Table of Contents

Greetings, fellow investors and financial enthusiasts! We are thrilled to announce the arrival of StockEdge’s game-changing update that is set to elevate your stock market experience to unprecedented heights. Introducing StockEdge Version 11.3, the latest milestone in our relentless pursuit of providing cutting-edge tools and insights to empower your investment decisions.

In this dynamic world of finance, staying ahead of the curve is paramount. With StockEdge 11.3, we have not only refined our existing features but also added a plethora of new tools designed to cater to the diverse needs of investors, from novices to seasoned professionals.

StockEdge, the leading stock market analysis and research platform, with its newest version – 11.3, comes with powerful features that are designed to strengthen your investment decisions and help you make more informed choices in the stock market.

StockEdge has been a trusted companion for investors, both beginners and seasoned professionals alike, providing valuable insights, comprehensive market data, and intuitive tools to make informed decisions.

With over 5 million downloads and a user base of 600,000 active traders and investors, StockEdge has become one of the most trusted and reliable sources for stock market data and analysis. The new version aims to further enhance the user experience by introducing advanced tools and features that cater to the evolving needs of investors.

In this blog post, we will delve into the exciting new features and upgrades that StockEdge Version 11.3 brings to the table. Let’s explore how this update will empower you to navigate the dynamic world of investing with greater precision, confidence, and profitability.

What’s New in StockEdge 11.3?

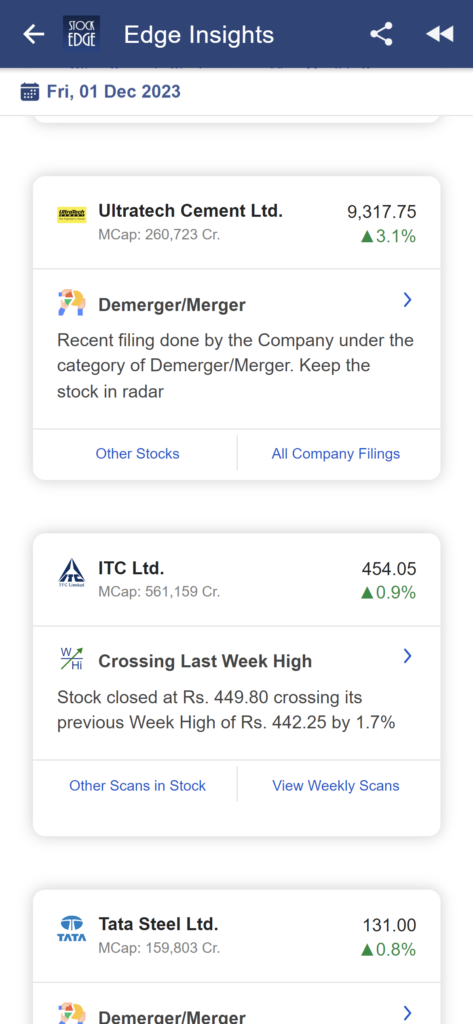

1. Edge Insights:

What is Edge Insights?

At the heart of StockEdge’s latest offering, Edge Insights is your go-to resource for gaining a deep understanding of stock dynamics. Whether you’re a seasoned trader or a novice investor, this feature is tailored to provide a holistic view of key events shaping the market landscape.

Key Features:

Technical Analysis: Delve into intricate technical patterns and indicators to gauge the market sentiment and potential price movements. From moving averages to RSI, Edge Insights offers a comprehensive technical analysis toolkit.

Fundamental Analysis: Uncover the underlying strengths and weaknesses of a stock with in-depth fundamental analysis. From earnings reports to balance sheets, make informed decisions backed by a thorough examination of the company’s financial health.

Price Action Signals: Identify critical price action signals that may indicate trend reversals, breakouts, or potential market movements. Stay ahead of the curve with real-time alerts based on price action analysis.

Company Insights: Get an insider’s view into the companies you are interested in. Understand corporate strategies, recent news, and management insights that could impact stock performance.

So what are you waiting for? Dive into the depths of market trends with our enhanced Edge Insights feature. Uncover real-time analysis, market sentiment, and expert commentary to make informed decisions in the ever-evolving financial landscape.

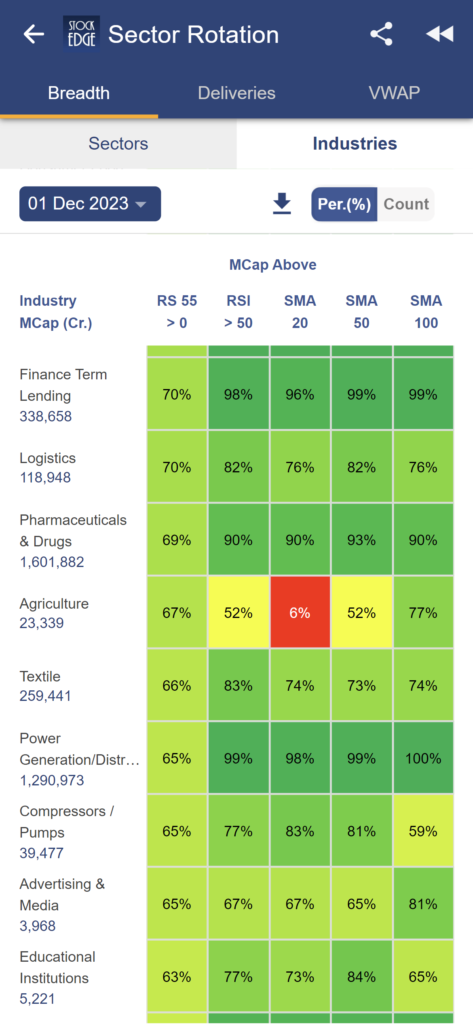

2. Industry Rotation Analysis:

Say hello to “Industry Rotation” – your ultimate guide to identifying industries gaining momentum, understanding capital flows, and pinpointing high-performing stocks within each industry.

