Table of Contents

In the Union Budget 2024-2025, the Indian government has “sown the seeds” for increased productivity and resilience, allocating ₹2,65,808 crores for rural development and ₹1,51,851 crores for agriculture and allied activities. India is a land of agriculture. It is a primary source of livelihood for almost 55% of the country’s population. In global ranking, India ranks 1st in milk production and 2nd largest producer of food grains, fruits and vegetables. It is also the 3rd largest fish-producing country, accounting for 8% of the global fish production. Therefore, it opens up exciting opportunities for investors.

In this blog, we will dive into a comprehensive analysis of the agriculture sector and highlight some of the top agriculture stocks in India, presenting lucrative prospects for savvy investors.

Introduction to Agriculture Sector

In FY 2022-2023, agriculture and allied sectors account for 18.3% of India’s GDP. From April 2000 to March 2024, FDI (Foreign Direct Investment) in agriculture services was valued at US$ 3.08 billion. The sector is diverse, producing a wide range of crops, including rice, wheat, pulses, fruits, and vegetables. In India, there are two major agricultural seasons:

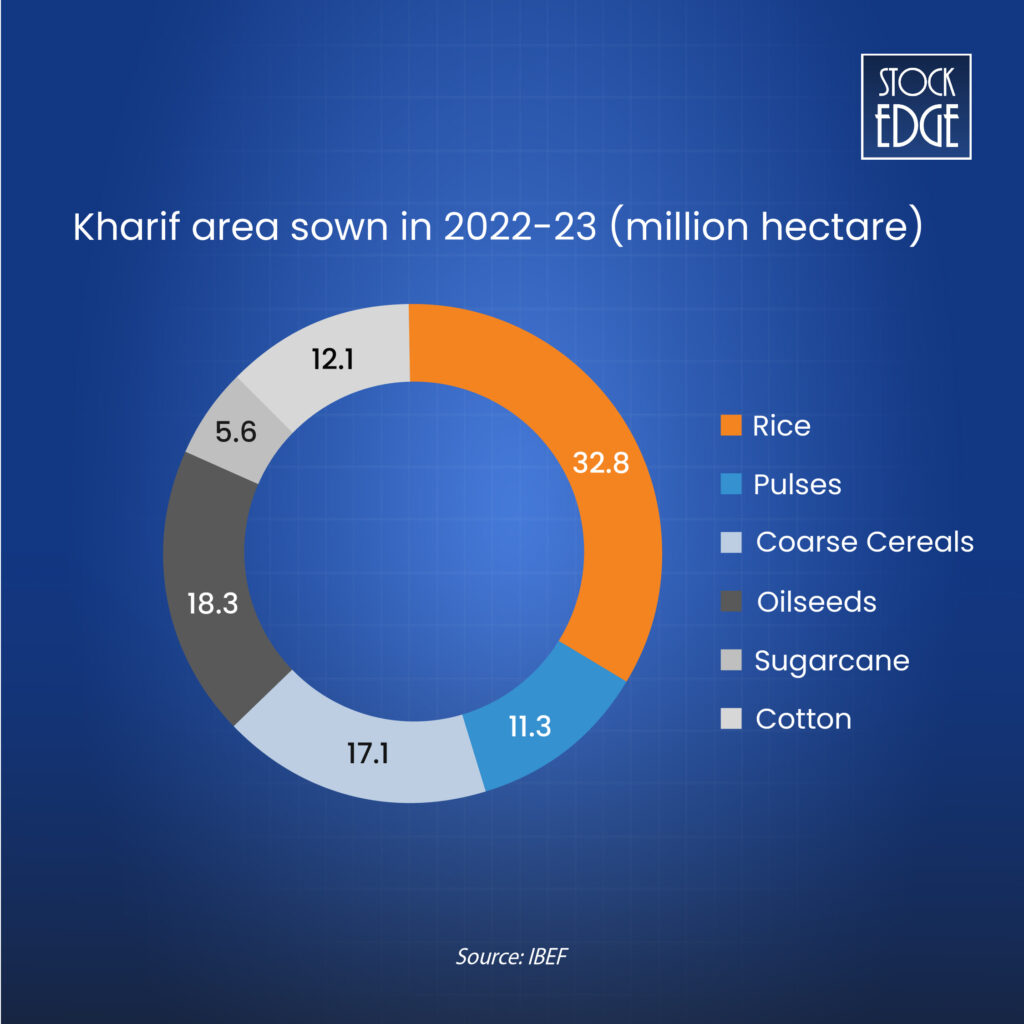

- Kharif in summer season (April-September)

