Key Takeaways

- Personal Dashboard: The My StockEdge section acts as your personal assistant bringing portfolios, watchlists, scans, filings, notes, targets, and mutual fund tracking all into one place.

- My Portfolios & Watchlists: Quickly view total investment value and daily changes for your portfolios; watchlists spotlight top and worst performers with metrics like price change and momentum.

- Combo Scans & Saved Scans: Create tailored filters using multiple technical and fundamental criteria in My Combo Scans. Save your favourite scans in My Scans for instant access whenever you need.

- Company Filings & Notes: Stay updated with essential company updates and announcements under My Company Filings, and jot down your own observations or research in My Notes.

- Investor Collaboration Tools: Track targets, manage investor groups, and curate mutual fund watchlists within the section making it easier to stay organised and collaborate.

StockEdge is a popular platform designed to help investors and traders understand and analyze the stock market. It provides simple yet powerful tools to make better decisions, including market analysis, stock screeners, learning resources, and portfolio tracking.

One of its best features is the My StockEdge Section, which works like your personal assistant for managing your investments and finding new opportunities in the stock market.

It brings all the information you need into one place, making it easier to keep track of your portfolio and stay updated on the latest developments in the stocks that you own in your portfolio.

In this blog, we will cover this section’s features and explain how you can use this section to stay updated about your portfolio.

1. My Portfolios

The “My Portfolios” section is the first thing you’ll notice. It shows you a summary of all your portfolios, including the total value of your investments, how much they have gained or lost during the day, and the percentage change. This feature helps you monitor your portfolio’s performance at a glance.

One should regularly review their portfolio, as it helps you to stay aligned with your financial goals.

For example, you can check if you need to rebalance your investments by diversifying across different sectors or assets in order to reduce risks.

2. My Watchlists

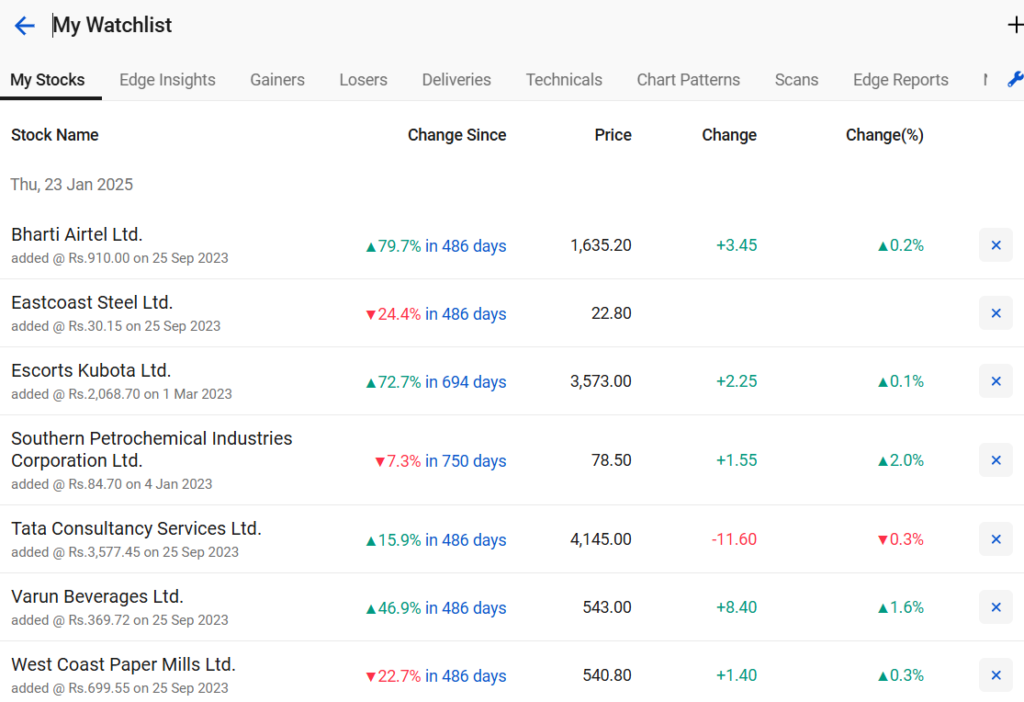

The “My Watchlists” section highlights the top-performing stock and the worst-performing stock from your selected lists.

