Table of Contents

The Indian Aviation Industry is one of the fastest-growing civil aviation markets in the world, according to the International Air Transport Association (IATA). India is currently the 3rd largest civil aviation market in the world. Despite the current position of the Indian Aviation industry, we have come a long way. Did you know when the first commercial flight in India took off? It was on 18 February 1911, and in December 1912, the first international flight was introduced from London to Delhi.

Although it started early, the Indian aviation industry has only started to take off in recent years. Earlier, traveling by airplane was considered a luxury, and only the elite class of the country could afford it. However, things have changed over the years. An increasing number of middle-class households, strong competition among low-cost carriers, infrastructure development at top airports, and a supportive regulatory environment have all contributed to the growth of the Indian aviation industry.

Aviation Sector Overview

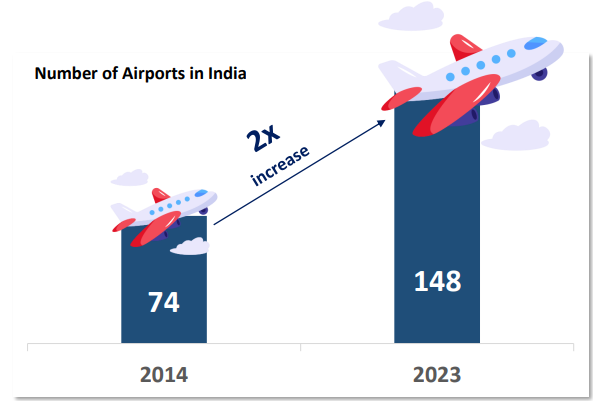

Being the 3rd largest aviation market in the world, it is rapidly growing in terms of infrastructure. The number of airports has surged from 74 in 2014 to 148 in 2023. The government aims to further increase this to 220 by 2024-25. The growth in infrastructure development to build airports is significant for the overall aviation industry as it would lead to increased air connectivity.

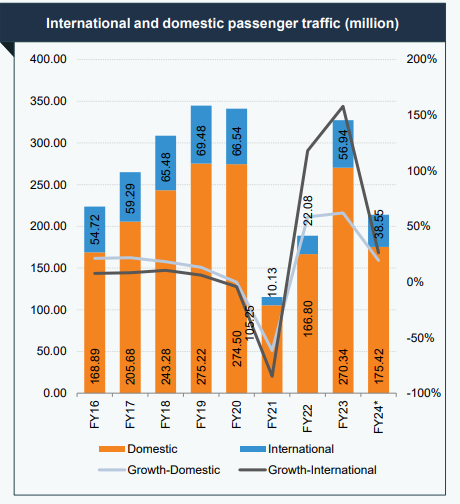

The domestic passenger and international passenger traffic increased at a CAGR of 6.95% and 0.57%, respectively, from FY16 to FY23.

As you can see in the above chart, airline passenger traffic has been steadily increasing except the drop during the covid pandemic. But it has quickly recovered in the past 2 years.

During January- December 2023 there were 1520.32 lakhs passengers as against 1232.45 lakhs during the corresponding period of previous year. Thereby registering an annual growth of 23.36% YoY.

The numbers are still lower than in the more developed countries. By 2036, India is projected to have 480 million flyers, more than Japan (just under 225 million) and Germany (just over 200 million) combined.

Therefore, it indicates there is ample opportunity for growth in the Indian aviation industry.

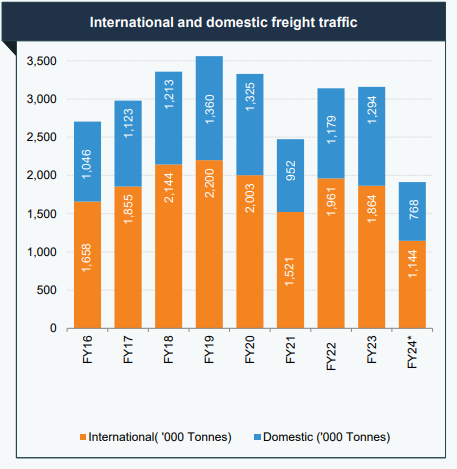

Apart from passenger traffic, the Indian aviation industry witnessed decent growth in freight traffic. From FY16 to FY23, domestic freight traffic increased at a CAGR of 3.7% and international freight traffic increased at a CAGR of 1.7%.

