Table of Contents

“If you are in the right sector at the right time, you can make a lot of money real fast.” by Peter Lynch.

Overall, markets and sectors move cyclically, but identifying the right sector at the right time can be challenging. We have curated top 5 sectors for Lok Sabha Election 2024. However, note that not all sectors or industries perform the same in a bullish or bearish market. Additionally, with the upcoming Lok Sabha Election 2024, this year is an excellent opportunity for investors to generate significant returns.

In this blog, we will identify strong sectors for Lok Sabha Election 2024. The 2024 general election is not just a big event for the country but equally important for the Indian stock market as well.

Although the Lok Sabha election is expected to be scheduled for April-May 2024, we recently had the Interim Budget 2024, which has already shown how India will shape up in the coming years.

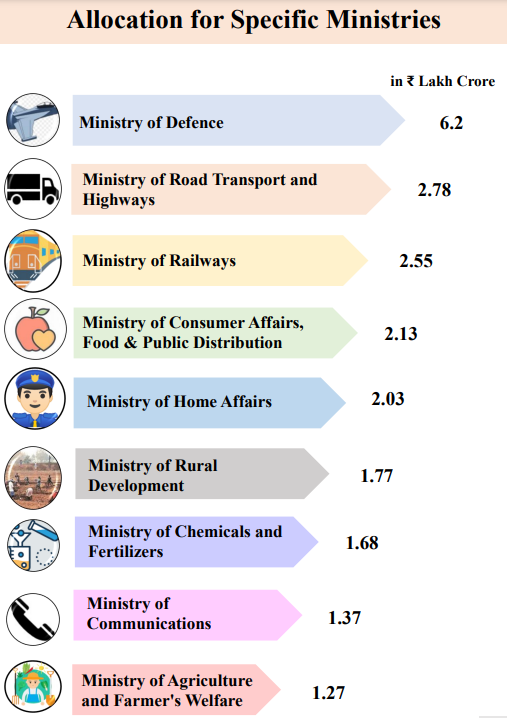

Here is a glimpse of budget allocation to different ministries of the government.

Therefore, based on the above data, we may see a few sectors in the market that might see exponential growth in the coming days.

So, without further ado, let’s start identifying strong sectors for Lok Sabha Election 2024, which you may invest:

Top 5 Sectors for Lok Sabha Election 2024

1. Defence

The top pick for strong sectors for Lok Sabha Election 2024 is the Defence because the Indian government has been allocating large sums of money to grow India’s overall defence sector. Not just this year but for the past couple of years, the Ministry of Defence has received high capital allocation to make India’s defence sector stronger. So, currently, investing in the defence sector can be a good opportunity to ride the strong momentum.

Where does India rank in defence?

As per Global Firepower Index report lists it as the fourth most-powerful military. With a strength of over 1.4 million active personnel. It is the world’s second-largest military force and has the world’s largest volunteer army.

