Key Takeaways

- AI’s Growing Role in India: Artificial Intelligence is increasingly used across sectors like healthcare, education, agriculture, and sustainability, offering solutions to complex problems.

- India’s AI Potential: With a young, skilled population and supportive policies, India is poised to become a significant player in the AI industry, especially with the “China + 1” strategy gaining momentum.

- Companies Leveraging AI: Businesses such as Zomato, Swiggy, Policy Bazaar, and Jio are integrating AI to enhance operations, though they may not be pure AI stocks.

- Top AI Stocks to Watch: Tata Elxsi Ltd, Bosch Ltd, Persistent Systems Ltd, Oracle Financial Services Software Ltd, Cyient Ltd, Zensar Technologies Ltd, WIPRO Ltd, Tech Mahindra Ltd, and more.

- Investment Considerations: Assess company performance and future projections. Stay informed about market trends and indicators. Understand the risks associated with AI stock investments.

Table of Contents

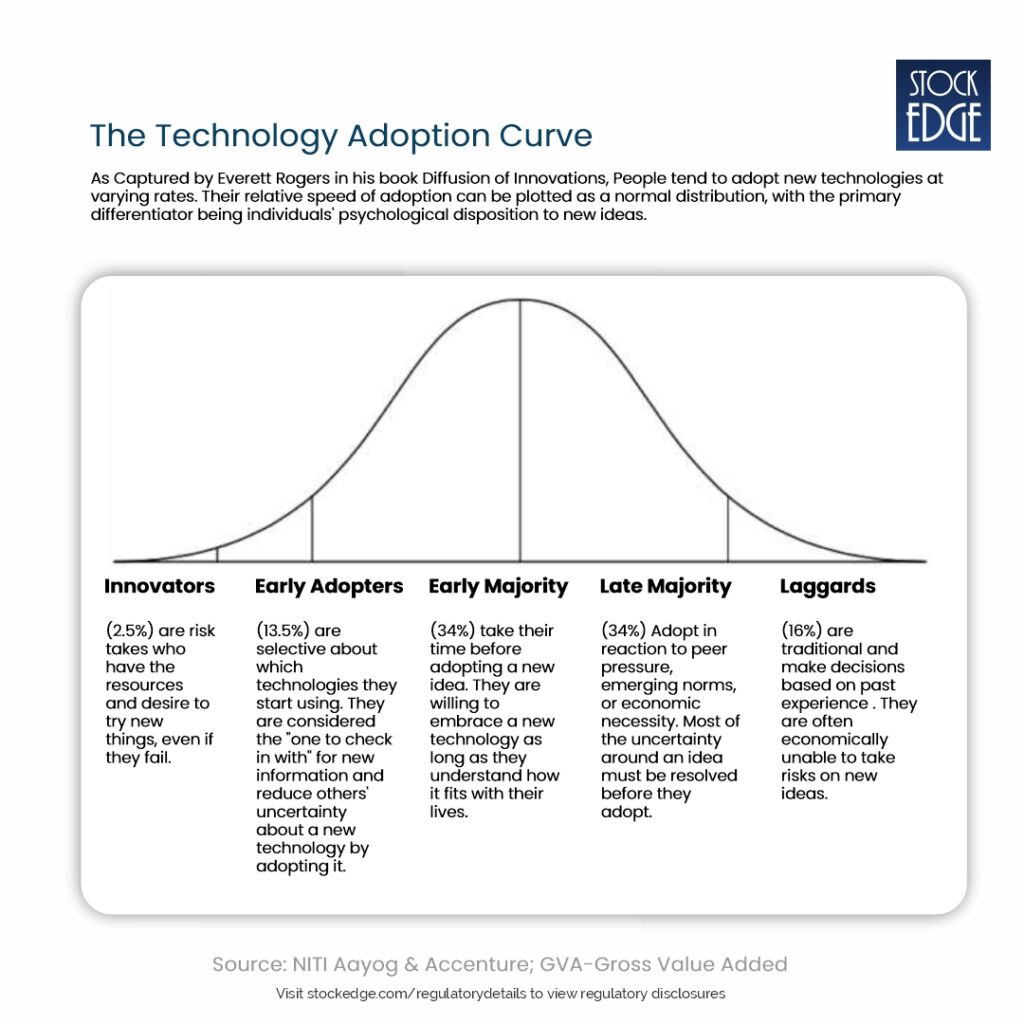

The above diagram is called the Innovation curve. Any significant innovation, be it the early like electricity, cellular phone, computers or be it the latest ones like smart devices, wearable devices and the latest one Artificial Intelligence, goes through this curve. The earliest ones to enter into the space are the innovators, whom we call “Techies” now-a-days. They take the maximum risk and also are rewarded handsomely when their innovation materializes. Elon Musk can be called an Innovator.

Then there are early adopters, which usually are the big companies supporting innovators, say Microsoft. If you’re reading this then probably you fall in the “Early Majority” stage which are people who are willing to embrace new technologies.

There may be two ways by which you can take advantage of the AI industry. One, by making use of the technology itself or two, by investing in AI stocks in India.

Understanding AI Stocks in India

Definition and Importance of AI Stocks

In simple language, Artificial Intelligence (AI) is the capability of computers to solve complex problems and learn by themselves to become better with more usage. With AI, at some point in the future, machines will be able to see, understand and make recommendations.

With development in AI, several problems in crucial sectors such as health care, education, agriculture and sustainability can be addressed.

AI in India needs to develop. With the “China + 1” slogan gaining momentum, it is beneficial for India due to its young and skilled population, growing infrastructure and favorable policies. Uber CEO Dara Khosrowshahi said, “India is one of the toughest markets out there; they are so demanding and do not pay for anything.” He also acknowledged that if you can survive in India, you can win in any part of the world. India, due to its diverse socio-economic population, would require an AI that is not only innovative but also cost-effective.

Indian entrepreneurs in the last decade have come a long way in utilizing AI in India. They use AI to boost their sales and marketing, manage risk, solve problems, expand reach, and much more. Some of the Indian companies that are using AI are Zomato, Swiggy, Policy Bazaar, Jio and many more. This doesn’t necessarily mean that these are AI stocks; these are just utilizing the products made by other companies that we are going to discuss in this blog!

