Key Takeaways

- Curated Portfolios: StockEdge Investment Cases are carefully designed baskets of stocks and ETFs built around specific investment ideas or themes.

- Diverse Strategies: Options range from Mother Stocks for stability, Momentum Portfolios for growth, to Dynamic Allocation blending equities, gold, and LiquidBees.

- Data-Driven Approach: Backed by over 10 years of research and 20+ years of market expertise, ensuring systematic, emotion-free investing.

- All Investors: Suitable for beginners, busy professionals, and seasoned investors looking for structured, disciplined investment options.

- Easy Access: Available on the StockEdge app and web portal, making portfolio investing simple and convenient for everyday investors.

For most investors, the biggest challenge is not deciding what to buy but figuring out how to stay invested with discipline. Markets move every day, news flows are noisy, and emotions often take over. Many investors end up buying and selling too often and miss out on the long-term benefits of compounding.

This is where Investment Cases come in and why StockEdge is excited to launch its very own set of StockEdge Smallcases. These are not just random collections of stocks, but curated, model-driven portfolios designed to simplify investing.

What are Investment Cases?

An Investment Case is a basket of stocks or ETFs built around a particular investment idea or theme. Instead of buying a single stock, you’re investing in a portfolio that follows a clear thesis.

For example:

- A Smallcase on “Momentum Leaders” would include the top-performing stocks based on momentum indicators.

- A “Mother Stocks” Smallcase might include large, stable companies designed for long-term capital preservation.

Each Investment Case is:

- Curated – carefully selected using research, data, and rules.

- Transparent – you can see all the holdings before investing.

- Dynamic – portfolios are rebalanced monthly to stay aligned with the thesis.

This means you don’t need to keep checking charts or news every day. You invest in the idea, and the system keeps it updated for you.

Why Investment Cases Matter Today

Over the years, investors have realized that discipline matters more than tips. It’s not about chasing the latest hot stock; it’s about having a process.

StockEdge has been researching momentum investing for over a decade, and the team has more than 20 years of market experience. One insight stands out:

A systematic, rules-based approach beats emotion-driven trading over time.

Smallcases make this possible for everyday investors. Instead of getting lost in noise, you can simply choose a Smallcase that fits your style, whether it’s steady preservation of wealth or higher alpha through momentum plays.

