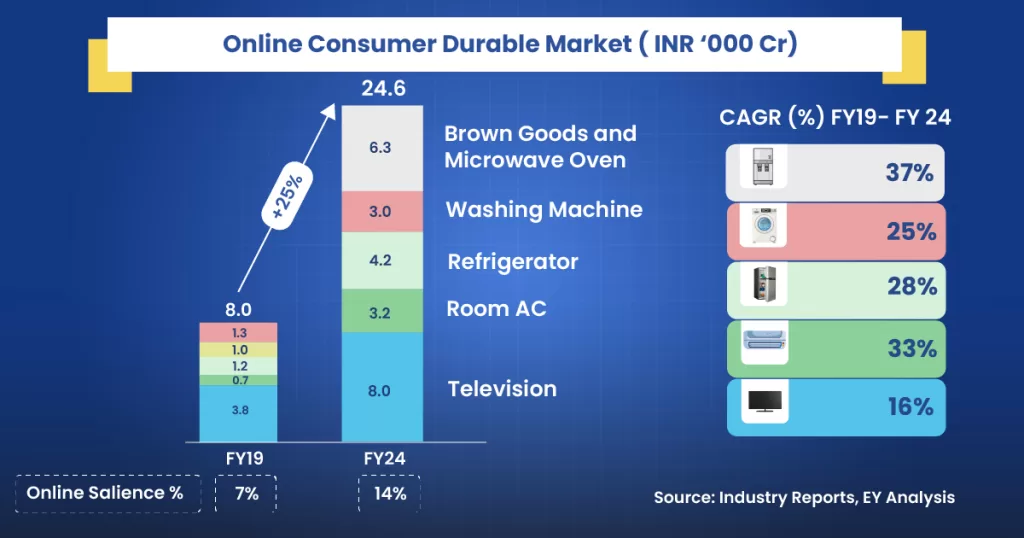

5. Rise of Online and Omnichannel Sales

The rise of e-commerce has dramatically transformed the consumer durables landscape, with online platforms offering better price discovery, product comparisons, and wider availability across brands. The Government’s ONDC (Open Network for Digital Commerce) initiative is expected to further democratize online retail, potentially pushing gross merchandise value (GMV) to US$250–300 billion by 2030. Combined with expanding logistics and digital payments, companies are now able to reach tier 2, tier 3 cities, and even rural India with greater efficiency.

Best Consumer Durables Stocks List

Blue Star

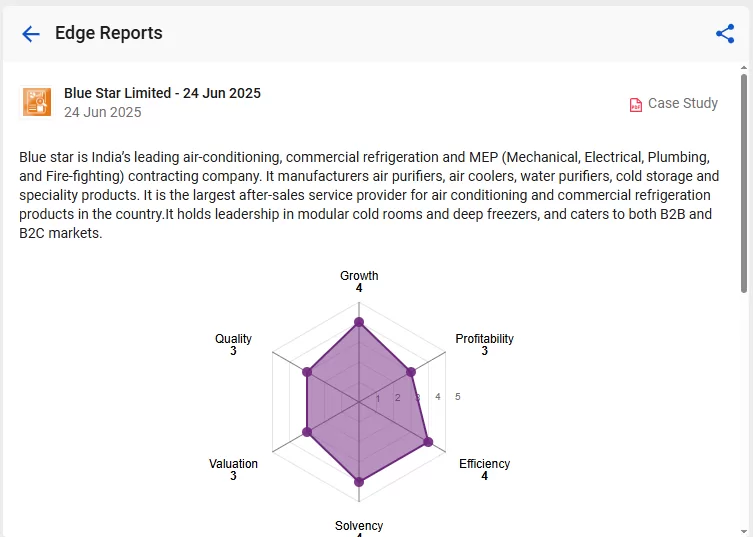

Blue Star Limited is one of India’s leading companies in the air conditioning and commercial refrigeration (HVAC&R) space. With a strong presence across 31 offices, 7 manufacturing facilities, 7,500 retail stores, and over 1,100 service associates, the company serves customers in more than 900 towns nationwide.