The Impact of AI on India Stock Market

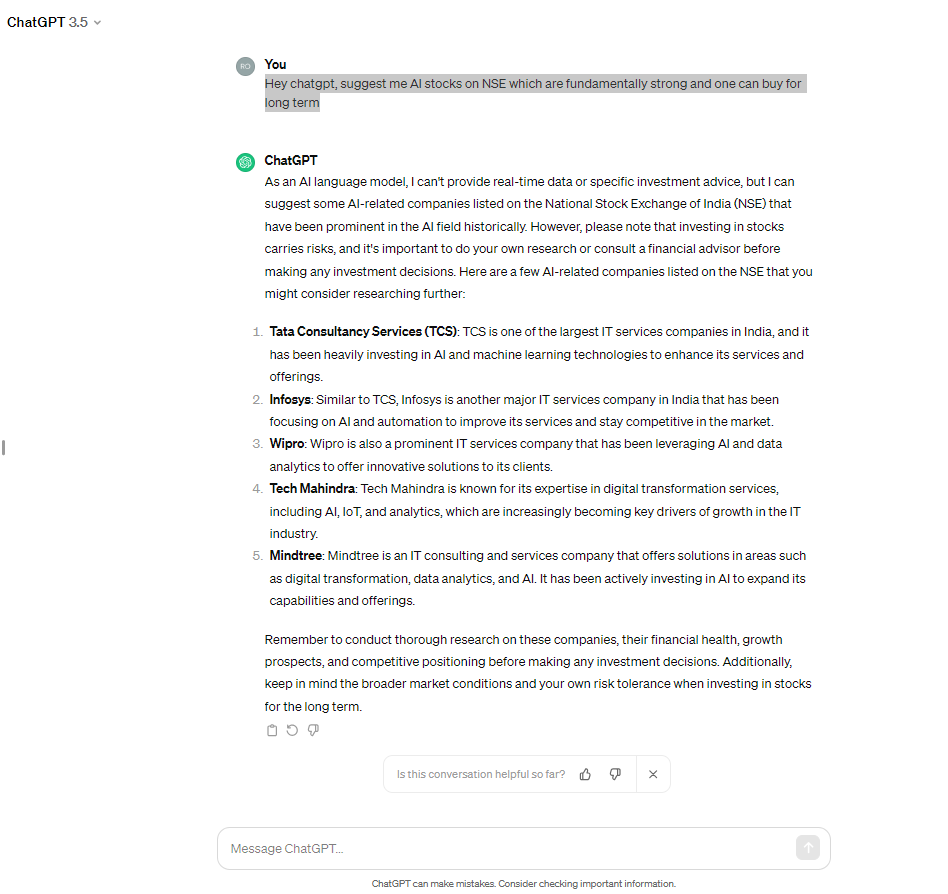

Let me show you the power of AI. I asked Chat GPT, “Hey Chat GPT, suggest AI stocks on NSE that are fundamentally strong, and one can buy for the long term”.

Chat GPT is an AI tool that, as of today, is the most advanced conversational AI model with which a user can interact.

(Important: Chat GPT is trained only to answer questions that are related to the period prior to January 2022. Hence, currently, it’s not a good idea to take stock advice from AI.)

As you just saw, AI can be used by analysts to screen stocks and get answers to various questions related to the stock market.

A Dive into the Indian AI Sector

Overview of Indian AI Industry

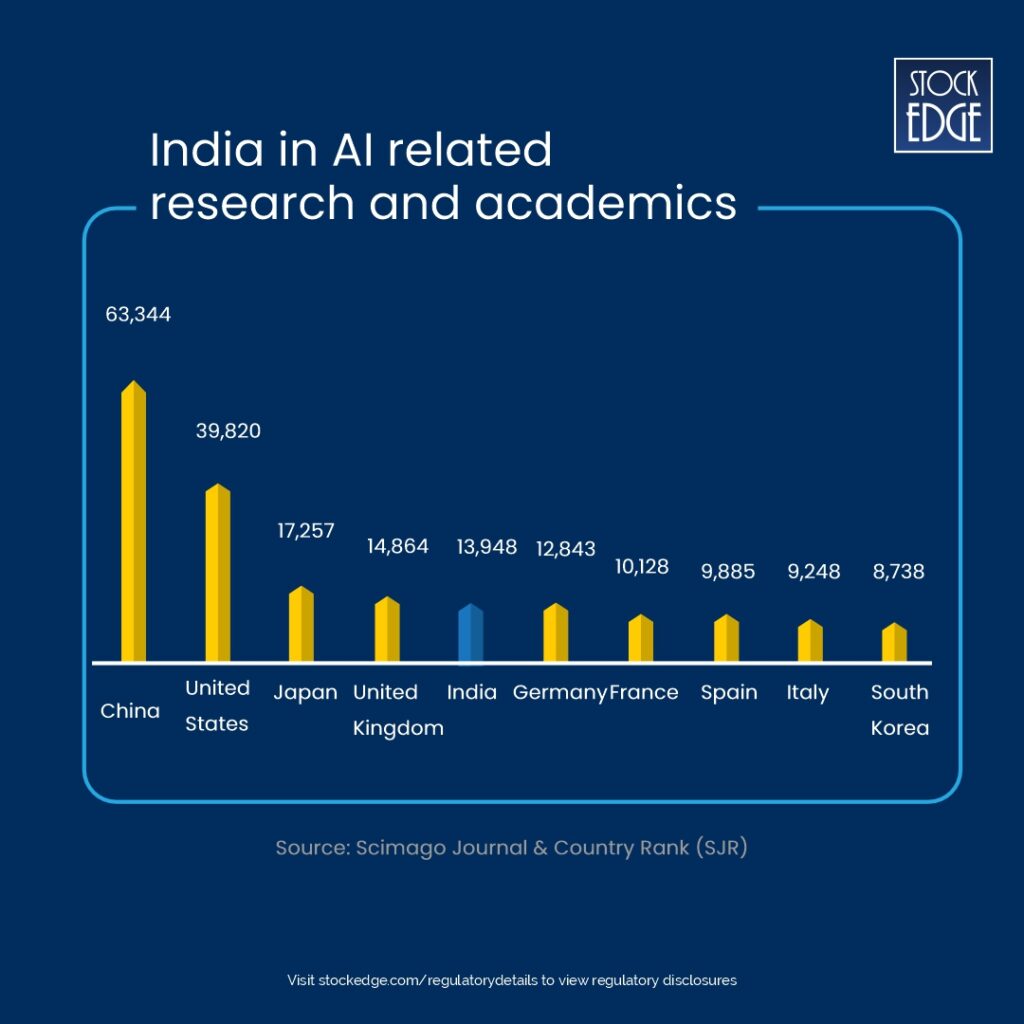

India is progressing well in AI technology but there are still miles to go when compared to other developed nations. See the chart below.

India stands at fifth position in AI-related research and academics.

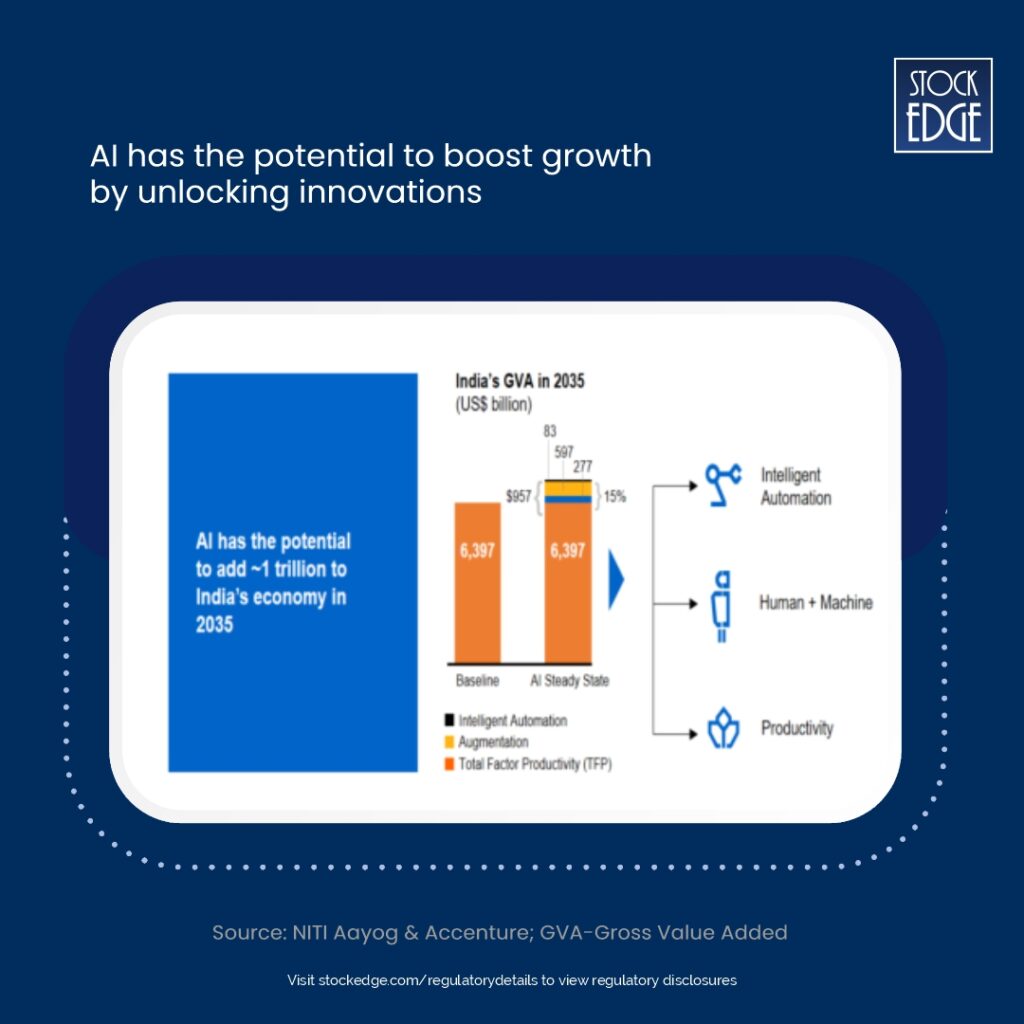

Another study indicates that AI in India has the potential to add 1 trillion to our economy.