StockEdge Investment Cases

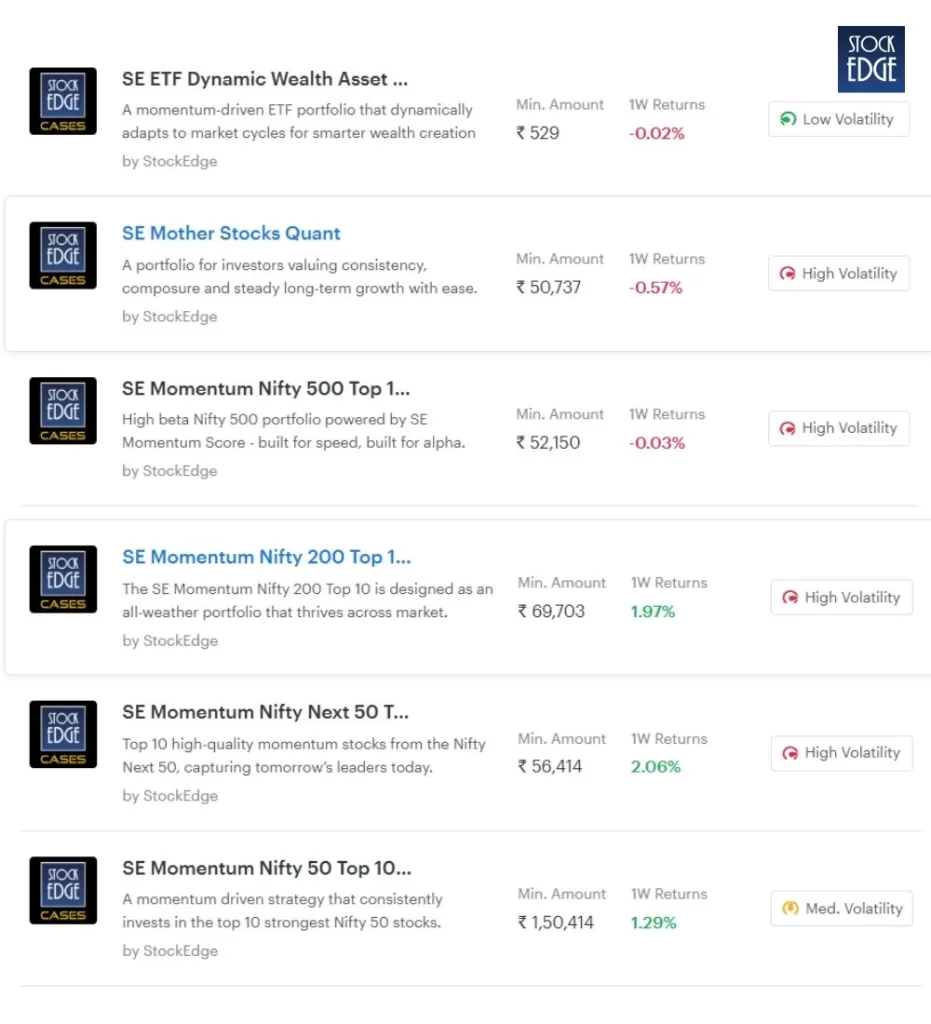

To start with, StockEdge is introducing a set of focused Smallcases built on momentum research, and disciplined execution.

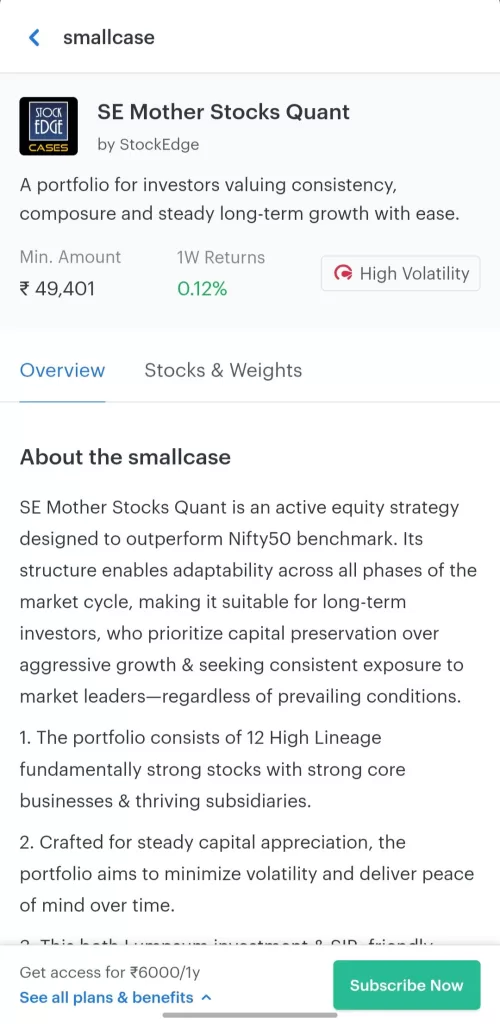

1. StockEdge Mother Stocks

A portfolio of 12 high-quality, weighted stocks designed for long-term investors who want stability, low volatility, and steady capital growth.

Our methodology focuses on carefully selecting 12 fundamentally strong, high conviction “Mother Stocks” with strong core businesses and thriving subsidiaries, ensuring competitive edge over traditional benchmarks like the Nifty 50 and most mutual funds.

StockEdge’s Mother Stocks Smallcase is more than a portfolio, it’s a disciplined investment philosophy. Our research team has conducted meticulous stock selection by analysing company reports and financial statements. Each stock is evaluated against a comprehensive set of qualitative and quantitative parameters, carefully chosen to align with the specific objectives of the strategy.