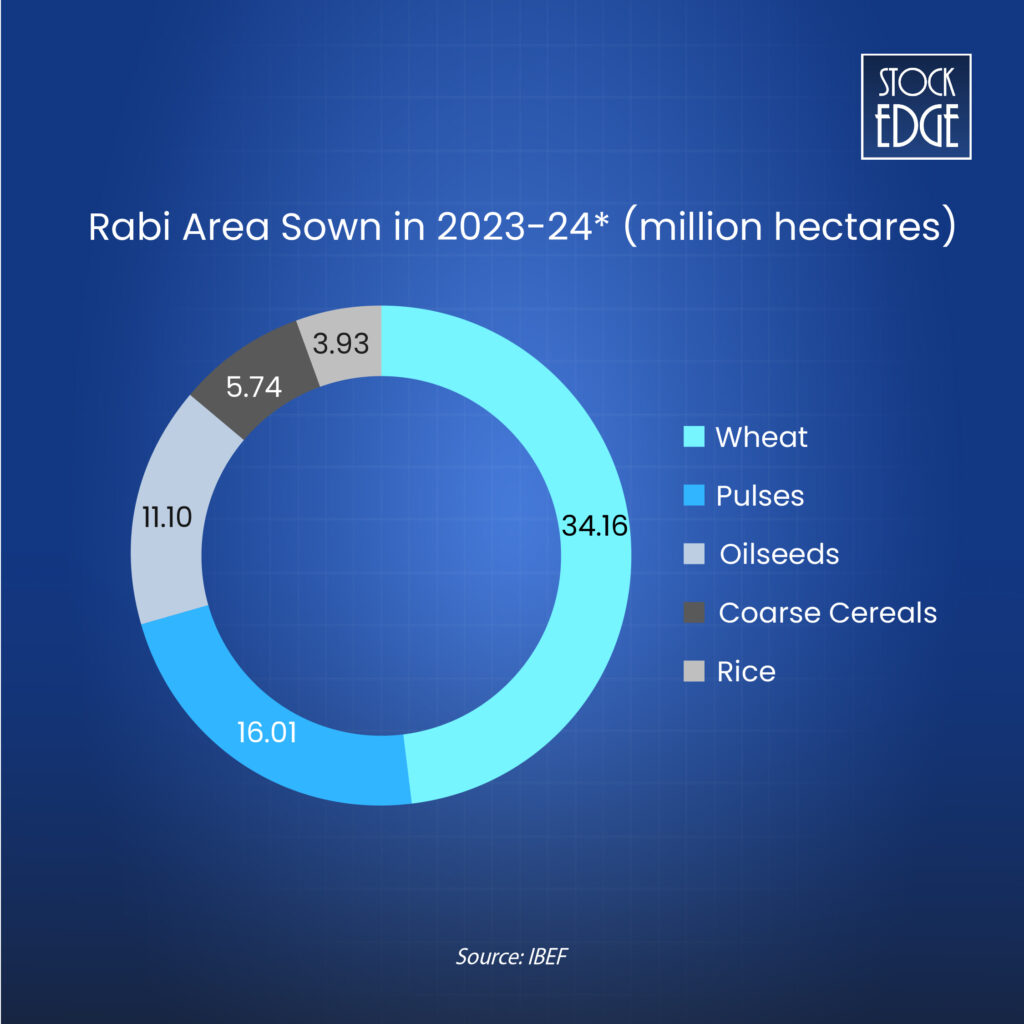

- Rabi in winter season (October-March)

As you can see, the major crop during the kharif season is rice (paddy) whereas wheat is the major crop during the rabi season. This suggests our country’s advantage of growing different crops throughout the year which leads to opportunities for investors in the agriculture stocks.

