Markets often reward patience before speed. Some of the strongest price moves in equities do not begin with sudden excitement, but after long periods of quiet consolidation, where the price appears to go nowhere. These phases are usually ignored by most participants, yet they often precede powerful trends that can deliver meaningful returns in a relatively short time.

Breakout stocks emerge from these periods of consolidation. They represent moments when demand decisively overtakes supply, forcing prices into a new range. For traders and investors, identifying such moments early can offer favourable risk–reward opportunities.

In this blog, you will explore what breakout stocks are, why they occur, and how they can be identified using a structured, rule-based approach. It also covers how StockEdge can be used to systematically filter potential breakouts, along with common mistakes and essential risk-management principles.

What are Breakout Stocks?

In simple terms, a resistance level is a price zone where selling pressure has repeatedly stopped the stock from moving higher in the past.

When a stock breaks through these levels with strong volume, it indicates that earlier sellers are exhausted or buyers have become more aggressive. As a result, breakout stocks often mark the beginning of a new trend, attracting institutional investors, traders, and momentum-based participants. Because of this, breakouts are closely watched for their potential to deliver sharp and sustained price moves when supported by volume and broader market strength.

How to Find Breakout Stocks?

Identifying breakout stocks involves finding assets that have been “coiling” within a specific price range and entering the trade as they move beyond a defined barrier. Success in this strategy relies on confirming that the move is backed by real conviction rather than just a temporary spike.

Here are the essential steps to identify and trade breakout stocks:

1. Identify the Consolidation Range

Before a breakout occurs, a stock usually moves sideways in a “consolidation” phase. This is where buyers and sellers are in equilibrium.

- Support & Resistance: Draw lines connecting the price floors (support) and ceilings (resistance). The more times the price has touched these lines without breaking them, the stronger the potential breakout will be.

- Common Patterns: Look for specific shapes on the chart that signal a build-up of pressure:

- Triangles: Ascending (bullish), Descending (bearish), or Symmetrical.

- Flags & Pennants: Short-term pauses after a sharp price move.

- Rectangles: The price moves strictly between two horizontal levels.

2. Confirm with Volume

One of the most common mistakes in breakout trading is entering a false breakout (bull trap). Volume confirmation helps filter out weak moves. High volume reflects institutional participation and strong demand, increasing the probability of follow-through.

3. Validate with Technical Indicators

Technical indicators help confirm whether the price breakout is supported by strength and momentum, reducing the risk of false signals.

Exponential Moving Average (EMA)

- Price should be trading above key EMAs (such as 20 EMA or 50 EMA).

- A rising EMA indicates an uptrend, suggesting that buyers are in control.

- Breakouts occurring above a rising EMA tend to have higher sustainability.

RSI (Relative Strength Index)

- RSI should be trending upward at the time of breakout.

- Ideally, RSI remains above 50, confirming bullish momentum.

- Avoid entries when RSI is already above 70, as this may indicate overbought conditions and limited upside.

How to Find Breakout Stocks Using StockEdge

Now, let’s understand how to use StockEdge for finding breakout stocks.

