Table of Contents

The Indian industrial conglomerate turned 106 years old in 2024.

Lala Kamlapat Singhania was the founding father of J.K Organization. Born into a Marwari Bania family in Kanpur, his first major business setup was a cotton mill that laid the foundation of JK Group.

The name JK is derived from the initials of Kamlapat and his father Seth Juggilal. JK Group was founded in 1918. During the 1950s to 1980s JK Group became the third largest Indian conglomerate after Birlas and TATAs.

JK Group – The Beginning

Kamlapat Singhania was from a business family. His father was a successful businessman. In the early days, Kamlapat Singhania joined his family business and assisted his father in expanding the business from traditional money-lending operations to trading in areas such as cotton, pulses and sugar cane.

In 1918, business was split between Kamlapat and his brothers. Then Kamlapat decided to start a cotton mill along with his father. in 1921. JK Cotton Spinning & Weaving Mills produced cotton cloth and yarn and was a successful venture.

Rise of JK Group

After the success of his first venture in cotton mills, he went on to set up several mills.

- 1921 – Kamla Ice Factory

- 1924 – JK Oil Mills

- 1929 – JK Hosiery Factory

- 1931 – JK Jute Mills

- 1932 – JK Cotton Manufacturers Ltd

- 1934 – JK Iron & Steel Co Ltd.

Today, JK group has multi-business, multi-product, and multi-location operations across geographies outside of India having overseas manufacturing operations in Mexico, Indonesia, Romania, Belgium, Portugal, the UAE, and Switzerland.

JK Group – The Business House

The business house J.K Organization has four major listed companies in the stock market. Here is the list of JK group stocks.

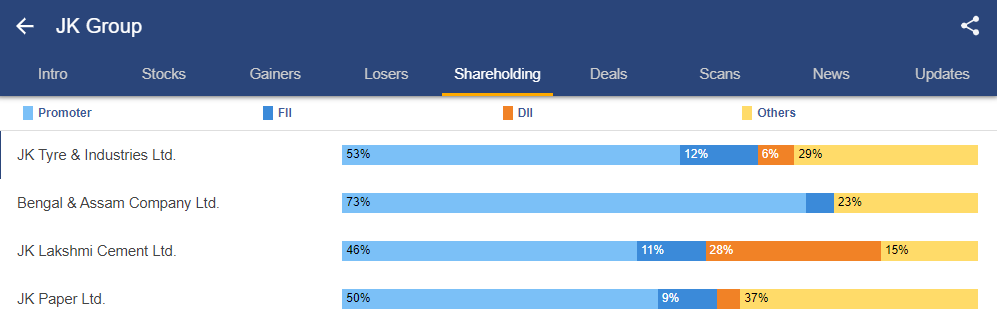

You can compare the list of stocks under JK group as shown in the image below:

Out of the 4 listed entities of JK Group, the company with the highest market cap is JK Tyre & Industries Ltd., which is the flagship company of the entire JK Group today.

JK Tyre & Industries Ltd.- The Flagship Co.

Established in 1951, JK Tyre & Industries Limited is one of India’s foremost tyre manufacturers and among the top 25 manufacturers in the world.

History of JK Tyre

The company was incorporated as a private limited company on 14th February 1951 in West Bengal. Until 1970, it was engaged in managing agency business. In 1972, the company obtained the letter of intent to manufacture tyres and tubes. Later, the letter of intent was converted into an industrial license, and JK Tyre & Industries became a public limited company.

It also entered into technical collaboration with General Tire International Co., U.S.A. (a subsidiary of General Tire & Rubber Co., U.S.A.) for technical services for a period of 5 years.

Today, JK Tyre has been leading the way in innovation and excellence within the tyre industry. They introduced groundbreaking technologies and products to serve various sectors within the automobile industry.

