Key Takeaways

- Fundamentals & Purpose: An IPO is a company’s first public share offering to raise large capital, boost brand visibility, offer investor exits, and enhance share liquidity.

- IPO Process: The journey includes appointing underwriters, SEBI registration, drafting the Red Herring Prospectus, roadshows, SEBI approval, pricing, public subscription, and final listing.

- IPO Evaluation: Key evaluation factors include sector performance, investment horizon, IPO prospectus, valuation metrics (P/E, P/B), and Grey Market Premium (GMP) trends.

- StockEdge’s Role: StockEdge simplifies IPO investing by offering a dashboard with details on active/upcoming IPOs, subscription data, promoter holdings, facilitators, and access to IPO prospectuses.

- Edge Reports for Informed Decisions: StockEdge’s IPO notes provide company background, financials, SWOT analysis, key timelines, and grading to help investors make better IPO investment choices.

Table of Contents

2024 has been a landmark year for Initial Public Offerings (IPOs) in India, reflecting the country’s strong economic growth and rising investor confidence. From January 1 to December 31, the capital market witnessed a cumulative issue of ₹1,89,897.7 crore through 341 IPOs, including both Main Board and SME listings. Of these, 294 IPOs delivered positive returns, showcasing the immense potential for wealth creation in the IPO market.

In this article, you will learn about what an IPO is, why companies issue it, how it works, and how to analyze IPOs using StockEdge, which simplifies your investing journey in IPOs.

What is an IPO?

When startups need funding, they typically have two primary options: either they take loans from banks or financial institutions, or they raise capital by selling equity to venture capitalists or private equity firms. In their early stages, startups often attract investments from prominent investors. Shark Tank India is the best example to understand this cycle.

As these startups grow and mature, they often take the next big step by launching an Initial Public Offering (IPO). An IPO is the first time a private company offers its shares to the public, enabling it to raise capital from a broader pool of investors, including individuals and institutions.

However, the main question that comes to mind is, if companies can raise money from venture capitalists and banks, why go for an IPO?

Why do companies issue IPO?

Companies can raise money from private investors or venture capitalists, but they opt to launch an initial public offering (IPO) due to the multiple benefits it offers. Here are the key reasons why companies launch an IPO:

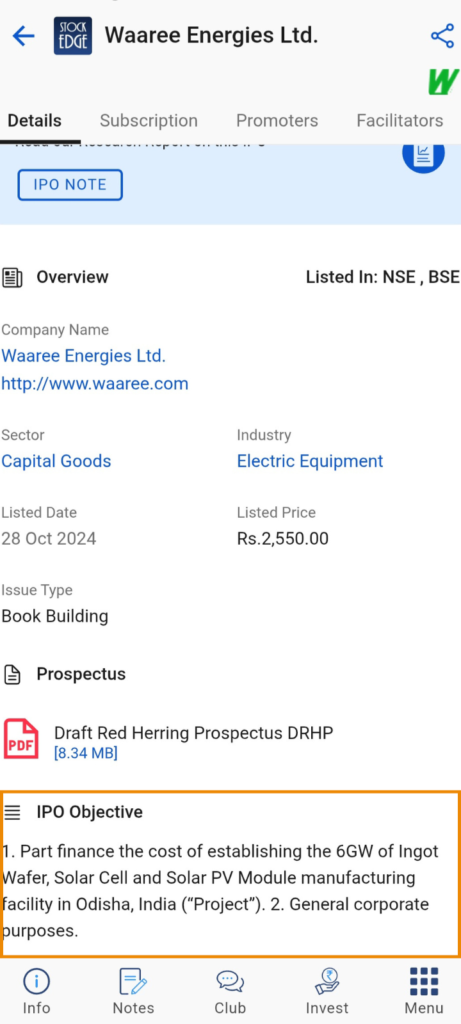

Raise Large Capital

The primary objective of an IPO is to raise substantial funds for business needs. They use IPO proceeds to finance projects, repay loans, expand operations, or provide an exit to early investors. It’s challenging to raise large sums from private investors or banks alone, and IPOs offer access to vast public capital. For example, the IPO of Waaree Energies Ltd. made its debut and planned to allocate the net proceeds of ₹2,775 cr towards a 6 GW addition of ingot wafer, solar cell and solar PV module manufacturing facility.

