Just when global investors start thinking, “Maybe the world is finally stable,” Mr. Trump finds a way to remind everyone that tariffs are never really out of fashion. Once again, the world seems to be revolving around Mr. Trump.

Whenever Mr. Trump talks about tariffs, financial markets don’t wait for policy documents or official notifications; they react faster than caffeine hitting your system on Monday morning.

In 2026, the US-India trade dynamic has again entered the spotlight, with discussions around tariffs shaping investor sentiment and impacting stock prices across sectors. Understanding this impact is crucial for both short-term traders and long-term investors.

In this blog, we will discuss the effect of tariffs on the Indian stock market, sector-specific outcomes, and what the future could hold for investors.

Why Are Markets Talking About US Tariffs Again?

Before understanding the effect of tariffs on India, you first have to understand what tariffs mean.

A tariff is essentially a tax imposed by a government on imported goods. When a country levies a tariff, imported products become more expensive compared to locally produced goods.

When the US imposes tariffs on Indian products, it makes these goods more expensive in the American market, reducing demand and potentially hurting exporters.

So, let’s understand how this tax escalation has happened.

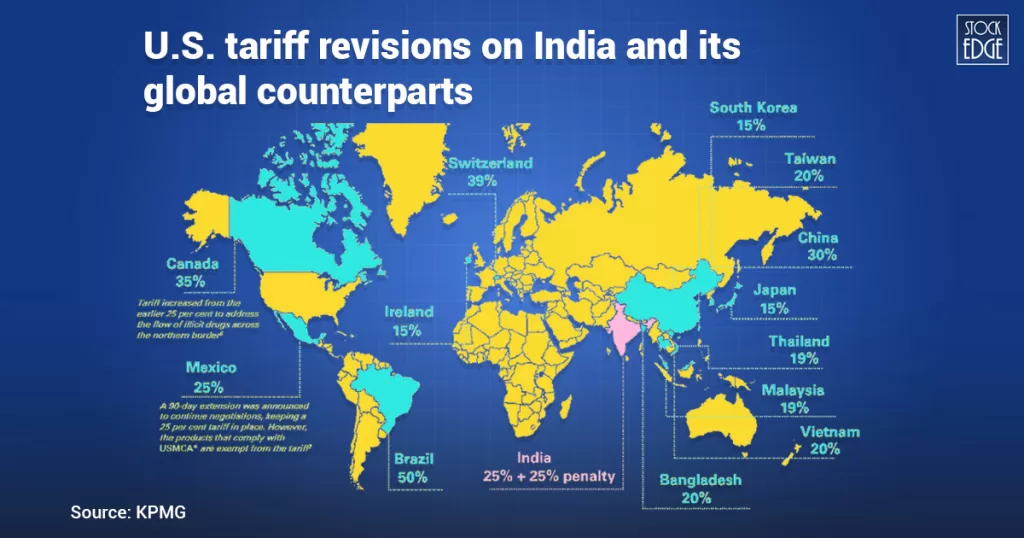

In April 2025, trade tensions escalated as the U.S. declared a national emergency over its widening trade deficit. A 90-day pause was introduced to allow negotiations, even as Section 232 probes into pharmaceuticals and semiconductors were launched.

India responded by imposing a 12% safeguard duty on steel to protect domestic producers from diverted Chinese exports.

In June 2025, the U.S. raised steel and aluminium tariffs from 25% to 50%, effective 4 June. On 7 July, tariffs were revised for select countries and the pause was extended.

By August 2025, revised reciprocal tariffs took effect for over 90 countries, with India facing a 25% tariff from 7 August.

On 27 August, the U.S. implemented an additional 25% penalty tariff on India, announced earlier on 6 August, citing continued imports of Russian oil.

This move raised the total tariff on certain Indian exports to 50%, making Indian goods significantly costlier in the U.S. market.

As a result, exporters are being forced to rethink pricing, supply chains, and market strategies, increasing pressure on sectors heavily reliant on American trade.

US – India Trade Relationship

India’s largest trading partner is the United States (US), and it is also one of the few countries with which India had a trade surplus in FY25.

India’s major exports to the US include engineering goods, electronic goods, gems and jewellery, pharmaceutical products, crude oil and petroleum, electrical goods, and others.

