Table of Contents

Maruti Suzuki India Ltd is the market leader in the Passenger Vehicles segment, commanding a market share of about 50%. Maruti Suzuki India Limited (MSIL), a subsidiary of Suzuki Motor Corporation, Japan, is India’s largest passenger car maker.

Maruti Suzuki is credited with having ushered in the automobile revolution in the country. The Company is engaged in the business of manufacturing and sale of passenger vehicles in India. Making a small beginning with the iconic Maruti 800 car, Maruti Suzuki today has a vast portfolio of 16 car models with over 150 variants. Maruti Suzuki’s product range extends from entry level small cars like Alto 800, Alto K10 to the luxury sedan Ciaz. The Company has manufacturing facilities in Gurgaon and Manesar in Haryana and a state of the art R&D centre in Rohtak, Haryana.

Maruti Suzuki India Ltd has 2 state-of-the-art manufacturing facilities located in Gurugram and Manesar in Haryana, capable of producing ~1.5 mn units per annum.

Suzuki Motor Gujarat Private Limited (SMG), a subsidiary of Suzuki Motor Corporation (SMC) Japan, was set up in Hansalpur, Gujarat to cater to the increasing market demand for the company’s products and has been operational since 2017. Through this new facility, an additional annual production capacity of ~0.75 mn units has been made available, thereby taking the combined production capability to ~2.25 mn units.

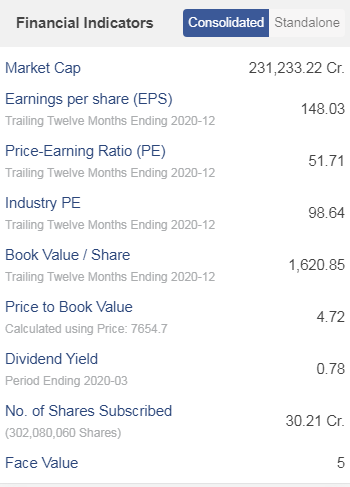

Maruti Suzuki India Ltd currently has 17 models with over 150 variants across segments. As of today’s date, this is the share price of Maruti Suzuki India Ltd

Operational Highlights of Maruti Suzuki India Ltd

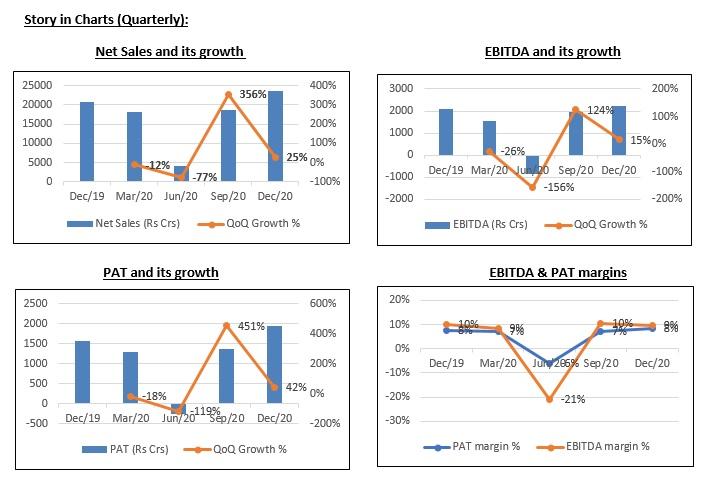

- The revenues grew during Q3FY21 to Rs 23471 cr as compared to Rs 20721 cr in Q2FY20. Volume increased QoQ driven by improvement in urban market and buoyancy in rural demand

- The EBITDA grew to Rs 2228 cr in Q3FY21 as compared to Rs 2105 cr in Q3FY20. There was a pressure on margins due to commodity pressure, partially offset by lower discounts.

- The PAT grew to Rs 1937 in Q3FY21 as compared to Rs 1568 cr in Q3FY20. The growth in profits was due to higher other income which was driven by higher fair value gains on invested surplus.

- Maruti Suzuki India Ltd plans to mitigate the impact of commodity inflation through a) lower discounts, b) price hikes, c) cost reduction efforts and d) supply chain optimization.

Future Outlook

- The management commentary on strong orderbook along with low levels of channel inventory, which means the company can post robust wholesale in Q4FY21

- There are three major challenges for EV adoption 1) current battery cost, which is 50% of vehicular cost, 2) lack of infrastructure (in India only 12% of cars are parked in the same place), and 3) range anxiety among consumers. This will need to be watched out.

- Cost structure depends on capacity ramp-up. Maruti being conservative on marketing cost in FY21, marketing cost will increase. It will continue to focus on other cost saving initiatives, such as digitalization and product efficiency.

Management Update of Maruti Suzuki India Ltd

- The management highlighted that current demand remains strong. The company has pending bookings of c.215k units. While the share of rural has reached 41%, urban markets have also started witnessing improvement in sales since 3QFY21.

- Network inventory at the beginning of Jan’21 stood at 21Kunits while factory stock was only 700units. Management highlighted that, till date, MSIL production has not been impacted due to shortage of semiconductor.

- The company will remain cautious while taking further price hikes as the current volume is still 33% below peak levels

Business Performance

• Maruti Suzuki India Ltd sold a total of 4,95,897 vehicles during the quarter, higher by 13.4% YoY. Sales in the domestic market stood at 4,67,369 units, growing by 13.0% YoY. Exports saw a rise of 20.6% YoY to 28,528 units.

