Table of Contents

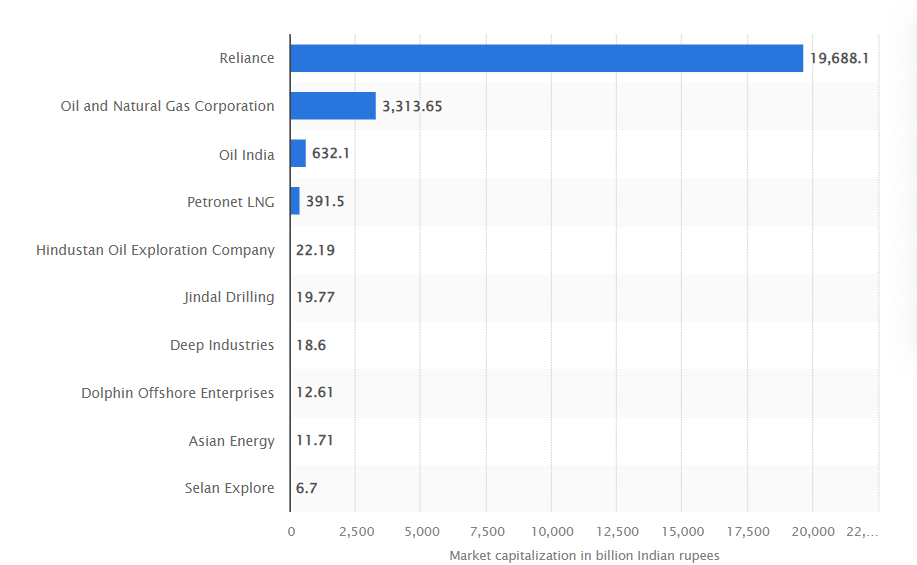

ONGC shares have the 2nd highest market capitalization for major oil exploration & production companies in India as of March 2024. Take a look at the list of leading Oil companies in India.

Crude is an essential commodity in the world. It is not just petroleum products that are directly used by consumers like us. Industries across the globe use crude oil for different purposes when manufacturing their products. For instance, crude oil is a raw material for paint companies.

Also, there are numerous reports that suggest that crude petroleum products are expected to grow at 7.84% CAGR (2024-2028).

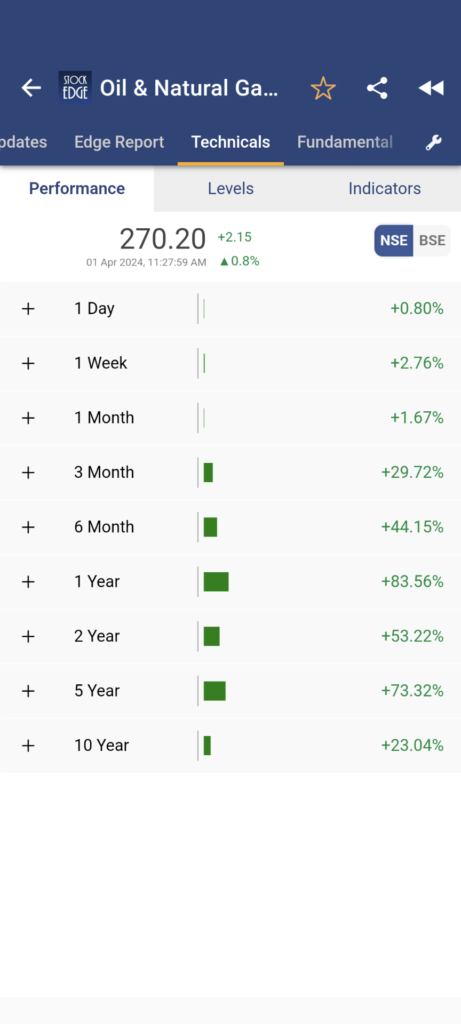

The phenomenal growth in the overall industry has pushed ONGC share to new highs. As of 31st March 2024, ONGC share increased 44% in the last 6 months and 83% in the past 1 year.