Freight traffic is basically cargo shipments through air. In FY23, domestic freight traffic stood at 1.2 MMT and international freight traffic was 1.86 MMT. As you can see here the international freight traffic is more compared to domestic freight, which was not the case for passenger traffic.

There is also hope for a rise in freight traffic as the country’s export imports rise. As of FY24 (until October 2023), India’s merchandise exports were estimated at US$ 244.89 billion, and imports were estimated at US$ 391.96 billion.

Factors Driving the Aviation Industry

The growth and steady increase in the overall Indian Aviation industry is driven by three major factors, which are as follows:

Growing Demand

India’s travel and tourism industry has been exponentially growing, and by 2028 Tourism is expected to contribute $512 bn to India’s GDP, said the chief of Travel Agents Association of India (TAAI). This is perfectly in line with the growing middle class income and working population of the country which will drive air-travel. There is also a continuous rise in domestic and foreign travels.

Indians spent around US$ 11.44 billion on overseas travel between April and January of FY23, a 122% jump from the same period of last year, which is significantly higher than global standards.

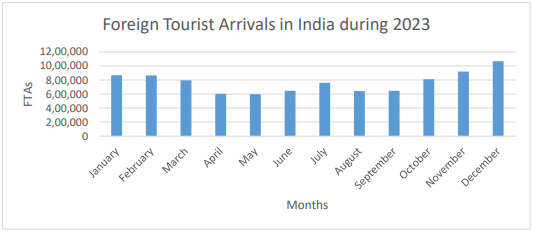

Similarly, foreigners traveling to India has also increased by 43% YoY from 2022-2023. Foreign Tourist Arrivals (FTAs) during the period January- December 2023 were 92,36,108 as compared to 64,37,467 in January-December 2022.

Here is a month-on-month rise in FTAs to India:

Apart from a rise in tourism and traveling, there is also a significant rise in import and export activity in the country. Currently, with the fast-moving world economy, consumers demand products and services to be delivered quickly. Hence, air cargo or air freight carriers’ activity will rise, leading to a rise in demand and higher aircraft movements.

Government Policies

The Indian government is continuously supporting the aviation industry with the implementation of newer and better policies for the sector which is leading to overall growth in the industry.

It started with The National Civil Aviation Policy 2016 (NCAP 2016), which was a major initiative by the Indian government to reform and develop the civil aviation sector in the country. It majorly focuses on making flying affordable to Indians by promoting competition and encouraging low-cost carriers. The next objective was to enhance regional connectivity: It focuses on improving air connectivity to smaller cities and regions through subsidies and infrastructure development.

The infrastructure development in building airports has led to a massive increase of 2x since 2014. The number of airports in India has doubled from 74 in 2014 to 148 airports in 2023.

India has set the target to increase the number of operational airports to 220 by 2030.

Next comes the liberalization of the Indian Aviation industry; with the opening of the airport sector to private participation, six airports across major cities are being developed under PPP (Public-Private Partnership).

Until 2013,the Airport Authority of India (AAI) was the only one involved in developing and upgrading airports in India. Post-liberalization, private sector participation in the sector has been increasing. The Government of India gave ‘in-principle’ approval to 19 airports, out of which seven are going to be developed on a PPP basis with an investment of Rs. 27,000 crore (US$ 41.89 billion). Going forward, AAI To Lease 25 Airports By 2025 Under PPP Model.

Some major private players in developing country’s airports:

- GMR Airports Infrastructure Ltd. The company is into development of Hyderabad International Airport; and modernisation of Delhi International Airport.

- GVK Power & Infrastructure Ltd. It is into development of Mumbai International Airport.

- Siemens Ltd. It is into development of Bengaluru International Airport.

- Larsen & Toubro Ltd. It is into development of Navi Mumbai International Airport.

