Key Takeaways

- ESG Investing: Focuses on companies that care about environment, society, and governance, not just profits.

- Better Delivery: ESG-focused companies usually handle risks better and win long-term trust.

- Fast Growing: ESG investing is picking up in India with policy support and rising awareness.

- Strong Performance: The Nifty100 ESG Index has outperformed the Nifty 50 in recent years.

- Top Picks:

- Axis Bank

- Infosys

- ICICI Bank and more.

Table of Contents

Welcome to the exciting world of ESG investing, where Environmental, Social, and Governance (ESG) criteria guide the search for sustainable and ethical investment opportunities. With growing concern about climate change, social justice, and corporate transparency, ESG investing has emerged as a key weapon for people seeking to match their financial objectives with a more vibrant and responsible future.

Let’s understand with a simple example.

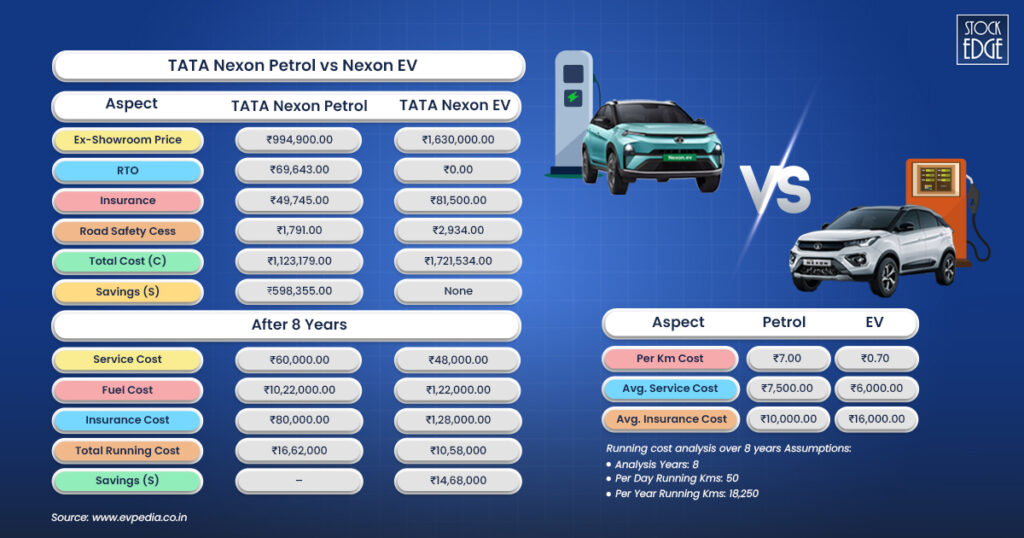

Imagine you’re on a journey to choose your next car. Tata Motors has two exciting options: the eco-friendly Tata Nexon EV and the Tata Nexon Petrol car. It’s important to find out which one is more efficient for you!

While the Tata Nexon EV’s initial price might seem steep, consider all the long-term savings you’ll enjoy. With no fuel costs, less maintenance, and some great government incentives, the EV could be a fantastic and cost-effective choice in the long run!

This shift towards sustainability is evident in the corporate world. Since its inception, Tata Motors has produced 150,000 EVs, and its net sales have grown by 26.58%.

ESG investing can contribute to a movement that supports not only financial success but also a more transparent, inclusive, and environmentally responsible world. In this blog, we will explore ESG investing, key metrics to consider for ESG stocks valuation and the top 10 ESG stocks to watch in 2025.

What is ESG Investing and Why Does it Matter?

ESG investing stands for Environmental, Social, and Governance investing. It is a strategy that considers not just financial returns but also a company’s impact on the environment, society, and governance practices. It helps assess how a company’s operations impact the environment, culture, and internal governance.

Let’s understand with a real example how ESG impacts the financials. Tata Power Company Ltd installed 1000+ public EV charging stations in 102 cities during FY2-23. This initiative not only accelerates the adoption of EVs but also aligns with key ESG investing. It is expected to achieve significant environmental milestones, such as saving an estimated 2 million tons of CO2 annually by FY25.