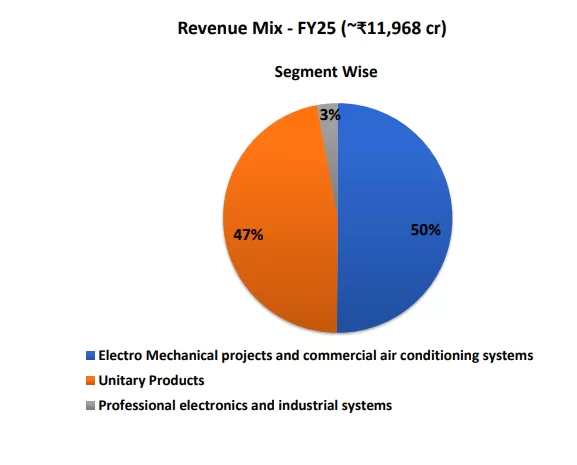

Blue Star operates with an integrated business model that spans manufacturing, EPC (engineering, procurement, and construction) services, and robust after-sales support. It caters to sectors such as buildings, infrastructure, and industry, and also exports to 19 international markets. Its product portfolio includes room ACs, chillers, cold rooms, deep freezers, VRF systems, and even water and air purifiers.

The company’s revenue grew significantly by 23.6% year-over-year (YoY) to ₹11,968 crore in FY25, up from ₹9,685 crore in FY24. The carried forward order book as of March 31, 2025, increased to ₹6,263 crore.

Why it Stands Out?

Despite facing reduced European demand and US trade uncertainties, Blue Star’s presence in 19 export markets and its integrated model, spanning from manufacturing to after-sales, helps mitigate regional risks. An expanding order book in Electro-Mechanical Projects and Commercial Air Conditioning, driven by growing manufacturing hubs and data-centre investments, offers solid growth. In Commercial Refrigeration, operational challenges are resolved, paving the way for growth in sectors like hospitality, healthcare, quick-commerce, and pharmaceuticals. With margins targeted at 7-7.5% in EPC/AC and 8-8.5% in refrigeration, aiming for 9%, and a goal to increase market share from 14% to 15%, Blue Star is positioned to benefit from domestic and international cooling needs. You can check out the Edge report to find out more details.

Dixon Technologies

Dixon Technologies (India) Limited stands as India’s largest homegrown design-focused solutions company, specializing in contract manufacturing. The company operates as both an Original Equipment Manufacturer (OEM), assembling products based on client specifications, and a leading Original Design Manufacturer (ODM), conceptualizing and designing products from scratch. Dixon’s extensive product portfolio spans consumer durables, home appliances, lighting, security devices, set-top boxes, wearables, mobile phones, IT hardware, and telecom products. It offers end-to-end product integration for OEMs, encompassing global sourcing, manufacturing, quality testing, packaging, and logistics.

Currently, the company holds a significant market presence, catering to approximately 35% of India’s consumer electronics needs and about 50% of the country’s lighting requirements.

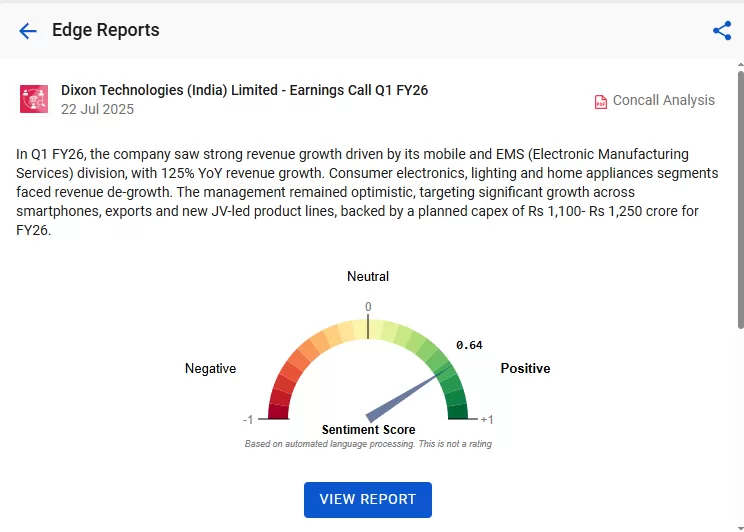

Dixon Technologies has demonstrated impressive financial growth over the past few years. In FY25, the company’s revenue increased by 120% year-over-year (YoY) to ₹38,860 crore, primarily driven by new client acquisitions in its mobile division.

