Key Takeaways

- AMCs in India: Asset Management Companies pool investor money into mutual funds and manage it across equities, debt, and other securities. They earn through management fees and are closely regulated by SEBI.

- AUM: Assets Under Management (AUM) refers to the total value of investments managed by an AMC or scheme. SBI MF currently leads India’s mutual fund industry with the highest AUM.

- Industry Growth: India’s mutual fund AUM doubled from ₹23.6 lakh crore in 2019 to ₹53.4 lakh crore in 2024, driven by record SIP inflows of ₹19,300+ crore per month and 8.5 crore SIP accounts.

- Key Investment Factors: Strong AUM growth, high equity exposure, profitability margins of 35-40%, ROE above 20%, reputed promoters, and digital distribution are crucial for evaluating AMC stocks.

- Future Outlook: Rising financial awareness, SIP popularity, and digital penetration will fuel further growth. AMCs with innovation, trust, and scale will lead India’s next phase of mutual fund expansion.

- Top AMCs in India 2025:

- HDFC AMC

- Nippon Life AMC

- Aditya Birla Sun Life AMC

- Jio BlackRock AMC

Table of Contents

What are AMCs (Asset Management Companies) in India?

An Asset Management Company (AMC) is a financial services institution that manages pooled funds from retail and institutional investors. Instead of every investor making direct investments in the stock market or investing in Government or corporate bonds in the debt market, AMCs create mutual funds where investors buy units. The AMC manages these funds, allocates capital to different securities, and charges a fee known as the management fee or expense ratio.

In India, AMCs are regulated by the Securities and Exchange Board of India (SEBI). Each AMC must have a sponsor (usually a bank, NBFC, or insurance company) and a trustee board. The AMC itself earns revenue mainly through fees linked to the AUM, making scale a critical driver of profitability. In StockEdge, you will get a list of Asset Management Companies (AMCs) in India.

What is AUM (Assets Under Management)?

AUM is the market value of assets an AMC or a particular scheme manages at a point in time. For mutual funds, AUM can be calculated as: AUM=Net Asset Value (NAV) × Total Outstanding Units. Here is a fun fact! SBI Mutual Funds has the highest AUM in India.

The asset under management changes daily based on net inflows/outflows and market movement. Funds with higher AUM generally indicate popularity and stability. However, a larger AUM does not always mean better performance. With StockEdge, you can easily track the AUM of different AMCs and see exactly how much each company is managing and where they are investing.

Industry Overview

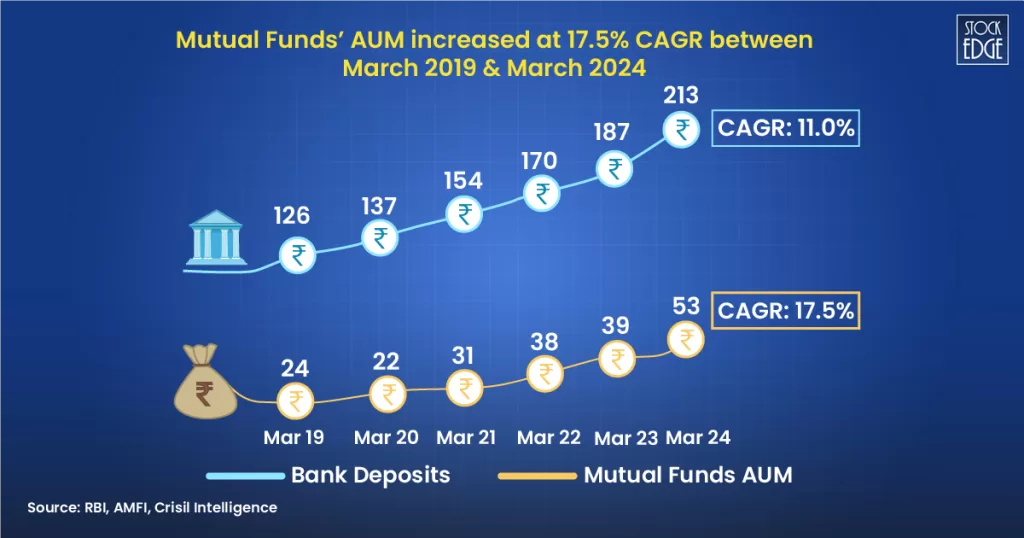

The Indian Asset Management Industry has emerged as one of the most rapidly expanding segments of the financial services industry. Mutual funds have evolved from an urban-centric investment vehicle to a widely used wealth-creation instrument in India during the last decade. In March 2024, the Indian mutual fund industry had a total Assets Under Management (AUM) of around ₹53.40 lakh crore, up from ₹23.6 lakh crore in March 2019. This represents a 2.3x increase in just six years, indicating an increased desire among Indian families for managed investment products.