This smallcase has a monthly rebalance schedule. Once every month, the research team reviews this smallcase and realign the weights with the selected asset allocation strategy for the next month

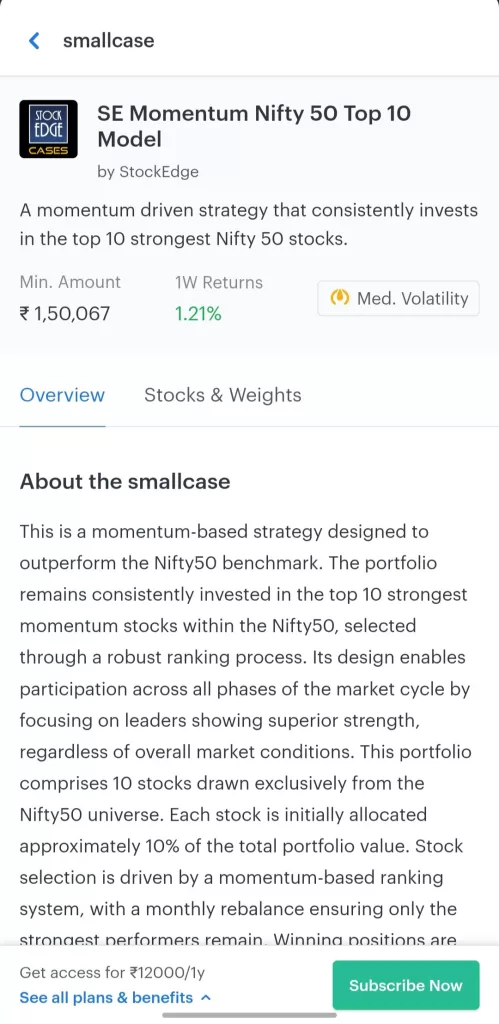

2. SE Momentum Nifty50 Top 10

Equal-weighted portfolio of 10 momentum leaders from the Nifty50, rebalanced monthly. Ideal for those seeking exposure to large-cap momentum stocks.

Forget human guesswork. Our approach is 100% rules-based and research-driven. Using proprietary quantitative algorithms, back-tested over many years of market data, we isolate signals of strength and momentum.

From the 50 contenders, we screen and shortlist the Top 10 winners based on their momentum strength. Winners are allowed to run longer. Underperformers are quickly replaced. This creates a dynamic, adaptive portfolio that thrives across bull, bear, and sideways markets.

Each stock is equally weighted at ~10%, ensuring: Diversification without dilution, No overdependence on one stock, Optimized risk-reward profile.

This smallcase has a monthly rebalance schedule. Once every month, the research team reviews this smallcase and realign the weights with the selected asset allocation strategy for the next month

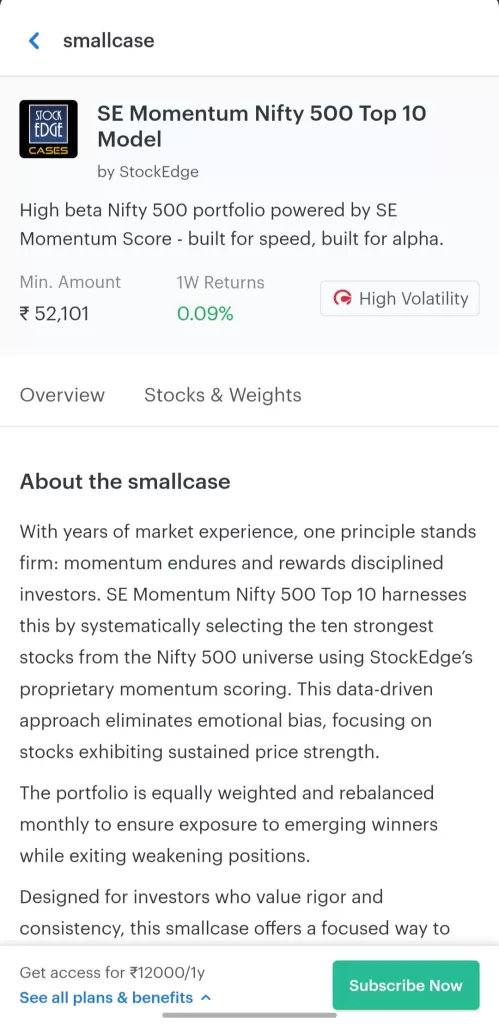

3. SE Momentum Nifty500 Top 10

Expands the universe to include the top-ranked momentum stocks from the Nifty500. Suitable for investors seeking higher growth potential.