Although, the agriculture sector is vast in India. There are several agriculture stocks which are directly or indirectly related to the growing opportunities in the sector.

Which are Agriculture Stocks?

Agriculture stocks are basically listed entities in the stock market. The companies are majorly involved in farming, production of seeds, manufacturing fertilizer and pesticide, engaged in machinery and equipment production, or any related activities which are directly or indirectly involved in the agriculture and allied sector of India.

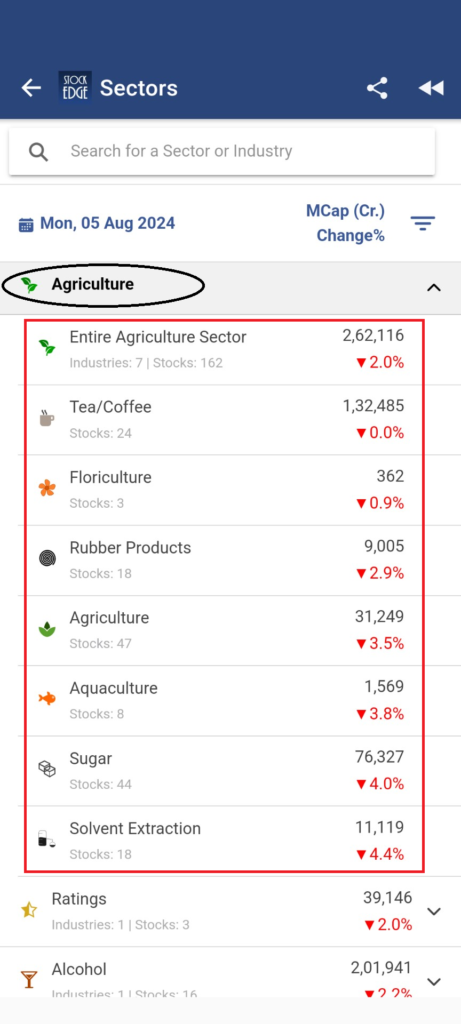

The sector is so vast that it can be subdivided into seven different industries which have 162 agriculture stocks. You can easily get this data from StockEdge.

To view the list of agriculture stocks, visit web.stockedge.com or download the StockEdge app.

Now, that you have an idea about which are agriculture stocks in India. It is time to identify opportunities in the agriculture & allied sectors. However, before you invest in any agriculture stocks, there are a few things to keep in mind before you invest.

What are the factors to consider before investing in agriculture stocks?

Here are some key factors to consider before investing in agriculture stocks:

- Market Demand: First and foremost assess the current and projected demand for agricultural products, which can be influenced by population growth, dietary changes, and global food security needs. For instance, the sales of processed food in the Indian market have been increasing at a faster pace. The domestic food processing market is expected to be worth US$ 535 billion by 2025, with a CAGR of 15.2%.

- Government Policies: Understand the impact of government regulations, subsidies, and support programs for agriculture, as these can significantly affect the profitability of agriculture companies. In the current union budget 2024-2025, our finance minister announced that in the next two years, one crore farmers across the country will be initiated into natural farming. Indis is witnessing a rise in demand for organic products, and it is anticipated to rise with a CAGR of 25.25% between 2022-27.

- Climate and Weather Risks: Consider the vulnerability of agricultural operations to climate change, natural disasters, and seasonal weather patterns, which can impact crop yields and production costs. The monsoon in India is one of the key factors which indicates a favorable climate for cultivation of major crops in India. You can read one of our blogs to find out How will the monsoon impact the stock market in 2024?

- Technological Advancements: Evaluate the use of modern technologies like precision farming, biotechnology, and mechanization in the companies you are considering, as these can enhance productivity and reduce costs. The union budget 2024-2025 emphasized undertaking a comprehensive review of the agriculture research set-up to bring the focus on rising productivity and developing climate-resilient varieties.

- Commodity Prices: Monitor the prices of key agricultural commodities, as fluctuations can directly affect the revenue and profitability of companies involved in their production and processing.

- Supply Chain Stability: Investigate the stability and efficiency of supply chains, including logistics, storage, and distribution, which are crucial for getting products to market and maintaining profitability.