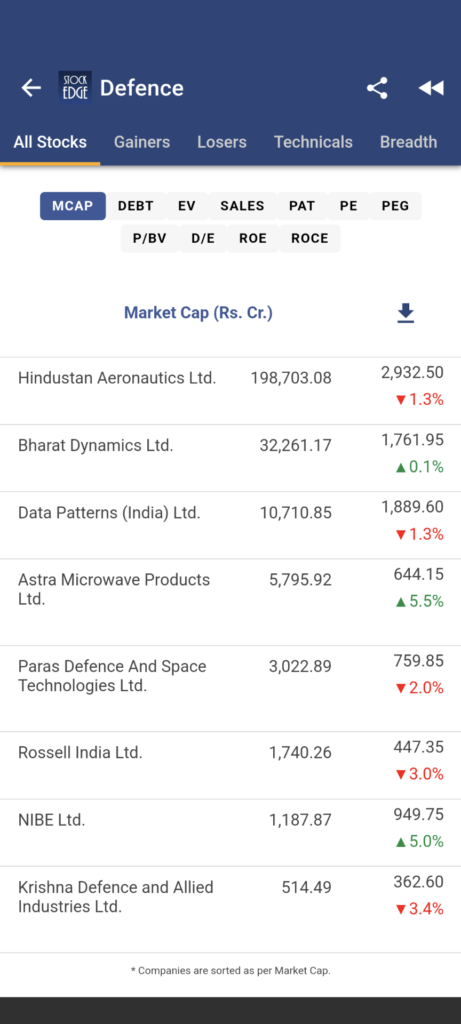

To find out which are the list of Stocks under the defence sector, StockEdge can easily help you to not only get the list of stocks but also identify the strong stocks from the sector by peer to peer analysis.

Here is the list of stocks in the defence sector:

As you can see, with StockEdge you can compare stocks under a sector and also do comparative analysis based on sales, PAT, PE, ROCE and more to identify which stock is fundamentally strong.

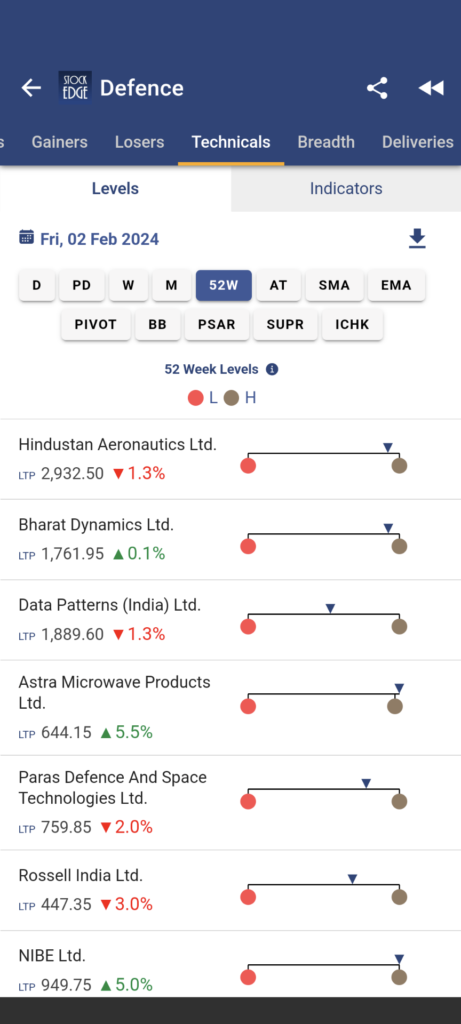

Additionally, you can also do a technical analysis directly from the StockEdge App itself, comparing the list of stocks under a sector to identify the right stock for your portfolio.

Also, peer comparison based on technical levels and technical indicators can be done with StockEdge.

To know this feature in elaborate, you may read: Beat the street with Sector Rotation Strategy