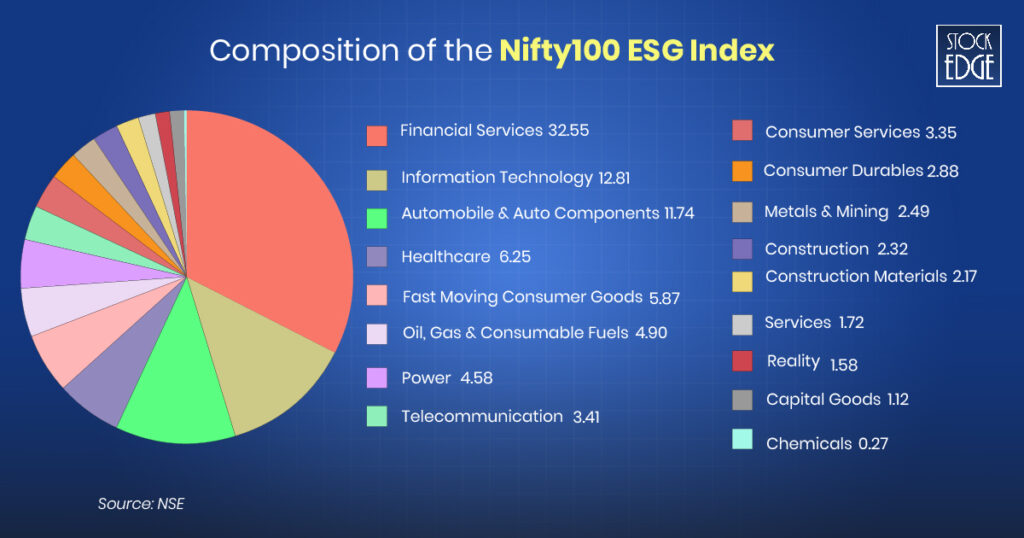

Investors worldwide are increasingly prioritizing SG investing when making investment decisions. In India, the Nifty 100 ESG Index has emerged as a benchmark for sustainability-focused investments. Let’s explore the concept of this index and compare it with the broader Nifty 50 Index

Nifty 50 Vs Nifty 100 ESG Index

The Nifty 100 ESG Index reflects the performance of companies in the Nifty 100, evaluated based on their Environmental, Social, and Governance (ESG) risk scores. Constituents are weighted by free-float market capitalization and adjusted ESG risk scores. It excludes companies in controversial sectors like tobacco, alcohol, weapons, and gambling. The index is rebalanced semi-annually and serves as a benchmark for ESG-focused funds and ETFs.

Now the big question as an investor or trader why does it matter to you?

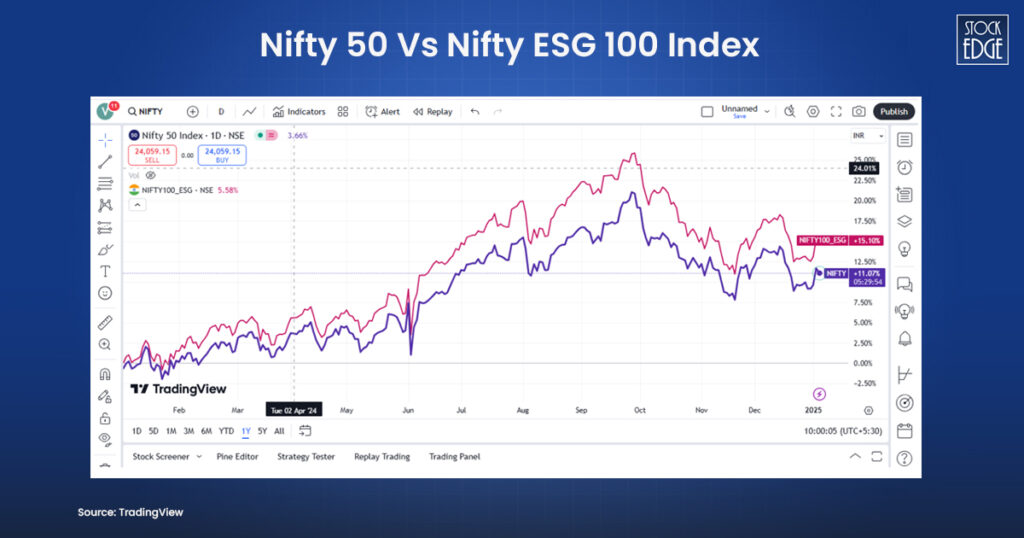

Even if we look at the bigger picture, the 1-year performance of the Nifty100 ESG and the Nifty 50 clearly shows that ESG stocks have demonstrated impressive growth over the past years.