- Financial Health: Analyze the financial stability of the company, including its debt levels, profit margins, and cash flow, to ensure it can weather market fluctuations and economic downturns.

- Global Trade Dynamics: Consider the impact of international trade policies, tariffs, and export-import restrictions, as these can influence market access and profitability for agriculture companies.

These factors can help you make more informed decisions when investing in agriculture stocks. Now, let’s head towards discussing some of the top agricultural stocks in India.

Top 3 Agricultural Stocks

Balrampur Chini Mills Ltd.

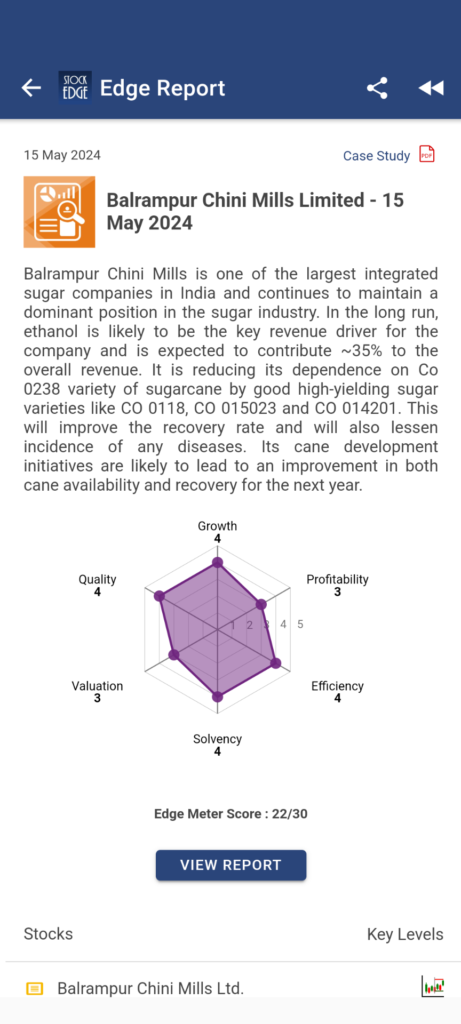

India is one of the largest producers of sugar and 2nd largest exporter in the world. Balrampur Chini Mills Ltd. (BCML), incorporated in 1975, is one of the largest integrated sugar companies in India. The export demand for sugar in 2023-2024 is valued at $ 2.82 billion, and it is expected to rise further in the coming years. The company has allied businesses that manufacture downstream products like ethanol, power (co-generation), alcohol, molasses, and bagasse, which gives it an edge over other sugar-producing companies in India.

To know more about the financial health and other factors of this agriculture stock, read our investment case study:

Our team of analysts have prepared a detailed report on the company’s outlook and financial performance. Kindly read the edge report on Balrampur Chini Mills Ltd. before making an investment decision.

CCL Products (India) Limited.

CCL Products Ltd. (CCL) is engaged in converting raw coffee beans into instant coffee powder. Coffee exports from India in FY 2023-2024 is valued at $1.29 billion and figures are expected to grow higher. Moreover, current demands for instant coffee have also increased in the domestic market due to change of taste and preferences among young Indian consumers.

