Table of Contents

Apple, a tech giant from the USA, is the most valuable brand globally. But do you know which is the most valuable brand in India?

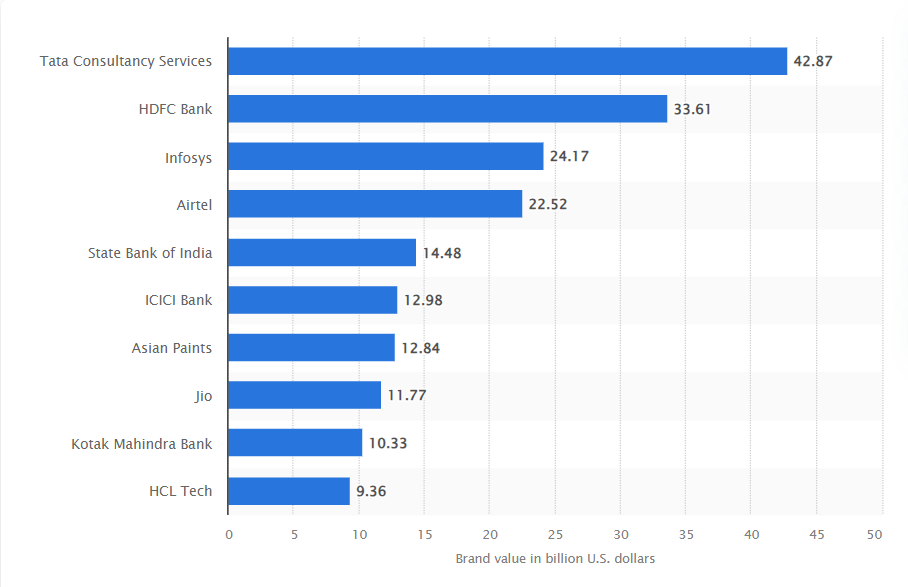

It is none other than TCS, the IT giant of India’s tech industry and the flagship company of the TATA group. It is TATA Consultancy Services Ltd. (TCS) with a brand value of 42.87 billion USD.

Here is the list of the most valuable brands in India as of 2023, published by Statista.

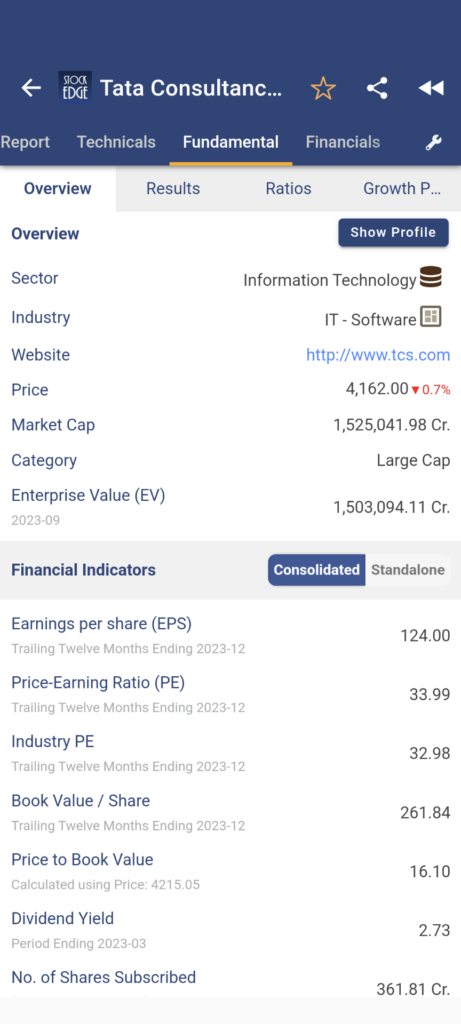

Also, TCS stock is the second largest publicly traded company in the stock market with a market capitalization of 15 lakhs crores. Additionally, TCS stock holds a significant 4.32% weightage in the benchmark index Nifty 50.

So, should you invest in TCS stock? The answer to this question lies with this blog, where a complete analysis will be provided so that you can make informed decisions in the stock market.

Company Overview

Tata Consultancy Services Ltd. (TCS) serves as the flagship company of the Tata Group. With over 50 years of experience, it specializes in IT services, consulting, and business solutions. TCS has partnered with numerous global enterprises in their transformation endeavors. It provides a comprehensive range of services and solutions, blending consulting expertise with cognitive technology and integration capabilities in business, technology, and engineering domains.

To put it simply, TCS helps businesses implement and maintain their IT infrastructures, offers newer technologies and software solutions, and provides consultancy services to its clients, providing suggestions and assisting with digital products to help reach business goals.

To get a fundamental overview of TCS stock, head to the StockEdge app.

Financial Highlights of TCS

Revenue has grown at 13% CAGR and Net Profit grew at 10% CAGR in the last 5 years. Margins have remained more or less stable over the years. During FY23, Revenue increased by 18% YoY, however higher wages and supply side challenges resulted in lower growth in Profit. View the annual revenue growth of TCS stock using StockEdge.