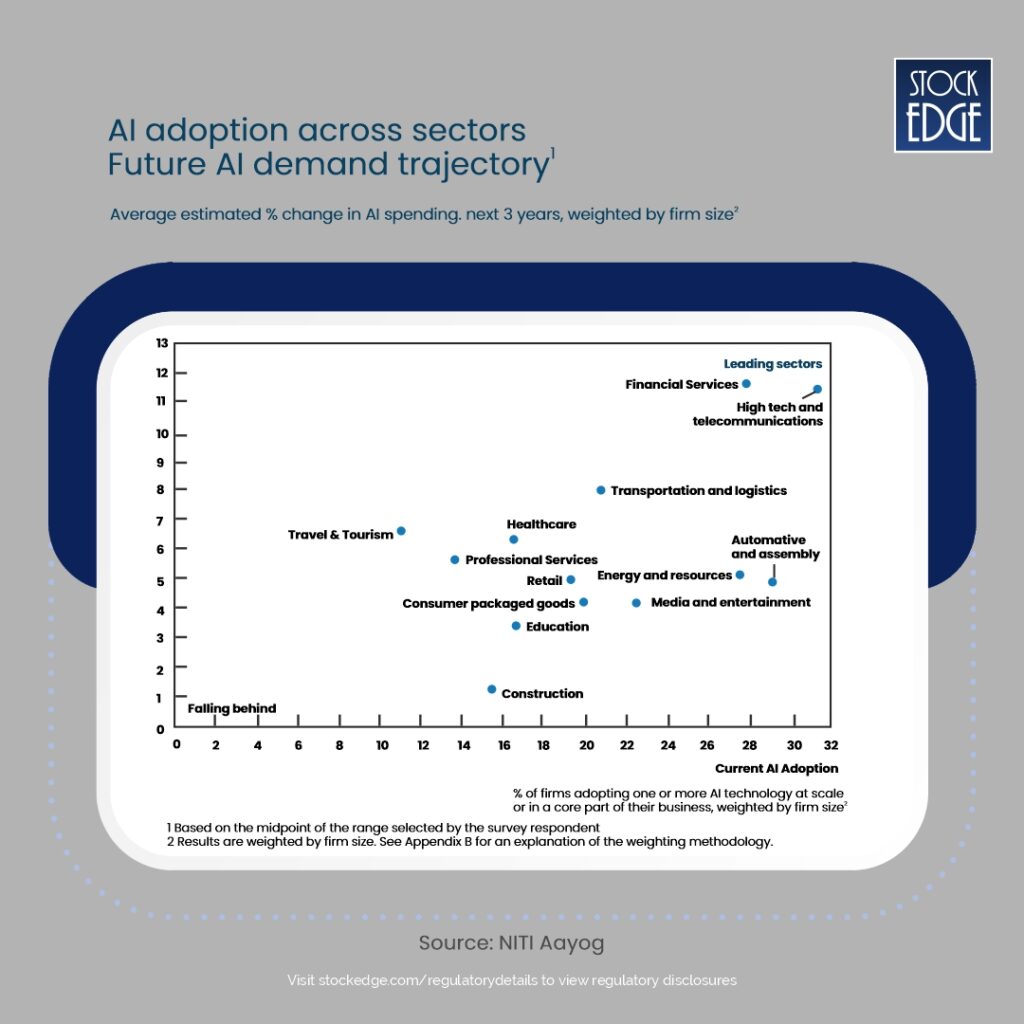

According to NITI Aayog, AI in India is widely adopted by many industries as shown below.

Amongst this, Telecommunications and Financial Services are leading the curve. AI stocks in India are destined to do well as more and more sectors understand the importance of artificial intelligence.

Growth and Future Prospects of AI in India

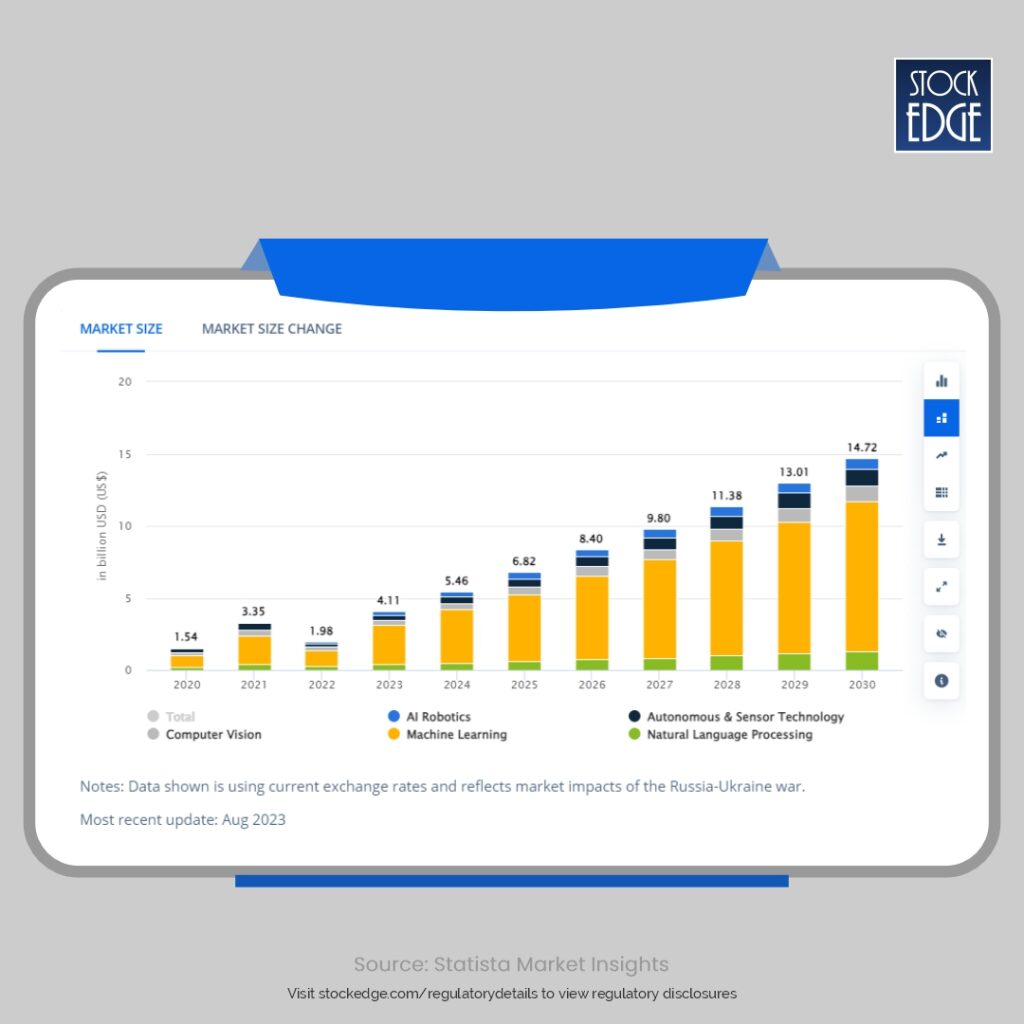

As of 2024, the US AI market stands at $106.5 billion. According to Statista, the market size of AI in India is $5.47 billion and is projected to reach $14.72 billion by 2030, which is an annual growth rate of 17.94%. Within this, Machine Learning is expected to be the largest segment.