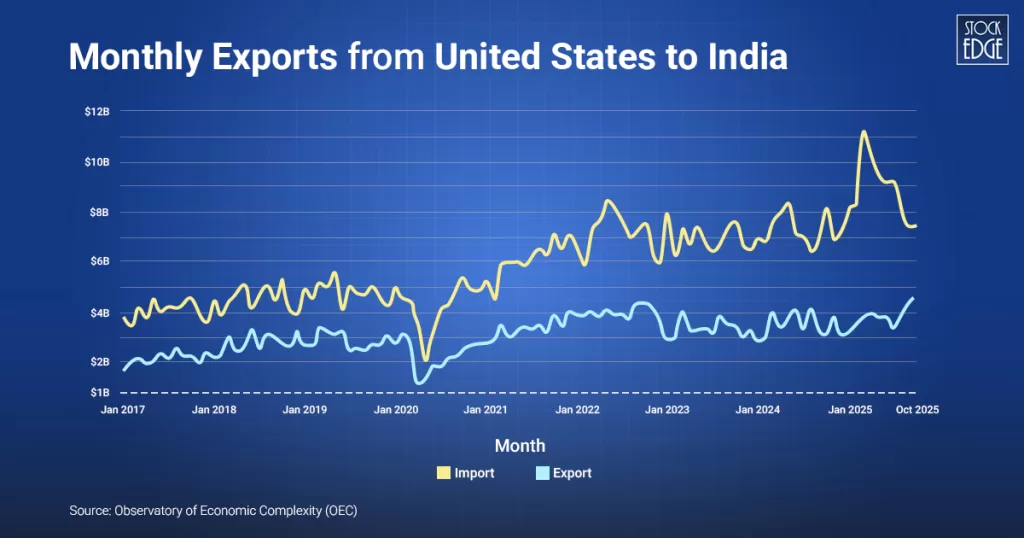

In October 2025, India exported $6.31B and imported $4.46B from the United States, resulting in a positive trade balance of $1.84B.

Between October 2024 and October 2025, India’s exports to the U.S. fell by $606 million (8.77%) to $6.31 billion, while imports rose by $727 million (19.5%) to $4.46 billion. This widening gap highlights the growing impact of higher tariffs and trade frictions on India’s export momentum.