Later, in Q1 FY24, Revenue increased by 13% YoY, backed by steep growth in the Life Sciences & healthcare and manufacturing sectors. In Q2 FY24, the company reported revenue growth of 7.9% YoY, reaching ₹59,692 crore, and a Net Profit increase of 8.7%, reaching ₹11,380 crore. The operating margin for the quarter stood at 24.3%, reflecting a QoQ increase of 110 basis points, driven by enhanced utilization and productivity, coupled with optimized sub-contracting and discretionary expenses.

For Q3 FY24, Company reported only 4% YoY Revenue growth as it was a seasonally weak quarter and weaker macroeconomic headwinds contributed to the slowdown.

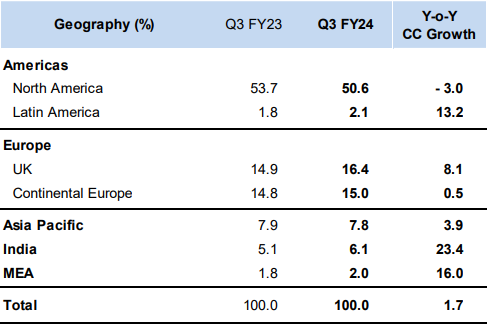

Despite macro uncertainties, the company showcased improved performance during the quarter, driven by strong double-digit growth across emerging markets, particularly in India, experiencing a ~23% YoY surge.

Here is an overview of geography-wise market growth of TCS:

The company faced sequential challenges with a ~2.5% decline in net profit, attributed to seasonal furloughs and rising discretionary expenses.

TCS maintained a robust order book, reaching $8.1 billion during the quarter, reflecting a strong deal momentum across various markets. The company continued to focus on operating model transformation, vendor consolidation, and enterprise IT as a service, driving growth in artificial intelligence, industrial IoT, and digital adoption.

SWOT Analysis of TCS Stock

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses,

opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strength

Over the past decade, TCS has continued to grow at a 10-year CAGR of around 20%, solidifying its position as one of India’s fastest-growing companies and a prominent member of the Nifty 50. It has also maintained its margins during various market conditions. So overall, TCS is a trusted company, and the management has continually delivered, making handsome returns for its shareholders.

Robust pipeline, strong order book, and new deals wins are the key highlights. Additionally, operational efficiency and better Day sales outstanding cycle should support the company’s outlook further. High Dividend Payouts and Buybacks- TCS has been a generous payer to shareholders and has paid 70% of its cash flows from FY05 to FY20. It has paid about 80% of its cash flows as dividends since FY15.

To identify high dividend paying stocks, you can use StockEdge Scans.

TCS is recognized as a top employer brand across the major markets it operates in, including North America, Europe, the UK, India, Latin America, and Australia, among others. It has an employee base of 600,000+ employees of which about 35%+ are women. TCS’ significant organic investments in manpower training and developing capabilities have also given it a competitive edge and helped it capture many transformational digital deals.

Weakness

High concentration in the BFSI vertical – The Company has a high concentration of revenues, primarily in the BFSI (~39%) segment. Demand for the sector in the past has been adversely impacted by the macro- economic conditions. Challenges were evident in segment-wise and geography-wise performance during Q3 FY24, with de-growth in verticals like BFSI, Technology & Services, Communications & Media, and Consumer Business.

Opportunity

TCS has a strong order book and is continually adding new deal wins to its pipeline as the demand continues to be strong for cloud and digital technologies as enterprises are investing for the future. The management believes its investments in the areas of future technologies, such as battery management software for electric vehicles, will help them to participate in larger deals going forward.

TCS’s intellectual property portfolio, highlighted by Ignio and TCS BaNCS, continues to contribute significantly. Looking forward, the company remains optimistic about Gen AI, AI, and digital adoption, focusing on existing levers such as employee utilization and productivity to enhance margins. The management anticipates sustained growth driven by robust deal wins and prioritizes strategic areas aligned with evolving client needs.

There could be some continued headwinds from supply-side challenges in FY24, which may have an impact on margin performance. Margins are expected to remain under pressure in the near term. It is anticipated that Europe will be contributing more towards the Revenue in the next two quarters.

Threat

Slowing revenue growth from traditional outsourcing business- The IT services industry has been facing headwinds in the form of slowing demand for traditional services such as application development and maintenance as well as infrastructure management services (IMS), which have been negatively impacted by Social, Mobility, Analytics and Cloud computing (SMAC) and artificial intelligence (AI), commonly referred to as digital technologies.

Attrition and Employee loyalty- Higher attrition rates would lead to higher costs for the company and could affect margins. Bigger MNCs are entering India and competing for global clients from the likes of Accenture, Infosys, HCL, and many others.

The Bottom Line

The IT sector has strong structural growth drivers in place because as organizations modernize, they will be using even more technology (data analytics and AI) to differentiate themselves. So from a long- term perspective, the company would likely be a decent compounder.