Top AI Stocks for Investment in India

Tata Elxsi Ltd – A Potential AI Stock

Tata Elxsi is a part of the flagship Tata group. The company is not any ordinary IT services company, but is involved in a niche area of providing design, connectivity and integration related services to the Automotive, Communication, Media and Healthcare sectors. Tata Elxsi uses a host of AI enabled services in cars (autonomous cars), wearables, etc.

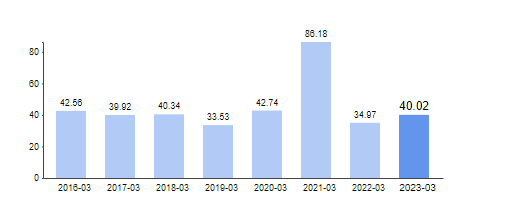

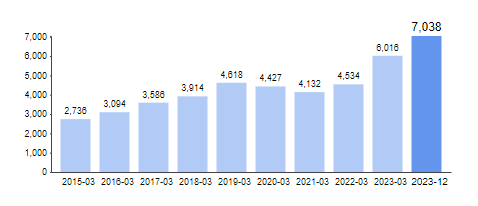

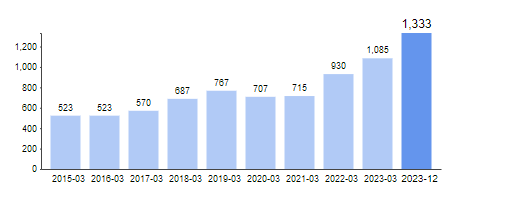

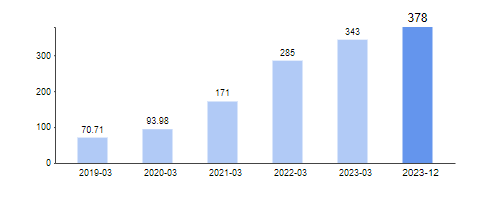

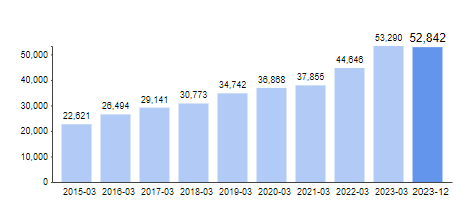

Let’s look at the financials of this AI stock in India:

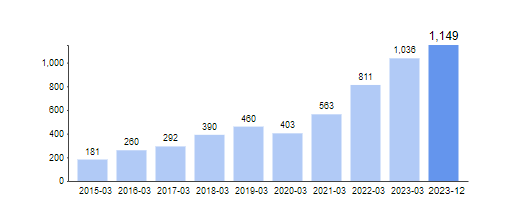

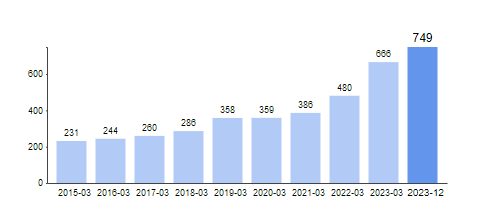

The company has steadily grown its sales over the last few years at the rate of 17.80% CAGR over the last 5 years.

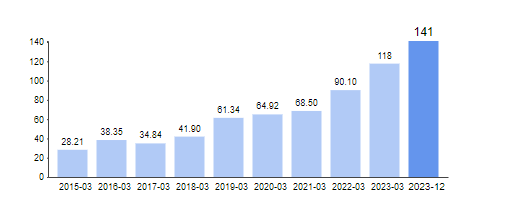

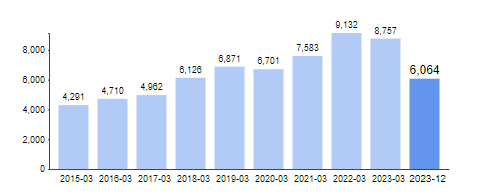

The EBITDA has grown by 22.67% CAGR over the last 5 years.

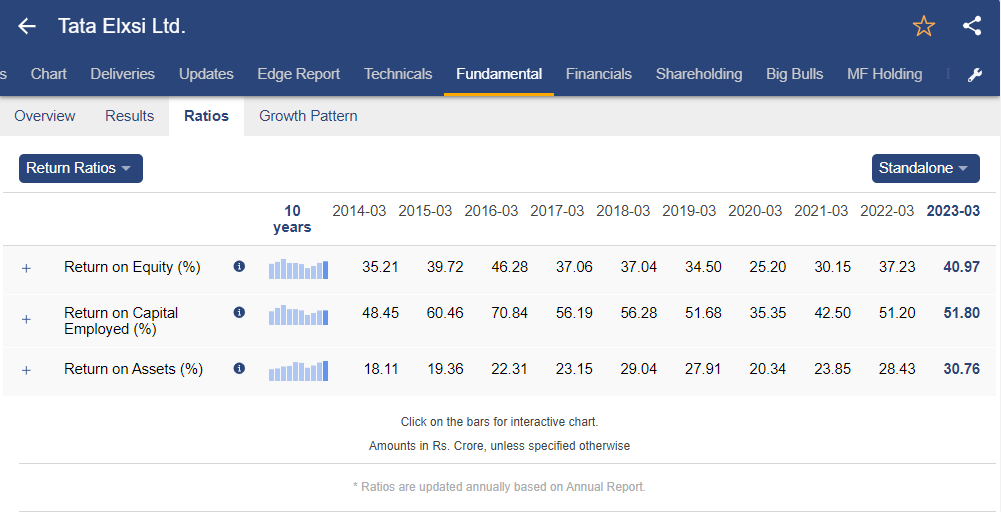

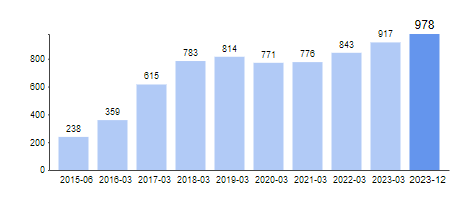

The company has strong return ratios as the ROE and ROCE for FY23 stood at 40.97% and 51.80% respectively. Along with return ratios, you can also analyze valuation, efficiency, as well as solvency ratio of TATA Elxsi from the StockEdge app.

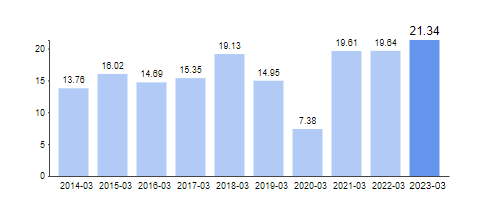

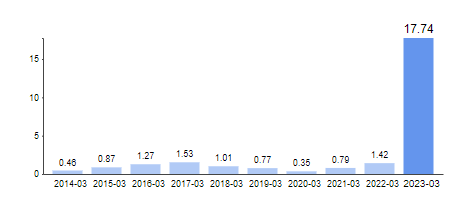

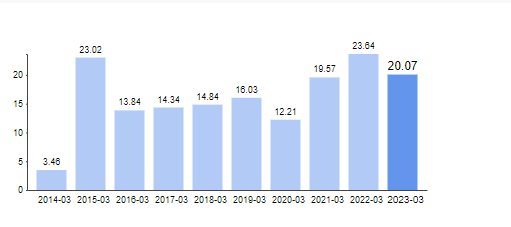

Tata Elxsi trades at a PE of 60.1x higher than the average of the last 10 years.