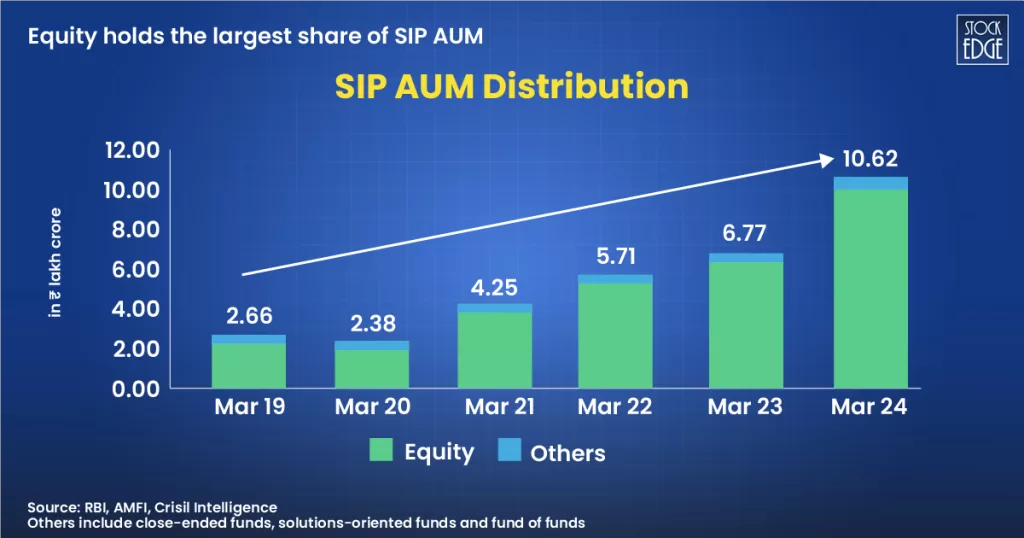

SIPs a.k.a Systematic Investment Plan continue to drive retail participation. In FY 2023–24, the SIP book crossed ₹19,300 crore per month, compared to around ₹8,000 crore in FY 2018–19. The total number of SIP accounts stood at over 8.5 crore, reflecting how mutual funds have become a preferred vehicle for long-term wealth creation among retail investors.

Key Factors While Investing in AMC Stocks

Here are the key factors to consider while investing in AMC (Asset Management Company) stocks in India:

Growth in Assets Under Management (AUM)

The first factor to assess is the growth in Assets Under Management (AUM). A rising AUM base, especially in equity funds, signals growing investor trust and higher profitability since equity assets generate better fee income compared to debt or liquid funds. It is also important to look at whether the AMC’s AUM is growing faster than the industry average, which reflects strong competitiveness.

Revenue & Fee Structure

Revenue generation in an AMC depends primarily on the fees it charges for managing funds. These fees come in the form of management charges, advisory fees, and transaction charges. AMCs with a higher share of equity assets in their portfolio tend to generate stronger revenues. A stable revenue model driven by retail SIP inflows is a positive sign, as it ensures predictable income even during volatile market phases.

Profitability

Another critical factor is profitability and margins. Since AMCs operate on an asset-light model, they enjoy high operating leverage, meaning profits grow faster once scale is achieved. Investors should look for strong net profit margins, typically above 35–40%, along with a healthy return on equity (ROE) above 20–25%. These ratios indicate the AMC’s efficiency and long-term earning power. You can create a combination scan in the StockEdge app to filter out AMC stocks that fit the above fundamental criteria. Go to My Combo Scan in StockEdge

Promoter Strength

Promoter strength is equally important. AMCs backed by large, reputed financial institutions like SBI, HDFC, or ICICI enjoy brand credibility, customer trust, and wide distribution support, which help them capture a larger market share. The strength of the promoter often plays a decisive role in investor preference.