• During 9M FY21, it sold a total of 9,65,626 vehicles, lower by 18.0% YoY. Sales in the domestic market stood at 9,05,015 units, lower by 17.8% YoY and exports declined by 21.9% YoY to 60,611 units. • Export revenue was ₹1,318 crore for the quarter.

• Sales of CNG vehicles grew by 18.9% YoY in 9M FY21. Rural sales penetration stood at over 40% for the quarter.

• Over 1,60,700 units of Swift were sold in CY20 with total sales of over 23 lakh units. Super Carry was sold across 235+ cities with ~20% market share in FY21.

• Recently, the company commenced the export of Jimny three doors for terrains of Latin America, Middle East and Africa.

• The network stock was ~21,000 vehicles and the factory stock stood at ~700 vehicles in the beginning of January, 2021.

• First-time buying and additional buying both saw a rise during the quarter.

• The company lost some market share in the sports utility vehicle segment.

• Demand in the replacement segment fell sharply by 720 bps YoY.

• The capacity utilization was more than 70%-75% for the full year.

• The company remained unaffected from the shortage of steel and semi-conductors so far.

• Increase in input cost was not passed on by way of price increase of the vehicles. Royalty rate was 4.9% for the quarter v/s 5.0% in the previous quarter. Concall Summary MARUTI SUZUKI INDIA LTD

• Staff cost increased during the quarter on account of increments and a one-off provision worth ~₹20 crore for retirement benefits.

• It launched its online financing platform – Smart Finance to offer an online end-to-end real time car finance service facility.

Read Blog on : Vinati Organics Limited – Shaping a Reliable Future

StockEdge Technical Views:

Maruti Suzuki trading in between support and resistance zone whereas Technical indicators are mild bearish if price closes above resistance level 7800 near by resistance is swing high 8329 and 8800 support is 7170 and 6753 on daily chart.

Bottom Line:

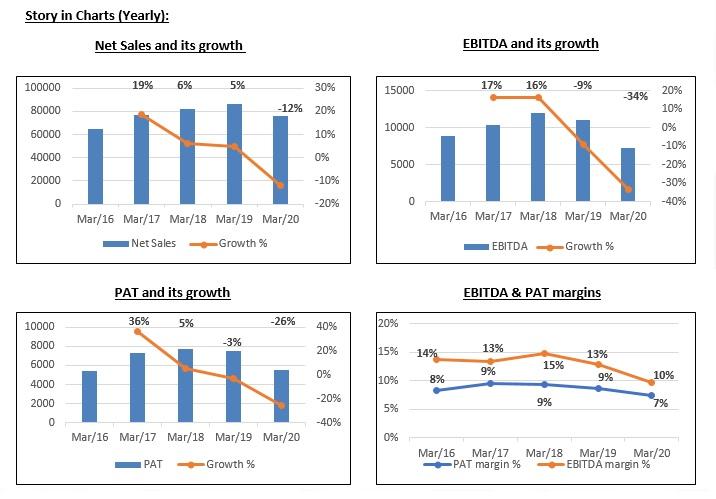

The PV industry is exhibiting a strong sequential recovery on the back of pentup demand, preference for personal mobility and the ongoing festive season. MSIL is witnessing strong festive demand. Demand trends have been encouraging. Shift in preference for personal mobility over shared mobility on account of COVID-19 has led to an increase in demand for personal vehicles.

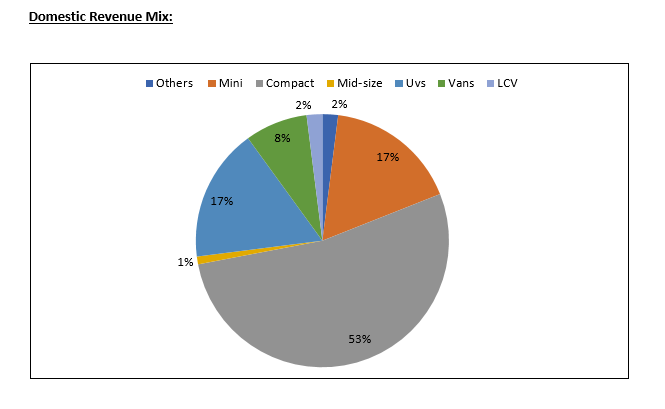

With lower income and job losses, downtrading is being witnessed across segments. Current data (in terms of enquiries) indicates that there is a spike in demand for smaller cars. MSIL is well placed to capitalize on this demand given its strong brand equity and strength in entry-and mid-segment PVs. (MSIL commands ~80% & ~60% market share in the Mini and Compact PV segment respectively). The company has a strong cash generating ability and negligible debt levels. MSIL is able to provide financial support to its dealer and vendors to tide over the challenging business environment. In this segment, Maruti remains the top pick. Maruti Suzuki India Ltd has the potential to perform in a healthy manner. Going ahead.

Additionally, it is a part of Nifty 50, which is the India’s benchmark index. To know more about Nifty 50 stock read; All About NIFTY50, Components of NIFTY50, and How to Invest in it

Disclaimer:

This document and the process of identifying the potential of a company has been produced for only learning purposes. Since equity involves individual judgements, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector. Our knowledge team has limited understanding and we all are learning the art and science behind this.

Thank you for the valuable information. Great article