- Adani– It is into development of Ahmedabad and Thiruvananthapuram Airports.

If someone, looking for Proxy for the development and growth of the Indian aviation industry, the above list of companies could be an investing opportunity. However do note that investment carries various risks. Hence you should first carefully analyze company fundamentals before investing.

Increasing Investments

The Airport Authority of India (AAI) is driving large modernization, development projects for new airports and expansion and upgradation of existing airports. The AAI is planning to invest Rs. 25,000 crore or US$ 3.58 billion in the next 5 years to augment facilities and infrastructure at airports.

Talking of augmented facilities at airports, Digi Yatra is a biometric boarding system that uses facial recognition technology to offer a seamless and hassle-free experience for passengers at airports.

Also, the Government of India is planning to invest US$ 1.83 billion for infrastructure development of airport and aviation navigation services by 2026. In 2023, the government announced ‘In-Principle’ approval for developing 21 Greenfield Airports across the country.

Additionally, foreign investment of up to 49% is allowed under automatic routes in scheduled or regional air transport services and domestic scheduled passenger airlines.

Investment Opportunities in the Indian Aviation Industry

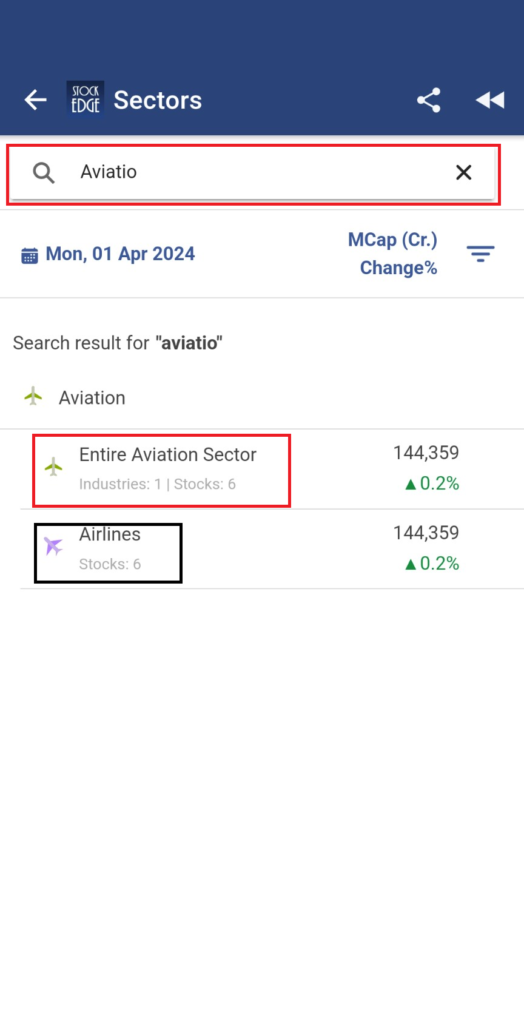

The overall sector is currently going through a major overhaul. During such times, numerous investing opportunities can come up with passing times. But before going forward in finding opportunities in the aviation sector, let’s find out the list of stocks under the aviation sector.

Using StockEdge you can easily identify the list of stocks under the aviation sector. Login to your StockEdge app and click on sectors, then type “aviation”. Then click on the entire sector to get the list of stocks.