The future outlook of the Tata Elxsi stock, which is one of the best AI stocks in India looks bright. The company has been able to showcase its potential and serves global clients such as Airtel Digital, Panasonic, Tata Motors, Zoox and KMRL. As the usage of AI rises, investment in this AI company can prove to be profitable over the long term.

Bosch Ltd – Leading in the AI Space

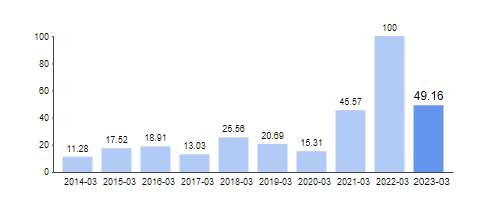

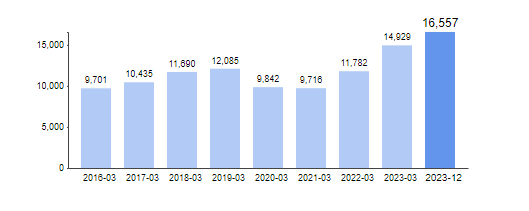

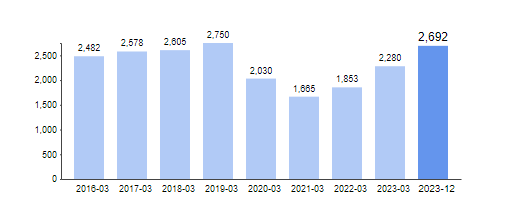

Bosch is a German multinational company and is one of the AI stocks in India. The company manufactures technology and services in the areas of mobility, industrial technology, consumer goods, energy, and building technology. In a recent press release, the company announced the implementation of AI in manufacturing to improve efficiencies. Let’s look at the company’s financials.

Bosch has grown its sales by a CAGR of 14.90% in the last 3 years.

The EBITDA has grown at a rate of 6.79% CAGR over the last 3 years.

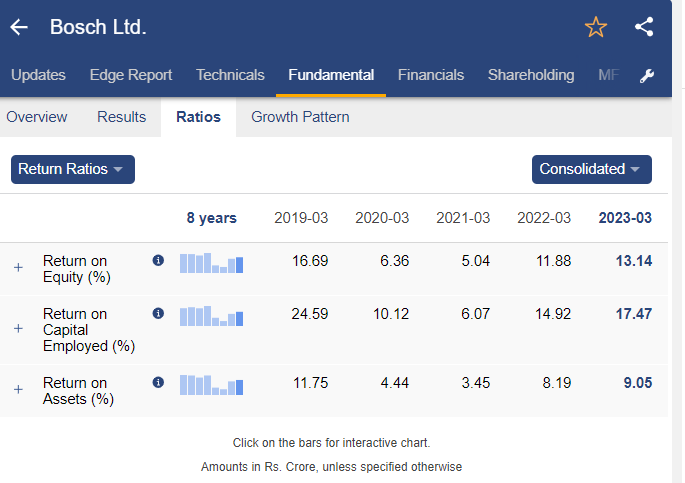

ROE and ROCE of Bosch stands at 13.14% and 17.47% during FY23. You can analyze all financial ratios of Bosch Ltd. from StockEdge.

Valuation wise, Bosch commands a premium due to its MNC status and trades at a PE of 51.3x, higher than the PE ratio of the last 5 years.

The outlook of Bosch as an AI stock in India is bright as the manufacturing sector in India is growing and with increasing cost of labor, companies are turning to automation in order to save cost and increase efficiency.

Persistent Systems Ltd. – A Noteworthy AI Player

Persistent is an IT services company that recently ventured into the AI space. The company has AI offerings for Industry Solutions (increase speed and agility of organizations through ERP applications), Enterprise Reinvention (using generative AI like ChatGPT to transform value chains and drive productivity), Search and Insights (using generative AI to manufacture chatbots for organizations) and Accelerated Engineering (designing cars, machines, instruments using AI along with the engineering team to get maximum efficiency). Persistent Systems has been a integral part of NIFTY IT Index.

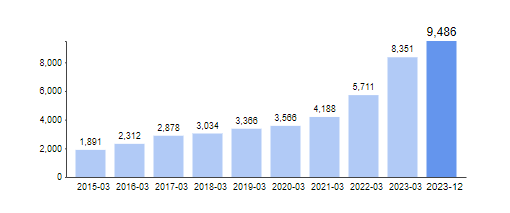

Let’s jump into the fundamental analysis of Persistent systems.

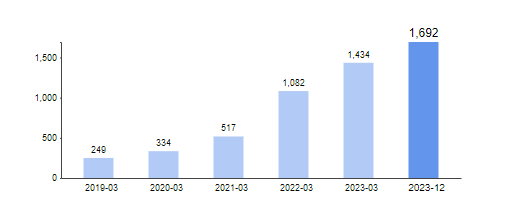

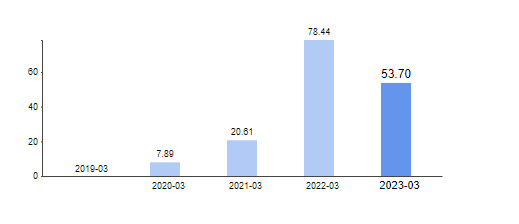

The company has been able to grow its sales at a CAGR of 71.13% over the last 3 years.

The company has been able to grow its EBITDA at the rate of 45.59% CAGR over the last 3 years.

Persistent, which is one of the AI stocks in India, has been able to achieve an ROE and ROCE of 26.36% and 31.44% in FY23 respectively. You can analyze all financial ratios of Persistent Systems Ltd. from StockEdge.

Valuation wise, Persistent Systems trades at a PE of 63.4x, higher than the last 10 year average.

Persistent is developing its capabilities in the field of generative AI and has an order book of $521 million in the quarter ending December 2023. The company has exciting plans for innovating in this space, and the outlook for this AI stock in India looks bright. The stock is also available at reasonable valuations.

Oracle Financial Services Software Ltd.

The company is the Indian subsidiary of Oracle Corporation, an American multinational organization. The company makes software for banks and insurance sectors. Using generative and classic AI technologies, Oracle has integrated AI into its software and allows customers to access the AI capabilities without leaving the product interface. AI of Oracle is used in the area of data processing, analytics, document processing (KYC) and onboarding customers.

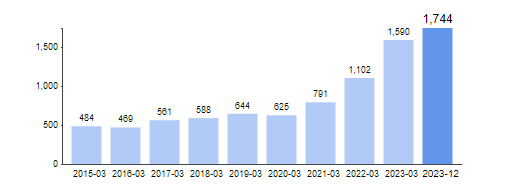

Let’s take a snapshot of the company’s financials.

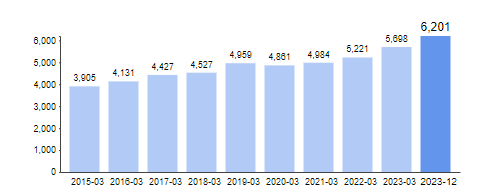

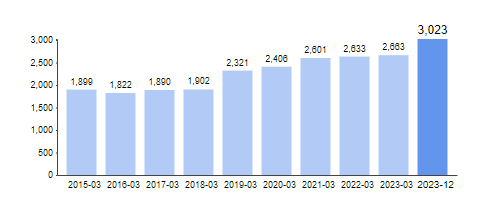

The company has been able to grow its sales at the rate of 5.44% CAGR over the last three years.

The EBITDA of the company has grown at a CAGR of 3.51% over the last three years.