Price Scans

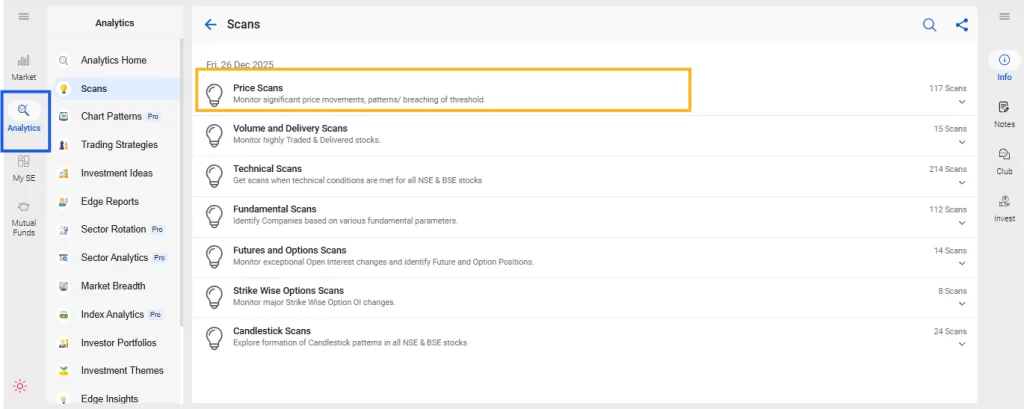

In StockEdge, breakout stocks can be identified using Price Scans, which are available under the Analytics tab.

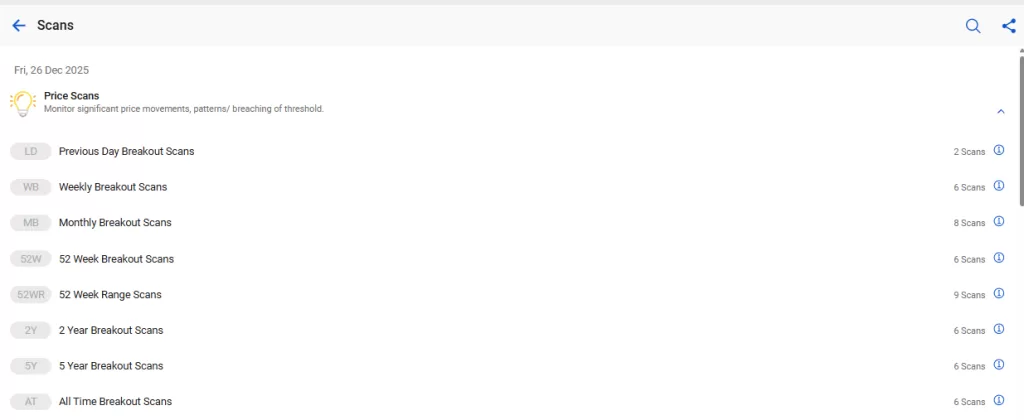

Under price action scans, you will get a list of scans that help you identify the breakout stocks in different time frames.

- Previous Day Breakout Scans

- Weekly Breakout Scans

- Monthly Breakout Scans

- 52 Week Breakout Scans

- 52 Week Range Scans

- 2 Year Breakout Scans

- 5 Year Breakout Scans

- All Time Breakout Scans

Know how to use Price Scan here: 7 Useful Scans Explained

Edge Reports

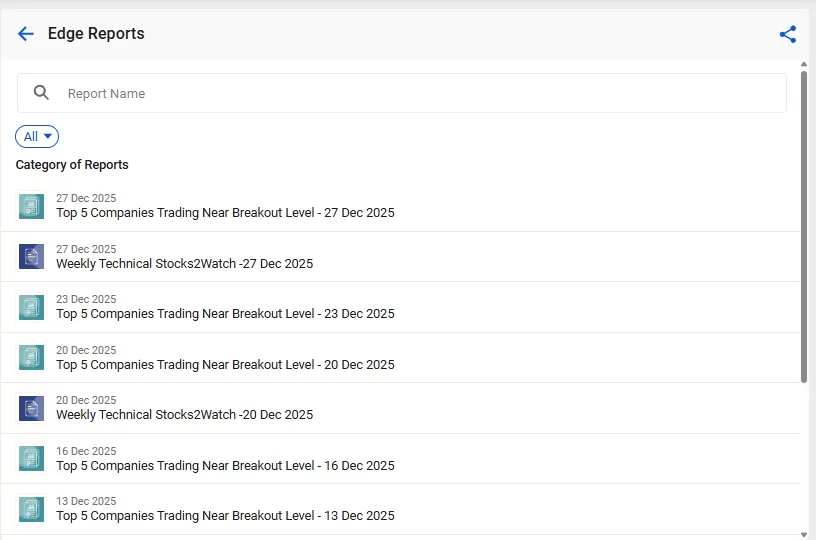

Edge Reports are reports prepared by the StockEdge Analyst team. This includes case studies, call analysis, infographics, and more.