JK Tyre shares

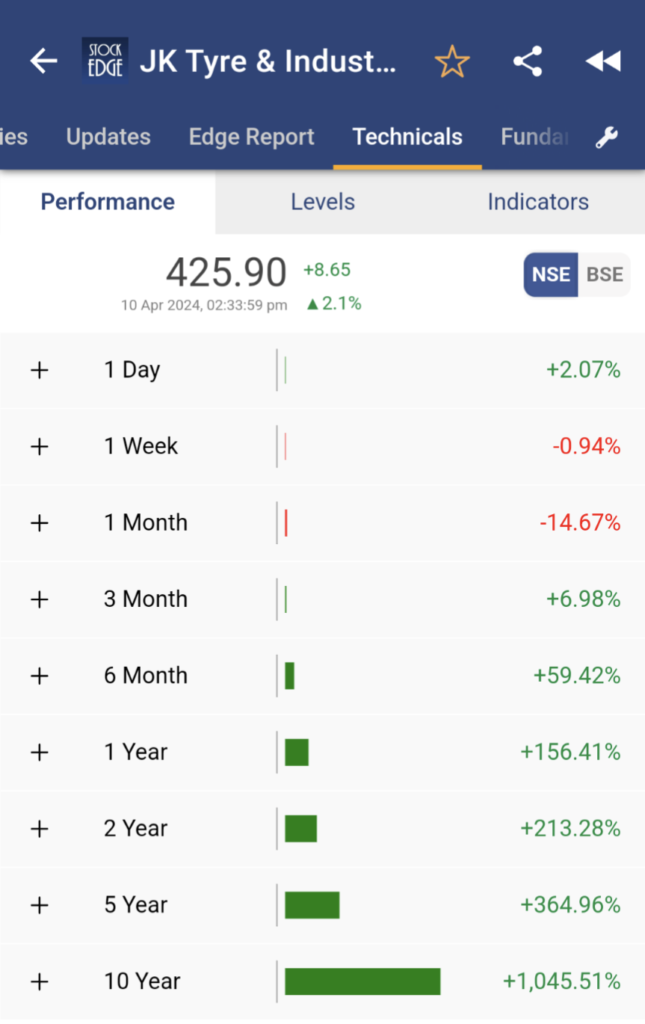

JK Tyre shares were listed on the National Stock Exchange (NSE) on 19th March 2007. Since then, JK tyre shares have been performing phenomenally. JK Tyre share has given an absolute return of more than 1000% in the past 10 years. You can check JK Tyre’s shared performance.

JK Tyre & Industries is one of the flagship companies of JK Group. There are other subsidiaries which are both public and private limited companies.

Other Subsidiaries of JK Group

JK Paper Limited Established in the year 1962, JK Paper Limited is the leading player in office papers, coated papers and packaging boards. The company is a part of the prominent JK Group.

JK Lakshmi Cement Limited Established in 1982 in the small district Sirohi, Rajasthan. The company has become a renowned name in the Indian cement industry. It has a formidable presence in the northern & western part of India. The current capacity stands at 5.60 Million MT per annum.

Bengal & Assam Company Limited Established in 1947 in the state of West Bengal. The company is involved in the business of holding investments and other financial assets of other group companies. It is duly registered as a Non-Banking Financial Company (NBFC) with RBI.

Shareholding of JK Group

Wondering! Out of 4 listed entities of JK group, which has the largest promoter holdings or which stock is held by FIIs or DIIs?

You can easily track the shareholding pattern of JK group’s stocks

Conclusion

JK Group has more than a century’s legacy in diversified businesses. Using StockEdge’s Business House feature, you can explore different conglomerates of the Indian business world. Explore the business domains the TATAs or Birals are into to identify opportunities in the stock market.

Major business conglomerates such as Reliance and Adani are integral to a nation’s economy, significantly contributing to its GDP. In many developing economies, the industrial landscape is shaped by these business groups. In India, 90% of businesses are family-owned, playing a pivotal role in the development of the economy.