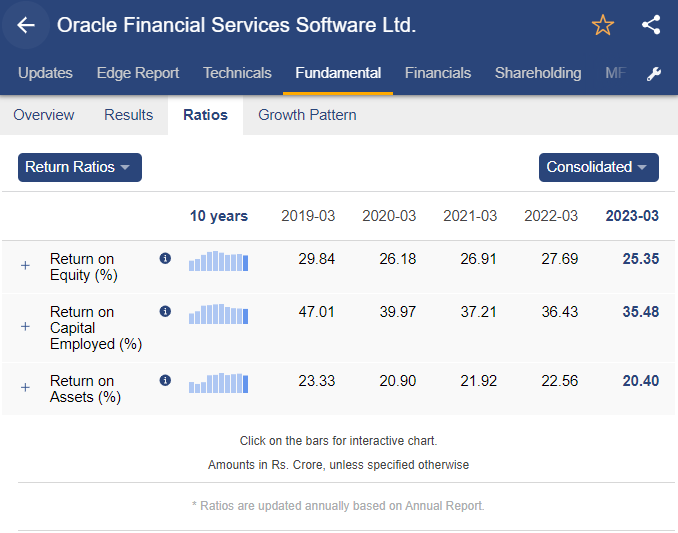

The company has a ROE and ROCE of 25.35% and 35.48% respectively in FY23. You can analyze all financial ratios of Oracle Financial Services Software Ltd. from StockEdge.

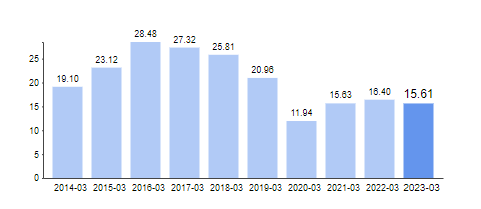

The AI stock in India, Oracle, trades at a PE of 31.5x, higher than the average of the last 10 years.

The company is the most reasonably traded AI stock in India, although it is trading higher than its past averages. The financial outlook of the company are positive given its recent partnership with Microsoft to deliver Oracle Database Services on Oracle Cloud Infrastructure. Since the company’s order book is closely tied with banks and financial services, its growth is correlated to the growth of financial services in India.

Cyient Ltd.

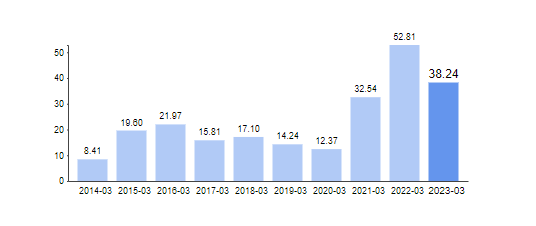

Cyient India is part of a global multinational company focused on engineering, manufacturing, data analytics, networks, and operations. The company is ranked as a leader in Industry 4.0, which is nothing but the industry working towards AI in India.

The company has shown a net sales growth of 10.76% CAGR over the last 3 years.

The EBITDA of the AI stock in India, Cyient, grew by 22.26% CAGR over a 3-year period.

The ROE and ROCE of the company stands at 15.80% and 19.92% in FY23. You can analyze all financial ratios of Cyient Ltd. from StockEdge.

Valuation of the company as indicated by PE is at 30.3x, higher than the last 10 year average.

Cyient is expected to touch $1 bn of revenues by FY25, driven by increased consumer spending and improving dealing mix. Cyient’s deal demand is driven by aerospace, automotive, sustainability and healthcare.

Affle (India) Ltd.

Affle is an India-based global technology company that does mobile advertising through an intelligence platform as per consumer conversation and recommendation. The AI stock in India, Affle, holds 36 patents relating to AI.

The company grew its sales by 62.56% CAGR over the last 3 years.

The EBITDA of the AI stock grew by 48.6% CAGR during the last 3 years.

The ROE and ROCE of the company stands at 18.67% and 20.24% in FY23. You can analyze all financial ratios of Affle India Ltd. from StockEdge.

Affle, one of the AI stocks in India, is trading at a PE of 56.2x, higher than the 5-year average.

This company is pure play AI since marketing through AI is expected to grow at 24.5% CAGR till 2030, as per Zion Market Research.

Zensar Technologies Ltd.

Zensar is a Pune based company with expertise in experience services, advanced engineering services, data engineering and analytics, application services and foundation services. The company is part of the $ 4.4 billion RPG group.

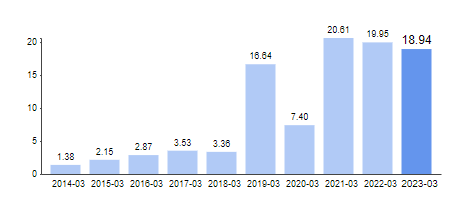

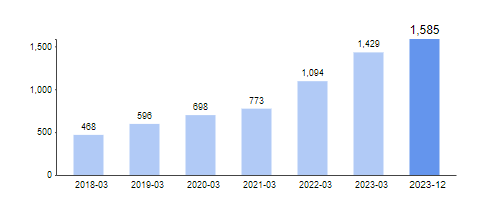

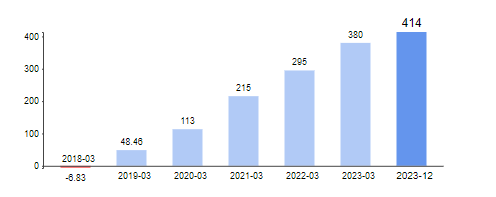

The company grew its net sales by 22% CAGR for 3 year period.

EBITDA of the AI stock in India, Zensar, grew by 2.88% over the last three years. You can analyze all financial ratios of Zensar Technologies Ltd. from StockEdge.

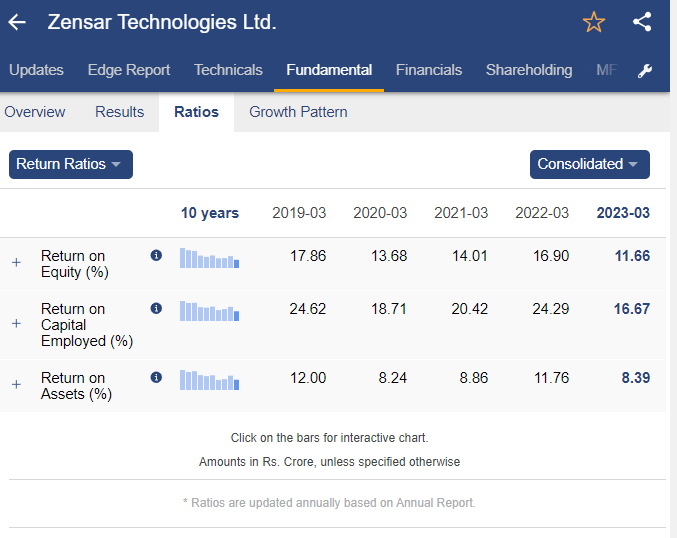

The company earns an ROE and ROCE of 11.66% and 16.67% for FY23.

The company is trading at a reasonable valuation of 20.1x, although still higher than the 10 year average.

The company expects the market to be tough as discretionary spending has come down and clients have become cost conscious. The management is cautious of the near-term demand outlook. However, for the long term the company has a strategy of EEE, i.e., “Experience to Engineering to Engagement”, helping it to gain client loyalty.

Happiest Minds Technologies Ltd.

The AI stock in India, Happiest Minds is engaged in providing big data analytics, cloud computing, networking, engineering, digital solutions, infrastructure and other support services to customers worldwide.

