Table of Contents

TATA means Trust!

Tata Consumer Products Ltd. is one of the leading companies of the Tata Group, engaged in the food and beverages business in India as well as internationally. Globally, it is the second largest tea company globally, with significant leadership in many markets.

In India, It was formed after a demerger of the consumer products business from Tata Chemicals Limited into Tata Global Beverages Limited, w.e.f 7th February 2020. It is into a 50:50 joint venture with Starbucks, which owns and operates Starbucks Outlets in India. Along with India it has presence in Canada, UK, North America, Australia, Europe, Middle East and Africa.

In today’s blog, we take a closer look at the growth opportunities and study tata consumer products share price to understand whether it is a good investment or not?

Company Overview

Tata Consumer Products (TCPL) is a specialized company in the consumer goods sector, consolidating the key food and beverage businesses of the Tata Group. Its range of products encompasses tea, coffee, water, salt, pulses, spices, and ready-to-eat items. Renowned as the second-largest branded tea company globally, Tata Consumer Products sees widespread daily consumption of its beverage brands worldwide.

Additionally, it is a part of Nifty 50, which is the India’s benchmark index. To know more about Nifty 50 stock read; All About NIFTY50, Components of NIFTY50, and How to Invest in it

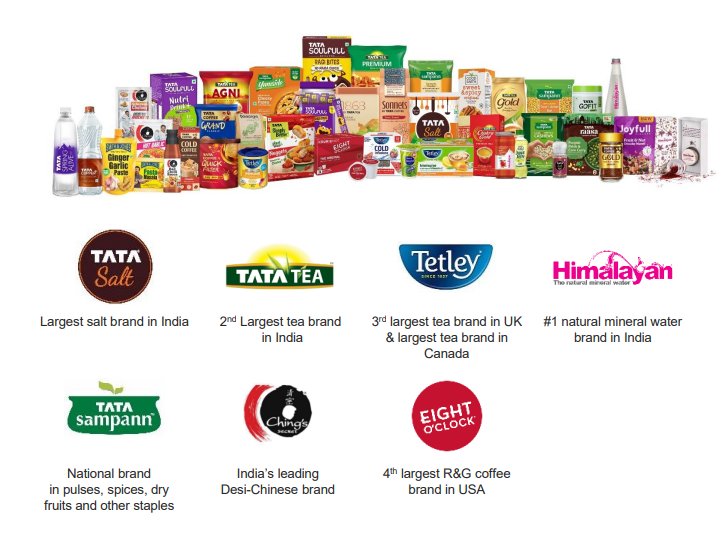

In a nutshell, here are the popular brands under TATA Consumer Products Ltd.

The company is a focused consumer products company uniting the food and beverage interests of the Tata Group under one umbrella.

The type of products includes:

- Tea

- Coffee

- Water

- Salt

- Pulses

- Spices

- Ready-to-eat offerings

As of FY23, revenue contribution by the branded businesses stood at 89%, and the rest of the 11% was contributed by the non-branded businesses. Under the branded category, the revenue mix was India business-71% and international business-29%.

Financial highlights of TATA Consumer Products Ltd.

The company’s revenue has grown at 15% CAGR, and its Net Profit has grown at 19% CAGR in the last 5 years. Past 3 years have been great for the company as it has not only seen substantial rise in topline but also the bottom line showed immense growth with improved margins. You can get the revenue growth or net sales growth from the income statement of TATA Consumer Products Ltd. Additionally, with StockEdge you can easily analyze the data YoY or QoQ along with visual charts for more simplicity.

During FY23, the company reported 11% YoY growth in Revenue. Overall margins remained strong except for the International branded business. However, profitability improved for the segment towards the end of the year.

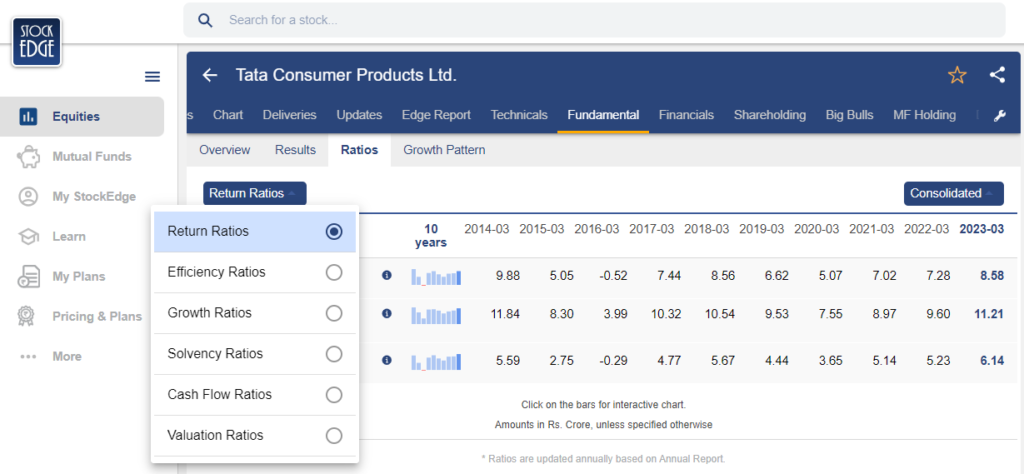

The return ratios have been stagnant at the same levels since last 2 years. You can do a complete ratio analysis on Tata Consumer Products shares directly from StockEdge.