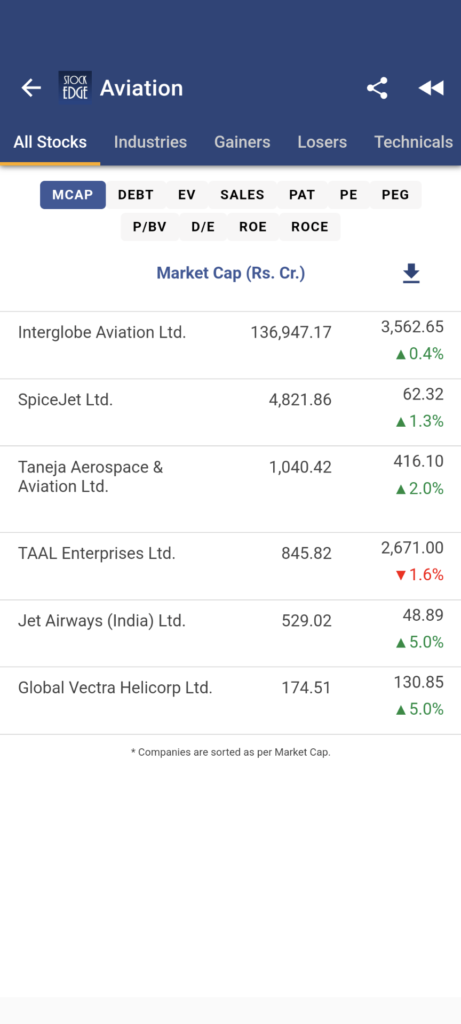

As you see, the entire list of stocks under the aviation sector can be viewed along with other fundamental information like Mcap, PE, Sales, PAT etc. So that you can easily compare the stocks under the sector to identify strong stocks in the sector.

Now that you got the list of stocks, you must be wondering which stocks can be good for your portfolio?

We will definitely come to that, but before you take a fresh entry into a sector or a particular stock. You must have an understanding of how the sector is currently performing in the market?

Aviation Sector Performance

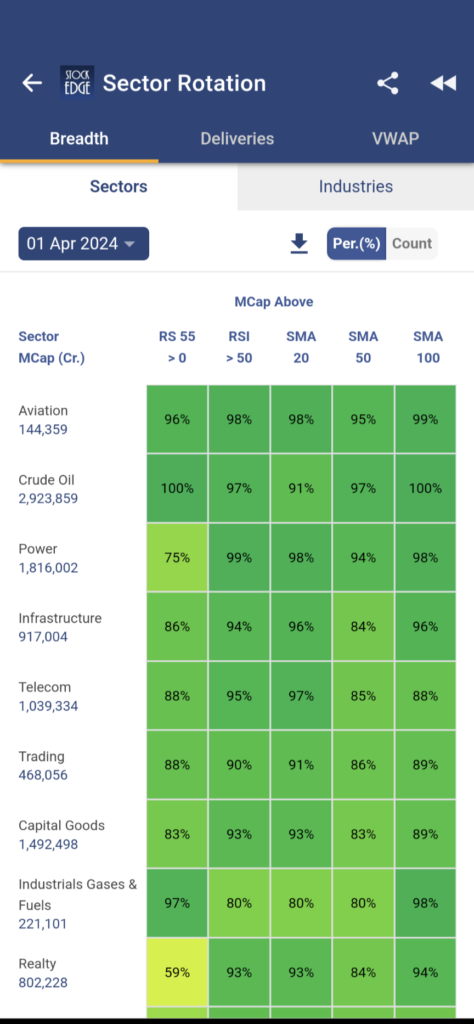

Yes, we already discussed the growing opportunities in the aviation sector, but in the current market scenario, how is the sector performing? To find out, we can use the “Sector Rotation” feature of StockEdge. At StockEdge, we have developed a sector rotation model based on key technical parameters to make a view of the sector’s outperformance or underperformance.

Let’s see how?

As you can see, the aviation sector is at the top of the list among all other sectors in the market, showing great strength as it is currently outperforming other sectors in the market.

To know how you can identify strong sectors in the market and then identify stocks for investment. You can read; this entire blog on Sector Rotation.

Now, let’s focus on stock-specific investment opportunities in the Indian aviation industry.

Best Stocks in the Indian Airline Sector

It seems like you have already guessed it right! It is none other than Indigo with its top market share and low cost carrier service make it best suited not only the Indian market but may also turn out to be a good investment in the long term.