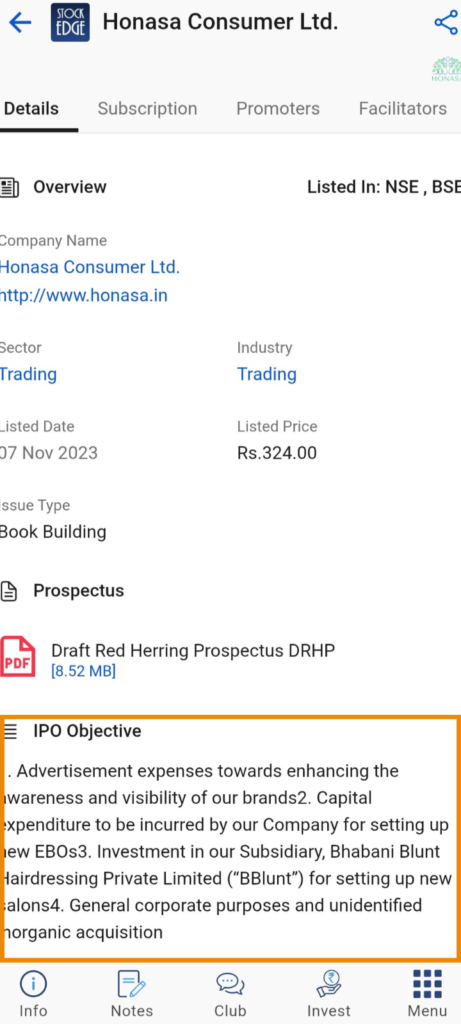

Build a Better Public Image

Launching an IPO requires meeting strict regulatory and financial standards, which enhances the company’s reputation. The marketing efforts associated with an IPO boost the company’s visibility and brand recognition. For example, the IPO of Honasa Consumer Ltd. made its market debut on November 10, 2023, aiming to raise ₹182 crores for advertisement expenses to enhance the visibility of the brands.

Provide Exit Opportunities for Investors

IPOs allow venture capitalists and other investors to sell their equities and realize profits on their investments. Sagility India Limited recently entered the market with an IPO, seeking to raise ₹2,107 crore by offering existing shares to the public. Also known as Offer for Sale (OFS).

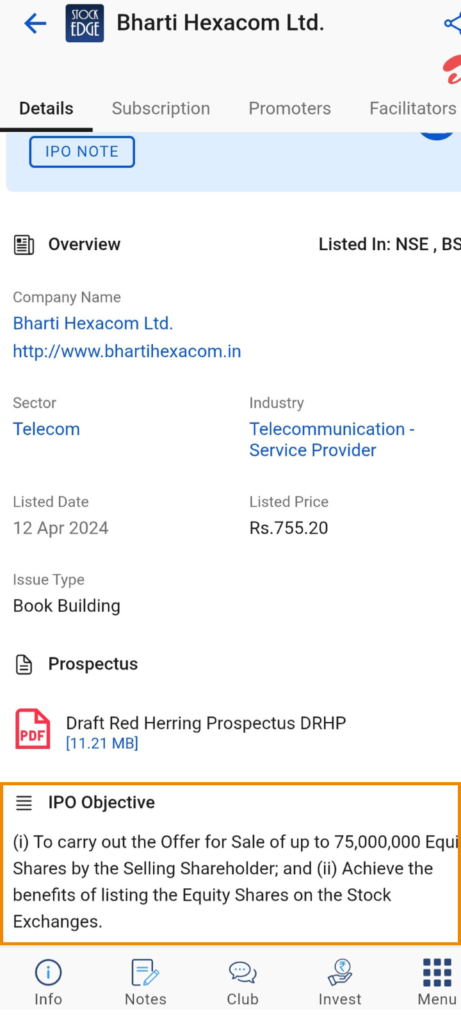

Enhance Share Liquidity

When a company debuts on stock exchanges after an IPO, it becomes easier for investors to buy or sell it. Liquidity attracts a broader range of investors and can lead to a higher valuation. Bharti Hexacom issued an IPO to achieve the benefits of listing its Equity Shares on the Stock Exchanges.