During Q2 FY24, the company reported revenue of ₹3,733.8 crore, marking an 11% increase YoY. The net profit also showed a modest rise of 1.2%, reaching ₹359.2 crore. The growth was primarily driven by an 11% YoY expansion in the company’s India business, 8% in the international sector, and 3% in the non-branded segment. New product launches across various categories contributed to an increased total addressable market. EBITDA margins improved by 220 basis points YoY, attributed to pricing interventions, favorable commodity prices, and effective operational management. The quarter saw an exceptional item of ₹15 crore related to business restructuring.

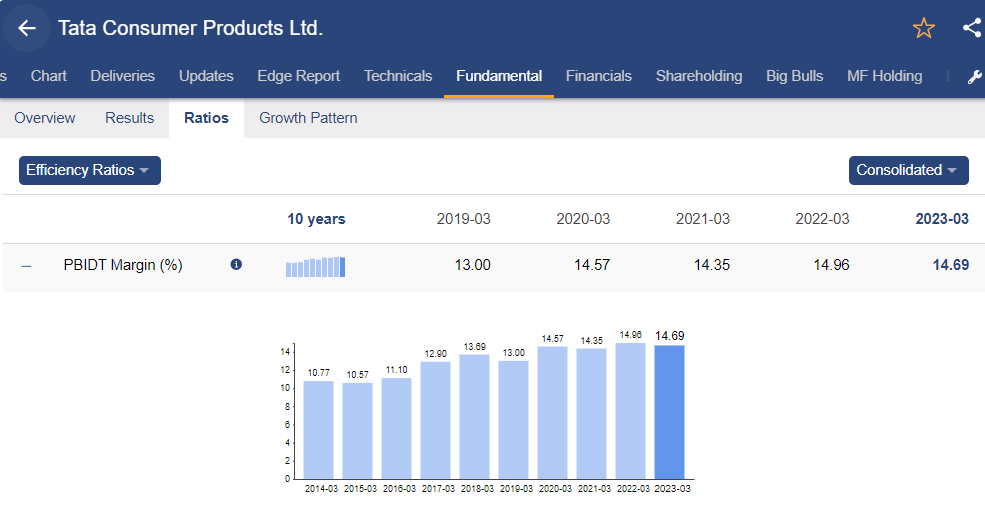

Surprising, in Q3 FY24 EBITDA margin in international business expanded by 130 bps YoY to 12.7%, mainly driven by softening of input costs. You can check the overall EBITDA margins of TATA Consumer Products share under the efficiency ratios.

The company witnessed strong performance of alternate channels, with a 13% increase in modern trade and a 33% surge in e-commerce during H1 FY24. In India, the packaged beverages segment witnessed a 5% YoY revenue growth, with premium brands outperforming popular and economy brands. The India foods business recorded a 16% revenue growth and 6% volume growth YoY in Q2 FY24, with a focus on value-added salt and the Tata Sampann portfolio. The Nourish Co category showed a 25% YoY revenue growth, with Tata Gluco+ expanding its geographic footprint.

Internationally, the United Kingdom (UK) segment reported a 13% YoY revenue growth, fueled by the launch of a millet-based muesli range and a successful Tetley tea revamp. In the United States, the revenue from the coffee business declined by 10% YoY, while Tetley outpaced category growth in the tea segment. Canada saw an 8% YoY revenue increase, driven by price increases, and Tetley outperformed in both regular and speciality tea categories.

The latest Q3 FY24 updates, reveal that revenue from operations increased moderately 9% YoY, whereas EBITDA jumped 25%. However, this quarter the net profit declined by 14.6% YoY due to some exceptional items in 9M FY24, which the company incurred related to UK pension matters. Additionally, the share of profit from joint ventures and associates was impacted by higher losses in the Starbucks business due to expansion and accounting standards.

