Key Takeaways

- Government Support Fuels Ethanol Industry Growth

India aims for 20% ethanol blending with petrol by 2025, achieving 18.2% as of December 2024. The government provides incentives like interest subvention and guaranteed procurement by Oil Marketing Companies (OMCs) to promote ethanol production. - Expanding Market Opportunity

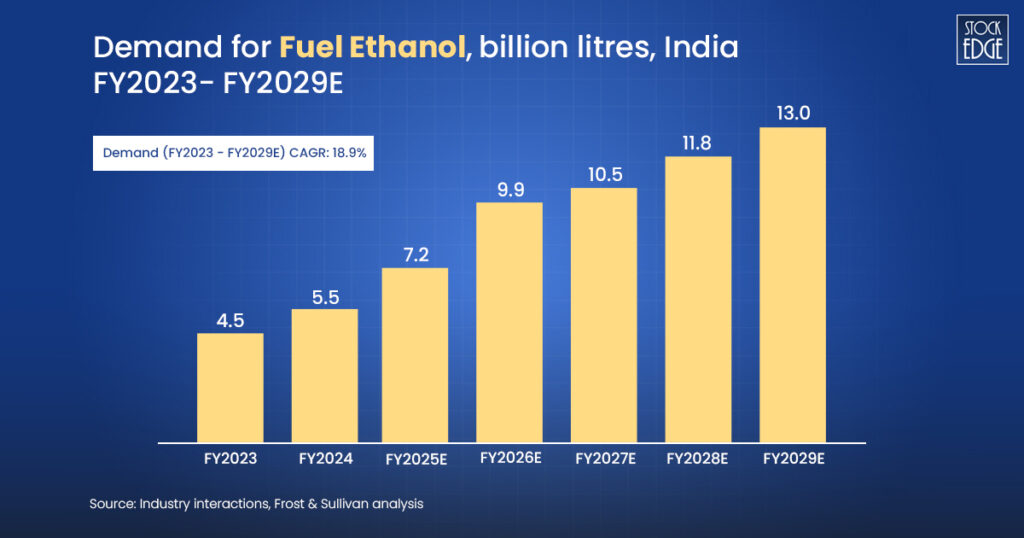

Ethanol demand in India is projected to nearly triple from 4.5 billion litres in 2023 to about 13 billion litres by 2029, driven by the push for cleaner fuel alternatives. - Environmental and Rural Economic Benefits

Ethanol burns cleaner than petrol, reducing emissions of carbon monoxide, hydrocarbons, and nitrogen oxides, aiding India’s fight against pollution and progress toward net-zero emissions. - Top Ethanol Stocks to Watch

- Balrampur Chini Mills Ltd: A leading sugar producer with significant ethanol production capacity, benefiting from integrated operations.

- E.I.D. – Parry (India) Ltd.: A prominent player in sugar and bio-products, with a strong focus on ethanol production and sustainable practices.

Imagine fueling your car with sugarcane! Sounds wild? Welcome to the world of ethanol. With India aggressively pushing towards cleaner fuel alternatives, ethanol has emerged as a game-changer. The government’s Ethanol Blending Program (EBP) aims to achieve 20% ethanol blending with petrol by 2025 – a move that can potentially reduce crude oil imports, support farmers, and lower emissions. This tectonic change is generating significant opportunities for investors eager to capitalize on the green energy movement.

One of the most exciting ways to tap into this transition is by exploring top gainers Ethanol Stocks in India. Companies with strong backward integration into sugar production and forward integration into ethanol distillation are poised to benefit the most.

Let’s explore this investment theme, understand the fundamentals, and identify the Top 2 Ethanol Stocks in India.

Table of Contents

What Are Ethanol Stocks?

