Table of Contents

Introduction

The landscape of Indian investing has been on a significant transformation journey post the pandemic year of 2020.

The Indian Mutual Fund Industry had an AUM of 30 lakh crore in November 2020, which had grown to 54 lakh crore as of March 2024.

With the increasing number of investor accounts, from 8.97 crore in March 2020 to current investor folios reaching 17.79 crore in March 2024, retail investors have shown the most interest in the world of investing.

One such Asset Management Company, Quant AMC, has grown multifold in the last four years.

According to sources, Quant AMC has secured the fifth position among the most popular AMCs in India for 2023 after HDFC AMC, ICICI AMC, Nippon India AMC, and SBI Mutual Fund.

This rank has been possible as Quant Mutual Fund follows a rule-based investing.

The term Quant funds in the world of investing means that stocks are selected using advanced mathematical models and quantitative analysis, which is exactly where the AMC name came from. They have seasoned professionals who manage the fund based on certain algorithms and rule-based investing techniques, which in turn are reflected in the fund’s performance.

We will talk about the investment strategies later in the blog.

History of Quant Mutual Fund House

Quant Mutual Fund is a very young mutual fund company.

Quant Money Managers Limited was established in 1995 and approved by SEBI to act as an Asset Management Company for the Quant Mutual Fund via its letter dated October 30, 2017.

The fund house came into existence in 2018 when Sandeep Tandon led Quant Capital to acquire Escorts Mutual Fund, which was previously headed by Anil Ambani-owned Reliance Securities. At the time of acquisition, Escorts Mutual Fund had an Average AUM of ₹235 crore.

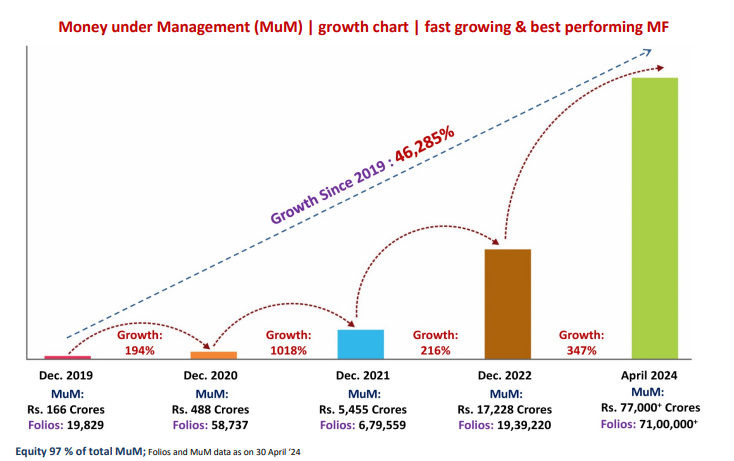

At the end of March 2020, Assets Under Management for Quant Mutual Fund came down to Rs.135 crores. Since then, the change in management at Quant Mutual Fund has witnessed an exponential increase in the AUM, mainly because of the investment strategies and active management of the fund.

Let us understand the investment rationale, list of best-performing funds, and steps to invest in quant mutual funds in more detail.

Investment Methodology

Investment Strategy adopted by Quant Mutual Funds is the core engine that drives the fund’s performance and sets them apart from its peers.

It enables its schemes to generate alpha returns while safeguarding the interest of its investors as it focuses on ‘Predictive Analytics’ which has helped the AMC to sustain amidst adverse market conditions.

The Assets Under Management has surged from 166 crore to 77,358 crore (as on April 2024) recording an astonishing growth of 46,501% in the period of just 4 years.

Its investment philosophy, dynamic asset allocation, multi-dimensional research, and unique & innovative product offerings have helped quant mutual funds to generate a large number of investor folios.

From 58,737 folios in Dec 2020, it has reached to an all time high of 7.1 million folios as on 30 April 2024.

Investment Framework

Quant’s fund management investment philosophy follows the VLRT stock selection methodology. By VLRT, we mean Quant mutual funds, which select stocks based on Valuation, Liquidity, Risk appetite, and Timing.

Let us understand each of the parameters.

Valuation: Valuation is a crucial parameter when selecting a stock. Quant mutual fund management considers the price of a stock and its valuation as two different metrics. A lower price does not necessarily mean a stock has the proper valuation; its earnings growth, along with various parameters, should be considered while calculating the valuation of the stock.

Liquidity: Understanding the flow of money across asset classes and the volume it has is a crucial parameter for stock selection.