Here you will get a list of stocks that are trading near their breakout levels. A move beyond the key level is likely to trigger fresh momentum in the short term.

Custom Scans

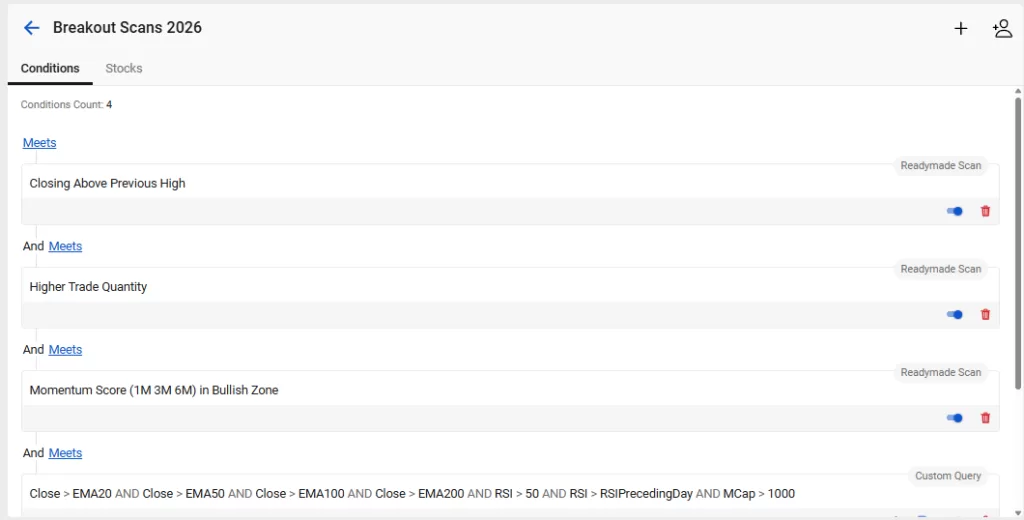

The latest StockEdge Version 14.0 brings a major upgrade for investors and traders, giving them more control, flexibility, and precision in identifying potential stocks. With this update, you can now create powerful Custom Scans that help you to make scans that filter out the breakout stocks.

The first condition, Closing Above Previous High, indicates that buyers have enough strength to sustain prices at higher levels, reducing the chances of a false or intraday-only breakout.

Then the second condition, Higher Trade Quantity, ensures that the breakout is supported by strong volume.

Then add the Momentum Score in the Bullish Zone for 1-month, 3-month, and 6-month periods, and check whether the stock has been showing consistent strength across multiple timeframes.

After we run the query by adding the closing price to be above the 20, 50, 100, and 200-day EMAs, RSI above 50 and the market-capitalization filter above ₹1000 crore, it removes low-liquidity and high-risk stocks, improving tradability and stability.

Overall, this scan filters for stocks that are breaking out with confirmation, not just reacting to short-term noise. It is best suited for swing and positional traders who want to trade breakouts that are supported by volume, trend, and momentum rather than speculative spikes.

Know more about Custom Scans here: My Custom Scans

Common Mistakes to Avoid

One of the most common mistakes traders make while identifying breakout stocks is entering the trade too early, without proper confirmation. This often leads to getting caught in a false breakout, where the price briefly moves beyond a key level but fails to sustain the move.

Some of the key mistakes traders should avoid while trading breakout stocks are:

- Ignoring volume confirmation: A genuine breakout is usually supported by a clear rise in trading volume, which shows strong participation from the market. When a stock moves above resistance or below support on low volume, the move is often unreliable and may quickly reverse.

- Entering the trade too early: Many traders jump in the moment the price crosses a support or resistance level. Instead, waiting for the candle to close above or below the level, especially on the daily or weekly chart, helps confirm whether the breakout has real strength.