Rule-based momentum screening applies a systematic set of criteria to identify stocks with strong upward trends. It removes emotional bias by relying on objective, data-driven signals.This approach ensures consistency and helps uncover high-potential stocks within the Nifty 500 universe.

Fixed 10% equal weight for each component. This smallcase has a monthly rebalance schedule. Once every month, the research team reviews this smallcase and realign the weights with the selected asset allocation strategy for the next month

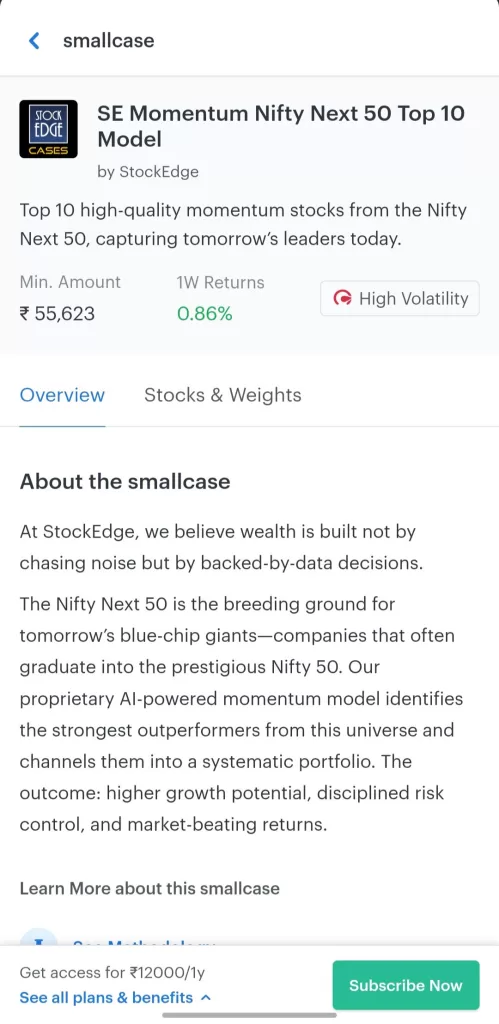

4. SE Momentum Nifty Next 50 Top 10

Targets the future blue-chip companies in the Next 50 that are showing strong momentum and could become tomorrow’s market leaders.

