Table of Contents

Introduction

In today’s world, we spend a lot of time on social media like Facebook, WhatsApp, and Instagram, and we use tools like Microsoft Excel and Microsoft Word every day at our work.

Additionally, we rely on premium devices like Apple products and chips made by companies like Nvidia, Intel, and Qualcomm.

But did you know you can do more than just use these products?

You can actually invest in these companies and become a part owner. Instead of just being a consumer of these products, you can be a shareholder of your favourite companies!

This is where International mutual funds step in.

Being an Indian resident, international mutual funds are currently one of the best ways to invest in global markets and foreign companies.

So, why not consider investing in the companies you love and potentially grow your money along with them?

Let’s explore in depth such funds, their role, their investment strategies, the risks involved with international funds, the steps to invest in such funds, and some top recommendations from StockEdge.

Understanding International Mutual Funds

Defining International Mutual Funds

As the name suggests, international mutual funds are those that primarily invest in equities and equity-related assets of foreign countries.

As per SEBI norms, international mutual funds have to invest a minimum of 95% of assets outside India, including any equity companies listed abroad, ADRs and GDRs of Indian companies, ETFs of other companies, and mutual fund units of foreign companies.

The Role and Importance of International Mutual Funds in a Portfolio

One of the significant roles of international mutual funds is diversification to international markets wherein an investor cannot directly invest, potential growth opportunities in global leaders, and exposure to a broader range of industries and sectors that may not be available in the investor’s country.

International Mutual Funds also offer options to invest in Emerging markets, which provide endless growth opportunities. They offer the opportunity to invest in multiple economies and diversify the portfolio with unique business models, investment themes and ideas, and different types of strategies, providing a hedge against possible domestic market corrections, if any.

Analyzing the Nature and Types of International Mutual Funds

Equity Funds, Fixed Income Funds, and Index Funds

International Mutual funds have similar types and bifurcations as Indian mutual funds. They are typically divided into Active and Passive investing styles.

An Equity fund is an equity-oriented actively managed international mutual funds in which the fund manager directly invests in foreign equity or companies listed outside of India. These funds usually fall under the Equity: Thematic category and the fund manager makes direct buying and selling decisions.

For example, ICICI Prudential US Bluechip Equity Fund and Nippon India US Equity Opportunities Fund is an active Index fund that invests in all the top Bluechip companies listed on the Nasdaq Stock Market in the U.S.

An Index Fund is a passive style of international mutual funds where the fund manager directly invests in the broader market for Foreign Equity by investing in its Index.

For example, Motilal Oswal NASDAQ 100 FOF is a passive Index fund that invests in all the components of the 100 largest non-financial companies listed on the Nasdaq Stock Market in the U.S., based on market capitalization.

Fixed-income funds are like a basket of bonds from various countries. They offer the chance to earn fixed interest from governments and companies worldwide, spreading risk across countries while potentially earning higher income from diverse sources.

For example, Bandhan US treasury bond 0-1 year FoF is a Debt Mutual fund that invests in JP Morgan’s ETF which in-turn invests in US treasury bond 0-1 year.

Country-Specific vs. Region-Specific Funds

Country-Specific Funds: These funds focus on a single country’s stock and bonds and diversify their portfolio by investing only in particular country-specific stocks like that of the U.S. or Japan, etc. The portfolio remains concentrated in a specific country but with an aggressive stance of benefiting from the economic reforms of that country.

Region-specific funds, as the name suggests, focus on specific geographical regions of the world, such as Europe, Asian countries, or the Greater China region.

By targeting particular geographic areas, these funds look to explore opportunities in all countries within that region.

The Benefits of Diversifying with International Mutual Funds

Access to Global Markets

International Funds give exposure to different companies from different markets, reducing the risk by not relying on one market.

It gives investors the opportunity to invest in emerging markets and industry leaders from around the world. It also provides unique opportunities to invest in businesses that are domestically not available.

The growth prospects of such international funds are not restricted to a country, and investors can participate in the company’s future growth by investing in them.

Risk Diversification

Diversification across countries and currencies helps to mitigate the impact of adverse economic events like war, global recession, or pandemic situations.

