- Why Did the Stock Go Down?

- Zomato Q3 Results Overview

- Key Takeaways from Zomato Q3 Results

- 1. Quick Commerce and Hyperpure Turn Profitable

- 2. Blinkit Shows Explosive Growth Amid Structural Changes

- 3. Food Delivery Growth Rebounds

- 4. “District” Segment Investment Widens Losses

- 5. Store Expansion Continues, Slightly Behind Guidance

- 6. Emerging Ventures: Bistro Gains Traction

- 7. Leadership Transition Signals Strategic Shift

- Key Risks to Watch

- Conclusion

- Frequently Asked Questions (FAQs)

The third quarter of FY26 marks a defining inflection point in the journey of Zomato, now rebranded as Eternal Limited. What was once a single-business food delivery platform has evolved into a multi-vertical consumer internet conglomerate with profitable scale, operational discipline, and a clear capital allocation framework.

Zomato Q3 Result FY26 stands out not because of headline revenue growth alone, but because it validates three long-term strategic bets:

- Food delivery has matured into a dependable cash-generating business

- Blinkit has crossed the profitability threshold, silencing skeptics of quick commerce

- The company has successfully navigated a founder-CEO transition without disrupting execution

Yet, despite these positives, Zomato’s stock fell sharply after the results, triggering the obvious question: if the business is getting stronger, why did the market react negatively?

In this blog, we will break down why the market reacted negatively and understand Eternal aka Zomato Q3 Results FY26, highlight the key takeaways for investors, and assess how the market is likely to interpret this strategic shift.

Why Did the Stock Go Down?

Despite delivering a strong operational and financial performance in Q3 FY26, Eternal Limited (formerly Zomato) witnessed a classic “sell-on-news” reaction, with the stock declining nearly 9% over two trading sessions following the results announcement.

The correction was driven by a combination of company-specific concerns and broader market pressures, rather than any deterioration in underlying business fundamentals. Three factors largely explain the market reaction.

1. Management Transition Triggered Near-Term Uncertainty

The most immediate overhang was the unexpected announcement of a leadership transition. Founder Deepinder Goyal disclosed that he would step down as Group CEO effective February 1, 2026, moving into a non-executive Vice Chairman role.

Markets tend to react cautiously to unanticipated leadership changes, particularly when a company is in the middle of a multi-year profitability transition.

Although Albinder Dhindsa, CEO of Blinkit, was named successor, investors initially expressed concern over how day-to-day execution and capital allocation priorities might evolve under new leadership.

2. Rising Competitive Intensity in Quick Commerce

While Blinkit’s achievement of Adjusted EBITDA breakeven (₹4 crore profit) marked a significant milestone, investors remain cautious about the long-term economics of quick commerce.

Aggressive expansion and discounting by players such as Zepto, Amazon, and Swiggy Instamart have raised fears of renewed price wars, which could force Eternal to increase promotional spending to defend market share.

Despite nearly tripling revenue year-on-year, consolidated net profit margins stood at just ~0.6%, reinforcing concerns that topline growth may not yet be translating into durable profitability.

3. Broader Market and Macro Headwinds

The stock-specific concerns were amplified by a weaker market environment. Sue to global uncertainty, driven by fears of a potential US trade war and tariff escalations, led to heightened volatility and significant FII outflows from Indian equities in January 2026.

Trading at a steep valuation multiple (with headline P/E exceeding 1,100x on trailing metrics), Eternal remains particularly sensitive to management changes, earnings volatility, or even modest deviations from expectations.

Zomato Q3 Results Overview

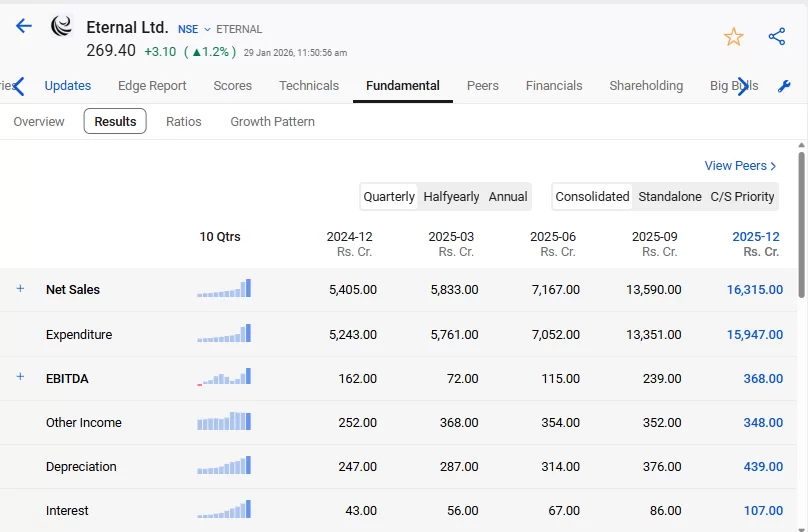

For the quarter ended December 31, 2025, Eternal Limited reported a great improvement in profitability alongside a sharp expansion in scale.

- Revenue from Operations: ₹16,315 crore (up 202% YoY)

- Adjusted EBITDA: ₹364 crore (up 28% YoY)

- Net Profit (PAT): ₹102 crore (up 73% YoY)

- Cash Balance: ₹17,820 crore

At first glance, the 200%+ revenue growth appears extraordinary. However, this jump is largely driven by Blinkit’s transition to an inventory-led (1P) model, where the company now recognizes the full value of goods sold as revenue rather than just commissions.