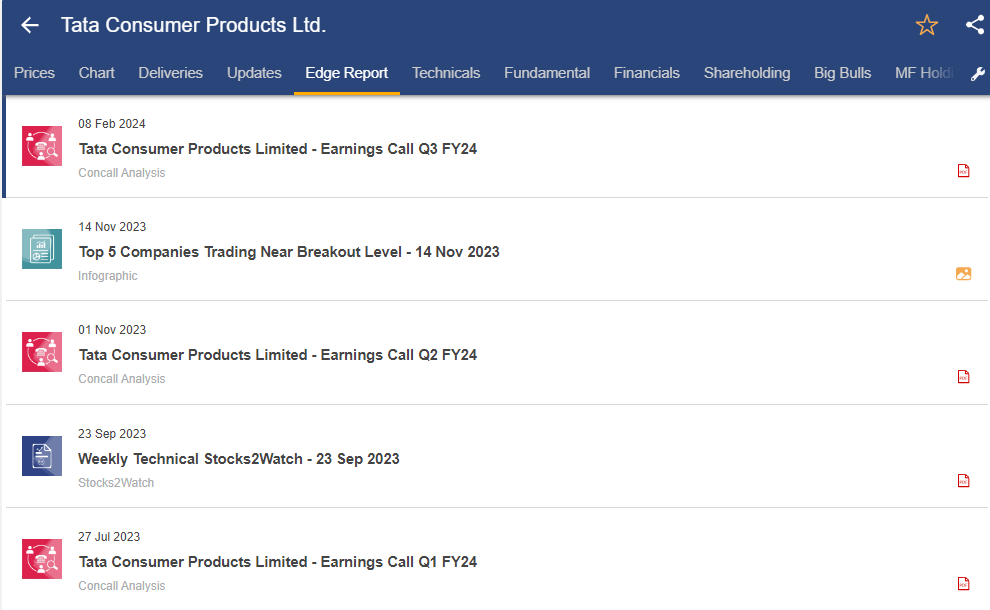

Get latest financial updates of Q3 FY24 from the concall analysis on TATA Consumer Products share. You can access the earning calls every quarter from the edge reports section of StockEdge.

SWOT Analysis of TATA Consumer Products Ltd.

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses,

opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strengths

The company enjoys leadership positions in its key brands. Tata Salt, Tata Tea, Tata Coffee, Tetley, etc, are leading in terms of market share. During the recent quarter, the company has gained market share in tea and holds leadership positions in the e-commerce and premium segment.

Tata Sampann brand continues to gain traction and is looking to further strengthen its presence by entering a new category with the pilot launch of its dry fruits range premium cashews, almonds, pistachios and raisins. New product launches included Tetley Premium black leaf tea, Tata Coffee quick filter range of decoction, and additions to the health & wellness beverages portfolio.

It continues to drive innovation through launches and re-launches of new products. It is also investing in its own brands that are expected to improve its operating profitability in the future. Its joint venture with Starbucks is also going well. It is continuously expanding into new cities and adding new stores.

Weakness

In FY22, international business growth got impacted on the back of an elevated base driven by increased home consumption of tea and coffee last year. The performance of its overseas entities continues to be impacted by declining demand trends in the black tea segment and intense competition in the developed market over the last few years. India packaged beverages Revenue declined and market share also fell slightly.

Opportunities

The parent has acquired 100% ready-to-eat packaged food products under the brand ‘Tata Q’ in its portfolio and a manufacturing facility for expansion in food products. As per the management, these acquisition will help the company to expand its product portfolio enabling them to enter the Ready to Eat segment. The category is expected to grow at a significant pace in India and presents a sizable opportunity in overseas markets.

The company announced that it would be merging all the Tata Coffee businesses with itself; however, the plantation business of Tata Coffee Ltd will be demerged into TCPL’s wholly-owned business segments, TCPL Beverages & Foods Ltd.

Additionally, it has also offered to buy a minority interest in its UK subsidiary, Tata Consumer Products UK Ltd., by share-swap through a preferential issue of its equity shares.

The company has revealed its venture into the plant-based meat products sector, introducing a new brand called Tata Simply Better. This move expands the company’s product range into a fresh category aimed at consumers seeking to integrate more plant-based components into their diets for reasons such as health, environmental consciousness, or other factors while still prioritizing taste.

Threats

The continued inflationary trend in commodity prices and other inputs is likely to have a bearing on the overall margin of the company.

The Bottom Line

Tata Consumer Products has showcased a strong performance in various segments, setting a positive outlook for the future. In the Indian market, the company witnessed impressive revenue growth, driven by packaged beverages and food businesses. Though there were some market share losses in the tea category, Tata Sampann and Tata Soulfull’s strong growth, along with the robust performance of dry fruits and masala oats, indicate promising potential in the staples and health-focused segments. Furthermore, Nourishco’s exceptional revenue growth and expansion of Tata Gluco+ and Tata Copper+ products bode well for the company’s diversification strategy.

The international business, especially in the UK, exhibited signs of progress, with reorganization efforts showing early benefits and each brand gaining substantial market share. In contrast, the US and Canada faced challenges in the coffee and speciality tea segments. However, efforts to outpace category growth and maintain competitive market shares provide hope for future improvements.

Looking ahead, Tata Consumer Products aims to continue its growth trajectory through increased distribution, expansion of outlets, and leveraging synergies from the proposed merger with Tata Coffee Limited. Management’s focus on volume growth, coupled with improved price mix, is expected to drive positive results. By maintaining its innovation agenda, tapping into alternate channels, and capitalizing on market opportunities, the company is positioned to achieve steady growth in FY24.

To know about other businesses under TATA group, you can read Tata Group: Leadership with Trust

Happy Investing!