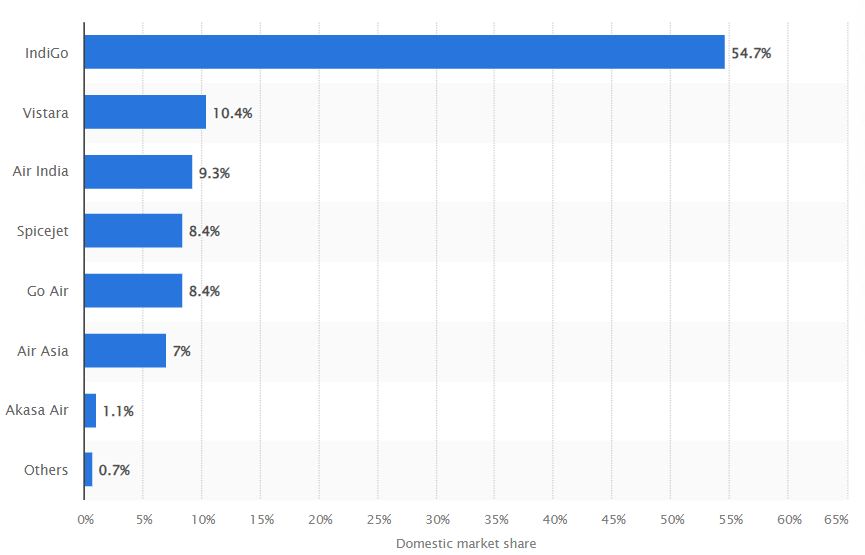

Domestic market share of airlines across India in financial year 2023

As you see, Interglobe Aviation Ltd. has the top market share in the domestic airline industry by a huge margin compared to its other competitors in the market.

Therefore, with the rise in demand for air travel in the coming years, Interglobe aviation will be at the forefront to benefit from the rise in air travel.

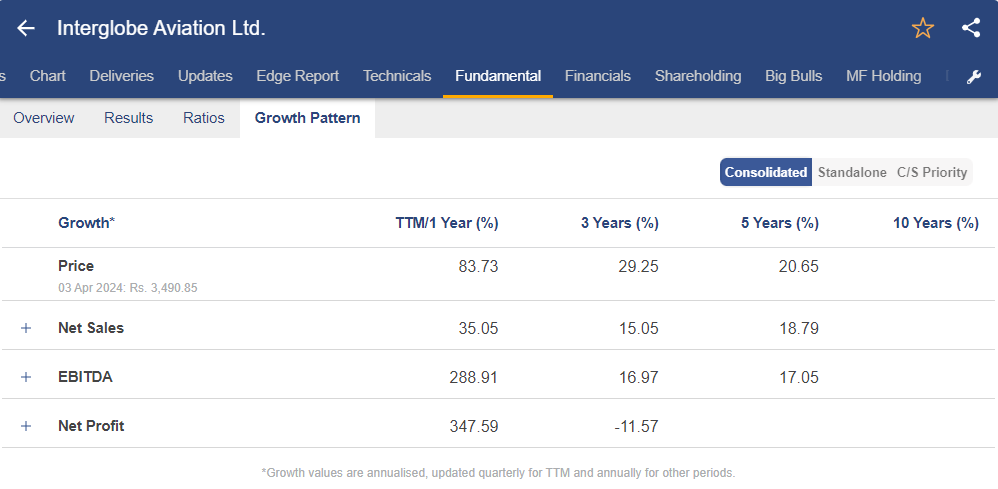

Now, let’s have a look at how the company financials are improving. At StockEdge, we have a growth pattern section from where you can have an understanding of how well the company is performing based on Sales, EBITDA and net profit. These three are important parameters you can judge a company’s fundamentals. Also, with this you can compare how Indigo shares have been performing in 1, 3, 5 years and 10 years as well.

Here is the growth pattern of Interglobe Aviation Ltd.

As you can see there is significant improvement in financial figures of Indigo which is reflected in share price performance as well. Therefore with the overall growth of the Aviation industry, Interglobe Aviation Ltd, may turn out to be a good investment for the long term.

The Bottom Line

In conclusion, the Indian aviation sector stands at the peak of a transformative era, poised to soar to new heights. With burgeoning demand, robust government initiatives, strategic infrastructure development, and technological advancements, the sector showcases immense potential to outperform its global counterparts. However, challenges such as regulatory hurdles, infrastructure constraints, and economic fluctuations necessitate agile and collaborative approaches from industry stakeholders.