The above image clearly shows that as of 03rd January 2025, ESG stocks had outperformed the Nifty 50 over the past years, with a return of 15% compared to the Nifty 50’s 11%.

Key Metrics to Consider for ESG Stock Evaluation

An ESG Score is a quantitative measure used to evaluate a company’s performance in terms of environmental, social, and governance (ESG) factors. Investors, analysts, and stakeholders use ESG scores to assess how well a company aligns with sustainability goals and ethical practices.

These scores are typically assigned by rating agencies like MSCI, Sustainalytics, or Refinitiv, and they help investors evaluate the risks and opportunities tied to sustainability and ethical behaviour within a company. ESG stocks with strong ESG performance are often seen as more appealing due to their potential for long-term stability, lower operational risks, and greater appeal to socially-conscious consumers. Conversely, poor ESG scores may reflect exposure to environmental risks, poor corporate governance, or social controversies, which could affect the financial health and reputation of ESG stocks.

When using ESG scores to evaluate ESG stocks, consider the following key metrics to get a deeper understanding of a company’s sustainability and ethical practices:

Environmental Metrics

The term “environment” refers to anything that includes the natural world and our planet. It focuses on a company’s impact on the earth. For ESG stocks, key indicators include:

- Carbon Footprint: The total greenhouse gas emissions produced by the company, indicating its contribution to climate change.

- Energy Efficiency: Measures the energy consumption per unit of output or revenue, reflecting efforts to reduce energy usage and adopt renewable energy sources.

- Waste Management: The efficiency of waste disposal and recycling practices, as well as efforts to minimize pollution.

- Water Usage: The amount of water the company consumes is significant for industries that use significant water resources, such as manufacturing and agriculture.

- Sustainability Initiatives: Investments in clean technologies, renewable energy, and eco-friendly product innovations.

Social Metrics

Social metrics evaluate a company’s relationships with its stakeholders, including the company’s disclosure regarding its relationship with its human capital and relationship with its stakeholders. For ESG stocks, consider:

- Diversity and Inclusion: The representation of women and minorities in the company, especially in leadership roles, and efforts to promote an inclusive workplace culture.

- Labor Practices: The company’s treatment of employees, including fair wages, working conditions, health and safety standards, and employee welfare programs.

- Community Impact: The company’s contributions to society, such as philanthropy, volunteer work, and support for local communities.

- Customer Satisfaction: Efforts to maintain high-quality products, consumer safety, and positive customer relations.

Governance Metrics

Governance metrics evaluate a company’s commitment to good governance and ethics. They focus on key areas like board practices, executive compensation, financial reporting, and stakeholder engagement. For ESG stocks, key indicators include:

- Board Composition and Diversity: Ensuring the board is independent and diverse, with members who bring varied expertise and backgrounds.

- Executive Compensation: Ensuring executive pay is aligned with long-term performance and shareholder interests, as excessive pay without results can signal poor governance.

- Transparency and Accountability: Clear and transparent financial reporting and business practices, with strong companies communicating openly with shareholders and the public.

- Shareholder Rights: Protecting shareholder interests and ensuring fair engagement with all stakeholders.

By analyzing these key ESG metrics, investors can make more informed decisions, selecting ESG stocks from companies that not only align with ethical and sustainable practices but are also more likely to perform well in the long term, navigating the risks and opportunities of a changing global landscape.

Now let’s look at the ESG stocks

Top 10 ESG Stocks to Watch in 2025

After understanding the parameters to analyze ESG stocks, let’s move on to explore the top 10 ESG stocks that should be considered for your portfolio and understand why these stocks have been included in the ESG group.

