Table of Contents

“Kona Kona Kotak”, India’s 3rd largest private lender, Kotak Mahindra Bank, has over 1869 branches present across the country. Despite its vast presence, Kotak Mahindra Share did not perform well in the last 2 years due to multiple reasons ranging from RBI imposing a penalty on the bank for non-compliance of promoter’s shareholding to penalized for failing to conduct an annual review or due diligence of its service provider and for violation of contact hours with customers.

There has been a continuous tug-of-war between the RBI and Kotak Bank since 2019. However, in September 2023, it came to an end when Uday Kotak, the former MD & CEO of the bank, stepped down from the board of directors.

The year 2024 could be brighter for the bank as the new MD & CEO of Kotak Bank, Mr. Ashok Vaswani who has three-and-a-half-decade experience with CitiGroup. Additionally, he was also at Barclays Bank, UK, where Vaswani was associated as the Chief Executive Officer of their Global Consumer, Private, Corporate and Payments business. Vaswani’s experience and expertise could bring back Kotak’s lost glory.

Additionally, it is a part of Nifty 50, which is the India’s benchmark index. To know more about Nifty 50 stock read; All About NIFTY50, Components of NIFTY50, and How to Invest in it

In today’s blog, we will conduct a comprehensive analysis of Kotak Mahindra Share to find out if it is the right opportunity to invest in Kotak Bank or not.

Company Overview

Kotak Mahindra Bank provides an extensive array of banking products and financial services catering to both corporate and retail customers. These services are accessible through diverse delivery channels and specialized subsidiaries covering areas such as investment banking, life insurance, and wealth management.

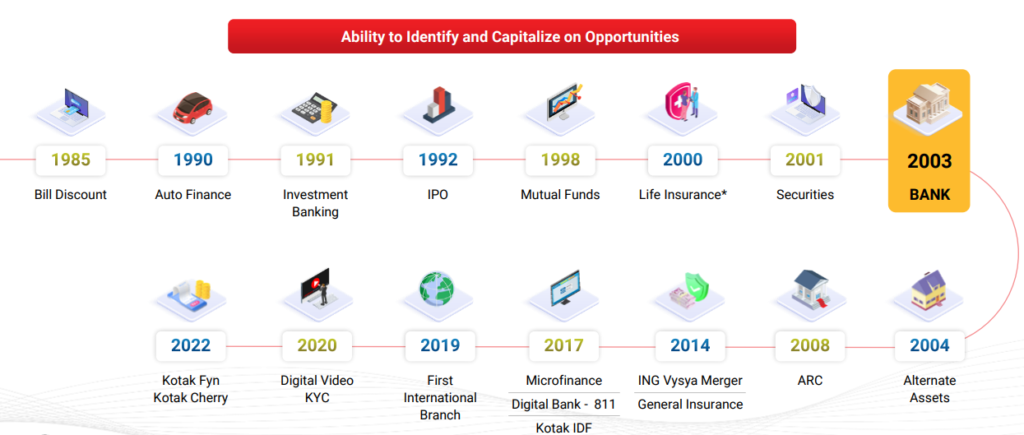

Kotak group is a well-diversified and integrated financial services company. The journey started way back in 1985 with bill discounting and receiving banking licenses in 2003. Since then, the company has brought innovations to the overall banking sector. Here is a look at the Kotak group journey from 1985 to present.

Financial Highlights of Kotak Mahindra Bank Ltd.

The bank has given an outstanding performance over the years. Net Interest Income has increased at 17% CAGR in the past 5 years and Net Profit grew at 19% CAGR during the same period. Net Profit increased extensively over the years.

During FY23, Standalone Net Interest Income was up by 28% YoY. Net Interest Margin increased by 72 bps YoY to 5.33%. Operating Expenses grew owing to higher business volume and investment in tech and digital programs. Standalone Net Profit stood at ₹10,939 Cr, growth of 28% YoY. Consolidated Net Profit grew 23% YoY.