Distribution Network and Digital Presence

The distribution network and digital presence of the AMC significantly influence its ability to attract investors. A company with strong relationships with banks, independent distributors, and fintech platforms, coupled with digital initiatives like online onboarding, can expand its retail reach more effectively and sustain growth.

Regulatory Environment

The regulatory environment is another factor to watch. Since SEBI frequently revises norms around expense ratios and distribution commissions, an AMC’s adaptability to such regulatory changes is vital. Companies that diversify into ETFs, index funds, and passive products are better positioned to handle these pressures.

Top 4 AMCs in India 2025

HDFC Asset Management Company Ltd.

HDFC Asset Management Company (HDFC AMC) is the investment manager to HDFC Mutual Fund (HDFC MF), with a total Asset Under Management (AUM) of ₹7,54,500 cr as of 31st March 2025. HDFC AMC has a diversified asset class mix across Equity and Fixed Income/Others. It has a countrywide network of branches along with a diversified distribution network comprising Banks, Independent Financial Advisors and National Distributors.

Here are the HDFC AMC’s top 5 schemes by AUM

- HDFC Mid-Cap Opportunities Fund

- HDFC Flexi Cap Fund

- HDFC Liquid Fund

- HDFC Corporate Bond Fund

- HDFC Balanced Advantage Fund

As of 31st March 2025, the proportion of equity-oriented AUM to non-equity AUM stands at 67:33, maintaining a favorable position compared to the industry distribution.

Why it Stands Out?

In Q1 FY26, the company experienced a 23% year-over-year rise in QAAUM, hitting Rs 8.29 lakh crore, and maintained an 11.5% market share. Equity AUM constituted 64% of the total. Growth was fueled by strong SIP inflows and positive net inflows in both equity and debt markets, with operating margins remaining stable. Furthermore, the company obtained approval to launch a Specialized Investment Fund (SIF). To know more about the future perspective, please read the Edge report.

Nippon Life India Asset Management Ltd.

Nippon Life India Asset Management Limited is a prominent asset manager with an AUM of ₹652570 crore as of July 31, 2025. They offer a broad spectrum of investment options, such as Mutual Funds, ETFs, Managed Accounts (including AIF and PMS), Offshore Business, and GIFT City products, catering to a diverse range of investors. As of June 30, 2025, NAM India had a unique investor base of 21.2 million, capturing a 38.3% market share.

Why it Stands Out?

The mutual fund QAAUM (quarterly average assets under management) increased by 27% YoY to ₹6.12 lakh crore. The company’s market share grew to 8.49%, up from 8.26% QoQ and 8.2% YoY. Nippon experienced the largest sequential rise in market share across the industry. The company plans to launch the Nippon India Digital Innovation Fund, a fund of funds focused on venture capital, along with a new long-short equity fund. To know more about the future perspective, please read the Edge report.

Aditya Birla Sun Life AMC Ltd.

Aditya Birla Sun Life AMC is a joint venture between Aditya Birla Capital Ltd and Sun Life AMC. It offers mutual fund products, portfolio management, offshore investments, and real estate services. As of 30th June 2025, the proportion of equity-oriented assets under management (AUM) to non-equity AUM stayed at 45:55. The Equity Mutual Fund QAAUM increased by 11.2% year-over-year and 6.6% sequentially, reaching ₹1,80,200 crore on 30th June 2025.

Why it Stand Out?

During Q1 FY26, the company experienced strong growth in AUM (Assets Under Management), with total QAAUM (Quarterly Average Asset Under Management) increasing by 21% year-over-year to Rs 4.43 lakh crore. This growth was driven by robust SIP (Systematic Investment Plan) inflows and rising retail participation. The company is also broadening its product lineup by launching new passive funds to better meet the diverse needs of its expanding investor base, with plans for one or two additional funds in the pipeline. To know more about the financials, please read the Edge report.

Thanks for staying with us till the end! Now, here’s a little bonus for you. One more big player has entered this market – can you guess who it is?

Yes, you got it right – it’s Jio Financial Services Ltd.

Let’s explore their business model and the potential they hold to emerge as a market leader in the AMC space.

Jio Financials Ltd.