Axis Bank Ltd

In 2024, Axis Bank achieved an impressive (A) rating from MSCI ESG Ratings and proudly stands among the top ten constituents of the Nifty100 ESG Sector Leaders Index. Let’s explore the reasons behind this remarkable recognition.

- Environmental: In FY24, Axis Bank achieved ₹30,400 Cr in wholesale banking to sectors with positive social and ecological outcomes. Through various energy-saving initiatives, it avoided ~12,860 tCO2e of GHG emissions.

- Social: The bank has reached 1.7 million households under sustainable livelihoods and has 2.2 million women borrowers under retail microfinance.

- Governance: Axis Bank was the first Indian bank to constitute an ESG Committee on its Board. The board has 61% Non-Executive Directors and 15% women directors.

To know more about the financials of this ESG stocks, read our Edge Reports.

Infosys Ltd.

For the seventh year in a row, in 2023, Infosys is listed on the Dow Jones Sustainability Indices (DJSI), a leading benchmark for corporate sustainability. They also received an (AA) rating in the MSCI ESG ratings.

- Environmental Leadership: In FY24, Infosys achieved carbon neutrality for the fifth consecutive year, covering all emissions. It created 29.6 million square feet of energy-efficient, green-certified office space with rainwater harvesting and zero-waste practices.

- Social Impact: Infosys assisted 264,000 rural families with biogas and cookstove projects, improving air quality and reducing deforestation. Women comprise 39.3% of its workforce, and employees received over 24 million hours of training, focusing on inclusivity and skill development.

- Governance Excellence: Recognized as one of the most ethical companies for the fourth year by Ethisphere, Infosys ensures transparency and ethical practices. It is also a leader in AI ethics, being among the first to achieve ISO 42001:2023 certification for responsible AI management.

If you’re interested in the financials of these ESG stocks, read our Edge Reports.

ICICI Bank Ltd.

ICICI Bank has consistently prioritized sustainability in its operations and has received accolades for its strong ESG practices. Its inclusion in MSCI indices reflects its outstanding performance and compliance with global ESG standards. Below are the key points supporting this recognition:

- Environmental Initiatives: ICICI Bank significantly advances sustainability by investing in renewable energy with a capacity of 1.64 GW. It protects over 53 forest reserves, planting 1.1 million trees in fiscal 2024 and creating a water harvesting potential of 25.8 billion litres annually for local communities.

- Social Impact: ICICI Bank uplifts underprivileged communities through skill development and women’s self-help groups, aiding 10 million women. It enhances healthcare infrastructure by supporting cancer care at the Tata Memorial Centre and rural healthcare initiatives.

- Governance Excellence: ICICI Bank demonstrates strong corporate governance, featuring independent board oversight. It integrates ESG risk assessments into credit evaluations and ensures customer safety and privacy through robust cybersecurity policies.

If you’re curious about the financials of these ESG stocks, be sure to check out our Concall Analysis!

To know more about the ICICI stocks, read our blog ICICI Bank Stock Analysis: A Comprehensive Guide

Bharti Airtel Ltd.

Bharti Airtel’s commitment to Environmental, Social, and Governance (ESG) principles is a cornerstone of its strategy for sustainable growth. Here are the key highlights of Airtel’s ESG initiatives for FY 2023-24:

- Environmental Initiatives: Bharti Airtel powers 20,000 network sites with solar energy. Nxtra met 41% of its energy needs from renewables by FY24 and aims for zero Scope 1 and 2 emissions by FY31. The company uses recycled PVC for SIM cards and compostable packaging for DTH boxes, procuring 140,208 MWh of renewable energy to reduce its carbon footprint.

- Social Impact: In FY24, Airtel increased female workforce representation by over 40% and ensured gender balance in its stores. The Airtel Foundation supported education with scholarships and tech labs, while digital inclusion initiatives provided resources like robotic labs to rural schools. The Teacher App (TAPP) enhanced skills for educators in rural areas.

- Governance Excellence: Bharti Airtel received the Golden Peacock Award for Sustainability 2023 and was included in the S&P Global Sustainability Yearbook 2024. Airtel follows transparent practices, aligning with international standards like GRI, UN SDGs, and GSMA ESG Metrics.