Risk appetite: This means the risk reward offered by the fund, along with understanding the psychology of market participants. It enables the management team to decide whether to buy or sell a particular stock at a given time and plays a crucial role in stock selection.

Timing refers to understanding and adapting to fluctuations in market sentiment, investor behavior, and perceived asset value. Successful investors and fund managers often navigate these complexities effectively and make informed decisions based on market trends and investor behaviour.

They have a dynamic approach to investing, which means they are not inclined to any particular sector and select stocks based on their performance. The word commonly used by Quant Mutual Funds is “unconstrained”.

Now that we have studied the investment framework let’s focus on the performance of various AMC schemes.

Quant Mutual Fund Performance

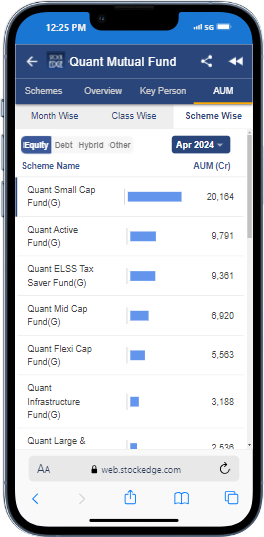

Quant Mutual Fund (Quant MF) first crossed ₹50,000 crore of Assets Under Management (AUM) in January 2024. The achievement includes a portfolio of 27 schemes and 54 lakh folios.

Presently, it has total assets of 77,358 crores, with folios reaching beyond 71 lakh investor accounts as of April 30.

Quant Mutual Funds follows aggressive and active investment management from a wide universe of companies, which makes it outperform its benchmark and peers in the category.

The fund house does not restrict itself to a particular style of investment, so it can make quick changes in its portfolio holdings.

All the Quant mutual fund schemes have a high portfolio turnover ratio, which means the number of times the portfolio is churned in the past 1 year.

In March 2024, Quant Midcap Fund had a Portfolio Turnover Ratio of 329%; in February, the fund had a PTR of 365%, signifying continuous buying and selling in the scheme.

Out of 273 equity schemes, the Quant Large Cap fund had the highest portfolio turnover ratio, 542% in March 2023 and 557% in February.

Apart from this, six other Quant Mutual Fund funds saw a high PTR ratio in March:

Quant Focused Fund (424%),

Quant Flexi Cap Fund (393%),

Quant Large & Mid Cap Fund (382%),

Quant Mid Cap Fund (329%),

Quant Value Fund (317%), and

Quant Active Fund (278%).

All the above funds has shown high PTRs for month of February as well.

Top Recommendations of Quant Mutual Fund Schemes are:

Quant Mid Cap Direct:

This scheme focuses only on Midcap companies listed in NIFTY Midcap 150 TRI. The fund has an AUM of 6,920 crores and charges an expense ratio of 0.62%. The fund has given annual returns of 34.78% in 3 years and 35.39% in 5 years.

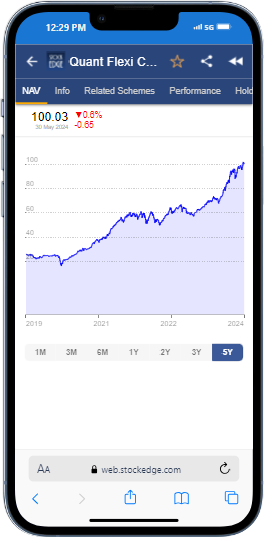

Quant Flexi-Cap Direct:

This fund falls under the Flexi-Cap category and follows an active strategy by investing in a diversified portfolio of Large, Mid, and Small-Cap companies. The fund has an AUM of 5,563 crores and charges an expense ratio of 0.59%. It has given annual returns of 29.13% in 3 years and 32.24% in 5 years.

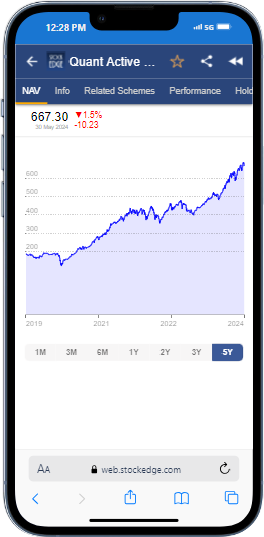

Quant Active Direct:

This fund falls under the Multi-Cap category and follows an active strategy by investing in a diversified portfolio of Large, Mid, and Small-Cap companies. The fund has assets under management of 9,791 crores and charges an expense ratio of 0.63%. It has given annual returns of 25.93% in 3 years and 30.58% in 5 years.