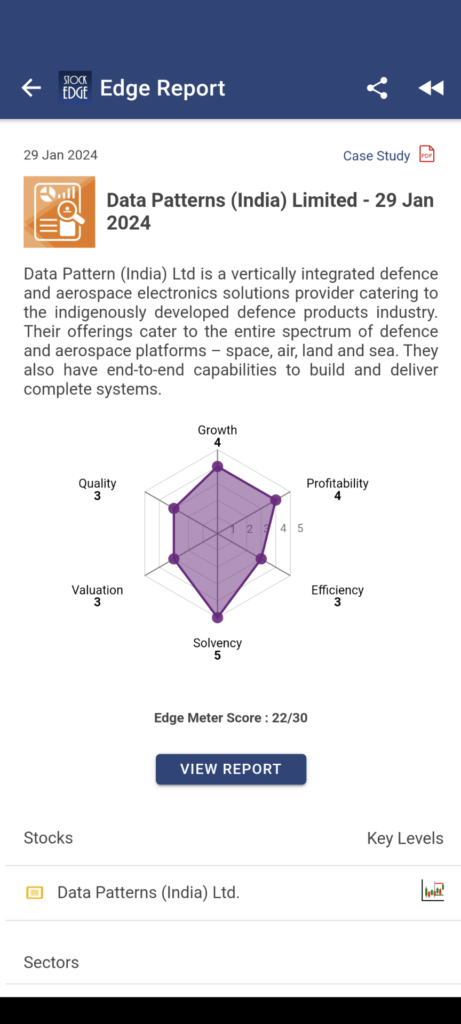

Over the past few years defence sector stocks had a good bull run. But Data Patterns is one such stock which may turn out to be a good investment in the long term. At StockEdge, we have recently published investment ideas on Data Patterns stock based on six parameters like profitability, efficiency, solvency, valuation, quality and growth.

2. Infrastructure

The government of India hikes infrastructure capex for the fourth year to Rs 11.1 trillion set for FY 2024-25.

So, how important is infrastructure for a country’s overall growth?

Infrastructure is critical for a country’s overall growth as it facilitates efficient transportation, communication, and access to basic services like water and electricity. Strong infrastructure attracts investment, boosts productivity, and enhances competitiveness, ultimately driving economic development and improving the quality of life for citizens.

This, in turn, attracts investment, fosters business expansion, and increases trade, leading to overall GDP growth through heightened efficiency and competitiveness.

Speaking of GDP growth, India is the fastest growing economy in the G20, with over 7% GDP growth in the past 3 consecutive years.

Infrastructure is a broadly defined sector in the market and it includes companies that are developing bridges, houses, railway networks, airports, etc.

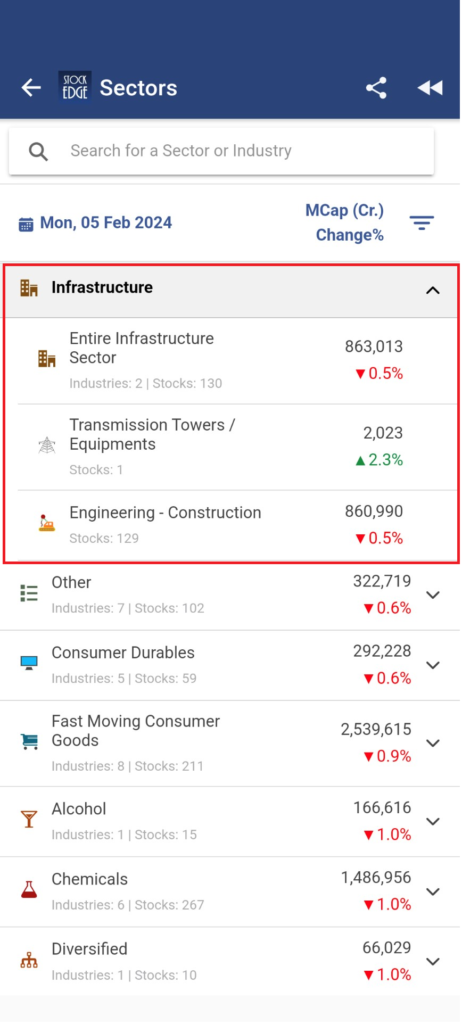

In StockEdge, we have divided this sector into sub-sectors. Find the list of Infra stocks:

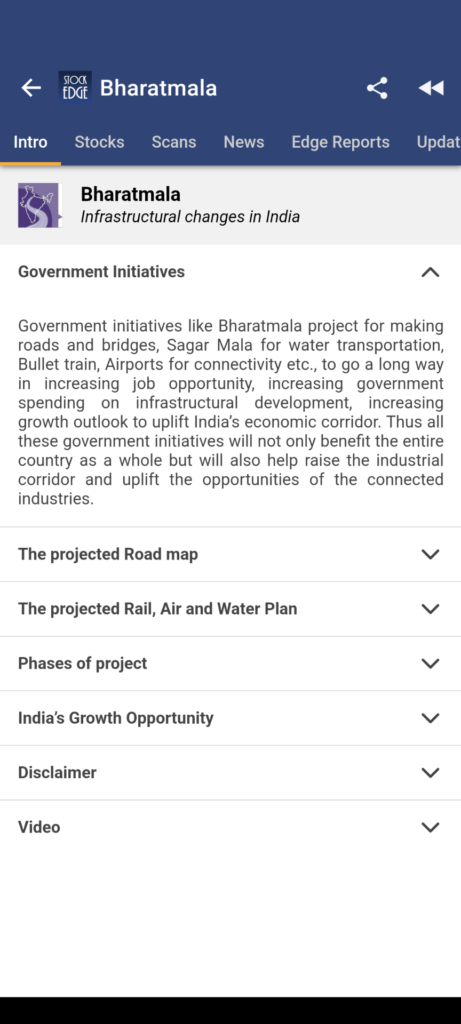

But what are the best stocks to invest in for India’s infrastructure development theme? At StockEdge, we have an Investment theme to bet on the infrastructural changes in India.

Bharatmala is an ambitious infrastructure development initiative launched by the Government of India. The project seeks to improve connectivity, reduce travel time, boost trade and commerce, and stimulate economic growth by enhancing transportation infrastructure.

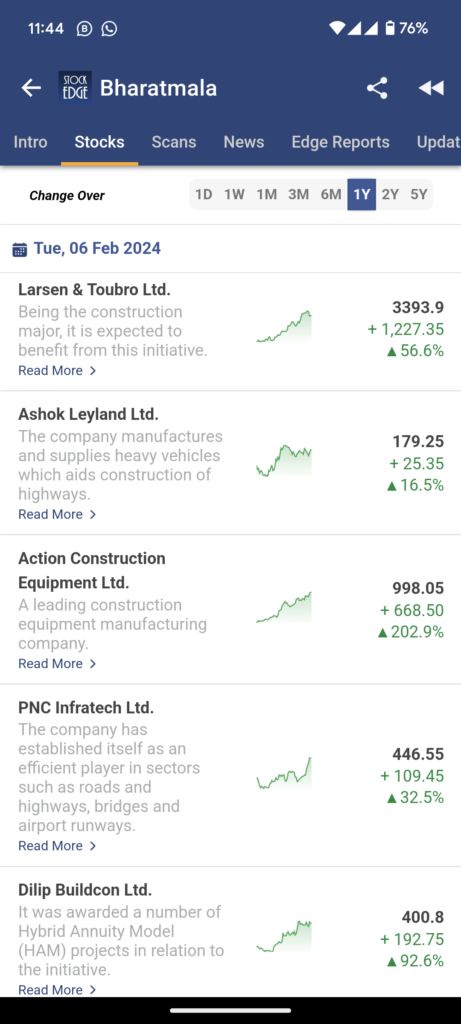

The list of stocks that we have curated for the Bharatmala investment theme are:

Also, you can see how the stocks have performed over the past 1 year.

3. Power & Renewable Energy

The power sector in India is characterized by a mix of sources, including coal, hydroelectric and renewable energy. It’s one of the largest and most diverse in the world, with rapid expansion driven by the country’s growing economy and population. In today’s rapidly changing world, various environmental concerns like global warming have been bombarded with challenges, which is to reduce dependency on fossil fuels. The goal is to meet the demand for power and energy from renewable energy for millions of people in the country.

From where does India generate its electricity?

India generates its electricity from both renewable (such as wind, solar, and biomass) and conventional (such as nuclear, hydro, and thermal) sources. Unfortunately, coal-fired thermal power plants account for the majority of electricity production, producing around 75% of all power generated. The Central Electricity Authority’s data shows that as of December 2020, India generated 103.66 billion units of power overall.

In the Interim budget 2024, the government announced “PM Suryodaya Yojana 2024.” to curb the dependency on burning fossil fuels for generating electricity.

This will help about one crore households to obtain up to 300 units of free electricity every month by installing rooftop solar panels. Hence, the power sector may become one of the best sectors for Lok Sabha Election 2024 which you can invest in.