Using StockEdge, you can check the performance of ONGC share, as you can see in the image below:

Please note that this is the absolute return of ONGC shares.

Therefore, considering the overall industry growth and stellar performance of ONGC shares, should you invest now?

Let’s dig deep into the fundamentals of the company to find out.

Company Overview

Oil and Natural Gas Corporation Limited (ONGC) is India’s foremost producer of crude oil and natural gas, making up approximately 76% of the nation’s domestic production. It is uniquely positioned as the sole fully-integrated entity in the Indian oil and gas sector, managing operations across the complete hydrocarbon value chain. While ONGC primarily focuses on oil exploration, its subsidiary HPCL engages in the manufacturing of petroleum products such as gasoline, diesel, kerosene, naphtha, and cooking gas (LPG).

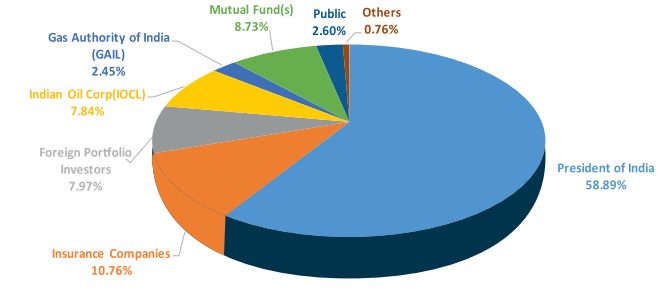

Moreover, (ONGC) is an Nifty 50 stock and operates as a central public sector enterprise in India, under the ownership of the Ministry of Petroleum and Natural Gas, Government of India. Let’s examine the shareholding structure of ONGC for the fiscal year 2022-2023.

Please note that the shareholding pattern of a public limited company changes every quarter. For the latest shareholding pattern of ONGC shares you can refer to StockEdge app.

Financial highlights

The company’s revenue has increased by 28.8% mainly due to increase in realization on the back of rise in the prices of crude. Although there was a significant decline of 33.5% in Net Profit owing to high base effect due to a gain out of change in taxation and creation of provision relating to GST on royalty.

Using StockEdge, you can evaluate the increase in revenue or net sales of ONGC.

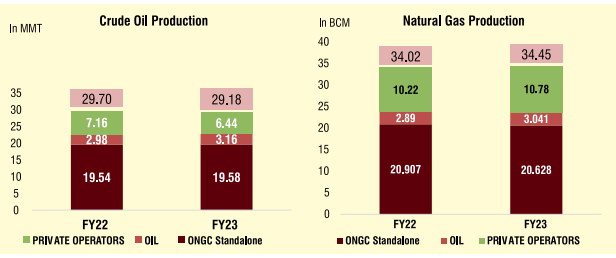

ONGC’s crude oil and gas production in Q4 FY23 stood at 5.23 million metric tonnes (MMT) and 5.26 billion cubic meters (BCM), respectively. However, there was a YoY decline in production attributed to project delays, lower-than-expected output, and reservoir challenges. The net realization of crude oil and gas in Q4 FY23 was $77.11 per barrel and $8.57 per metric million British thermal units (MMBTU), respectively, compared to $95.53 per barrel and $2.9 per MMBTU in Q4 FY22.

However, if you compare the production of ONGC with that of other private operators, ONGC has the highest share of crude oil and natural gas production.

ONGC’s overseas subsidiary, ONGC Videsh Ltd., reported oil and gas production of 10.17 million metric tonnes of oil equivalent (MMTOE) for FY23, a decrease from 12.33 (MMTOE) in FY22, influenced by factors such as geopolitical conflicts, production interruptions, and adverse weather conditions.

Further, the company’s affiliate, HPCL, achieved a significant milestone by surpassing 21,000 retail outlets, aided by the commissioning of 1,161 new retail outlets during the fiscal year. ONGC declared eight discoveries across its operated acreages during FY23, with a mix of onshore and offshore findings.