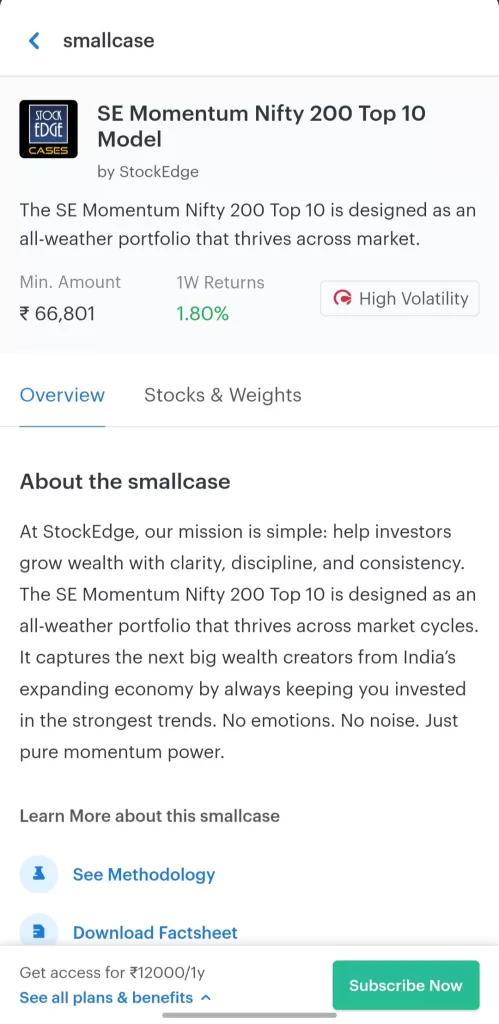

5. SE Momentum Nifty200 Top 10

Diversified momentum exposure across the Nifty200. Balanced yet powerful for investors looking for systematic outperformance.

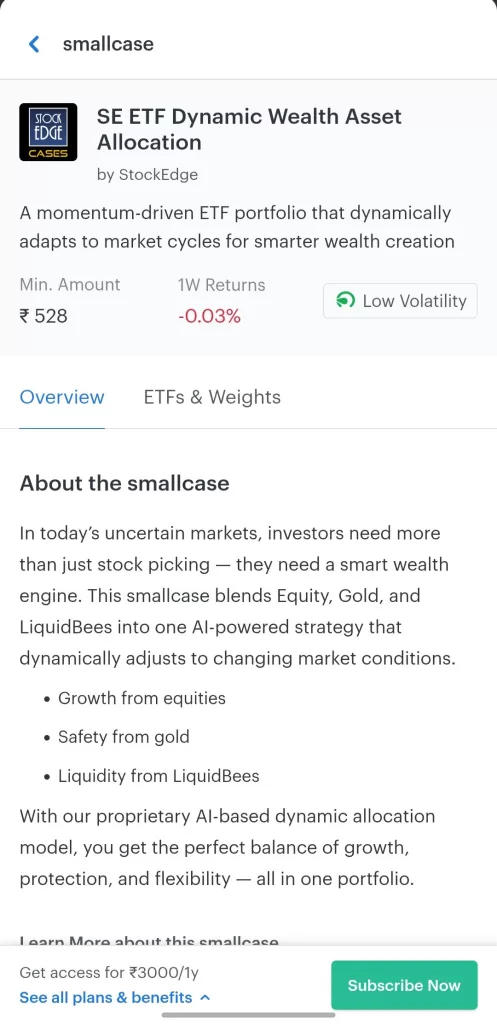

6. SE Dynamic Allocation Smallcase

A unique blend of equities, Gold, and LiquidBees, adjusts allocations dynamically to balance growth with risk management.

Who Should Consider Investment Cases?

Smallcases are not meant for just one type of investor. In fact, they fit well for different needs:

- Busy professionals who want meaningful equity exposure without doing daily research.

- Investors who struggle with emotions and want a process-driven approach.

- Beginners who want to learn by following structured ideas.

- Seasoned investors looking to complement their existing portfolios with rule-based strategies.

The StockEdge Difference

There are many Smallcases available in the market, but here’s what sets StockEdge Smallcases apart:

- Data-first momentum research – built on 10+ years of backtesting and real market performance.

- Experienced team – 20+ years of market expertise in trading and investing.

- Rules over emotions – execution is systematic; no manager discretion, just a repeatable process.

- Transparency – you see holdings, rebalancing schedules, and benchmark comparisons upfront.

- Ease of access – available on the StockEdge app and web portal.

In other words, it’s like having a portfolio manager inside the StockEdge app, one that runs purely on research and rules.

Why This Matters for Investors

Markets can seem unpredictable, but disciplined strategies have consistently proven their worth over time. By combining momentum signals and systematic execution, StockEdge Smallcases aims to give investors a clear, simplified, and structured way to build wealth.

Instead of reacting to daily headlines, you can let data and process work for you. And that is what long-term investing is really about.

Bottomline

Investing is not about chasing the next hot stock; it’s about owning a clear idea and staying disciplined. StockEdge Smallcases offer a way to do exactly that.

Whether you’re just starting your journey or looking to bring more structure to your portfolio, Smallcases can make investing both simpler and smarter.