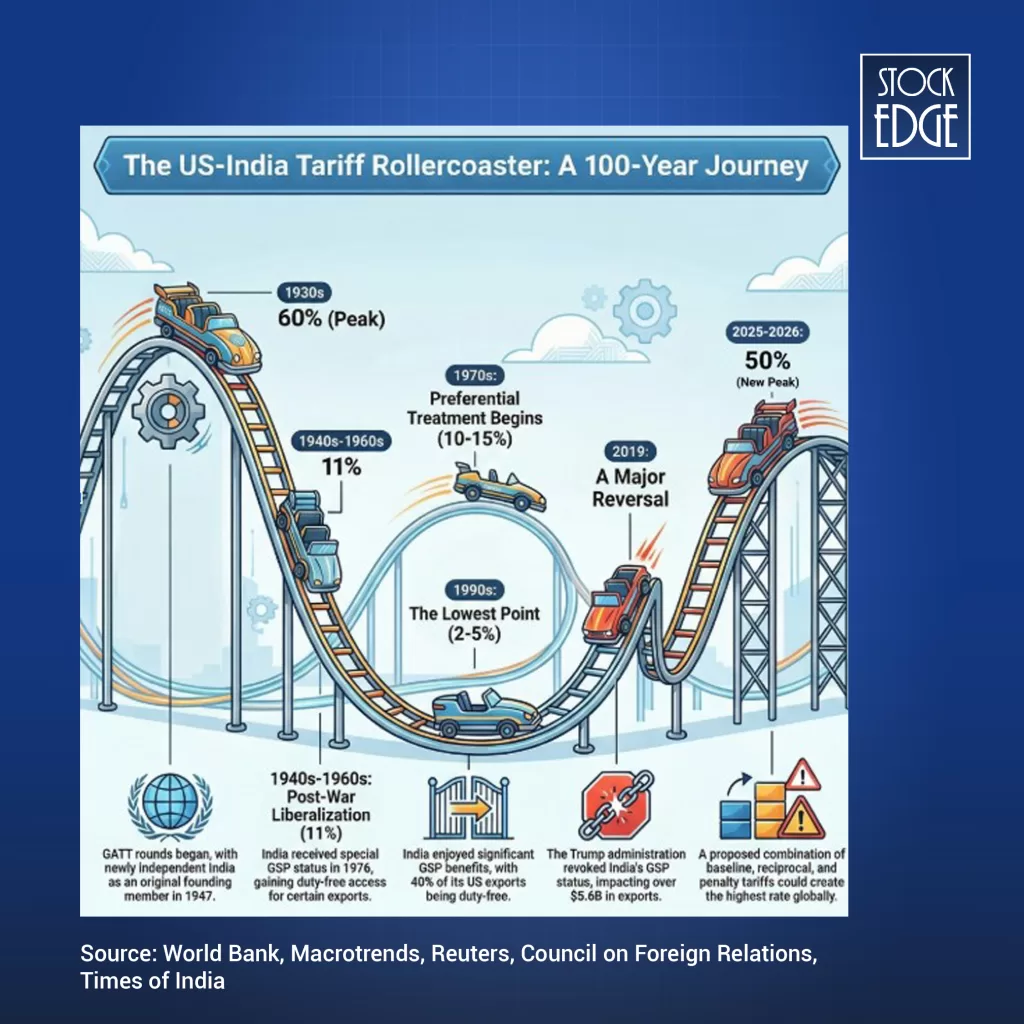

This is not the first time the US tariff rates have been raised. The image below highlights how the India – US tariffs relation works.

In the 1920s, the Fordney–McCumber Act imposed tariffs of about 38.5% on Indian goods, constraining exports even under colonial rule. This escalated in the 1930s with the Smoot–Hawley Tariff Act, which pushed tariffs close to 60%, deepening the Great Depression and disrupting global trade.

The 1990s marked a reversal. Tariffs dropped to 2–5%, and India benefited from duty-free access under the GSP during the globalisation and liberalisation phase.

In 2019, the U.S. withdrew India’s GSP status, triggering short-term volatility in export-oriented stocks. Today, tariff levels have once again climbed back to near-1930s peaks, reviving similar trade pressures.

Effect of Tariffs on the Indian Stock Market

Tariffs may appear to be a trade policy tool, but for financial markets, they function as a macroeconomic shock.

- Exports & Earnings: Higher tariffs raise costs for Indian goods in the U.S., leading to order cuts or delays and weaker revenue visibility.

- Margins: Limited ability to pass on costs results in margin compression and potential earnings downgrades.

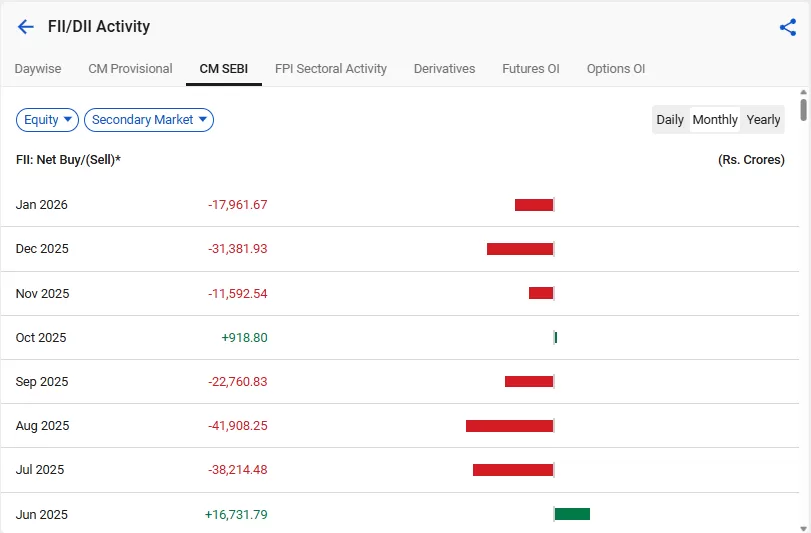

- Investor Sentiment: Trade uncertainty makes FIIs cautious, increasing volatility and pressuring equity flows.

To check the FII/DII Activity, please click here

- Currency Impact: Export stress and capital outflows weaken the rupee, raising import costs and inflation risks.

- Valuations: Globally exposed stocks face valuation de-rating, with indices typically entering consolidation rather than sharp corrections.

