Table of Contents

In this blog, we will learn how to identify High Dividend Paying Stocks in the Indian Equity Markets.

What are dividends?

A dividend is a portion of a company’s profits and retained earnings which are distributed to its shareholders and owners. When a company makes a profit and accumulates retained earnings, those earnings can be reinvested in the company or distributed to shareholders as a dividend.

The amount which is paid as a dividend is determined per share and is to be distributed equally to all shareholders of the same class (common, preferred, etc.). This dividend amount must be then approved by the Board of Directors of that company.

For example, if the face value of the stock is Rs. 10 and the company declares a 40% dividend, it means that shareholders will receive Rs. 4 per share. So, if you own 1000 shares in the company, you will receive Rs. 4,000 in dividends.

What is Dividend Yield?

When investing in a stock, fundamental analysts look for a number of factors. The dividend yield is an important metric to be aware of if you are a value investor looking for dividend income.

This ratio compares the annual dividend amount paid by a company to its share price.

What is the dividend yield formula?

Dividend Yield = (Annual dividend/Stock price) * 100. It is expressed as a percentage.

For example, if a company’s stock price is Rs 100 and it declares a dividend of Rs 5, the yield is 5%.

Analyzing yields before high dividend paying stocks

If we assume that the stock dividend remains constant, the yield will rise when the stock price falls and fall when the stock price rises. Because dividends do not fluctuate frequently, changes in stock prices are primarily responsible for dividend yield rising or falling.

In fact investors should track other factors before investing, especially a massive fall in stock price can lead to a ‘value trap’. In such a case, the company’s stock may not be a good investment. So, one needs to figure out the reason for the fall in stock price.

When it comes to the stocks they own, value investors want to know what the stock market yield is. It is a must-have matrix for value investors looking to generate consistent passive income from their investments. These investors seek consistent cash flow from their investments. They will consider the dividend yield ratio to determine how profitable the investment is.

When a company pays dividends, it indicates that it is stable and profitable. This is because only profitable companies are likely to pay dividends. Investors frequently regard such firms as “safer” investments.

Investors frequently inquire about what constitutes a good dividend yield. It is important to understand that dividend yield varies from sector to sector. Some sectors/industries, such as IT, have low dividend yields, whereas companies in the public or PSU sectors may have stable dividend yields.

Why does a Company pay dividend?

After earning a reasonable amount of profits from business the company shares some profits with their shareholders too which is called dividends. If Companies have a lot of cash reserve in their books and do not have any working capital requirement either for merger, acquisition, or expansion then they share their growth with their investors in the form of dividends.

What does Consistently Dividend paying mean?

Some companies after establishing themselves pay regular dividends to their Investors even when the times are favorable or unfavorable thus they are known as consistent dividend-paying companies. If a company generates good profits and pays regular dividends then they are supposed to be a healthy growth-oriented business and attract good investment opportunity as only profitable companies distribute healthy regular dividends.

What does Positive Dividend Yield suggest?

Positive dividend yield suggests that the company is distributing dividends from the profits generated by its business and not from its reserves or retained earnings. Thus positive dividend yields suggest the strength of the business of the company and thus contemplate higher growth in the future. It’s difficult for any company to sustain paying dividends from its retained earnings for a longer period of time thus any company doing so will have a negative dividend yield and also dent its future growth prospects going ahead.

What is Dividend Payout Ratio?

The Dividend Payout Ratio (DPR) is the ratio of dividends paid to shareholders to the total net income generated by the company. In other words, the dividend payout ratio calculates the percentage of net income distributed to shareholders as dividends.

DPR can be calculated using several formulas, including:

- DPR = Total dividends divided by net income

- DPR = 1 – Ratio of retention (the retention ratio, which measures the percentage of net income that is kept by the company as retained earnings, is the opposite, or inverse, of the dividend payout ratio)

- DPR = Dividends per Share / Earnings per Share.

For example, Company A reported a net profit of Rs. 20,000 for the fiscal year. Company A declared and distributed Rs. 5,000 in dividends to its shareholders during the same time period. The DPR is calculated as follows:

DPR = Rs. 5,000 / Rs. 20,000 = 25%

As a result, a dividend payout ratio of 25% indicates that Company A distributes 25% of its net income to shareholders. The remaining 75% of net income retained by the company for growth is referred to as retained earnings.

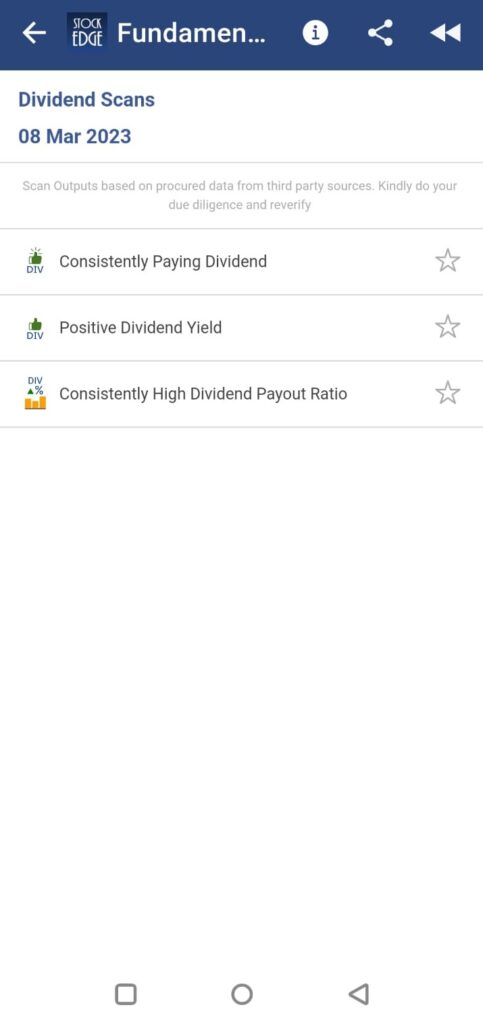

Now that we have got a good understanding of the concepts let’s see how we can identify such stocks using StockEdge.

Each of these three scans will give you a different list of stocks that will fulfill the pre-defined criteria.

Bottomline

It’s always a good idea to invest in companies whose dividend payouts are increasing along with the growth prospects of the business.

However, every company has its own set of risks, challenges, and growth opportunities due to various factors, focusing on dividend yield and the payout is just one part of the big game.

So, we suggest you use our scan section frequently and also track the Edge Report section for any premium reports on such companies from our StockEdge Analysts, which will guide you before you make an investment decision.

Until then, keep an eye out for the next blog on “Stock Insights.” Also, please share it with your friends and family.

Click here to join StockEdge Club.

Happy Investing!