Table of Contents

Part 1: Introduction

In most industries, sales growth is considered the key factor in measuring success. However, the banking sector is unique in this aspect. Instead of focusing solely on sales growth, banks must prioritize the recovery of loans.

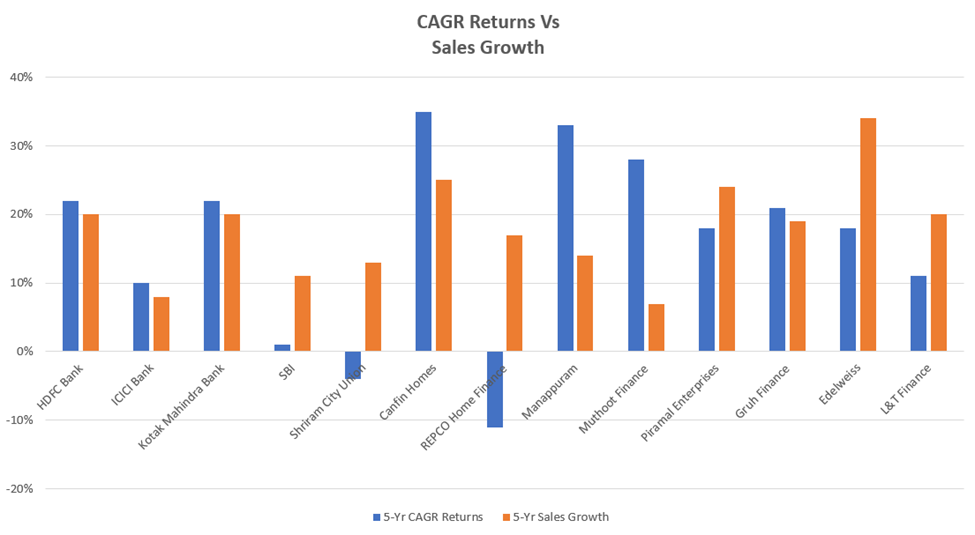

In the following graph, a closer look at various banks over a five-year period reveals a weak correlation between sales growth and returns. This highlights the significance of tracking non-performing assets (NPAs) in the banking sector.

In this article, we will dive deep into the world of NPAs to better understand their importance, the impact they have on the financial landscape, and the ways banks can effectively manage them to maintain profitability and stability.

A. Definition of NPA

Non-Performing Assets (NPAs) are loans or advances for which the borrower has stopped making interest or principal repayments. These assets are considered non-performing as they no longer generate income for the lending institution. The Reserve Bank of India (RBI) has guidelines in place for classifying assets as NPAs. An asset is deemed non-performing if the interest or principal payment is overdue for 90 days or more.

B. Importance of measuring NPAs

Measuring NPAs is essential for banks as it provides insights into their asset quality and helps identify potential risks. High levels of NPAs can strain a bank’s capital reserves, reduce profitability, and impact investor confidence. By tracking and managing NPAs, banks can maintain a healthy loan portfolio, ensuring their financial stability and long-term growth.

C. Overview of Gross NPA and Net NPA

Gross NPA and Net NPA are key metrics used to assess a bank’s asset quality. While both indicators provide valuable information on the bank’s financial health, their scope and implications differ. The following sections will delve deeper into Gross NPA and Net NPA, discussing their definitions, calculations, and impacts on banks.

Part 2: Gross NPA

A. Definition and calculation of Gross NPA

Gross Non-Performing Assets (Gross NPA) represent the total value of loans in a bank’s portfolio that have been classified as non-performing. It is calculated by summing up all the loan accounts deemed non-performing according to the RBI guidelines. Gross NPA gives an overall picture of the bank’s asset quality and the extent of stressed assets in its loan portfolio.

Gross NPA = Sum of all Non-Performing Loans

B. Causes of Gross NPA

Several factors contribute to the rise in Gross NPA, including:

- Economic slowdown: A downturn in the economy can lead to reduced demand for goods and services, making it difficult for borrowers to repay their loans, resulting in an increase in NPAs.

