Table of Contents

In today’s blog, we will discuss about the impact of budget on Stock Market and two stocks that can benefit the most from the recent Union Budget 2023.

The ‘Budget 2023’ Special Coverage

Well, well, well…now that the budget is out and people have their own opinion and analysis, let us dig into some hard facts about Budget 2023 and what is the impact of budget on stock market.

You have scrolled through all the news articles, read about Adani Saga, and understood the latest tax regime. It’s time for us to focus back on our work, save our taxes and use that money to invest and grow.

We took some extra time to collect and correlate various data points and have come up with two stocks that can be looked at.

This year’s budget continued to prioritize infrastructure and capital formation while also addressing consumption.

So, let’s begin…

For the third year in a row, the government has prioritized infrastructure. The allocation of INR 10 lac cr this year represents a 33% increase over the previous budget.

The government has maintained its fiscal deficit target of 6.4% for fiscal year 23 and 5.9% for fiscal year 24. The tax collection figures are reasonable and should be met. Given the current monthly GST collection run-rate of INR 1.2-1.5 lac cr, the INR 9.56 lac cr figure mentioned in the budget should be achievable.

To stimulate immediate consumption and support the masses in an inflationary environment, a tax on income up to INR 7 lakh is waived. The increased rebate will increase their disposable income by INR 380 billion.

Impact of Budget on Stock Market

HBL Power Systems

With a capital outlay of INR 2.40 lakh crore, the government’s focus on electrification, gauge conversion, electric loco and signaling, and telecom in the Indian railways is a huge trigger for stocks involved in wire/cable manufacturers, locomotive manufacturers, component suppliers, and signaling entities.

With such triggers, HBL Power Systems is well placed to benefit from it. HBL Power develops and manufactures products and solutions for telecom, industrial, railroad, and defense applications. Understanding the impact of budget in stock market from a hindsight, this is HBL power share price

The Company’s seven fully integrated facilities manufacture batteries, electronics, and engineered products based on proprietary technologies developed in-house. In addition to serving niche sectors such as telecom, UPS, solar, defense, and railways in India, HBL’s products are sold in over 80 countries worldwide.

Through its subsidiaries HBL America Inc. and HBL Germany GMBH, HBL has a global presence in America, Europe, and the Middle East.

Rolling stock, track infrastructure, traction power, signaling, and telecommunications are all expensive capital assets used in rail operations. To accomplish more with limited resources, the rail industry frequently focuses on safely increasing the capacity utilization of these assets.

The goal is to run more trains on existing infrastructure, transport more passengers and freight, and increase revenue and profitability. This necessitates cutting-edge solutions for managing rail traffic in a sustainable manner.

To avoid accidents and other disruptions, running more trains faster on an already congested network necessitates a high level of safety. The railway operator requires automated systems that can anticipate and prevent hazards in all areas of train operations by performing critical safety functions.

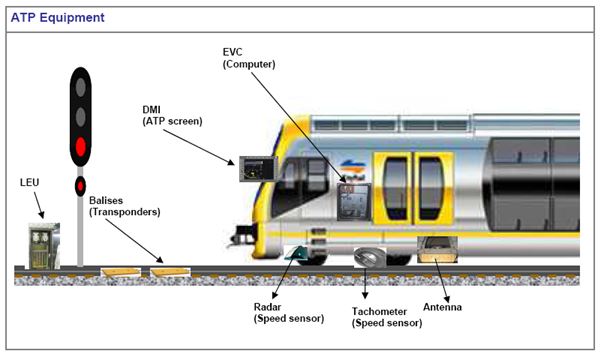

“Automatic Train Protection” (ATP) systems are one type of system. These systems have a high level of real-time situational awareness, which they use in conjunction with advanced algorithms to identify potential hazards and analyze and perform preventive actions.

HBL’s ATP system, developed indigenously for Indian Railways, provides train protection and collision avoidance functionality.

The train protection features include

- On-board display of signal aspects

- Enforcement of temporary and permanent speed restrictions

- Prevention of Signal Passing At Danger (SPAD) and

- Train integrity monitoring

HBL’s system is independently certified by European 3rd party auditors to SIL4 standards. It offers significant cost reduction compared to ERTMS and other technologies – allowing railway operators to install and operate state-of-the-art, proven railway technology on lines where the business case is unproven or marginal with more costly systems.