Jio Financial Services (JFS) entered India’s asset management industry via a joint venture with BlackRock, launching the Jio BlackRock Asset Management Company in 2025. This partnership leverages Jio’s vast digital reach alongside BlackRock’s worldwide investment experience, aiming to democratize mutual fund investment across India. By prioritizing a digital-first strategy, Jio BlackRock sidesteps traditional distributors and banks, providing direct, affordable access to mutual funds through Jio’s extensive digital platforms.

Why it Stands Out?

Jio Financial Services has quickly made its presence felt in the asset management industry. The company received a strong response to its New Fund Offering (NFO) and, in July 2025, secured approvals to launch five new index funds. Earlier, in June 2025, it was also granted licenses to operate as both an investment advisor and a broker, expanding its footprint in the financial services ecosystem. Reflecting this momentum, Jio Financial’s Assets Under Management (AUM) have already reached ₹17,876 crore as of June 2025 — a remarkable start that positions it as a strong contender in the AMC space. To know more about their financials, read our Edge Report.

Check out our blog to learn more about whether Jio BlackRock makes mutual funds more accessible to Indians!

Final Thoughts

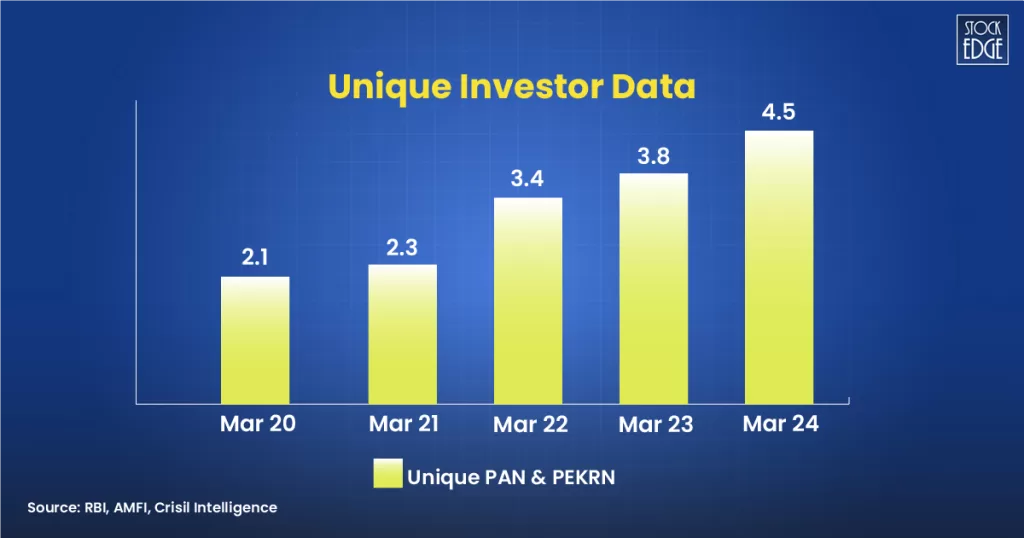

The investor base of the Indian mutual fund industry has expanded rapidly in recent years, with the number of unique PAN holders more than doubling from 2.1 crore in March 2020 to 4.5 crore in March 2024.

This substantial rise shows mutual funds’ growing popularity as a favored investment option among Indian households. Factors such as the popularity of SIPs with modest ticket sizes, seamless digital onboarding via e-KYC and investment applications, and ongoing investor education initiatives like “Mutual Funds Sahi Hai” have all played an important part in recruiting new investors.

Frequently Asked Questions (FAQs)

Can I invest directly through an AMC?

Yes. You can invest via AMC’s official website or mobile app under the Direct Plan option, which usually has a lower Total Expense Ratio (TER). Alternatively, you can invest through distributors or online platforms under a Regular Plan if you prefer guidance.

Which is the biggest AMC in India?

As of 31st July 2025, SBI Mutual Fund holds the top spot with an AUM of approximately ₹11.91 lakh crore, followed by ICICI Prudential Mutual Fund and HDFC Mutual Fund. To know which AMC has how much AUM and explore their schemes, visit StockEdge

How to compare AMCs effectively?

When investing in AMC stocks in India, one must look beyond just size and check factors such as equity AUM growth, revenue and fees structure, profitability, dividends, promoter strength, distribution reach, and regulatory adaptability. Together, these determine whether an AMC can deliver sustainable long-term value to shareholders.