For any bank, the net interest income is epitome of its financial performance. It is basically the difference between interest earned from lending and interest paid to depositors. Kotak Bank’s NII has been continuously growing at a significant rate of 17% CAGR. You can visually see the bar graph of NII of Kotak bank from the StockEdge app.

Kotak Bank’s deposits increased by 16.5% YoY in FY23 supported by Fixed Deposits growth. CASA deposits growth was subdued and CASA Ratio declined to 52.8% from 60.7% last year. Cost of savings account deposit increased by 15 bps YoY to 3.76%.

Advances increased by 19% YoY and 4% QoQ during the quarter. The growth was experienced across the segments. Advances are basically the loans disbursed by the bank.

The major chunk of a bank’s earnings is from interest on advances. Kotak Mahindra Bank’s “interest on advances” has been growing steadily for the past 10 quarters in a row. StockEdge app gives you a visual representation of its steady growth. Check the quarterly interest on advances of Kotak Mahindra Bank under the fundamentals tab of StockEdge.

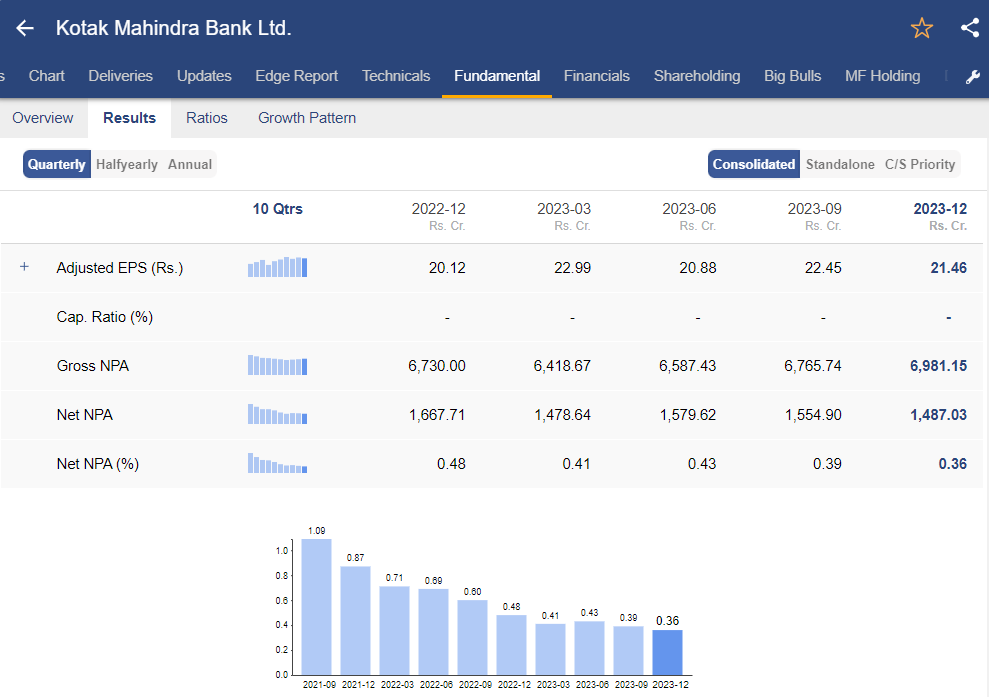

Last but not least is to keep a check on the solvency of the bank. Kotak Bank’s

Asset Quality has improved during the quarter. GNPA and NNPA ratio declined by 56 bps and 27 bps to 1.78% and 0.37% respectively.

As you can see from the StockEdge app, the net NPA of Kotak Mahindra Bank has been steadily declining, which is a sign of improved asset quality.

Q3 FY24 Update

The bank reported 18% YoY growth in net interest income (NII), reaching ₹8,510 crores. Operating expenses increased by 14.2% YoY, resulting in a sequential rise in the cost-to-income ratio to 48.4%. This increase was attributed to higher retiral costs of employees and elevated marketing and business promotion expenses. Provisions for the quarter saw a substantial 58% sequential jump, mainly due to provisions for Alternate Investment Fund (AIF) investments.