How does an IPO work?

Going public marks the pinnacle of startup success. But how does the IPO (Initial Public Offering) work? Let’s break it down into eight stages.

Step 1: Appointing the Investment Bank

The IPO journey starts with appointing an investment bank or a group of underwriters. Think of them as financial advisors and navigators for the IPO process. These experts evaluate the company’s financial health, future growth plans, and funding needs.

The underwriters don’t just offer advice, but they also assure you of how much money the IPO will raise. Big names like Goldman Sachs, Morgan Stanley, JM Financial, and Kotak Securities often lead the charge. They’re also called Book Running Lead Managers.

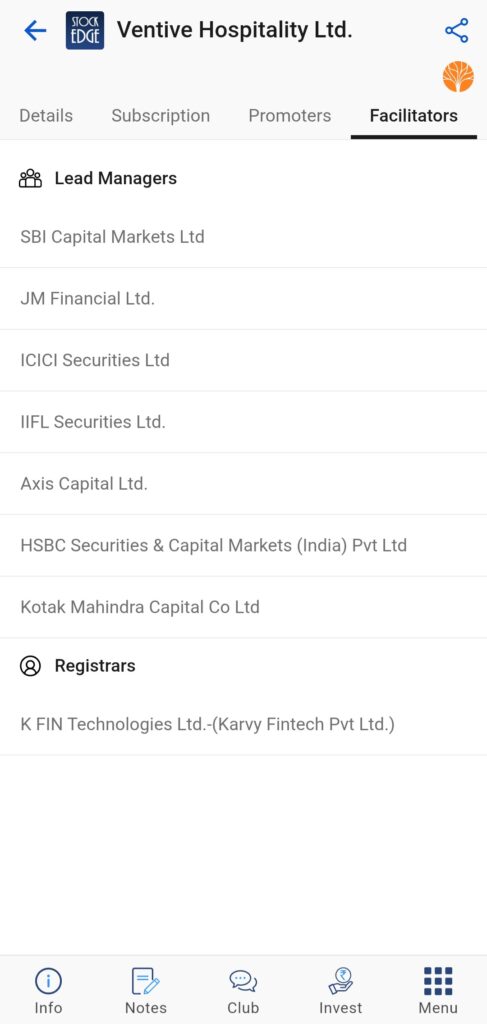

In stockedge, you can check out the list of lead managers and registrars on the Facilitator tab of the IPO section.

Step 2: Registering with SEBI

Next, the company, along with the underwriters, prepares a document filled with crucial details about the business. This is submitted to SEBI (Securities and Exchange Board of India), the regulatory body that ensures everything is transparent and investor-friendly.

SEBI reviews this offer document to ensure compliance with all rules and investor protection.

Step 3: Drafting the Red Herring Prospectus (RHP)

An initial prospectus is created with the help of underwriters. It details the company’s financial records, plans, and estimated share price range. This prospectus is known as a Red Herring Prospectus (RHP) because it includes a warning that the IPO is pending SEBI approval. Prospective investors who may be interested in purchasing the shares are then shared with it.

Step 4: Going on a Roadshow

Before the IPO goes live, the company’s executives literally hit the road doing roadshows visiting major cities, meeting investors, corporate leaders, and Qualified Institutional Buyers (QIBs).

This “roadshow” is a marketing blitz where the company shares its story, growth potential, and why investing in its IPO could be a smart move.

Step 5: SEBI Gives the Final Confirmation

After reviewing the documents and suggested amendments (if any), SEBI gives the go-ahead for the IPO. The company is now free to pick a listing date and prepare for the big day!