Now, let’s look at the sector-specific

Sector-by-Sector Impact

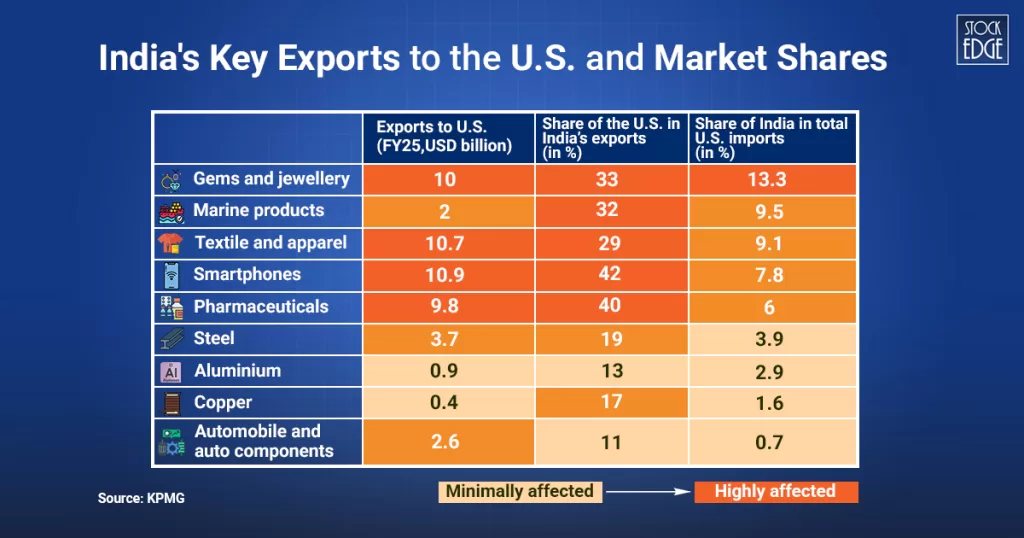

Over 30% of India’s exports in textiles, pharmaceuticals, smartphones, gems & jewellery, and marine products are linked to the U.S. market, making these sectors particularly vulnerable to US tariff actions.

The image below shows the relative exposure of Indian industries to the U.S., indicating areas of higher trade vulnerability.

Gems and Jewellery

The United States accounts for 33% of India’s gems and jewellery exports, with India supplying nearly 45% of the U.S. diamond import demand. The table below shows the category-wise share of India’s jewellery exports to the U.S., showing higher exposure.

| Category | The US’s Share |

| Pearls, precious, semiprecious stones | 35% |

| Gold and other precious metal jewellery | 25% |

Source: ICRA

Impact on the Gems and Jewellery Sector

The industry is already under pressure from weak pricing, slowing global luxury demand, and sanctions on Russian rough diamonds. Higher tariffs sharply intensify stress for MSMEs (≈85% of the industry), increasing risks of margin erosion, liquidity pressure, and job losses.

Strategic Response:

To mitigate the effect of tariffs, exporters are shifting processing and trading operations to the UAE and Gulf region, benefiting from lower U.S. duties, tax advantages, and stronger logistics infrastructure.

Textiles & Apparel

Approximately 29% of India’s textile exports are destined for the U.S. The table below shows the category-wise share of India’s textiles and apparel exports to the U.S., showing higher exposure.

| Category | The US’s Share |

| Carpet handmade | 60% |

| Silk carpets | 47% |

| Floor covering of jute | 45% |

| Handicrafts excluding handmade carpets | 40% |

| Cotton fabrics, madeups etc. | 39% |

| Ready made garments (RMG) of other textile materials | 36% |

| RMG of cotton incl. accessories | 33% |

| Other textile yarn, fabric madeups articles | 31% |

Source: ICRA

Impact on Textile and Apparel:

India faces strong competition from Bangladesh and Vietnam, which benefit from lower tariffs and cost advantages. Higher US tariffs squeeze margins and weaken price competitiveness in mass-market apparel.

Strategic Response:

The industry is accelerating its pivot toward the European Union, a market nearly twice the size of the U.S. India is positioning itself in premium, sustainable cotton textiles and compliance-led manufacturing, emphasizing quality, traceability, and ESG standards.

Marine Products

The U.S. absorbs 32% of India’s marine exports, with frozen shrimp accounting for over 90% of export value.

Impact on Marine Products:

Higher US tariffs sharply erode India’s competitiveness against Latin American exporters such as Ecuador, which enjoy lower U.S. duties. This poses a direct threat to farmer incomes, coastal employment, and export-linked aquaculture ecosystems.

Strategic Response:

Exporters are diversifying toward Russia and the Middle East, driven by hospitality-led demand in the UAE and Saudi Arabia. The U.K. market, which imports nearly 90% of its seafood and offers tariff-free access, has emerged as a critical alternative growth channel.