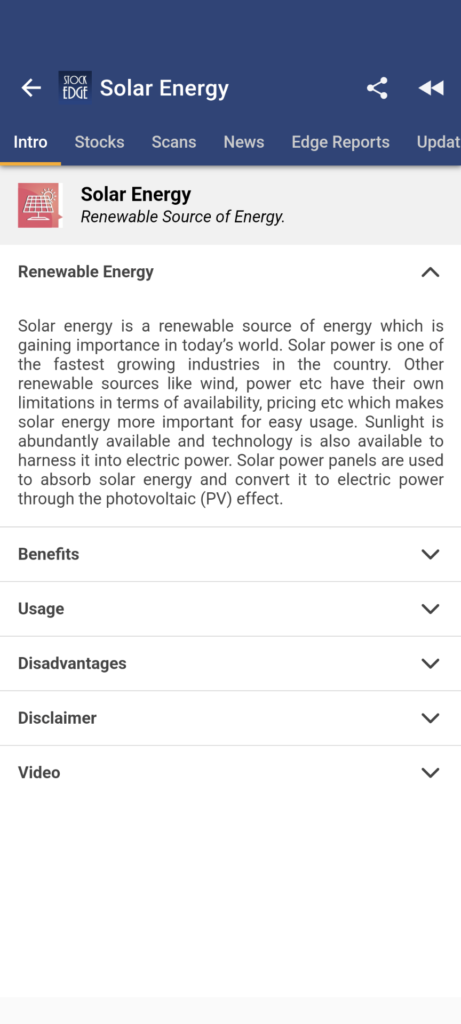

To invest in the renewable energy theme of solar energy, we have developed a theme named “Solar Energy.”

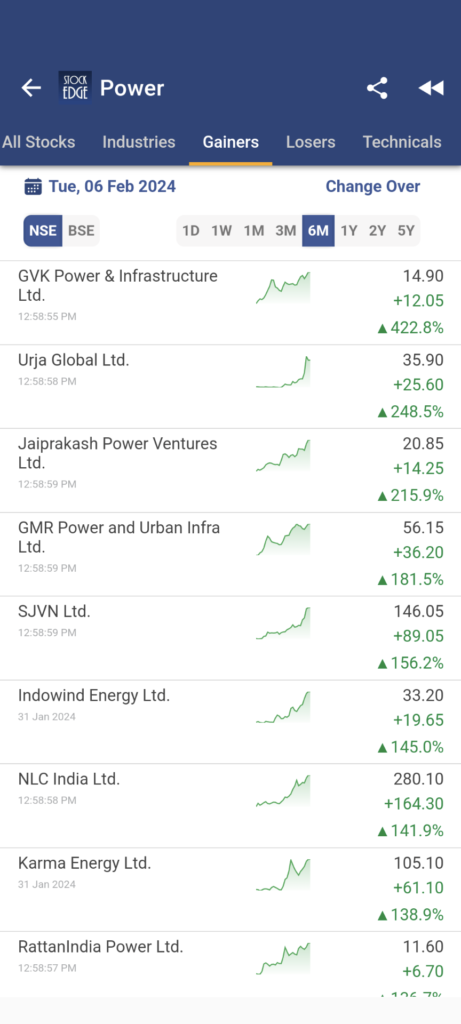

Additionally, you can get the entire list of power stocks from StockEdge. Here are some of the top-performing stocks in the power sector in the past 6 months.

Power sector itself has a huge number of stocks. Out of which one stock seems very promising at current levels is SJVN Ltd. It has been a reputable power producer for 35 years. The company is actively expanding into the renewable energy sector. Its subsidiary, SJVN Green Energy Limited, has made notable progress in this area, launching the Gurhah solar power project in Uttar Pradesh, which will generate 75 MW, and entering into a power purchase agreement for an 18 MW solar power project with Bhakra Beas Management Board.