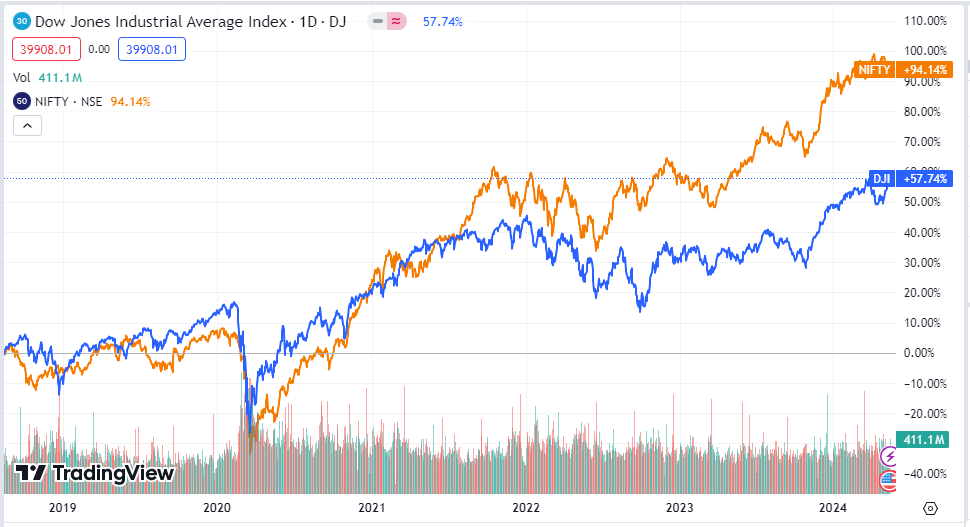

Domestic markets have a weak correlation with International markets as per the historical data of India and the U.S., which indicates both markets have a low correlation of about 0.4 — 0.43.

For instance, in 2008, the global market crashed during the financial crisis, which led to a 52% fall in the BSE Sensex and a 34% fall in the DJIA (Dow Jones Industrial Average) Index.

In 2011, when the Indian Index Sensex fell 24%, the DJIA Index gained by 5%.

For investors, low correlation gives them an opportunity to diversify their investments outside India, with exposure to international funds.

Top International Mutual Funds in India for 2024

Criteria for Selection

An investor exploring investment options outside India can look at International Mutual Funds for a decent return. However, many investors rush to follow past returns, which is not the correct strategy.

Here are a few things an investor should know before investing in International Mutual Funds.

The investment must be selected based on your views aligning with the investment objective and entirely on the fund’s potential to perform. A biased view never works in the long run.

Select your international mutual fund carefully and allocate a fixed percentage of your total portfolio size ( say 5% to 10%) with a horizon for long-term investment, a minimum of a five-year horizon.

Don’t over-diversify your exposure. Investing in one to two well-diversified international mutual funds can work better for you. You can hold multiple funds only if your portfolio size is large.

As always recommended, SIPs are the best way to invest as they average out the price and reduce the possibility of a sudden downfall in the value of your investments.

Overview of Leading Funds

StockEdge has shortlisted some funds based on their Assets Under Management, the theme/strategy followed by the fund, and the low expense ratio charged by the fund to maximize returns in the long run. You can check under MF Investment Themes under Mutual Funds section in StockEdge Web.

1. Motilal Oswal Nasdaq 100 FoF – Direct Plan:

This fund tracks the U.S. Index Nasdaq 100, which comprises 100 large-cap non-financial companies listed on the Nasdaq Stock Market. It gives Indian retail investors an easy way to invest in U.S. technology-based companies that are global leaders.

2. Franklin U.S. Opportunities Fund- Direct Plan:

This fund invests in Franklin India Feeder Franklin US Opportunities Fund, a mutual fund that is listed in the U.S. It is an Index fund with the same weightage as companies listed in the U.S.

3. ICICI Prudential U.S. Bluechip Equity Fund- Direct Plan:

It is an actively managed fund focusing on investment in large-cap U.S. companies with a track record of steady returns of 15%+ returns since inception. It gives investors an opportunity to gain from the growth prospects of the U.S. market.

4. Mirae Asset NYSE FANG+ ETF FoF – Direct Plan:

It is a passive investment that invests in Mirae Asset NYSE FANG+ ETF, which in turn invests in NYSE FANG+ TRI, which consists of the top 10 companies in the U.S. based on its market capitalization.

5. Edelweiss U.S. Technology Equity Fund:

As the name suggests, this fund invests in U.S. technology companies, exposing Indian investors to the innovative and fast-growing tech sector in the United States.

6. Nippon India Japan Equity Fund:

This fund invests in Japanese shares, giving Indian investors access to the growth prospects of one of the world’s largest economies and the most technologically advanced countries.

7. HDFC Developed World Indexes FoF – Direct Plan:

This fund is a passive investment strategy that owns mutual fund units of overseas Index Funds or ETFs that correspond to the MSCI World Index. It has exposure to five major regions of the world.