Pharmaceuticals

The U.S. accounts for 40% of India’s pharmaceutical exports, with Indian firms supplying roughly 40% of U.S. generic drug demand. The table below shows the category-wise share of India’s pharma exports to the U.S., showing higher exposure.

| Category | The US’s Share |

| Drug formulations, biologicals | 37% |

| Medical and scientific instrument | 16% |

| Surgicals | 13% |

Source: ICRA

Impact on Pharmaceuticals:

Generic pharmaceuticals operate on extremely thin margins, making it impractical to absorb a 50% US tariff shock. Cost escalation is likely to be passed on within the U.S. healthcare system. Additionally, the risk of Section 232 tariffs aimed at reshoring drug manufacturing adds further uncertainty.

Strategic Response:

Indian pharmaceutical companies are expanding aggressively into Europe, the U.K., and Australia, where regulated markets, aging populations, and stable pricing frameworks provide long-term demand visibility.

Automobiles and Auto Components

The U.S. represents 11% of total automobile exports and 29% of auto component exports.

Impact on Automobiles and Auto Components:

The effect of tariffs materially weakens India’s competitiveness in the U.S. replacement and aftermarket segments. Cost pressures have prompted industry representations to U.S. authorities, warning of disrupted supply chains and higher end-user prices.

Strategic Response:

Manufacturers are diversifying toward Africa and Latin America, where demand for affordable vehicles and components is rising and tariff barriers are comparatively lower.

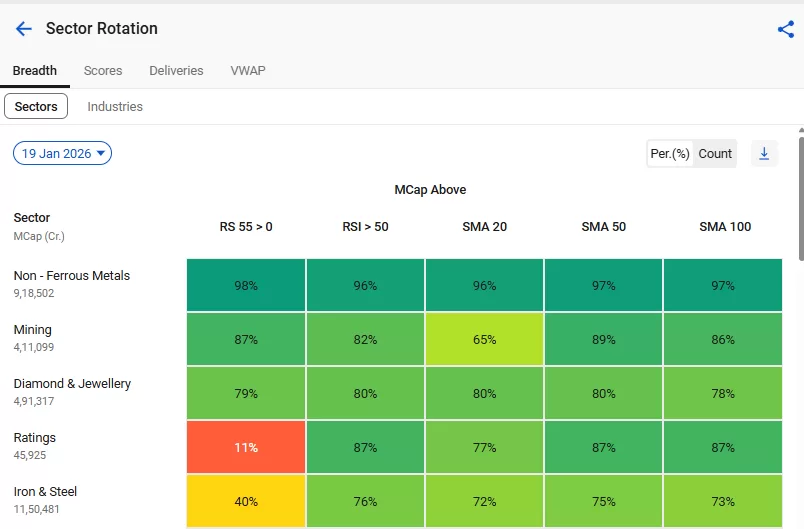

To track which sectors are outperforming or underperforming, explore the Sector Rotation feature on StockEdge.

What Does the Future Hold?

As of January 2026, the US-India trade relationship has entered its most volatile phase in decades. Following the 50% cumulative US tariff on Indian exports, imposed in August 2025. India’s key sectors like textiles, pharmaceuticals, gems, electronics, and leather face severe pressure.

Now, the US tariffs may push even higher, theoretically up to 500%, essentially acting as an import ban. The effect of tariffs would be dramatic:

- Indian exporters: Orders could vanish overnight, factories could shut, and jobs could be lost.

- US consumers: Prices of goods, electronics, and medical supplies could rise sharply.

- India’s economy: Slower growth, weaker rupee, and pressure on manufacturing.

To survive, businesses are likely to diversify markets, strengthen domestic production, and brace for continued trade uncertainty.

Conclusion

Today, India faces a dual challenge – safeguarding its export-oriented economy while maintaining strategic autonomy in foreign policy.

For businesses, the path forward demands market diversification, operational resilience, and proactive engagement with policy channels.

Read: Next Era of Finance Using AI

Frequently Asked Questions (FAQs)

1. Can US tariffs affect the inflation in India?

Higher tariffs can weaken exports, trigger capital outflows, and put pressure on the rupee. Imported goods become costlier, contributing to inflationary pressures.

2. How do US tariffs impact India’s GDP growth?

Reduced exports can lower corporate revenues, impact jobs in export-dependent sectors, and slow overall GDP growth. Diversification and new trade partnerships can offset some of these effects.