4. Banking & Financials

Banking and financials is one the core sectors in the market. This can be one of the sectors for Lok Sabha Elections 2024, but why so?

Banking and Finance are considered the backbone of the economy because they provide essential services that facilitate economic activity and growth.

It plays a central role in allocating capital by intermediating between savers and borrowers, enabling investments in businesses, infrastructure, and innovation. Moreover, the availability of credit and financial services supports entrepreneurship, job creation, and consumption, which are crucial drivers of economic expansion. Additionally, a stable and efficient financial system fosters confidence among investors and consumers, underpinning overall economic stability and prosperity.

India’s Current Account Deficit (CAD) has narrowed down to 1% of GDP which makes banking and finance the best sector to invest in, but why so?

A lower CAD suggests that the country is importing fewer goods and services relative to its exports, which can contribute to greater stability in the economy. This stability can reduce uncertainty for banks and financial institutions, making it easier for them to plan and allocate resources.

India’s GDP is more than 3 trillion dollars; ten years ago, it was just 1.9 trillion dollars. Now, we are preparing to become the third-largest economy in the world, with a GDP of $5 trillion in the next three years and a target of $7 trillion by 2030. Therefore, with this growth trajectory, the banking and financial sector must play a vital role; thus, it may turn out to be one of the best sectors for Lok Sabha Election 2024.

Additionally, going forward, if RBI cuts interest rates, it will help reduce the cost of borrowing and also decrease the risk of NPAs for the banks.