Q3 FY24 Update

The company reported a 2.2% decline in Revenue on a YoY basis, and Net Profit declined by 7.9% YoY. However, Net Profit growth for 9M FY24 stood at 20% YoY despite a 9% decline in Revenue for the period. The increase in net profit was attributed to the healthy contributions of its subsidiaries, including HPCL, MRPL, and OVL. Standalone Net Profit for Q3 FY24 decreased by 13.7% YoY to ₹9,536 crore, primarily due to lower sales revenue resulting from decreased crude and value-added product realizations, coupled with the impact of royalties and GST.

SWOT analysis of ONGC share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strength

The company is engaged in the oil exploration, development, and production of crude oil and natural gas and supplies crude oil, natural gas, and value-added products, such as petrol, diesel, kerosene, naphtha, and cooking gas – Liquefied Petroleum Gas, to major oil and gas refining and marketing companies. ONGC possesses a distinctive characteristic as a company equipped with in-house service capabilities across various aspects of crude oil and natural gas exploration and production, along with related oil-field services.

The company undertakes exploration and production activities in 15 other countries such as Azerbaijan, Kazakhstan, Myanmar, Vietnam, Iran, Iraq, Israel, Syria, UAE, Libya, Mozambique, South Sudan etc. through its wholly-owned subsidiary ONGC Videsh Limited (OVL). The primary focus of its international subsidiary, ONGC Videsh Limited (OVL), revolves around exploring oil and gas reserves beyond Indian borders, encompassing activities such as exploration, development, and production. In terms of reserves and output, ONGC Videsh stands as the second-largest petroleum entity in India, closely following its parent company, ONGC.

It has integrated downstream activities in India with two subsidiaries, viz. Mangalore Refinery & Petrochemicals Ltd. (MRPL) and Hindustan Petroleum Corporation Ltd. (HPCL) with a combined capacity of over 38 million metric tons per annum (MMTPA) refinery and an extensive network of over 21,000 retail outlets as of FY23.

Weakness

During the quarter, ONGC faced challenges in its operational performance, with a decline in both crude oil and gas production by 3.3% and 4.3% YoY, respectively. This reduction in production output was primarily attributed to declines in matured and marginal fields, shutdown at the Panna-Mukta plant, and issues such as leakage at Southern plants. However, the company continued to take proactive steps by implementing well interventions and advancing new well-drilling activities within matured fields to counter this decline.

Opportunity

ONGC continues to remain the largest player in the exploration and production segment, holding a significant position in the Nifty 50 index. It holds the largest exploration acreage in India as an operator. The company is expected to continue to maintain a dominant position in the domestic crude oil and natural gas production business, given the large proven reserves, globally competitive cost structure, and stable performance of its subsidiary ONGC Videsh Ltd. (OVL). The forward integration of the downstream business has been a defining move by the company, one which would continue to provide stability in the earnings and expand the revenue distribution.

ONGC envisions improving HPCL’s financial performance in the coming quarters. The company has set an ambitious goal of becoming a net-zero emission enterprise by 2038. Anticipated milestones include the commencement of oil production in Mozambique by October 2023, followed by gas production by the end of FY24.

ONGC also plans to focus on expanding its presence in the petrochemical sector, which is driven by India’s current low per capita consumption. The company intends to allocate approximately ₹10,000 crore annually for exploratory activities over the next three years, with a primary emphasis on drilling in nominated wells.

Threat

The structural shift in the focus on renewable energy sources. Additionally, the emergence of electric vehicles can be a big source of headwind for the company in the long run. ESG-related concerns continue to remain for these companies, for which it has already been applied for review.

The Bottom Line

ONGC remains optimistic about its future outlook. The company expects to compensate for production declines from matured fields with additional production from upcoming projects under various stages of development. It anticipates improvements in gas prices and aims for an increased premium share of gas production in the coming years. ONGC envisages production growth in FY24 to be similar to FY23, with significant growth projected by FY27, driven by healthy contributions from its projects. The company plans to invest substantial capital in development projects, focusing on increasing production capacity over the next three years. ONGC also aims to increase standalone capex for FY24 and FY25 to support its growth initiatives.

Overall, the outlook is positive for the upcoming quarters.