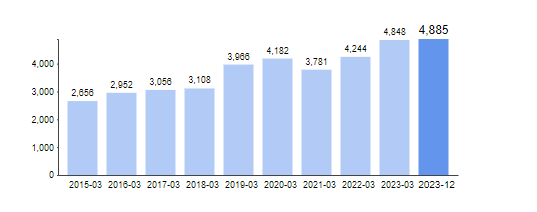

The company grew sales by 26.97% CAGR over last 3 years.

The company grew the EBITDA by 54.61% CAGR over the last 3 years.

The company has a ROE and ROCE of 30.84% and 30.67% in FY23. You can analyze all financial ratios of Happiest Minds Technologies Ltd. from StockEdge.

The company is trading at a PE of 52.1x, lower than the last 3-year average.

The company will be verticalizing its business into industry groups: Hi-tech (14.3% of revenues), banking and financial services (10.9%), travel, media and entertainment (11.7%), healthcare (14.8%), retail (7.6%) and manufacturing (7.4%). The company began to invest in AI in order to focus on Indian business. India now contributes 16.4% to the firm’s revenue, while the largest geography, the US, contributes 70.3%. Hence, the company will focus on India’s business to diversify.

RateGain Travel Technologies Ltd.

The company is in a niche sector in the AI sector in India, providing services to only the travel and hospitality sector in the form of SaaS (Software as a Service). The company processes hotel bookings and capitalizes on pricing behaviors and customer travel intent by using AI. When you see the prices of a hotel increasing during your second visit to the booking website, it’s probably due to the AI services provided by this company.

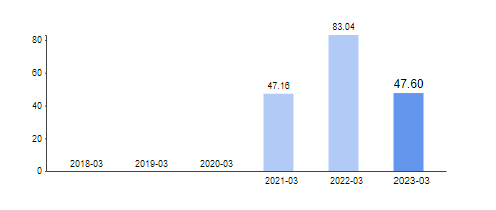

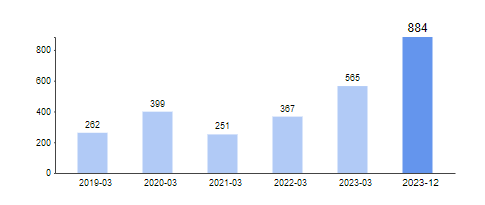

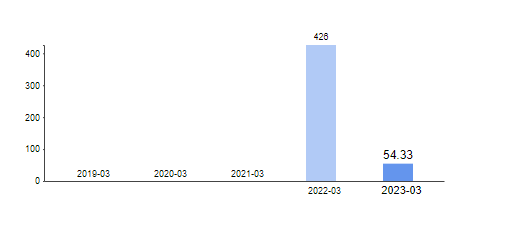

The company grew its sales by 80.41% YoY.

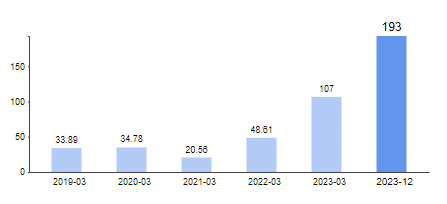

The company grew the EBITDA by 147.29% YoY.

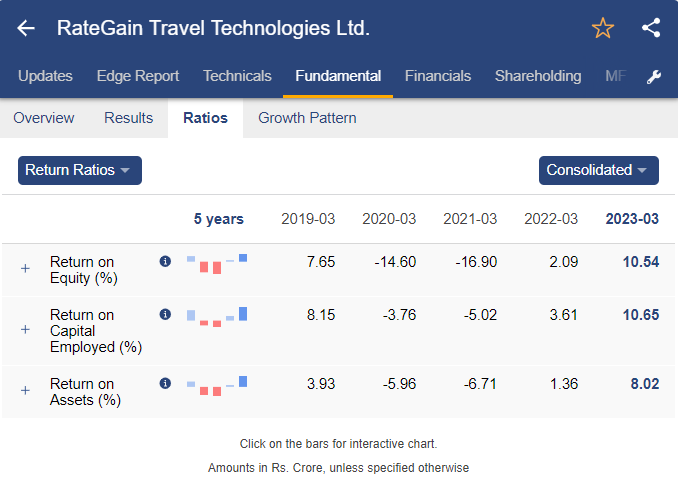

The ROE and ROCE of the company stands at 10.54% and 10.65% respectively in FY23. You can analyze all financial ratios of RateGain Travel Technologies Ltd. from StockEdge.

The company is trading at a PE of 71.8x. The stock is a turnaround story as the company went from losses to profit just last year. Hence comparing the current valuation with historical PE is irrelevant.

The company has partnered with FLYR to utilize its AI powered travel technology in order to provide revenue accretive solutions to the hotel industry. This will improve the revenues of the Indian AI company, RateGain, the JV will help hotel companies to reduce cost. The company recently announced a QIP of 600 crores to boost liquidity.

Saksoft Ltd.

AI stock in India, Saksoft provides technology services to industries such as Fintech, Utilities, Healthcare, Transport and Logistics. The company serves small and medium enterprises. Saksoft keeps up with new developments in technology and promptly incorporates them into its range of offerings. However, they only serve a specific niche with their services.

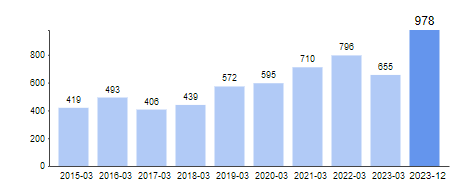

The company grew its sales by 22.87% CAGR in the last 3 years.

The EBITDA of the company grew by 21.02% CAGR over the last three years.

The ROE and ROCE stands at 22.85% and 29.60% respectively in FY23. You can analyze all financial ratios of Saksoft Ltd. from StockEdge.

The AI stock, Saksoft, trades at a PE of 27.4x, higher than the last 10 year average.

Saksoft over the years has relied on an inorganic growth route. The company has a healthy balance sheet and its debt is rated in the A+ grade by CARE Ratings. Experienced and well qualified management, presence across different business verticals and stable margins indicate better outlook for this AI stock.

WIPRO Ltd.

Wipro is the third largest IT services company in India, as per the market cap, where 80% of the company’s revenue is from export of services in the field of IT transformation, consulting and business process and service provider. Wipro is a integral part of NIFTY 50 Index

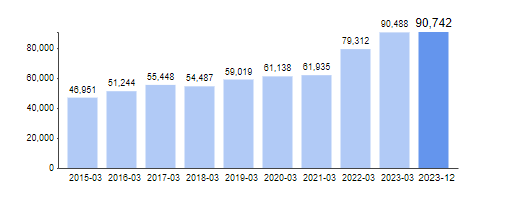

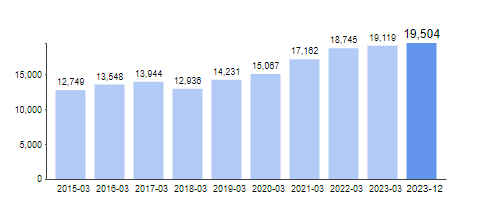

Over the last 3 years, the company’s sales have grown by 13.96% CAGR.

The EBITDA of the company has grown at a CAGR of 10.94% over the last three years.