The trading and MTM (mark to market) loss for the quarter stood at ₹168 crore, compared to a loss of ₹51 crore in the same period of the previous fiscal year. The Net Profit grew by 6.1% YoY to ₹4,202.4 crore. The net interest margin (NIM) for the quarter was 5.22%, 25 bps lower on YoY basis.

The overall loan growth stood at 15.7% YoY, reaching ₹3.59 lakh crores. Home loans and LAP increased by 15% YoY, and the secured consumer banking segment saw a notable 20% yearly growth. The bank reported impressive growth in personal loans, consumer durables, credit cards, tractor and agri finance, and retail microfinance. Despite a slower pace, CASA deposits remained vital, contributing to an overall deposit growth of 3.8% sequentially, totalling ₹4.08 lakh crores.

The performance of asset quality exhibited a mixed trend, with the GNPA ratio experiencing a slight uptick of 1 bps on QoQ basis, reaching 1.73%. Conversely, the NNPA ratio showed an improvement, declining by 3 bps QoQ to 0.34%. Provisions remained robust, with a provision coverage ratio of 80.6%, indicating the bank’s commitment to managing risk effectively.

SWOT Analysis of Kotak Mahindra share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses,

opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strength

Kotak Mahindra Bank is one of the top players in the private banking sector. The bank has decent NIM and yields on advances, along with good asset quality. It has a strong CASA position along with a diversified loan book. The bank has outperformed its strong peers in the last few years. Its subsidiaries have a stronghold in their respective segments.

Kotak Securities has witnessed a sharp rise in market share in the last year and launched an app called Kotak Neo. The company plans to shift the majority of trading volume on this platform. Under the financing segment, its market share is rising, and collection efficiency has improved. Apart from this, the bank holds a substantial market share in Mutual Funds and Investment Banking as well.

Weakness

Fresh non-performing asset (NPA) generation would be negative for the bank. Operating expenses increased by 14.2% YoY, resulting in a sequential rise in the cost-to-income ratio.

Opportunity

The bank enabled a new digital journey to help customers transact. This included Digi Home Loans 2.0, Digi Personal loans and 811 Credit Card. Under its 811 Initiative, customers are generally 25-35 years old and are salaried. This provides an opportunity for cross-selling products, which will help increase profitability for the bank.

The bank expects unsecured loans’ contribution to reach the mid-teens, indicating a strategic focus on this segment. The Net Interest Margins (NIMs) are anticipated to remain above the 5% mark in the medium term. Despite pricing pressure in large corporate and SME segments, the bank foresees positive momentum in construction equipment, with a 38% YoY uptick. The management also emphasized the bank’s commitment to digitalization, as evidenced by the disbursal of 99% of new credit cards through digital channels.

Going forward, the bank focus would be on revving up the customer acquisition engine, across both physical and digital channels. Additionally, it would continue to focus on increasing digitization and improving customer experience.

Threats

Well, Kotak Mahindra share has remained under pressure for almost 2 years now. The only threat which remains is the leadership under the new MD and CEO Mr. Ashok Vaswani.

The Bottom Line

Kotak Mahindra Bank has a strong customer base and branch network with a good Current account Saving account (CASA) ratio of more than 50% for the last 2 years. The bank has shown consistent performance on credit growth & earnings. Bank earns one of the highest NIM in the industry. Thus, shows its strong operational business model.

Performance of non-banking businesses (Securities, investments, Prime and insurance business) remains strong on profitability. Going forward, the management will focus on the retail segment and better-rated corporate to drive credit growth.

Overall the private banking sector seems to be value investment in the long term, other than Kotak Mahindra share, one more bank may turn out to be a profitable bet for your portfolio, read; Unlocking Potential: HDFC Bank Stock Analysis

Happy Investing!