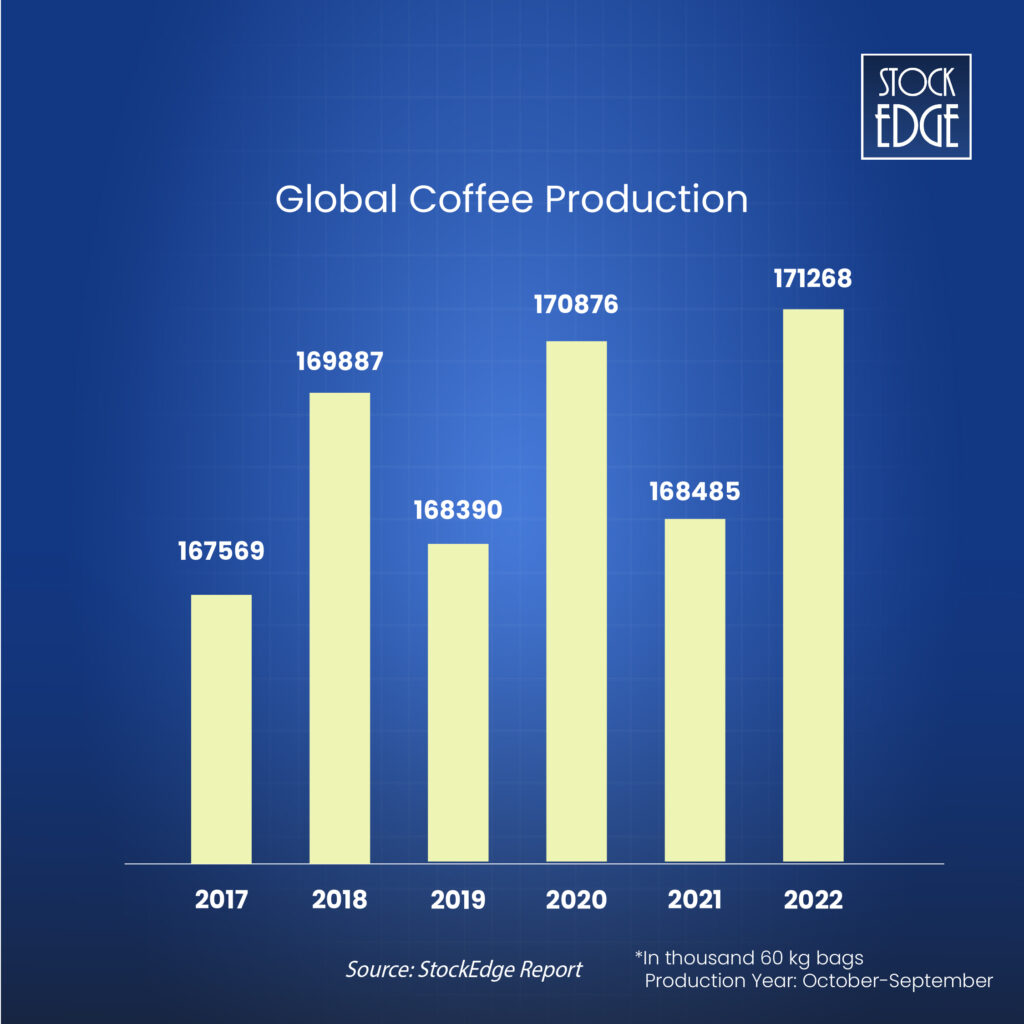

The company exports its products to more than 100 countries and supports more than 250 brands. Due to the rise in demand, the coffee production has significantly increased, as shown in the chart below:

The growing demand for coffee, in the last 30 years, has resulted in the expansion of coffee production and exports. The global coffee production (in volume) has increased by more than 60% since the 1990s and only 30% of production consumed domestically. However, coffee remains an export commodity. To know more about the financial health and other factors of this agriculture stock, read our investment case study: Edge report on CCL Products Ltd.

PI Industries Ltd.

PI Industries Ltd. is one of India’s leading agri-sciences and fine chemical companies. Although it is not a core agriculture stock, it can be considered under agriculture and allied industry. It has a strong position in domestic agricultural inputs and offers plant protection products, as well as speciality plant nutrient products and solutions. The company’s products include insecticides, fungicides, herbicides and speciality products. It is rapidly expanding its product offerings across agro-chemicals. It has a presence in both the domestic and international markets.

The increased production of agricultural products has triggered a rise in demands of various insecticides and specialty plant nutrient products. Therefore, investing in such allied agriculture stock could be beneficial for investors in the long term.