Step 6: Pricing the IPO and Deciding the Number of Shares

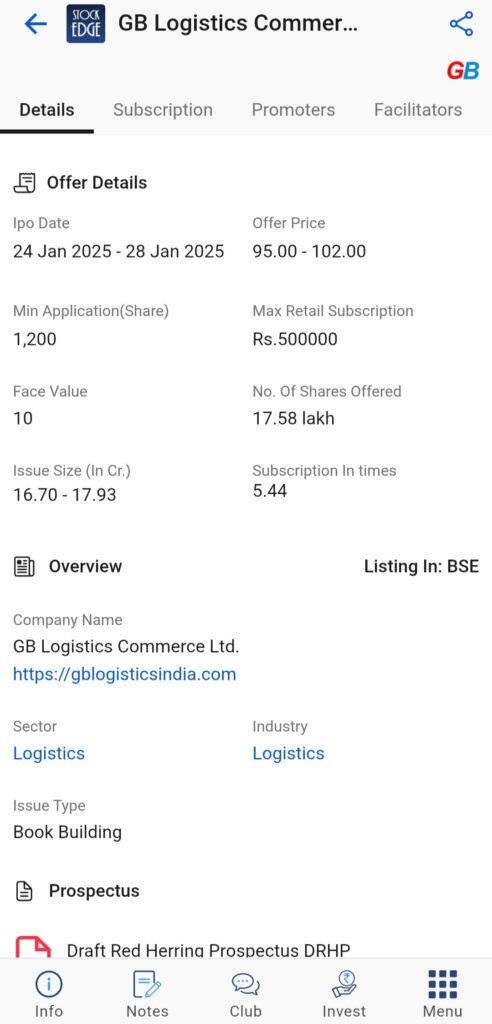

After receiving SEBI permission, the firm, with the assistance of the underwriter, determines the fixed price or price band for the shares and the number of shares to be sold.

There are two categories of difficulties.

- Fixed Price: The issuer determines the issue price and includes it in the offer document.

- Book Building: Price discovery through the book-building process occurs when the price is established based on the highest bid received at a specific price within a specified price range.

Step 7: The IPO Goes Public

Finally, it’s showtime! On the planned date, the IPO will be open to the public for a limited period (usually three working days). Investors can apply for shares online or offline through designated banks and brokerage firms. NSE has also made the process a bit smoother by reducing the equity IPO listing timeline from T+6 to T+3.

Step 8: Share Allotment and Stock Exchange Listing

Once the IPO closes, the company reviews all subscriptions and determines the final price for share allotment.

If the IPO is oversubscribed (there is more demand than available shares), some investors may receive refunds in their bank accounts. After allotment, the company is listed on the stock exchange, and trading begins!

Now, the big question arises of how to analyze an IPO.

How to Evaluate an IPO?

Evaluating an IPO is crucial for making informed investment decisions. IPOs are unique investment opportunities that offer potential rewards and risks. To assess an IPO effectively, you need to consider several factors, from the company’s fundamentals to market conditions.

Understand Sector Performance

Before investing in IPO, research the sector in which the company operates. Consider factors like sector growth, future prospects, and the company’s position within its industry. A strong, growing sector generally offers better investment opportunities. Make sure the company has a competitive edge that will help it thrive in the market.

Plan Investment horizon

Decide if you are looking for short-term gains or long-term investments. If you’re aiming for quick profits, you should focus on the market sentiment and trading momentum around the IPO. For long-term investments, consider the company’s fundamentals and how it aligns with your financial goals.

Read the IPO Prospectus

The prospectus is a crucial document that provides detailed information about the company, its financials, and the IPO itself. It’s essential to read and understand the prospectus carefully before investing. Now, the main question is, where can you find IPO prospectus?

IPO prospectuses can be found on the company’s website, the stock exchange’s website, or SEBI’s website. StockEdge also offers access to the prospectus.

Valuations

Valuation metrics are critical to understanding if the IPO is priced reasonably:

- P/E Ratio: Compare the price-to-earnings ratio with similar companies to check if it’s undervalued or overpriced.

- P/B Ratio: Analyze the price-to-book ratio to gauge the market’s valuation relative to the company’s book value.

Grey market premium

The Grey Market Premium (GMP) indicates how much investors are willing to pay for shares in the unofficial market before the IPO is officially listed. A high GMP can indicate strong demand and market interest, while a low GMP may suggest weak market sentiment. While not a foolproof indicator, the GMP provides valuable insight into the IPO’s perceived value.