- Poor credit appraisal: Inadequate due diligence and credit appraisal by banks during the loan approval process can lead to higher NPAs, as borrowers with poor creditworthiness may default on their loans.

- Overleveraging: Borrowers who take on excessive debt relative to their income may face difficulties in repaying their loans, contributing to the rise in NPAs.

- Sector-specific issues: Certain sectors, such as infrastructure or real estate, may face specific challenges that affect the ability of borrowers in these sectors to repay their loans, leading to increased NPAs.

- Fraud and willful default: Some borrowers may intentionally default on their loans, resulting in higher NPAs for the lending institution.

C. Impact of Gross NPA on banks

High Gross NPAs can have significant negative effects on a bank’s financial health:

- Reduced profitability: With a higher proportion of non-performing loans in its portfolio, a bank’s interest income may decline, leading to reduced profitability.

- Increased provisioning: As Gross NPAs rise, banks are required to make higher provisions to cover potential losses. This can further reduce their profitability and erode their capital base.

- Lower lending capacity: As banks set aside more funds for provisioning, they have fewer resources available for lending, which can hamper their growth and ability to generate income from new loans.

- Reduced investor confidence: High Gross NPAs can raise concerns among investors about the bank’s asset quality, leading to a decline in its share price and reduced access to capital markets.

Part 3: Net NPA

A. Definition and calculation of Net NPA

Net Non-Performing Assets (Net NPA) represent the actual financial loss for a bank after accounting for provisions made against non-performing loans. It is calculated by deducting the total provisions from the Gross NPA. Net NPA provides a more accurate assessment of the bank’s asset quality and financial health.

Net NPA = Gross NPA – Provisions

B. Difference between Gross NPA and Net NPA

Gross NPA represents the total value of non-performing loans, while Net NPA accounts for the provisions made against these loans.

Gross NPA does not consider the actual financial loss for the bank, as it does not take into account the provisions made against bad loans. In contrast, Net NPA reflects the actual financial loss for the bank after accounting for provisions.

Gross NPA is an indicator of the overall asset quality of the bank, while Net NPA provides a more accurate measure of the bank’s financial health and the effectiveness of its risk management practices.

C. Significance of Net NPA for banks

A low Net NPA ratio indicates that the bank has made adequate provisions against non-performing loans, thereby reducing the actual financial loss for the bank. This suggests effective risk management practices and a healthy financial position.

A high Net NPA ratio indicates that the bank may have under-provisioned against non-performing loans, leaving it exposed to potential losses. This can negatively impact the bank’s profitability, capital adequacy, and overall financial health.

Net NPA serves as a crucial metric for investors, regulators, and other stakeholders to assess the bank’s asset quality, risk management practices, and financial health.

Part 4: Gross NPA vs. Net NPA Management Strategies and Role of RBI

A. Comparison of Gross NPA and Net NPA

Gross NPA provides an overview of the bank’s overall asset quality, while Net NPA offers a more accurate measure of the bank’s financial health by accounting for provisions made against non-performing loans.

Gross NPA may not accurately reflect the bank’s actual financial loss, while Net NPA provides a clearer picture of the potential losses faced by the bank.

B. Advantages and disadvantages of Gross NPA and Net NPA

Advantages of Gross NPA:

a. Serves as an early warning indicator of deteriorating asset quality

b. Provides a comprehensive picture of the bank’s total exposure to non-performing loans

Disadvantages of Gross NPA:

a. Does not account for provisions made against non-performing loans

b. May overstate the bank’s actual financial loss

Advantages of Net NPA:

a. Offers a more accurate measure of the bank’s financial health

b. Considers the provisions made against non-performing loans, reducing the impact of potential losses