The company has also shown strong returns on capital, with its Return on Capital Employed (ROCE) at 49.1% and Return on Equity (ROE) at 33.9% as of Q1 FY26, attributed to improved earnings and effective working capital management. While free cash flow has been negative in recent years due to significant capital expenditure, Dixon has maintained an optimum mix of debt to equity, primarily funding its expansion through internal accruals.

To know more about Dixon Technologies Ltd., read our blog.

Why It Stands Out

Dixon Technologies distinguishes itself through several key strengths and strategic initiatives, making it a prominent player in the electronic manufacturing services (EMS) industry. As the largest EMS company in India, it benefits from a diversified client base and backward-integrated manufacturing facilities. The company’s future growth is firmly rooted in innovation and a shift towards a design-oriented manufacturing approach. Dixon has proactively engaged in strategic partnerships and joint ventures, such as its 51% stake in a JV with Vivo for smartphone manufacturing, which is expected to handle a significant portion of Vivo’s production. Other notable collaborations include a 60:40 JV with Inventec Corporation for manufacturing notebooks and PCs, and a partnership with HKC Corporation for mobile display module manufacturing. The company is also expanding its product portfolio, venturing into refrigerators, IT hardware (including notebooks and tablets), digital signage, and premium lighting products. Furthermore, Dixon is well-positioned to benefit from the Indian government’s Production Linked Incentive (PLI) scheme, which aims to boost domestic manufacturing and exports, and the global “China+1” strategy, attracting more international orders. With a strong order book across all verticals, especially in mobile, home appliances, and wearables, and ambitious targets such as manufacturing ~6-6.5 crore smartphones annually by FY27 (including the Vivo JV). To know more about the future outlook, read our Edge Report.

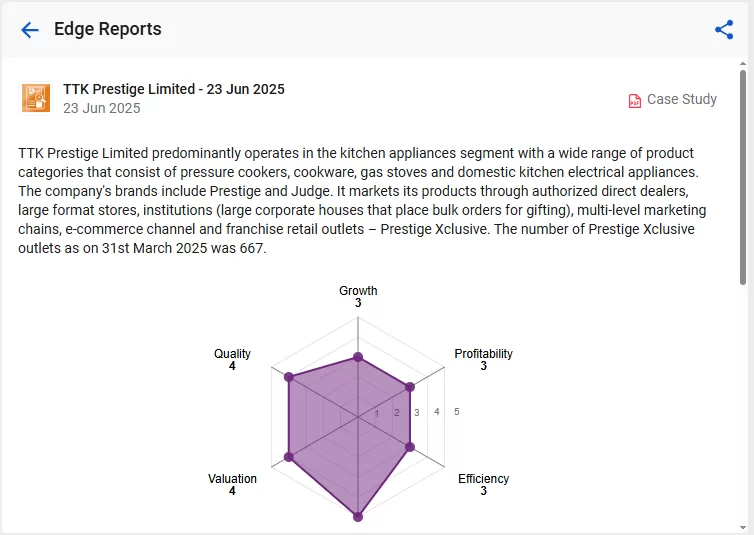

TTK Prestige

TTK Prestige Limited is a prominent Indian company primarily focused on the Kitchen Appliances segment. Their extensive product range includes essential kitchen items, such as pressure cookers, cookware, and gas stoves, as well as a variety of domestic kitchen electrical appliances, including induction cooktops, mixer grinders, and rice cookers. The company markets its products under two key brands: Prestige and Judge. Their products are distributed through a diverse network of channels, including authorized direct dealers, large format stores, institutional sales, multi-level marketing chains, e-commerce, and their exclusive franchise retail outlets known as Prestige Xclusive, which numbered 667 outlets as of March 31, 2025.