It also offers a deeper analysis of your selected stocks, showing metrics like price changes since you added them, the current price, daily price changes, and percentage movement.

For example:

Spotting the biggest movers can give you ideas for new trades or help you decide whether to hold or exit a position.

In this dashboard, Bharti Airtel Ltd. is the top performer with a 0.8% gain, while Varun Beverages Ltd. is the worst performer, dropping by 1.1%. This information can prompt further analysis to understand what’s driving these price changes.

This section can help you focus on stocks with high momentum or unusual price movements that align with your trading strategy.

Also, you can use this data to refine your strategy. For instance, analyze why a stock like Bharti Airtel performed well while others lagged, and adjust your future picks accordingly. Other than that, you can create multiple watchlists on this dashboard.

3. My Combo Scans

Combination scans are one of the most powerful features in this section. They let you filter for stocks based on multiple criteria, including fundamental and technical analysis.

Instead of manually sifting through hundreds of stocks, these scans save time by presenting a list of stocks that meet your specific criteria.

To create Combination Scans in StockEdge, go to the Scans section, select Combination Scans, and click Create Scan. Add criteria like RSI, price breakouts, or volume. Combine multiple conditions, name your scan, and save it. Use it to filter stocks matching your strategy.

You can experiment with different combination scans to match your trading style and market conditions.

4. My Scans

The “My Scans” section is where you can save your favourite stock scans for quick access. This feature helps you save time by just a click away from the scans that you use most often.

You can keep updating your favourite scans as your strategy changes. For instance, if market volatility is increasing, then you can add the high beta scan to the list.

5. My Company Filings

This section gives you the latest company announcements and filings, such as earnings reports, dividend declarations, or significant corporate actions. These updates are essential for staying informed about the companies you’re investing in.

Corporate news can significantly impact stock prices. For example, a positive earnings report might boost a stock’s price, while news of a regulatory issue could cause a decline.

6. My Notes

The “My Notes” section lets you organize and access your notes in categories like Stock Notes, General Notes, and MF (Mutual Fund) Notes. This is a great way to keep track of your research, trading plans, or market observations.

Having all your notes in one place ensures you can quickly refer back to the pages and strategies when needed.

You can use Stock Notes to jot down ideas about specific companies and MF Notes to document your insights on mutual funds.

7. My Targets

The “My Targets” section helps you set and track price targets for your trades. It also shows you which targets you’ve achieved, making it easier to be aligned with your trading plan.

This tab shows any alert set that has not been achieved yet. You can click on ADD to set Buy or Sell alerts, with the option to select Buy Above or Below the price you entered or Sell Above or Below the price you entered.

A Description can also be added at the time of setting the alert, which will be visible when the target is achieved. You can also delete the alert by clicking on the bin.

You can set a maximum of 50 active targets.

8. Investor Groups and Mutual Fund Watchlists

This section includes features like Investor Groups and Mutual Fund Watchlists, helping you connect with others and stay on top of your MF investments.

You can form a group of various big investors trading in multiple family accounts or entities and get consolidated data of all their bulk, block deals, and insider trades together with their latest shareholding for the last five years.

In the “My MF watchlist”, you will get the list of schemes that you have explicitly added to this watchlist. You will get a list of schemes categorized with their returns for different periods.

Conclusion

The “My SE” Section helps you stay organized, informed, and efficient. You can easily track your portfolios and watchlists, find stocks through powerful scans, and stay updated with company news. It’s all about making your trading life simpler and smarter.