If you’re interested in the financials of these ESG stocks, check out our Concall Analysis!

Tata Consultancy Services Ltd.

Tata Consultancy Services (TCS) is committed to integrating Environmental, Social, and Governance (ESG) principles into its business strategy, going beyond compliance to establish itself as a responsible corporate citizen. Here’s a detailed look at its ESG initiatives:

- Environmental Commitments: TCS is committed to reducing its carbon footprint, aiming for net-zero carbon emissions by 2030. Since its baseline year of 2016, the company has already achieved a 70% reduction in carbon emissions and increased renewable energy usage to 74% in FY 2023-24.

- Social Initiatives: TCS prioritizes employee well-being with comprehensive health and safety programs certified under ISO 45001:2018, as well as initiatives like the TCS Cares Program for mental health support and ergonomic health measures. The company is also committed to diversity and inclusion, with 35.6% of its global workforce being female and ongoing efforts to enhance representation at all levels.

- Governance Practices: TCS ensures transparency and accountability by regularly reviewing its ESG practices with the Board’s Stakeholders’ Relationship Committee (SRC). The company provides comprehensive disclosures aligned with the National Guidelines for Responsible Business Conduct (NGRBC) and GRI Standards.

If you’re curious about the financials of these ESG stocks, check out our Edge Reports!

HDFC Bank Ltd.

HDFC Bank, India’s largest private sector bank, has integrated Environmental, Social, and Governance (ESG) principles into its core values and operations. Since the fiscal year 2014-15, sustainability has been a fundamental value for HDFC Bank, reflecting its commitment to environmental commitments, social responsibility, and robust governance.

- Environmental Commitments: HDFC Bank aims to be carbon neutral by FY 2032 through renewable energy and energy-efficient buildings. It seals e-waste responsibly and has banned single-use plastics since FY 2019-20. The bank also fosters water conservation with advanced technologies.

- Social Initiatives: HDFC Bank’s Parivartan program enhances lives in marginalized communities by investing in rural infrastructure like roads, schools, and healthcare. The Sustainable Livelihood Initiative (SLI) supports women and families in underserved areas through Self-Help Groups (SHGs), credit, and training.

- Governance Practices: HDFC Bank maintains high corporate governance, integrity, and compliance. The CSR & ESG Committee and ESG Apex Council oversee ESG initiatives, adhering to the Indian Companies Act, SEBI guidelines, and global best practices for strong internal controls.

If you’re curious about the financials of these ESG stocks, check out our Edge Reports!

HCL Technologies Ltd.

HCL Tech’s latest ESG report highlights its commitment to sustainability, emphasizing governance, social impact, and environmental stewardship. Here’s a look at their initiatives and achievements areas:

- Environmental Commitments: HCL Tech focuses on net-zero emissions by 2040, reducing resource consumption, and pioneering sustainability solutions. They also increased renewable energy use by 6% and cut total energy consumption by 26%.

- Social Initiatives: HCL Tech seeks 40% women representation in the workforce and 30% in senior leadership by 2030. Through the HCL Foundation, over 6.5 million lives have been positively impacted, including support for 13,500+ individuals with disabilities and planting 2.12 million saplings.

- Governance Practices: HCL Tech emphasizes a governance framework that ensures transparency, accountability, and ethical conduct. Its 14 board members, including five women directors, reflect diverse expertise. Initiatives like an AI Risk Management Framework and ESG integration into audits aim to align operations with global best practices in governance.

If you’re curious about the financials of these ESG stocks, check out our Concall Analysis!

Tech Mahindra Ltd.

In today’s world, sustainability is not just a corporate responsibility but a fundamental necessity. Tech Mahindra Ltd., a leading global player in IT services and solutions, shows this mindset through its Environmental, Social, and Governance (ESG) initiatives.

- Environmental Commitments: Tech Mahindra aims for carbon neutrality by 2030 and net-zero emissions by 2035, significantly reducing Scope 1 and 2 emissions. The company has invested in renewable energy, installing solar panels at 11 facilities and sourcing 31% of its energy from renewables. It prioritizes waste and water management, diverting 97% of waste from landfills and recycling water for landscaping and flushing.