8. DSP Global Innovation FoF- Direct Plan:

This fund follows a passive strategy by investing primarily in BlackRock Global Funds—Global Allocation Fund I2 USD. It also invests in Indian equity, fixed-income instruments, and money market instruments to maintain liquidity from time to time.

Investment Strategies for International Mutual Funds

Active vs. Passive Fund Management

As we discussed earlier, International Mutual Funds have two styles of investing- commonly known as Active and Passive Fund Management.

The active style focuses on the fund manager selecting specific stocks in sectors or themes where the manager is aggressive about future earnings and growth.

Indian retail investors look at major US companies that are global leaders, and investment may not be available in domestic companies.

A passive approach to fund management involves the fund manager investing in a whole basket of securities that tracks the performance and composition of International Indices like the S&P 500, Dow Jones Industrial Average, and HangSeng Index, among others.

Currency Risk Management

International mutual funds expose investors to different currencies of different countries, which can be beneficial if the home currency is underperforming. Diversification by investing across countries and foreign currencies can reduce the impact of adverse economic events in domestic countries.

Investing in overseas funds also acts as a hedge against the rupee, which has been continuously depreciating against the dollar index.

1 USD cost around Rs. 40 in 2000; presently, INR to USD is trading at Rs. 82 in 2024. This means if an investor had invested Rs. 1000 in USD, it got returns of 12.19 dollars (1$= 82). Now, if the value of investment rises to, say, 15 dollars. At the time of redemption, if $ has moved to Rs.85. The value of an investment will be Rs. 1275 (15$ * ₹85) instead of Rs. 1230 (15$ * ₹82) had the rupee value remained constant at Rs. 82.

This increase in dollar price helps an investor generate an extra 4.5% gain by simply doing nothing. (₹45 difference from change in dollar value).

Risks and Considerations When Investing in International Mutual Funds

Market Volatility and Political Risks

There are certain risks an investor should be aware of before they pour their money into International Mutual Funds.

Investing in International Mutual Funds exposes an investor directly to the country’s geopolitical risk, any risk arising through events, government risk, change in economic policies, etc., whose information might not be readily available.

Investing in such funds also involves currency fluctuation risks. Exchange rate fluctuations might impact the overall returns for the investors, dragging down the returns.

Liquidity risk is another risk that investors face when investing in schemes with narrow objectives or schemes with low assets, making it difficult to exit at the chosen NAV.

An investor should regularly track the fund’s performance, any update in the scheme’s objective, news inflow and economic data for that particular country or region or the themes he has invested in.

Currently in India, general elections are taking place which might affect the market in the short term, following which there can be volatility in International Mutual Funds as well because of the uncertainty of the government coming in power.

You can also check out our recent blog which talks about Top 5 Sectors for Lok Sabha Election in 2024.

How to Invest in International Mutual Funds from India

Steps to Get Started

Now that you have gained ample knowledge about international mutual funds, let’s understand the steps to selecting the funds that are best for your portfolio.

There are no hard and fast rules, but some steps mentioned below can help you make an informed decision.

Step 1: Identify the sub-category of the International Fund that fits best based on investment goals and risk tolerance.

Step 2: Choose the geography or location in which you would like to invest.

Step 3: Compare the selected fund’s performance to its benchmark index to analyze its performance and consistency of returns. Check the fund’s track record, portfolio holding, and expense ratio.

Step 4: After selecting the fund, you can invest directly from the Fund House website by creating a login I.D. or through a full-time/discount broker account.

Step 5: You can invest regularly either via lump-sum or SIP mode. It is advisable to stay invested for more than five years to avoid any market risk.

International mutual funds taxation

International mutual funds majorly invest in equity and equity-related instruments of foreign companies. However, as they do not invest in Indian equity, they are not qualified under equity funds.

The purpose of taxation is the same as that of Debt funds.

Therefore, Debt mutual funds will be taxed on international mutual funds irrespective of the LTCG and STCG holding period. They are taxed flat as per the investors’ income tax slab rates.

Conclusion

To conclude, investing in foreign mutual funds in India is an intelligent way to diversify your investments and earn more money. There are lots of options to choose from, like funds that focus on different industries or parts of the world. But before you jump in, it’s essential to do your homework.

Recently, SEBI directed mutual fund houses to stop accepting fresh investments in ETFs. RBI has set an industry limit of 7 billion dollars for investments made in overseas securities, which has come close to 85% of the limit. So, investors should stay cautious and do proper research before investing in a particular mutual fund or an ETF which are investing in international markets.

Investors should also examine the funds’ past performance, who manages them, their cost, and their riskiness. By examining these factors, investors can make better decisions and take advantage of opportunities in global markets.