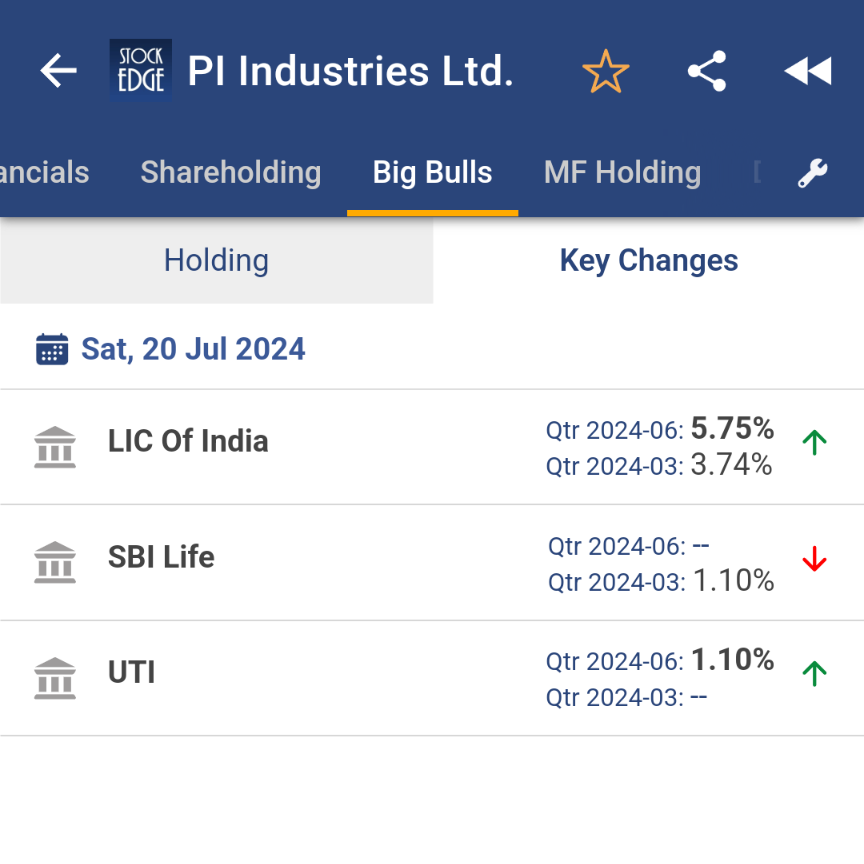

The outlook seems promising for the company, as institutional investors like LIC of India and UTI have increased stakes in PI Industries Ltd. in the past quarter, as you can view in the StockEdge app.

Moreover, to know about the financials of this agriculture stock, head over to the Investment Idea on PI Industries to view the entire edge report.

The list of above 3 agriculture stocks are mentioned based on the edge report prepared by our team of analysts. We keep on adding new investment ideas as and when the right opportunity arises. Hence keep following the investment idea section of StockEdge. You will not only find investment opportunities in agriculture stocks but investment ideas from other sectors and industries as well.

Moreover, at StockEdge, we believe in empowering retail investors and with powerful analytics tools like StockEdge, you can identify stocks for yourself.

If you have a sound knowledge understanding key financials of a company then Peer to Peer analysis is a good idea to identify stocks for long term investment.

Peer to Peer Analysis: Agriculture Stocks

Peer-to-peer (P2P) analysis in the stock market involves comparing a company’s performance, valuation, and other key metrics with those of its direct competitors or peers within the same sector or industry. This analysis helps investors assess how a company stands relative to its peers and make more informed investment decisions.

Let’s see how.

Go to StockEdge and click on Sectors. Find your choice of sector where you would like to conduct a peer-to-peer analysis. In this case, let’s find out how to conduct a peer-to-peer analysis of India’s agriculture stocks.