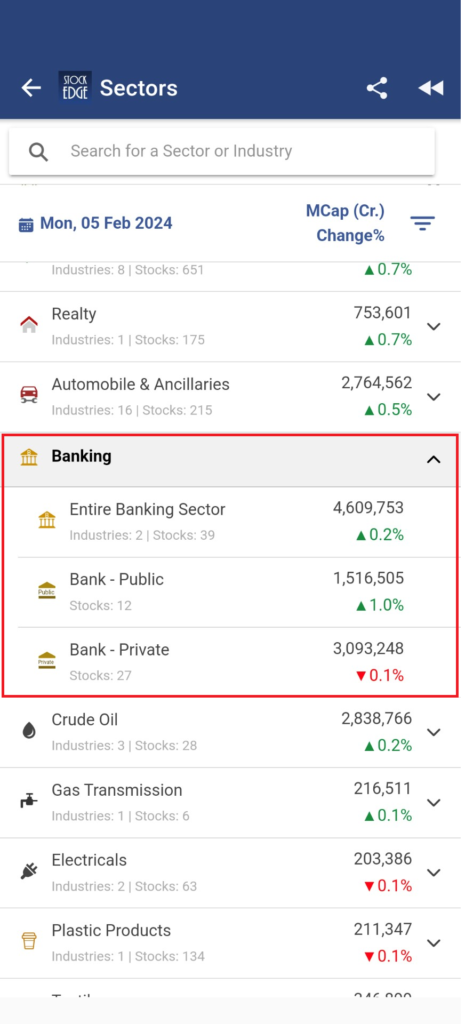

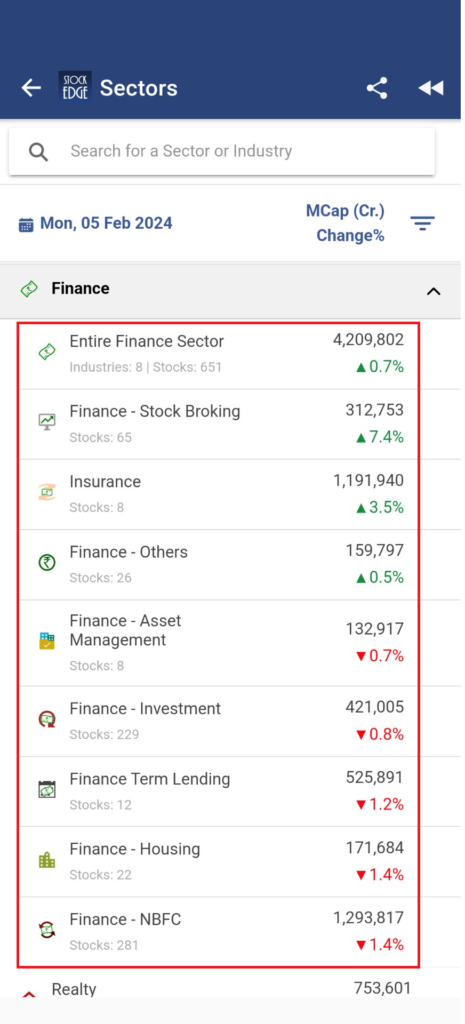

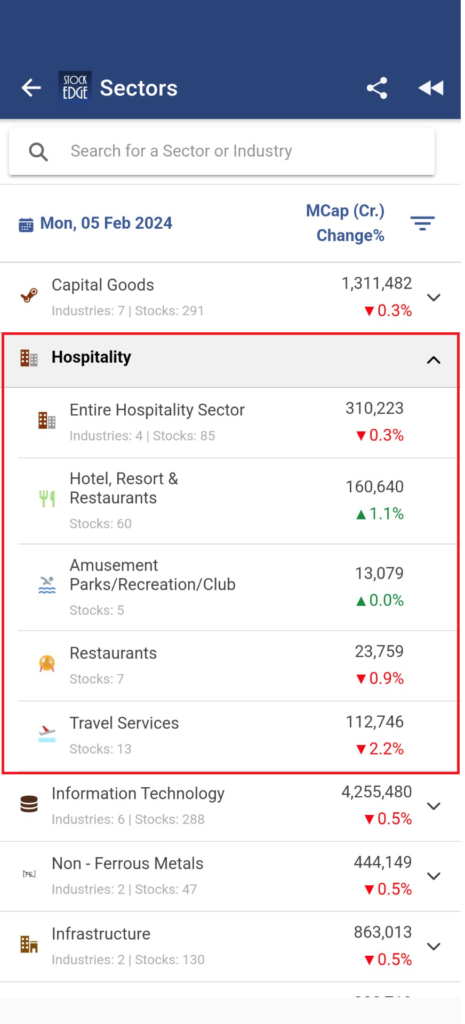

The banking and finance industry is extremely broad. Thus, at StockEdge we have divided into subcategories as well as sub-sectors.

As you can see, banking is divided into private and public whereas finance sectors are divided into sub sectors or industry for ease.

Can PSU Banks continue to remain the star performer?

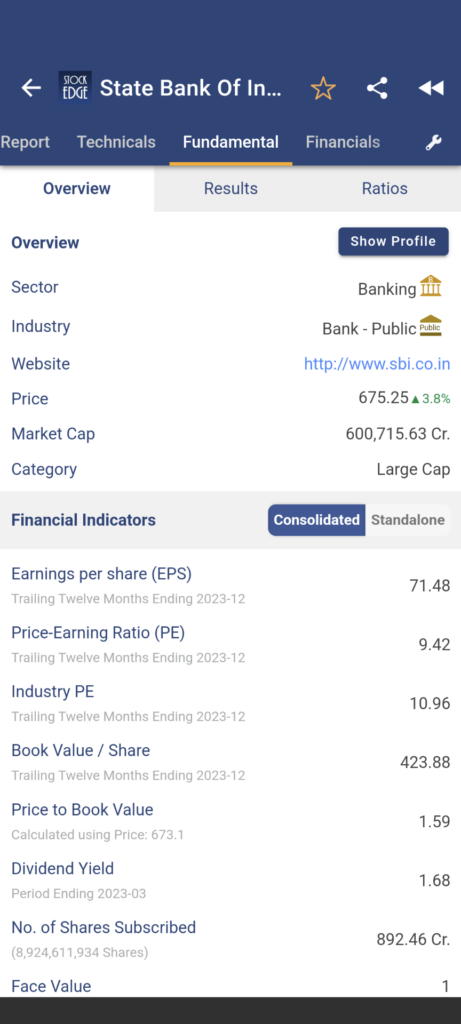

Under the banking sector, PSU Banks are the star performer. The rally may further continue going ahead before the Lok Sabha Election 2024. Out of which State Bank of India can be a good investing opportunity because being a large cap stock, it is still trading at industry PE average. This suggests the stock may create a value proposition at current levels.