Elecon Engineering Company

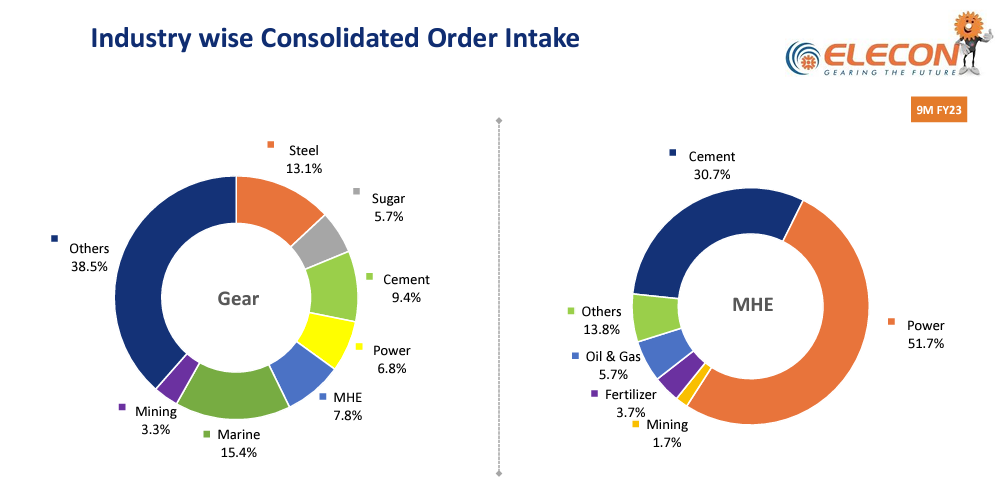

Elecon Engineering is one of the market leaders in its field and has world-class manufacturing facilities. It has been a play on the broad industrial capex cycle, supplying steel, cement, power, textiles, tyres, and sugar. Strong industrial capex is likely to drive higher industrial gear utilization. Based on major player announcements and keeping the recent Budget 2023 in mind, we anticipate particularly strong capex demand from the steel and cement sectors.

And that’s the reason why we are writing about it.

Elecon also manufactures stackers, reclaimers, wagon and truck loaders, crushers, feeders, and port equipment.

This was the main business in the previous capex cycle and was heavily reliant on the power sector; however, a slowdown in the power sector resulted in receivables and liquidity issues due to complications in EPC projects.

The company no longer accepts project orders and instead focuses solely on product supply and after-sales service.

Elecon controls 30-35% of the Indian industrial gear market, worth INR 2,000-2,500 crore. Given current demand growth and Elecon’s top-line expectations, it could reach 50%+ market share by FY25E.

The company’s management believes it can support a topline of INR 2,000 crore without incurring the significant capital expenditure.

Understanding the impact of budget in stock market from a hindsight, this is Elecon Engineering share price today.

Given the market’s size and the technical nature of the work, only a few credible players are present. Flender (ex-Siemens), SEW, Shanthi Gears (337cr), Premier (300cr), and NAW (100cr) are Elecon’s main domestic competitors in industrial gears.

The Flender India unit is used as a manufacturing hub by its German parent to supply the international market, and its product mix is heavily weighted toward the wind sector. Shanthi Gears is a listed competitor, and its margin profile appears to be better than Elecon’s. It should be noted, however, that Shanthi is much smaller than Elecon. Furthermore, Shanthi focuses primarily on niche orders, whereas Elecon is a much higher volume play with historically lower margins.

Closure

Budget 2023 prioritized capex and investment, an essential step in Amrit Kaal’s journey. Despite being an election budget, it was primarily focused on the country’s long-term growth while also managing to appease populist expectations while not compromising on the fiscal deficit.

While infrastructure is receiving a lot of attention, emerging sectors like renewable energy, space technology, electric mobility, and alternative fuels are also getting a lot of attention.

So that’s all we have. We’ve already taken advantage of our good fortune. And with that, we’ll wrap things up.

One thing to remember is that the companies discussed above carry certain risks that can hurt the expectations of retail investors, so we caution you to take proper advice from your financial advisor before taking any position in any of the above stocks.

You can also use StockEdge to track these stocks.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Interesting