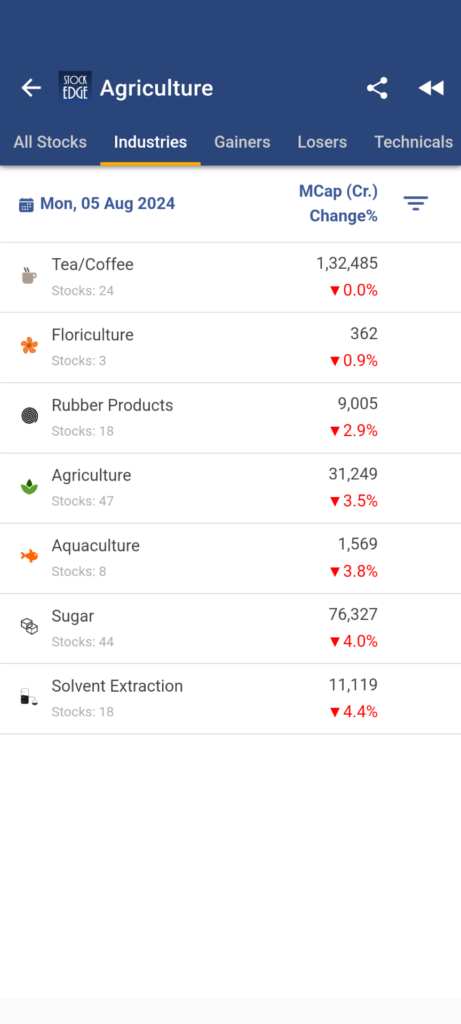

In the above image, you can view the list of industries in India’s agriculture sector.

Moreover, you can also view the number of stocks in each industry. Yes, it is important that you segregate the industries before you start your analysis. That’s because the overall agricultural sector is huge and it is highly sensitive to government policies and macro economic factors of the country. Therefore, segregating into different sub-industries can be helpful while you try to identify fundamentally strong stocks using peer to peer analysis.

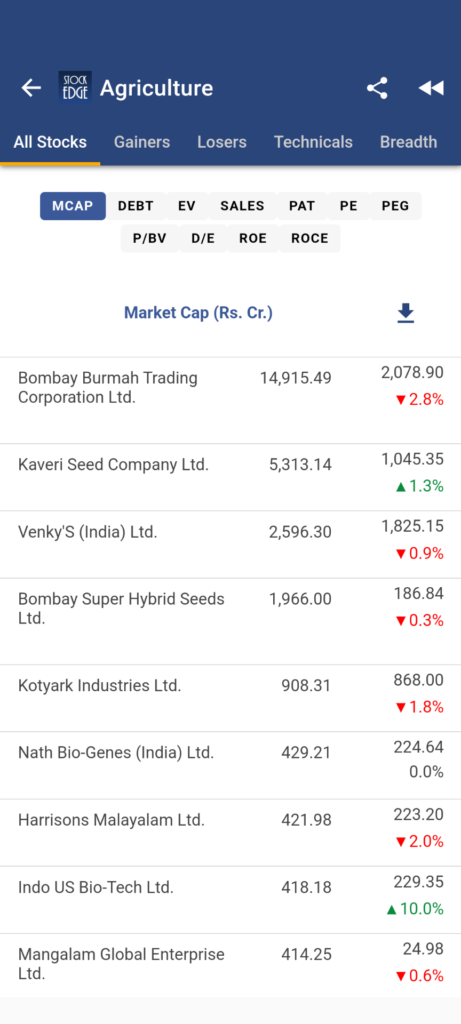

Now, let’s say, you want to find fundamentally strong stocks from the core agricultural industry where there are 47 listed companies. Simply click on the agriculture industry then you will be redirected to the below page where you can compare the key financial metrics of each agriculture stocks in India.

As you can see from the above screenshot, you can view key financial metrics like Sales, PAT, PE ratio, Debt-to-equity ratio and other essential metrics of the agriculture stocks. You can easily download the data in Excel for further analysis to identify potential investment opportunities in the agriculture sector or any other sector or industry of your choice. Please note that peer to peer analysis is a good idea to filter out stocks for investment but before making an investment decision you must have a thorough understanding of the company and its fundamentals before entering into a stock.

In case you find yourself in a difficult situation to conduct an analysis. You can join the StockEdge Club. It is India’s fastest-growing Stock Market Community with 20,000+ retail investors and more than 80 experts which can help you make the right move and beat the market.

The Bottom Line

The agriculture sector stands out as one of the best sectors to invest in right now due to its fundamental role in meeting the growing global demand for food. With a rising population, shifting dietary preferences, and increasing focus on sustainable practices, the sector offers robust growth potential. Additionally, advancements in agricultural technology and supportive government policies further enhance its attractiveness. Investing in agriculture not only provides opportunities for significant returns but also contributes to addressing critical challenges such as food security and environmental sustainability. Thus, the agriculture sector presents a compelling case for investors seeking both financial gains and impactful contributions to society.

Happy Investing!