Quant Small Cap Direct:

This fund follows an active management strategy by investing in a diversified portfolio of small-cap companies. The fund has assets under management of 20,164 crores and charges an expense ratio of 0.64%. Fund has given annual returns of 35.59% in 3 years and 41.12% in 5 years time frame.

Quant ELSS Tax Saver Direct:

This fund falls under the ELSS category and follows an active strategy by investing in equity shares of companies with high growth potential, with the objective of generating dividend income. The fund has assets under management of 9,361 crores and charges an expense ratio of 0.77%. It has given annual returns of 28.82% in 3 years and 33.71% in 5 years. This is the best-performing fund in its category.

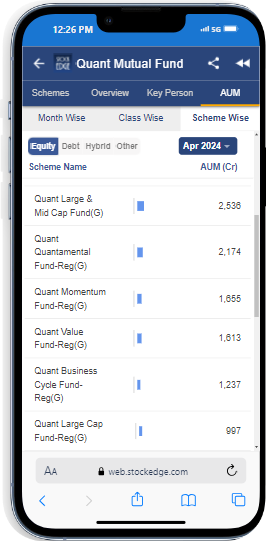

Quant Large & Midcap Fund:

This fund falls under the large and midcap category and follows an active strategy by investing in large and Midcap stocks comprising India’s Top 250 companies by market capitalization. The fund has an AUM of 2,536 crores and charges an expense ratio of 0.66%. The fund has given annual returns of 29.80% in 3 years and 27.99% in 5 years.

Quant Infrastructure Fund:

This fund invests in companies that engage in infrastructure and infra-related activities or are expected to benefit from them. It has an AUM of 3,188 crores and charges an expense ratio of 0.66%. It has given annual returns of 37.68% in 3 years and 36.35% in 5 years.

Steps to invest in Quant Fund

Quant Mutual Funds has become the most popular Mutual Fund House in the country. You can invest in these funds either directly through the AMC website or the registrar’s KFintech website or through any broker like Zerodha, Groww, HDFC Securities, etc.

The required documentation is basic, and it takes little time to sign up and start investing. Here are the steps to invest in Quant Mutual Funds:

Step 1:

To invest via the Quant Mutual Fund website, create your login ID and password if you don’t have one. Investing through a Mutual Fund Distributor will incur higher fees as the distributor charges a part as commission for managing the fund.

A simpler, cheaper, and more effective way to invest in Quant Mutual Fund’s schemes is through a discount broker like Groww/ Coin by Zerodha.

Step 2:

You must complete the KYC Verification process by providing your Address and identity proof, along with an e-signature, a selfie, and a live video. This will generally take 3 to 5 working days as it is verified by Government-Certified agencies.

For address verification, the following documents can be uploaded: a PAN Card, an Aadhaar Card, a Passport, a valid Driver’s Licence, or a Voter ID Card.

Step 3:

Once your account has been created and documentation for KYC is approved, you can log in using your email ID and OTP.

Step 4:

Select the Quant Mutual Fund scheme you want to invest in based on your risk-taking ability and the fund’s risk profile, which can range from low to medium to high.

A high-risk investor who wants superior returns can select funds focusing on equity securities, whereas low-risk investors can invest in debt or money market securities.

Step 5:

You must check fees charged by the fund, expense ratio, and exit load.

Enter your investment amount and choose the investment plan type, either through Lump-sum mode or SIP. In the case of SIP, select investment frequency and set up an auto-mandate, which will automatically deduct your SIP amount every month.

It generally takes 2-3 business days for the brokers to allot the mutual fund units in your demat account.

Conclusion

Quant Mutual Fund is a young company that started working five years ago with a clear strategy of how it wants to run the fund, including the investment strategies, selection of the stocks and how frequently to churn the portfolio,

It follows a special investment framework known as VLRT, selecting stocks based on valuation, liquidity, the investor’s risk appetite, and market timing. The schemes offered by the fund house have outperformed majorly in all equity category funds and have topped the charts in individual categories by delivering superior double-digit growth.

Considering the returns offered by the funds based on risk taken, the strategy seems to be working for the AMC. An investor with a long-term investment horizon of 5 to 7 plus years and a higher risk appetite who is looking for greater risk-adjusted returns can consider investing in schemes offered by Quant Mutual Fund House.

However, it is recommended to invest only via a Systematic Investment Plan. To periodically monitor the fund’s performance, key changes must be made to the fund and other factual data provided by the AMC. This will help investors gain confidence and stay invested in the fund for a longer tenure.