To simplify your evaluation process, StockEdge offers a comprehensive Edge Report on upcoming IPOs. This report provides a detailed analysis of the company going public, including its financials, issue details, and sector outlook. With this information, you’ll have a clear answer on which IPOs are worth applying for, making your decision easier and more informed.

How can StockEdge make it easier to invest in IPOs?

StockEdge provides a seamless and user-friendly platform to simplify your IPO investing journey. Here’s how StockEdge helps you:

Track Active and Upcoming IPOs

StockEdge provides a comprehensive IPO Dashboard that helps you monitor active, upcoming and listed IPOs. Here are the features:

Details Tab

This section provides details of the mainboard IPO (large and established company) and SME IPOs, including the IPO date, offer price, minimum share, maximum retail subscription, issue size, company overview, listed date, prospectus, and IPO objective.

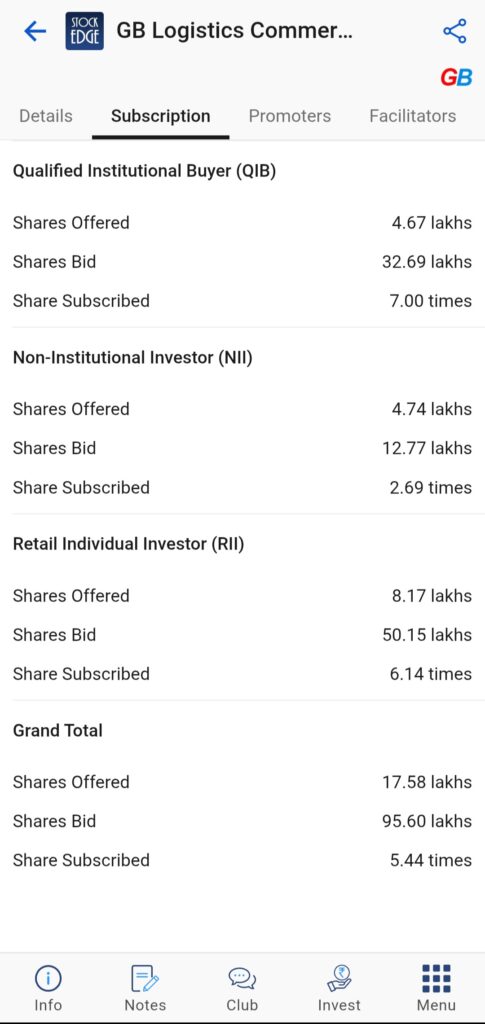

Subscription Tab

Subscription data shows interest of Qualified Institutional Buyers (QIB), Non-Institutiional Investors (NII), Retail Individual Investors (RII), and Employees (EMP) in an IPO. If the value is greater than 1, it suggests that there’s an enthusiastic over-subscription by that segment. Conversely, a value less than 1 indicates that there might be a bit less interest in this area IPO.