In FY 2025, TTK Prestige reported a revenue of ₹2,715 crore, showing a modest ~1% increase year-over-year (YoY). This follows a decline of 3.6% in net sales in FY24. Key segments saw varied performance in FY25, with cookware experiencing 7.3% YoY growth and appliances showing a slight 0.4% growth, while cookers registered a de-growth of 5.9%. The company faced challenges in alternative sales channels, such as microfinance institutions (MFIs) and Canteen Stores Department (CSD), resulting in a sales loss of ₹125 crore. However, traditional channels demonstrated resilience with ~8% YoY growth. Despite these challenges, the company maintained a healthy cash position, with free cash at ₹825 crore post capital expenditures, dividend payments, and a share buyback during FY25. The company completed a buyback of 16.7 lakh shares for ~₹200 crore in September 2024. For FY25, TTK Prestige paid a total dividend of ₹6 per share. To know more about the future outlook, read our Edge Report.

Why TTK Prestige Stands Out

TTK Prestige is actively positioning itself for future growth through several strategic initiatives and its strong market standing. The company demonstrates a commitment to innovation, having launched 191 new Stock-Keeping Units (SKUs) in FY25, with plans for more in the near future. A key growth driver is its aggressive expansion of the Prestige Xclusive store network, aiming to reach ~1,000 outlets across top towns in the coming years. The successful repositioning of the Judge brand has also provided significant growth, especially targeting value-for-money segments in tier-2 and tier-3 cities through general trade and e-commerce.

Looking ahead, TTK Prestige has outlined a significant investment plan of ₹500 crore over three years, starting from Q4 FY25. This investment includes ₹200 crore for operational improvements (such as innovation, manufacturing, market strategy, logistics, and service) and ₹300 crore for capital expenditure, particularly focusing on stainless steel capacity, plant automation, and renewable energy. This strategic outlay is designed to strengthen core businesses and enhance capabilities for long-term market leadership, although it may cause a temporary impact on operating EBITDA margins. The company is also investing in digitalization of financial transactions and sales force enablement.

Furthermore, the company is well-situated to benefit from favorable sector trends in India, including the rising number of LPG connections boosting demand for cookers and cookware, the overall growth in the household appliances market driven by urbanization and increased disposable income, and the improvement in the real estate sector fueling demand for new home appliances. While exports have been subdued due to global headwinds, India’s growing importance as an alternate supply source positions TTK Prestige to reap benefits once the global economy improves. The company’s diversified business model and aggressive market strategies allow it to outperform competitors like Hawkins, which primarily focuses on core products. To know more about the future outlook, read our Edge Report.

Bottomline

Consumer durables represent a compelling investment opportunity in India’s structural consumption story. The sector is backed by strong fundamentals, rising disposable incomes, favourable demographics, digital adoption, and policy tailwinds like PLI and Make in India. While cyclicality and input costs are inherent risks, companies with diversified portfolios, strong distribution networks, and innovation-led growth strategies are likely to outperform.

India’s consumer market growth will mainly be fueled by a favourable population composition and rising disposable incomes. Between April and December FY25, electronics exports totaled Rs. 2,25,869 crore (US$26.1 billion). With strong growth prospects, India aims to reach US$ 300 billion in electronics manufacturing, including US$ 120 billion in exports, by FY26.

Frequently Asked Questions (FAQs)

What are examples of consumer durables?

Consumer durables encompass household appliances, electronics, and vehicles. Notable companies in this sector include Voltas, Whirlpool of India, Blue Star, Dixon Technologies, BPL, Havells India and many others. You can explore the list of companies included in Consumer Durables stocks on StockEdge.

What are the risks of investing in consumable durable stocks?

While consumer durable stocks offer strong growth potential, they also come with risks:

1. Cyclicality: Demand for consumer durables often declines during economic slowdowns or inflationary periods

2. Input cost pressure: Rising prices of raw materials like steel, plastic, or semiconductors can compress margins

3. High competition: Intense price wars and changing consumer preferences can impact market share

4. Regulatory & currency risks: For companies dependent on imports, a weak rupee or import duties can impact profitability

Are consumer durable stocks a good investment?

Yes, consumer durable stocks can be a good long-term investment in India, where rising incomes, urbanization, and lifestyle changes boost demand for household appliances. Government initiatives like Make in India, PLI schemes, and ONDC support domestic manufacturing and digital access. Consumer trends favour premium, innovative, and energy-efficient products, potentially increasing margins for established companies.