Yes, identifying some of the strong stocks from this sector can be challenging due to its vast sub sectors. Therefore, the best way to identify a strong stock with bullish momentum is to track the sector rotation feature in StockEdge.

5. Tourism & Hospitality

Last but not the least is the travel and tourism sector. This particular sector is not just the one of the best sectors for Lok Sabha Election 2024 but also seems promising for the upcoming years.

India is among the top nations in terms of foreign tourism spending because of its diversified geography and ability to offer a range of civilizations, each with its unique experiences. India’s travel and tourism sectors account for a substantial portion of the nation’s GDP, contributing a combined $178 billion.

Tourism: The Incredible India

Now that our Lakshadweep islands have already replaced the internationally neighboring destination Mauritius, Travel, tourism and hospitality can turn out to be the one of the strong sectors for Lok Sabha Election 2024 as well as many years to come.

You can identify the list of stocks under the hospitality sector with StockEdge.

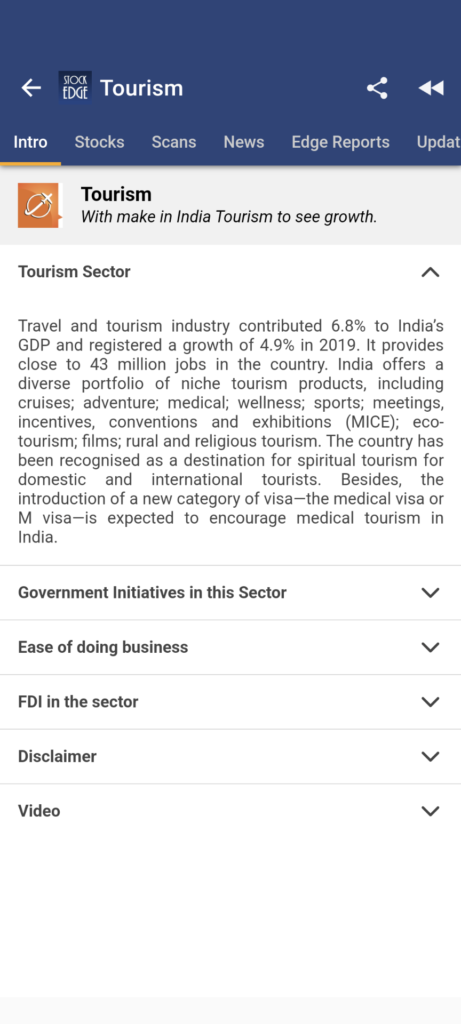

We also have an entire investment theme on Tourism, read the explanation why tourism can be considered as one of the best sectors to invest in.

In terms of travel and tourism, IRCTC Ltd. is at the top of the list because it operates large sectors of Indian Railways’ internet ticketing services. Next is Interglobe Aviation Ltd. (Indigo), India’s low-cost airline; the country’s aviation industry is expected to grow faster. The last nine years have seen a notable expansion of India’s aviation sector. From 74 in 2014 to 148 in 2023, the nation’s total number of airports in operation has doubled.

Conclusion

As we approach the Lok Sabha election of 2024, to maximize returns, you should consider allocating resources strategically across various sectors. The above-mentioned sectors for Lok Sabha Election 2024 offer promising investment opportunities driven by government initiatives, shifting consumer trends, and economic imperatives. Each sector presents unique advantages for long-term growth potential. By diversifying your portfolio across these sectors, you can capitalize on the emerging opportunities of India’s journey towards economic prosperity and development in the years ahead.