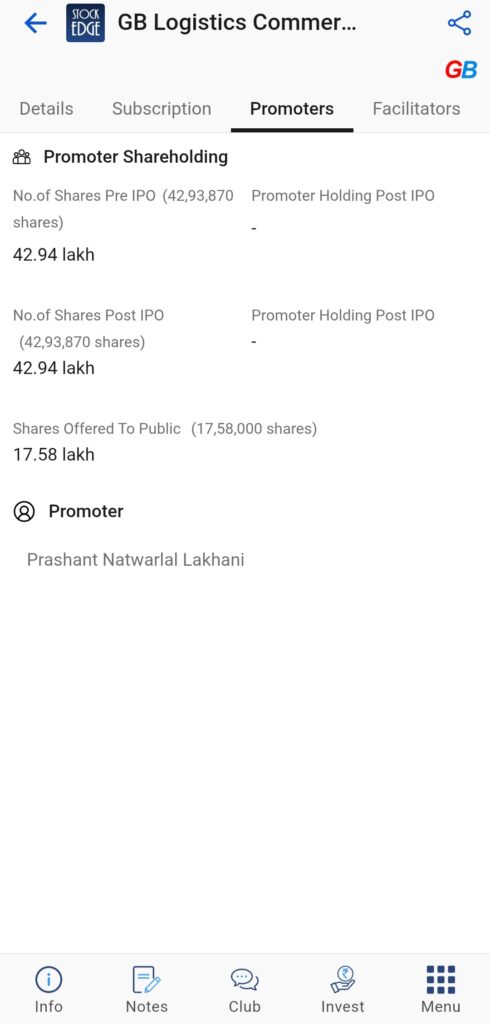

Promoter Tab

In this tab, you will provide an overview of the percentage of shares sold by the promoter, showing both pre- and post-IPO holding. A higher promoter stake is generally favourable, as it reflects a stronger sense of responsibility. Typically, a more significant stake indicates that the promoter is more likely to drive the company towards tremendous success.

Facilitators

Facilitators are individuals who assist a company throughout the entire Initial Public Offering (IPO) process, which encompasses Lead Managers, Syndicate Members, and Registrars. In this section, you will get the list of facilitators.

Access Edge Reports

IPO notes are comprehensive reports that provide detailed insights into a company offering shares to the public for the first time. These reports cover multiple aspects of the IPO, such as the company’s background, products, market outlook, competitors, risks, and promoter shareholding. The financial information is derived from the Draft Red Herring Prospectus (DRHP). It includes key details like the profit and loss statement, balance sheet, cash flow statement, and important metrics from the past three years. It helps you to make informed decisions while investing in IPO.

The report also includes a SWOT analysis that outlines the company’s:

- Strengths: Highlighting any competitive advantages or MOAT (economic moat) the company may have and potential future growth avenues.

- Weaknesses: Identifying internal issues the company faces that could hinder its performance.

- Opportunities: Exploring future growth prospects and potential market expansions.

- Threats: Addressing external challenges, particularly from competitors or market conditions.

Additionally, the IPO notes provide critical timelines, detailing the issue date, price band, bid lot, and IPO listing date, helping investors track the key dates. Investors are also given a grading system that evaluates the company’s IPO proposal on a scale ranging from “poor” to “excellent” based on the comprehensive evaluation of the factors above.

FAQs

What is the minimum investment for an IPO?

The minimum investment for an IPO varies based on the lot size and the category of investor you are. The minimum investment for retail investors in an IPO is usually around Rs 15,000 for mainboard issues. For SME IPOs, the minimum lot size is around Rs 1,25,000.

Can I apply for multiple lots?

Yes, you can apply for multiple lots in an IPO as long as your total investment doesn’t exceed ₹2,00,000. For example, if the price per lot is ₹15,000, you can apply for up to 13 lots. However, if the IPO is oversubscribed, you may not get the full number of lots you’ve applied for.

How is an IPO allotted?

IPO allotment is the process by which the shares are distributed to investors who have applied for them. Here’s a short overview of how it’s typically done:

- Applications Received: Investors (retail, QIB, NII) submit their applications, specifying the number of lots they wish to apply for.

- Oversubscription: If the IPO is oversubscribed (there is more demand than available shares), shares are allocated using a pro-rata (proportional) allotment method. This means that the number of shares allotted to each investor is proportionate to their application size.

- Retail Investor Allotment:

- If the IPO is oversubscribed, retail investors might not get the full number of lots they applied for.

- If the issue is under-subscribed, retail investors will receive the full allocation.

- Basis of Allotment: The allotment is done based on a random draw if there’s a tie between applicants (especially for retail investors). For QIBs and NIIs, it’s typically based on the bid amount and demand.

- Refunds: If you don’t get the entire allotment, the remaining funds will be refunded. The shares you receive will be credited to your Demat account.

Are IPOs profitable?

Investing in IPOs can be profitable, especially if the stock lists at a higher price than the issue price (listing gains). However, profitability depends on various factors like market demand, company fundamentals, and market conditions.

How do I access the IPO Notes?

IPO Notes is one of the paid tools offered by the StockEdge app that help you in investing in IPOs. Check out StockEdge’s premium plans to get the most out of it. Check out StockEdge Offers to find the best deals to subscribe. You can also check out our blog Edge Insights: A Gateway to Stock Insights.