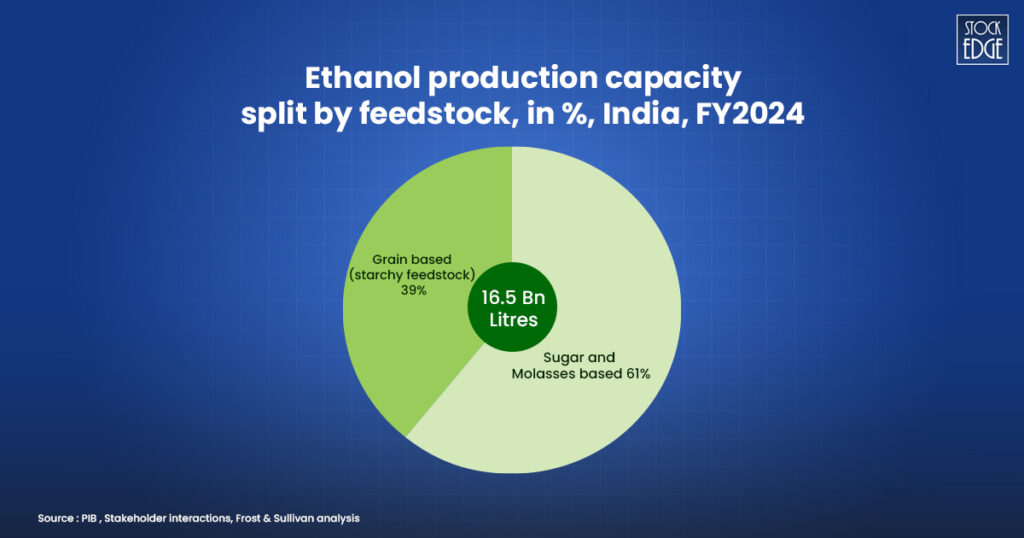

Ethanol stocks refer to shares of companies involved in the production and distribution of ethanol. Ethanol is primarily derived from sugarcane, maize, or biomass and is blended with petrol to create a cleaner-burning fuel. In India, sugar mills and agri-based companies dominate the ethanol production landscape.

These companies benefit from favourable policies, subsidies, and long-term government contracts. As the push for cleaner energy intensifies, these businesses are expected to see rising revenues and profitability.

Why Invest in Ethanol Stocks in India?

Let’s take a look at why you need to invest in ethanol stocks in India.

Government Support

According to the Ministry of Petroleum and Natural Gas, India achieved the highest-ever ethanol blending of 18.2% in petrol in December. In the current Ethanol Supply Year (ESY), ethanol blending reached 16.4% compared to 10.7% in the previous year. Under the Ethanol Blended Petrol (EBP) Programme, the Indian government has mandated a 20% ethanol blending target by 2025, providing several policy incentives, including interest subvention and guaranteed procurement by oil marketing companies (OMCS). This strong government support reassures investors and instills confidence in the investment.

Massive Market Opportunity

The Indian government is leading a significant shift toward cleaner fuel by increasing the amount of ethanol mixed with petrol. The goal is to raise this to 20% by 2025-26. To achieve this, India will need much more ethanol. In fact, the demand is expected to nearly triple from 4.5 billion litres per year in 2023 to about 13 billion litres per year by 2029. This opens a market for ethanol manufacturers.

Environmental Benefits

Ethanol burns cleaner than petrol, cutting harmful emissions like carbon monoxide, hydrocarbons, and NOx gases. This helps India fight pollution, especially in urban centers, and move toward its net-zero emission targets.

Boost to Rural Economy

Most ethanol is produced from agricultural feedstocks like sugarcane, maize, and rice. By creating a steady demand for these crops, the ethanol industry ensures better income for farmers, strengthens rural infrastructure, and reduces wastage of surplus produce.

All these factors make ethanol stocks in India a compelling theme for long-term investors.

Best Ethanol Stocks in India

Let’s dive into two top-listed players driving the ethanol revolution. These companies are selected based on market presence, production capacity, and forward-looking investment plans.

Balrampur Chini Mills Ltd

Balrampur Chini Mills Limited (BCML) is one of the largest integrated sugar companies in India. It has allied businesses that include the manufacturing of downstream products such as ethanol, power (co-generation), alcohol, molasses, and bagasse. Its products include sugar, molasses, alcohol, ethanol, bagasse and power. It sells its products within India and exports as per the government quota allocation. The company has identified sugar and distillery as its distinctive operating segments.

Why It Stands Out:

It’s their dominant position in the market and their sheer operational scale, boasting 10 integrated units, a massive crushing capacity, and significant distillery and power generation capabilities. But it’s more than just size; it’s their strategic focus. They are aggressively leaning into ethanol, seeing it as the key revenue driver for the long haul, potentially contributing around 35% of total revenue in the future. They’re even producing ethanol from grain to add flexibility.

Adding another exciting layer, they are making a bold move into Poly Lactic Acid (PLA), a type of bioplastic. This isn’t a small step; it’s a major diversification project involving an investment of about ₹2,850 crore. They have inked an agreement with three renowned technological experts, Sulzer AG, Alpine Engineering GmbH, and Jacobs, for technological support. The PLA project is progressing as anticipated, and the company has invested approximately ₹685 crore till December 2024. The unit is expected to be operational by H2 FY27. To know more in detail, read our Edge Report.

