Table of Contents

Asset turnover ratios are important parameters which helps investors to decide on their investment. Any ratios are important in their own manner for different kind of Financial analysis. A financial ratio is a representation of selected numerical values from a company’s financial statements. Financial ratios help in deciding the valuation strength of the company.

There are a lot of ratios such as PE ratio, Net profit margin, interest coverage ratio etc. used for valuation analysis of a company. We will discuss about the impact of turnover ratio. The Asset Turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets. The asset turnover ratio can be used as an indicator of the efficiency with which a company is using its assets to generate revenue.

Watch the video below on Everything you want to know about Asset Turnover Ratio:

Impact of Asset Turnover Ratio

Asset Turnover ratio measures the efficiency of a company. It measures a company’s ability to generate sales from its assets by comparing net sales with total assets. This tells us about how efficiently a company is utilizing its assets to generate sales. This ratio should be used to compare different companies in the same sector. Comparing the asset turnover ratio of one Auto Company with another cement company will not make much sense.

The higher the asset turnover ratio, the more efficient a company is at generating revenue from its assets. Conversely, if a company has a low asset turnover ratio, it indicates it is not efficiently using its assets to generate sales which might be due to excess production capacity, poor collection methods, or poor inventory management.

Exceptions

Historical data may not always be a fool proof way towards future perception as the industrial and economic conditions may wary every year. Moreover some companies are asset light whereas some companies are asset heavy. So it might seem redundant to use these ratios at times. The benchmark ATR can vary greatly depending on the industry. Industries with low profit margins tend to generate a higher ratio and capital-intensive industries tend to report a lower ratio.

See also: Price to Earnings Ratio (PE Ratio)

How to find total asset turnover ( Asset Turnover Formula )

Asset Turnover = Sales/ Average total assets.

Average Total Assets: (Beginning Assets + Ending Assets) / 2

Suppose a company (say A) has sales of 10 crores in a financial year and its total fixed assets are Rs 7.5 crores. Then the asset turnover ratio is 10/7.5= 1.33. Similarly if another company (say B) has sales worth 5 crores and its fixed assets is 2 crores. Then B’s asset turnover ratio is 2.5. Now company’s B asset turnover is better than A’s asset turnover. Hence the future business prospects of company B are better than company A only by analyzing this ratio.

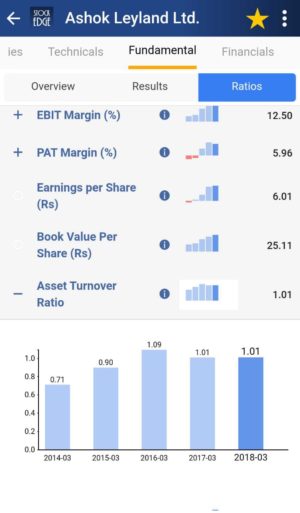

With stock edge app we don’t have to calculate Asset turnover ratio on our own. StockEdge gives us Asset turnover ratio of the last five years of any company listed in the stock exchange. We can look and compare Asset turnover ratio of any company and filter out stocks accordingly.

Suppose we want to look at the ATR of Ashok Leyland for last 5 years. In the home page under stocks type Ashok Leyland, click on the fundamentals tab, we will get Ratios tab. Then in the Ratios tab click on Efficiency Ratios, Asset turnover ratio will be seen of Ashok Leyland for 5 years simultaneously.

Bottomline

Asset Turnover ratio is an important parameter which helps to analyze the ease with which a company utilizes its assets to generate revenues. With the help of these ready-made parameters you can with the click of a button filter out companies having high asset turnover ratio. Thus to know about such companies in seconds subscribe to Stockedge. If you still do not have the StockEdge app, download it right now to use this feature. It is a part of the free offering of StockEdge App.

Join StockEdge Club to get more such Stock Insights. Click to know more!

You can check out the desktop version of StockEdge.