- Social Initiatives: Tech Mahindra focuses on diversity and employee development. Women represent 33.12% of the workforce, supported by programs like the Women Leadership Program (WLP) to boost diversity. The goal is 50% diversity in fresher hiring by FY 2025. Employees receive an average of 48.96 hours of training annually, concentrating on robotics and AI. The company promotes community involvement, with volunteers contributing over 3,500 hours to sustainability initiatives like tree planting and workshops.

- Governance Practices: Tech Mahindra links executive compensation to ESG goals through a Balance Score Card (BSC) system and implements policies on human rights, anti-corruption, and data privacy. It evaluates 77% of top suppliers on ESG criteria, favouring those with sustainable practices, and directs 78.79% of procurement spending to local suppliers. Customer-centric governance is enhanced with tools like the Account Escalation Dashboard and CSAT surveys, focusing on innovative, sustainable solutions for clients.

Through these robust initiatives, it is not only enhancing its operational efficiency but also contributing to a sustainable future. If you’re curious about the financials of these ESG stocks, check out our Concall Analysis!

Wipro Ltd.

Wipro, a global leader in technology services and consulting, continues its mission to drive sustainability and equity.

- Environmental Commitments: Wipro aims for net-zero emissions by 2040, reducing Scope 1 and 2 emissions by 59% and Scope 3 by 55% by 2030. It uses 76% renewable energy in India, targeting 100% by 2030, and seeks 60% water reuse. Wipro recycles 94.2% of its waste and is moving toward nearly 100% recycling.

- Social Initiatives: Wipro prioritizes inclusivity and community support, increasing female management representation to 23.9% and targeting 21% in senior leadership by FY25. They invested 12.9 million hours in employee training for compliance and technical upskilling.

- Governance Practices: Wipro emphasizes transparency, ethical conduct, and solid governance, with 22.2% female board representation and 100% compliance with its Code of Conduct. It adheres to global cybersecurity standards, resolving 93.5% of 1,104 complaints trust.

If you’re interested in the financials of these ESG stocks, check out our Concall Analysis!

Tata Motors Limited

Tata Motors, a global automotive industry leader, operates in 125 countries and employs over 60,000 people. The company integrates advanced technology with strong governance and social responsibility. Here’s how Tata Motors is making a difference:

- Environmental Commitments: Tata Motors has advanced sustainability by planting over 11.3 lakh saplings, achieving a 90% survival rate to boost biodiversity. They have rejuvenated 106 water bodies in Maharashtra, enhancing water tables in drought-prone areas, and plan to extend this to 350 water body districts.

- Social Initiatives: The ENABLE program supported 18,000 rural students, 27% qualifying for JEE Advanced. Pre-matric coaching and scholarships helped over 3,600 underprivileged students. The Aarogya program enhanced nutrition and healthcare for malnourished children. The LEAP initiative trained 2,863 youth in automotive trades in FY24, achieving an 80% placement rate.

- Governance Practices: Tata Motors ensures transparency through KPMG’s annual assessments. Their CSR programs align with Sustainable Development Goals (SDGs) to enhance social and environmental outcomes. The company also collaborates with local governments, NGOs, and communities to implement initiatives effectively.

If you’re interested in the financials of these ESG stocks, check out our Concall Analysis!

Conclusion: A Sustainable Future with ESG Investing

Currently, the Indian economy is experiencing a significant slowdown, with GDP growth falling from 8.2% in the last financial year to 6.7% in June 2024. Additionally, geopolitical tensions and investing in ESG stocks have become critical strategies for investors. Companies that emphasize ESG factors tend to be more resilient in facing these difficulties. Investing in ESG companies mitigates risks, generates more reliable profits, and aligns with individual values.

India’s ESG business is expanding rapidly, driven by global initiatives such as the G20 Summit, which has prioritized sustainability and the adoption of green practices. And it opens the doors for the growth of sustainable investments, encouraging investors to allocate capital toward companies that drive positive environmental and social impact while ensuring long-term financial stability.

Happy Investing!

Read Also: SIP and SWP: The Magic Formula