- Ignoring market and sector trends: A breakout works better when the overall market and the stock’s sector are moving in the same direction. Trading breakout stocks against the broader trend reduces the chances of follow-through.

- Poor stop-loss placement: Placing stop-loss orders too close to the breakout level often leads to being stopped out by normal price fluctuations. Slight breathing room below support or above resistance can help avoid unnecessary exits.

- Trading during low volatility or news-driven spikes: Breakouts in quiet, range-bound markets often fail due to a lack of momentum. Similarly, sudden price spikes caused by news events can reverse quickly, making them risky for breakout trades.

- Letting emotions take control: Fear of missing out, greed, or overconfidence can push traders into impulsive trades without following a proper plan or risk management rules.

- Not waiting for a retest: In many strong breakouts, price revisits the earlier resistance level, which then acts as support. Waiting for this retest and confirmation improves trade quality. Skipping this step increases risk.

Risk Management for Breakout Investing

Breakout trading can offer strong profit opportunities, but it also carries higher risk if trades are not managed properly. Since not every breakout succeeds, effective risk management is essential to protect capital and stay consistent over the long term.

- Place stop-losses: Stop-loss levels should be based on price structure, not fear. Instead of placing stops exactly at the breakout level, it is better to keep them slightly below the previous resistance (for long trades) or above previous support (for short trades). This helps avoid getting stopped out due to normal price fluctuations.

- Position sizing matters: Even a good setup can turn into a bad trade if position size is too large. Adjust the quantity of shares based on the distance between the entry price and the stop-loss. Wider stop-loss levels should always be matched with smaller position sizes.

- Trail stop-losses to protect profits: Once the trade moves in your favour, trailing the stop-loss helps lock in gains while allowing the trend to continue. This ensures that profits are protected if the price reverses unexpectedly.

- Focus on risk–reward, not win rate: Not every breakout will succeed, and that is normal. What matters is maintaining a favourable risk–reward ratio, such as risking ₹1 to potentially make ₹2 or more. A few good trades can offset multiple small losses.

- Avoid overtrading: Taking too many breakout trades at once increases exposure and emotional pressure. It is better to focus on a few high-quality setups rather than trading every visible breakout.

- Review and learn from every trade: Regularly reviewing both winning and losing trades helps identify patterns, mistakes, and areas for improvement. This habit strengthens discipline and improves decision-making over time.

Conclusion

Breakout stocks offer an opportunity to participate in strong price moves at an early stage, but they demand discipline, confirmation, and risk control. Not every price move beyond resistance or support qualifies as a true breakout, and blindly chasing momentum often leads to avoidable losses. Successful breakout trading lies in waiting for the right conditions, clear consolidation, strong volume expansion, supportive technical indicators, and alignment with broader market trends.

Also Read: Weekend Market Research Routine: 5 Scans to Build a Fresh Watchlist

Frequently Asked Questions (FAQs)

1. Why Do Stock Breakouts Happen?

Breakouts occur when buying pressure overwhelms sellers at resistance, driven by strong earnings, sector momentum, or market psychology such as FOMO. Institutional accumulation during consolidation phases builds the foundation, leading to explosive moves once barriers break. Patterns like flags, triangles, or rectangles frequently precede these events.

2. How long do breakout moves usually last?

The duration of a breakout move varies widely depending on the stock, market conditions, and the catalyst behind the move.

3. Do breakout stocks always come from trending sectors?

Not necessarily, but it helps if the stock belongs to a trending sector. Breakouts in sectors with overall momentum tend to have higher follow-through because multiple stocks in the same sector attract buyers simultaneously.

4. How important is volume while identifying breakout stocks?

Volume is one of the most critical factors in breakout trading. A price move without significant volume is often unreliable and prone to reversal. Volume confirmation helps filter out “fake breakouts” and reduce the risk of entering trades based on short-term noise.