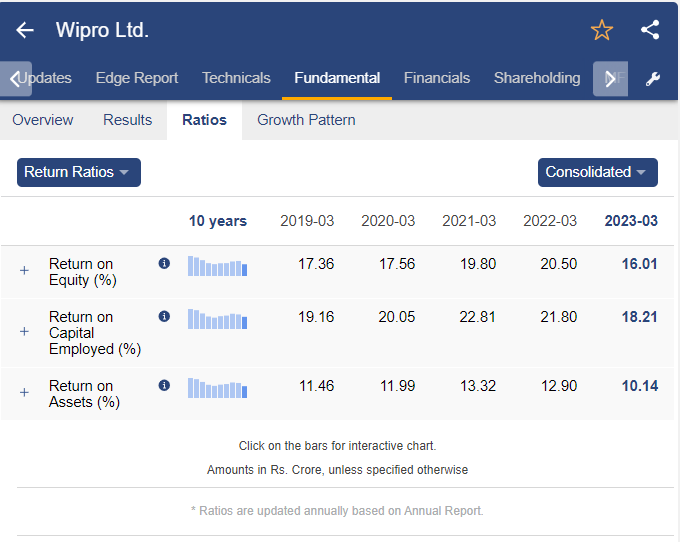

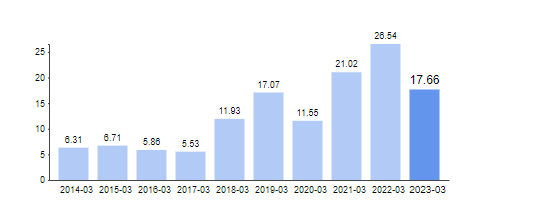

The ROE and ROCE of the company is at 16.01% and 18.21% respectively in FY23. You can analyze all financial ratios of Wipro Ltd. from StockEdge.

The company trades at a PE of 23.8x higher than the 5-year average.

The company’s promoter has guided that over the next 3 years, the company will invest a billion dollars in AI, particularly from an enhancement and augmentation perspective.

Tech Mahindra Ltd.

Part of the Mahindra group, Tech Mahindra is an Indian multinational dealing in consulting and IT services. This is the company that took over the infamous Satyam Computers and turned it around, saving billions of dollars and jobs in turn. Tech Mahindra is training 8,000 of its employees in AI in order to meet future demand.

The company grew its sales at the rate of 11.61% CAGR over the last 3 years.

The EBITDA of the AI stock in India, Tech Mahindra grew at 10.59% CAGR over the last 3-years.

The ROE and ROCE of the stock stands at 17.98% and 22.41% respectively in FY23. You can analyze all financial ratios of Tech Mahindra Ltd. from StockEdge.

The company trades at a PE of 44.2x, higher than the last 10-year average.

Tech Mahindra is a stable company backed by a large conglomerate; hence, the cost of capital is lower for this AI company. The company in the recent past has partnered with a host of companies such as Pegatron, Populii, Indosat, etc. to deliver AI capabilities. The future outlook of the company looks promising.

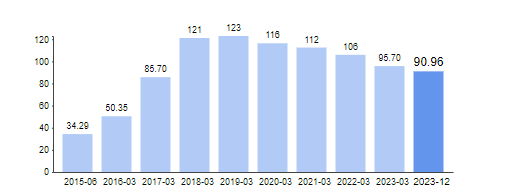

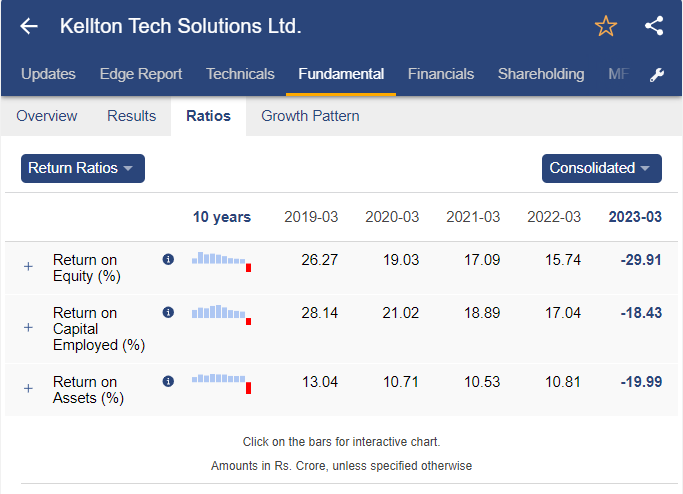

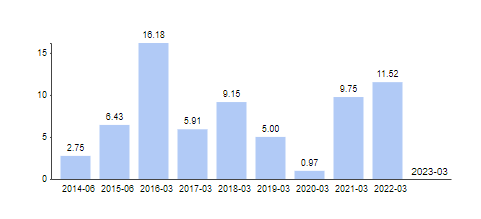

Kellton Tech Solutions Ltd.

Kellton tech is recognized among the top AI companies in India with presence in Hyderabad India, US and Europe. The company comes under the IT services sector which delivers digital solutions and innovative IoT solutions.

The company grew its sales by 3.20% CAGR over the last 3 years.

The company grew its EBITDA by -4.61% CAGR over a 3-year period.

The AI stock in India, Kellon Tech, generated a ROE and ROCE of -29.91% and -18.43% respectively in FY23. You can analyze all financial ratios of Kelton Tech Solutions Ltd. from StockEdge.

The company trades at a PE of 25x, higher than the last 10-year average.

Kellton Tech provides information technology services, enterprise resource planning, and digital transformation among other areas. The company posted a loss in the last FY due to an exceptional loss, however has remained profitable for the last 10 years. 10-year Stock price return has mirrored the profit growth of 37% CAGR. Hence the company, although looks overvalued in relative terms, has been a consistent performer.

Crucial Factors to be Considered Before Investing in AI Stocks

Company Performance and Projections

AI is developing a fast-changing world. One invention leads to another one. Hence it is important to keep a track of the performance of the AI stock in India where you are investing in order to see whether the growth is profitable or not. This is important as it’s only a profitable company that will be able to sustainably re-invest for future growth.

Market Trends and Indicators

It’s important to keep up with the market trends in order to stay relevant in the AI market. Also, while investing in the AI stock, it’s important to look at the technical indicators as well. As Mr. Rakesh Jhunjhunwala used to say, buy a stock on fundamentals but sell it when both fundamental and the technical indicators (such as RSI, MACD, Moving Averages, etc.) suggest a sell.

Advantages of Investing in AI Stocks in India

Diversification of Portfolio

Due to the high return potential of AI stocks, it provides a potential to generate alpha. Also, it’s a relatively new sector, and its correlation with other sectors might be lower. Hence, the possibility of diversification benefits.

High Return on Investment

AI stocks in India can provide high returns as the AI industry is going to disrupt the functioning of most of the sectors. The contribution of AI to India’s GDP is expected to reach $1 tn by 2035, and hence, there is scope for high returns in this sector.

Risks Associated with AI Stock Investment

- Since AI is a new sector, not much data is available to perform a detailed analysis of the volatility of the sector.

- There is a continuous threat of disruption. Hence the companies need to upscale their knowledge from time to time,

- The industry requires a highly skilled employee force, which may not be available in India at this point in time.

- Due to the market frenzy, valuations of many of the AI stocks in India are unreasonable, and hence, there is the possibility of sharp corrections in a few names.

- The sector is prone to government regulations, like the recent restrictions on DeepFake.

Essential Tips for Investing in AI Stocks

- Evaluate the fundamentals of the stock well and understand the business in depth. StockEdge provides a detailed analysis of AI stock in India and can be used in investment decision-making.

- Make sure that the purchase price is at a reasonable valuation.

- Profit booking in high beta stocks is important, and effective sales can be made at the right levels using technical indicators. Some of the indicators are listed on StockEdge, which can be referred to in order to make an informed decision.

Ai stock in India, can be great opportunity to invest for a long term. However, if you would like to know best stock to invest in 2024, you can read; Strategic Investments: Unveiling the Top 5 Stocks for 2024

Happy Investing!

Frequent Asked Questions (FAQ)

Are AI stocks a good investment?

AI stocks in India can be a good investment option for the long term as there is adoption and growth of AI across companies followed by technical advancement and government focus on AI. However, evaluate business fundamentals to avoid risk of loss.

Which are AI stocks in India?

Tata Elxsi Ltd, Bosch Ltd, Persistent Systems Pvt Ltd, Oracle Financial Services Software are the top AI Stocks in India.