What is Industry Rotation?

At the core of StockEdge’s latest innovation, Industry Rotation is a sophisticated tool designed to provide you with a dynamic perspective on market trends. This feature empowers you to strategically allocate your investments by staying ahead of the curve on sector-specific movements.

Key Features:

Identifying Momentum: Industry Rotation helps you identify sectors gaining momentum and those experiencing a slowdown. Spot trends early and position your portfolio for maximum returns.

Capital Flow Analysis: Gain insights into the flow of money across various industries. Understand where institutional and retail investors are directing their capital, guiding you to potential opportunities.

High-Performing Stocks: Pinpoint stocks that are in demand within their respective industries. Leverage this information to focus on securities with strong potential for growth.

Why Industry Rotation?

Strategic Allocation: Make informed decisions on sector allocation based on real-time data, ensuring your portfolio is strategically positioned for prevailing market trends.

Risk Mitigation: Diversify with confidence. Industry Rotation aids in risk mitigation by allowing you to spread investments across sectors, reducing vulnerability to downturns in any single industry.

Performance Optimization: Maximize your returns by focusing on high-performing stocks within industries exhibiting positive momentum. Uncover hidden gems and capitalize on emerging opportunities.

So let’s get started and Navigate through industries with precision using our Industry Rotation Analysis tool. Identify industries and stocks that are ripe for investment and strategically position your portfolio for maximum returns.

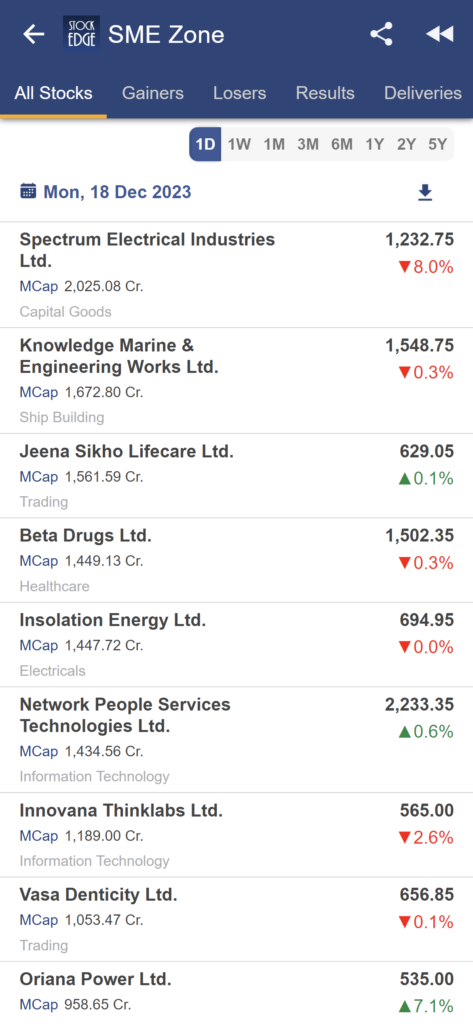

3. SME Zone:

For those with a keen eye on small and medium enterprises, our SME Zone offers specialized insights, research, and data to help you discover hidden gems in this segment of the market.

What is the SME Zone?

SME Zone is a dedicated space designed to empower you with unique insights into the SME landscape. This feature is tailored to help you navigate through the momentum shifts, technical and fundamental indicators, and key developments that influence the performance of small and medium-sized enterprises.

Key Features:

Momentum Gainers and Losers: Identify SMEs gaining momentum and those experiencing shifts in their trajectory. Stay ahead of market movements and make timely decisions.

Technical Insights: Leverage detailed technical analysis tailored for SMEs. Uncover intricate patterns, trends, and indicators to guide your investment decisions in this dynamic sector.

Fundamental Analysis: Gain a deep understanding of the fundamentals driving SMEs. Assess financial health, growth potential, and risk factors to make informed investment choices.

Key Announcements and News: Stay informed with real-time updates on key announcements, news, and events impacting SMEs. From product launches to regulatory changes, we’ve got you covered.

Join us on this exciting journey as we unveil StockEdge Version 11.3. Your success in the world of finance is our ultimate goal, and StockEdge is here to empower you every step of the way.

If you enjoy using StockEdge, don’t hold back from sharing the platform with your near and dear ones.

Check out StockEdge’s Premium Plans to get the most out of it. Also, watch this space for our midweek and weekend editions of ‘Stock Insights‘.

Happy Investing and Trading with StockEdge Version 11.3!

-The StockEdge Team