On a like-for-like basis, organic revenue growth stood at ~64% YoY, which remains exceptional for a company operating at this scale.

Key Takeaways from Zomato Q3 Results

1. Quick Commerce and Hyperpure Turn Profitable

For the first time, Zomato’s major growth engines achieved Adjusted EBITDA profitability. Blinkit posted a ₹4 crore profit, a remarkable turnaround from a ₹156 crore loss in Q2 to Q3 FY26, thanks to supply chain efficiencies, operating leverage, and a focus on “long-tail” categories. Hyperpure, the B2B restaurant supply arm, also went green with ₹1 crore Adjusted EBITDA, up from a ₹5 crore loss. Together with steady food delivery performance, consolidated Adjusted EBITDA grew 28% YoY to ₹364 crore.

2. Blinkit Shows Explosive Growth Amid Structural Changes

Blinkit’s Net Order Value (NOV) surged 121% YoY. Adjusted for GST rationalization and seasonal demand shifts, “like-for-like” growth was over 130%. The company now fulfills 90% of orders through owned inventory, leading to full revenue recognition for goods sold, which boosted consolidated Adjusted Revenue 190% YoY to ₹16,692 crore.

3. Food Delivery Growth Rebounds

Zomato’s core food delivery business is back on an upward trajectory. NOV growth accelerated to 16.6% YoY, while Gross Order Value grew 21.3% YoY. Margins hit a record 5.4% of NOV, aided by higher demand and lowering the free delivery threshold for Gold members, which increased order frequency.

4. “District” Segment Investment Widens Losses

The “Going-out” segment saw NOV growth of 20% YoY, but Adjusted EBITDA losses widened to ₹121 crore from ₹63 crore. The company is heavily investing in category creation, including new live events and upfront costs for the District Pass membership. Management expects losses to normalize over the next 4-6 quarters.

5. Store Expansion Continues, Slightly Behind Guidance

Blinkit added 211 net new stores, totaling 2,027, slightly below the 2,100 guidance due to pollution-related construction bans in Delhi NCR and prioritizing peak-season order management. The company targets 3,000 stores by March 2027 and could scale up to 3,500-4,000 if competitive intensity eases.

6. Emerging Ventures: Bistro Gains Traction

Within the “Others” segment, Bistro, a quick food delivery service with 45 managed kitchens in Delhi NCR and Bangalore, shows early signs of product-market fit. Though currently loss-making due to infrastructure investment, throughput per outlet is promising.

7. Leadership Transition Signals Strategic Shift

Deepinder Goyal resigns as CEO effective February 1, 2026, with Albinder Singh Dhindsa, Blinkit CEO, stepping in as the new Chief Executive Officer. Goyal will continue as Director and Vice Chairman, signaling a shift in focus toward experimental and high-risk ventures outside publicly listed companies.

Key Risks to Watch

1. Quick Commerce Margin Volatility: Blinkit achieved an unexpected EBITDA breakeven in Q3, but management cautions that profitability may remain uneven in the coming quarters due to aggressive expansion, higher inventory costs, and competitive pricing pressures.

2. Intense Competitive Pressure: The quick commerce sector remains fiercely competitive, with rivals offering free deliveries, discounts, and other incentives. Such tactics could continue to compress margins and affect sustainable growth.

3. Regulatory Risks for Gig Workers: Ongoing regulatory developments, including government-mandated social security contributions for gig workers, could impact operating costs. Future rules under the Social Security Code remain a key variable for margins.

4. Leadership Transition Risks: The change at the top, with founder Deepinder Goyal stepping down and Albinder Dhindsa becoming Group CEO, is a critical point to monitor for operational continuity and strategic execution.

5. Potential Slowdown in Food Delivery Growth: Although the food delivery segment rebounded in Zomato Q3 results, broader factors such as a slowdown in consumer demand or weather disruptions could temper growth in upcoming quarters.

6. High Valuation and Investor Expectations: Despite positive quarterly results, Zomato’s elevated P/E ratio means investors expect consistent, high-quality growth. Any deviation from projections could impact sentiment and stock performance.

7. Expansion-Related Costs: The rapid addition of 211 dark stores in Q3, part of a plan to reach 3,000 by March 2027, may increase both operational and capital expenditures, potentially affecting near-term profitability.

Conclusion

Eternal Q3 Result FY26 represents a turning point for Zomato. The company has successfully transitioned from a single-business food tech platform into a multi-vertical commerce ecosystem, backed by profitability, scale, and a strong balance sheet.

Blinkit’s profitability milestone, food delivery’s cash-generation capability, and a stable leadership transition collectively strengthen the long-term investment thesis.

While near-term earnings may remain volatile due to investments in District, Eternal’s strategic direction and execution quality place it among the most structurally strong consumer internet companies in India.

For more such helpful analysis, visit StockEdge

Frequently Asked Questions (FAQs)

1. Did Zomato report a profit in Q3?

Yes, Zomato (now Eternal Limited) reported a consolidated net profit of ₹102 crore in the Zomato Q3 results of the financial year 2025-26 (Q3 FY26), marking a 73% surge from ₹59 crore in the same period last year.

2. What role did Blinkit play in Zomato Q3 results?

Blinkit was the key driver, achieving EBITDA profitability for the first time and delivering 121% YoY growth in Net Order Value.

3. How did the food delivery business perform in Q3?

Food delivery remained resilient, posting 21% YoY growth and an all-time high EBITDA margin of 5.4%, firmly establishing it as a cash-generating core business.