E.I.D. – Parry (India) Ltd.

EID Parry is engaged in Sugar, Nutraceuticals and ethanol production. It also has a significant presence in the Farm Inputs business, including biopesticides through its subsidiary, Coromandel International Limited.

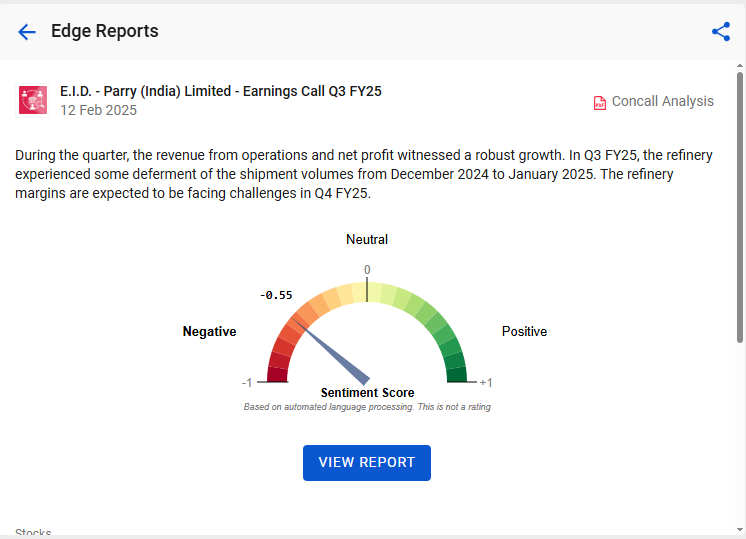

In Q3 FY25, revenue decreased to ₹1,298 crore from ₹2,035 crore in Q3 FY24, impacted by a lower release quota. The EBIT loss for the quarter was ₹51 crore, compared to an EBIT loss of ₹3 crore in Q3 FY24, due to lower cane volume, reduced recovery, and higher cane costs. The selling price remained under pressure. This quarter was not good, and one may look for better financial performance.

Why It Stands Out:

The Company has six sugar factories with a capacity to crush 40,800 TCD, generate 140 MW of power and five distilleries having a capacity of 582 KLPD. In the Power and Distillery segments, the Company has been making significant advancements, augmenting distillery capacities across the plants and maximizing the Ethanol volumes to capitalize on the EBP opportunity. The company also has a significant presence in the Farm Inputs business through its subsidiary Coromandel International Limited. E.I.D. Parry has a 100% stake in Parry Sugars Refinery India Private Limited and US Nutraceuticals Inc, USA.

Management is focused on improving operational efficiencies and enhancing recovery rates through better agricultural practices and varietal improvements. Future capital allocation is expected to prioritize consumer products and ethanol blending, contingent on a sustainable policy framework. To know more in detail, read our Edge Report.

Bottom Line

India’s ethanol story is no longer just a policy dream – it’s an unfolding reality. Ethanol Stocks in India are a smart bet for investors focused on sustainability, energy independence, and the promise of long-term returns. Companies with integrated supply chains, expansion plans, and advanced technologies are best positioned to benefit from the ethanol boom, offering a hopeful outlook for the future.

The diversion of domestic ethanol is estimated to be 3.75 million metric tons (MMT), while sugar consumption is projected to reach 28 million tons. The government has been granted export permissions for approximately 1 million tons of sugar. The ethanol blending initiative under the Ethanol Blended Programme (EBP) has successfully achieved a blending percentage of approximately 14.6%.

If you’re looking to add a high-potential theme to your portfolio, Ethanol Stocks in India deserve a serious look. Explore the trending stocks of ethanol industries and keep track of their performance on the Ethanol Investment Theme by StockEdge. To know how to use this investment theme feature, read our blog Powerful Investment Themes for Retail Investors.

Frequent Asked Questions (FAQ)

Is ethanol a good stock to buy?

Ethanol stocks can be a good buy due to the increase in demand for fossil fuels. However, factors like crop prices, regulations, and oil market trends impact returns. Always research the growth potential and the challenges before investing.

What is the future of ethanol stocks?

Ethanol stocks in India have strong growth potential, driven by government support, rising biofuel demand, and energy security goals.

Can I invest in ethanol stocks?

Invest in ethanol stocks with growing focus on clean energy and government support for biofuels. However, it’s important to consider factors like raw material availability, policy changes, and market demand. Do your research or consult a financial advisor before making any investment decisions.