Disadvantages of Net NPA:

a. May not capture the full extent of the bank’s exposure to non-performing loans if under-provisioned

b. Requires more detailed analysis of the bank’s provisioning policies

C. Managing Gross NPA and Net NPA

Strategies a Bank can adopt to manage Gross NPA and Net NPA:

a. Rigorous credit appraisal and risk assessment processes

b. Regular monitoring and follow-up of loan accounts

c. Implementing early warning systems to identify potential non-performing loans

d. Restructuring and rescheduling of loans

e. Recovery of non-performing loans through legal and recovery channels

f. Adequate provisioning against non-performing loans

D. Role of RBI in managing NPAs

The Reserve Bank of India (RBI) plays a critical role in managing NPAs through the following measures:

- Prudential regulations: RBI issues guidelines on income recognition, asset classification, and provisioning to ensure banks follow a standardized approach in classifying and managing non-performing loans.

- Supervision and monitoring: RBI regularly monitors and supervises banks to ensure compliance with prudential regulations and assess their overall asset quality and financial health.

- Prompt Corrective Action (PCA) framework: RBI has implemented a PCA framework to take corrective action against banks that breach specified thresholds for NPAs and other financial parameters. This ensures that banks take timely action to address deteriorating asset quality.

VI. Conclusion

A. Recap of key points

Gross NPA and Net NPA are essential metrics to assess banks’ asset quality and financial health. While Gross NPA provides an overview of the bank’s total exposure to non-performing loans, Net NPA accurately measures the bank’s actual financial loss by accounting for provisions made against these loans.

B. Final thoughts

Understanding the difference between Gross NPA and Net NPA is essential for investors, regulators, and other stakeholders to assess the bank’s asset quality, risk management practices, and financial health. By closely monitoring and managing these metrics, banks can safeguard their financial position and contribute to the overall stability and growth of the financial system.

StockEdge App

Nowadays, we can easily calculate NPA and ratios (%) with an effective stock market analysis tool. The StockEdge app gives us the NPA and ratios of the last five years of any company listed on the stock exchange. We can look at and compare the NPA ratio (%) of any bank and filter out stocks accordingly.

Suppose we want to look at the NPA and ratios of ICICI Bank Ltd for the last 10 years then click on the Fundamental tab of ICICI Bank Ltd. we will get the Ratios section. Then in the Ratios section, choose Efficiency ratios from the drop-down table; we will get the NPA and GNPA ratios (%) of ICICI Bank Ltd.

Frequently Asked Questions

What are the current gross NPA and net NPA?

Gross NPA is the summation of all loan assets that are classified as NPA as per RBI guidelines. When the NPA occurs, it is not just an interest income loss to the bank, but a principal loss as well. That means, if a bank has lent Rs.100 to a company with an outstanding loan amount of Rs.80, then the bank would lose this 80 along with the future interest payments as well when the company does not repay back.

What is provisioning in NPA?

Banks/NBFCs are required to set aside a portion of their income as a provision for the loan assets so as to be prepared for any contingent losses that may arise in the event of non-recovery of loans. The amount of provision to be kept by the banks, depend on the probability of loan recovery.

What is NPA according to RBI?

An asset, including a leased asset, becomes non-performing when it ceases to generate income for the bank. A ‘non-performing asset’ (NPA) was defined as a credit facility in respect of which the interest and/ or installment of principal has remained ‘past due’ for a specified period of time.

What is a good NPA?

No bank wants an NPA on its books, but sometimes it is unavoidable when the economic cycle worsens. Still, anything below 1% would be considered good management. Private Banks such as HDFC Bank consistently maintain low NPAs.

Superb Explanation.

Thank you alot keep coming back for more good content

Mind blowing explanation

Thank you a lot keep supporting us

Sir I taken personal loan 526000/_ for the period of 60 EMI s,and in between I paid remaining closing due in 32 EMI,i.e.3130000/- ,I gone to Bank for loan clousure letter, they are showing still 105000/-due in my loan i several times request to close my account, they are not respond, and now they send message to me that my account was put into NPA,can give any solution to me

Sir, we would suggest you to speak to the Branch Manager of the Bank, as he/she would be the right person to help you regarding your issue. Hope your issue gets resolved soon.

Very useful information. Thank you very much.