Table of Contents

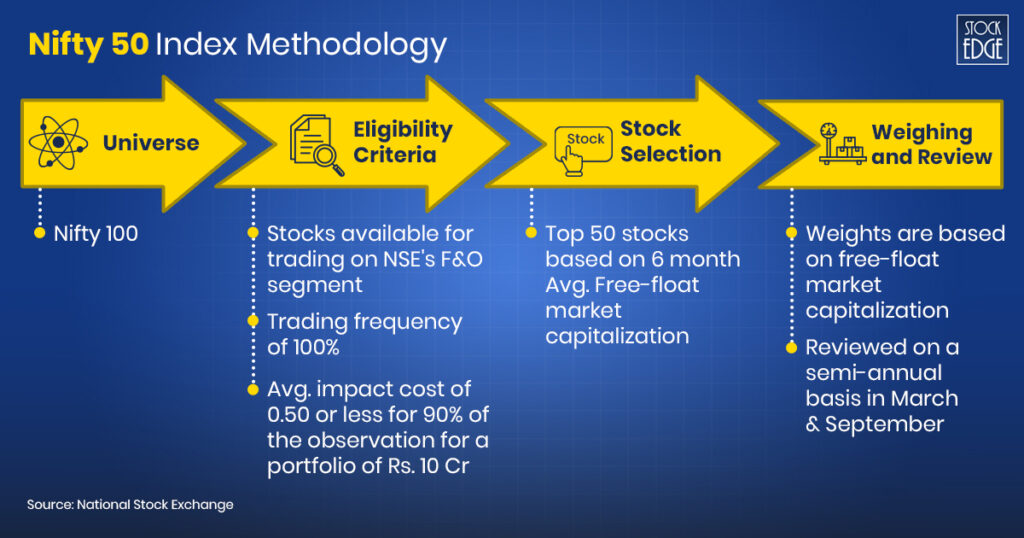

Imagine out of over 5000 listed shares, selecting 50 of them to represent the pulse of a nation’s economy is like trying to find a needle in a haystack. However, this is what the Nifty 50 does.

Choosing the right stocks to invest in is more challenging as it requires more skills and knowledge. However, Nifty 50 gives an opportunity to invest in the top 50 stocks. These 50 stocks act as a barometer of the Indian Market.

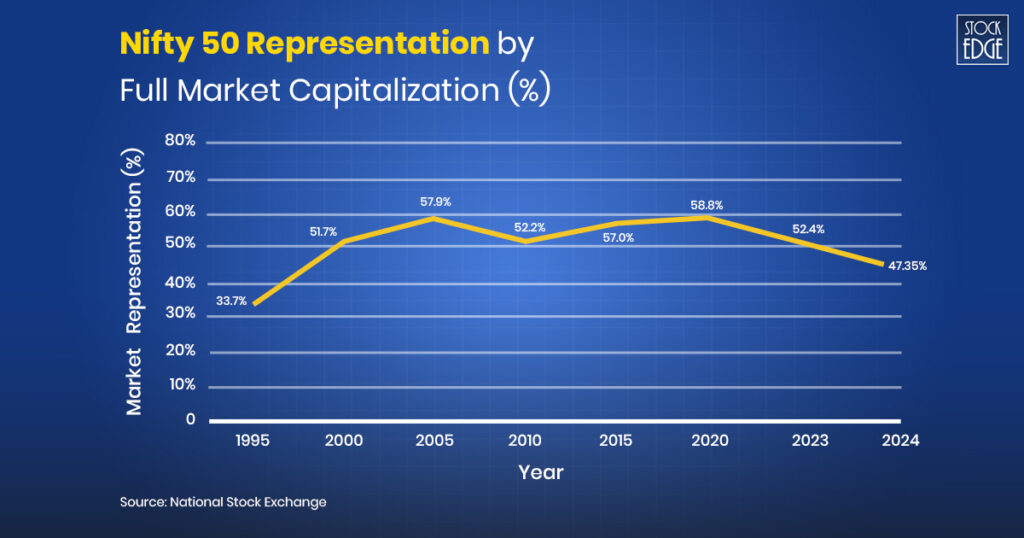

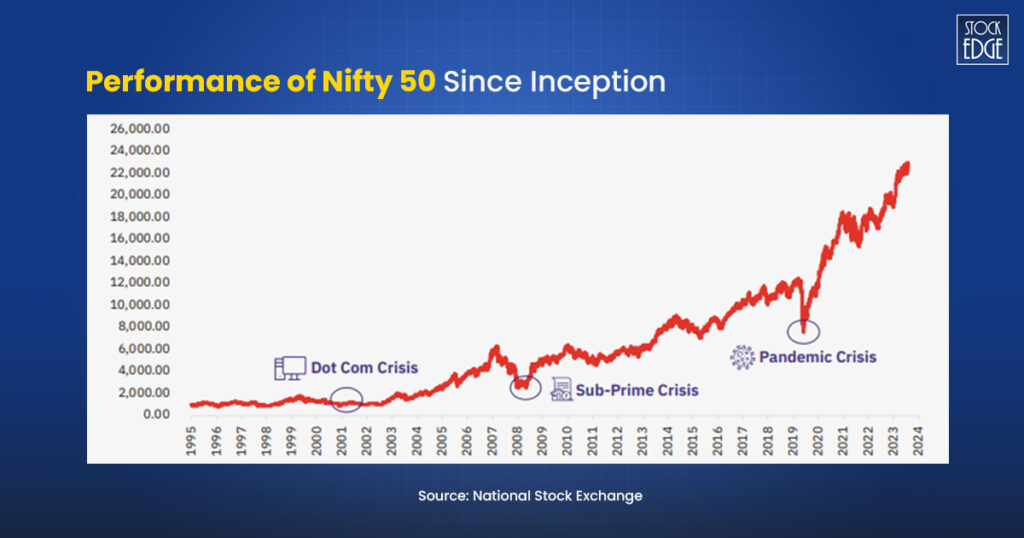

Since its inception in November 1995, the Nifty 50 index has witnessed remarkable growth in its market capitalization coverage, expanding from 33.7% to 47.35% of the total traded equities at the National Stock Exchange (NSE) as of March 2024.

In this blog, you will dive into the role of Nifty 50 and the reason for investing in Nifty 50 stocks. You will also check the top 10 Nifty 50 stocks that can be added to your watchlist.

Nifty 50 and Its Role in India’s Economy

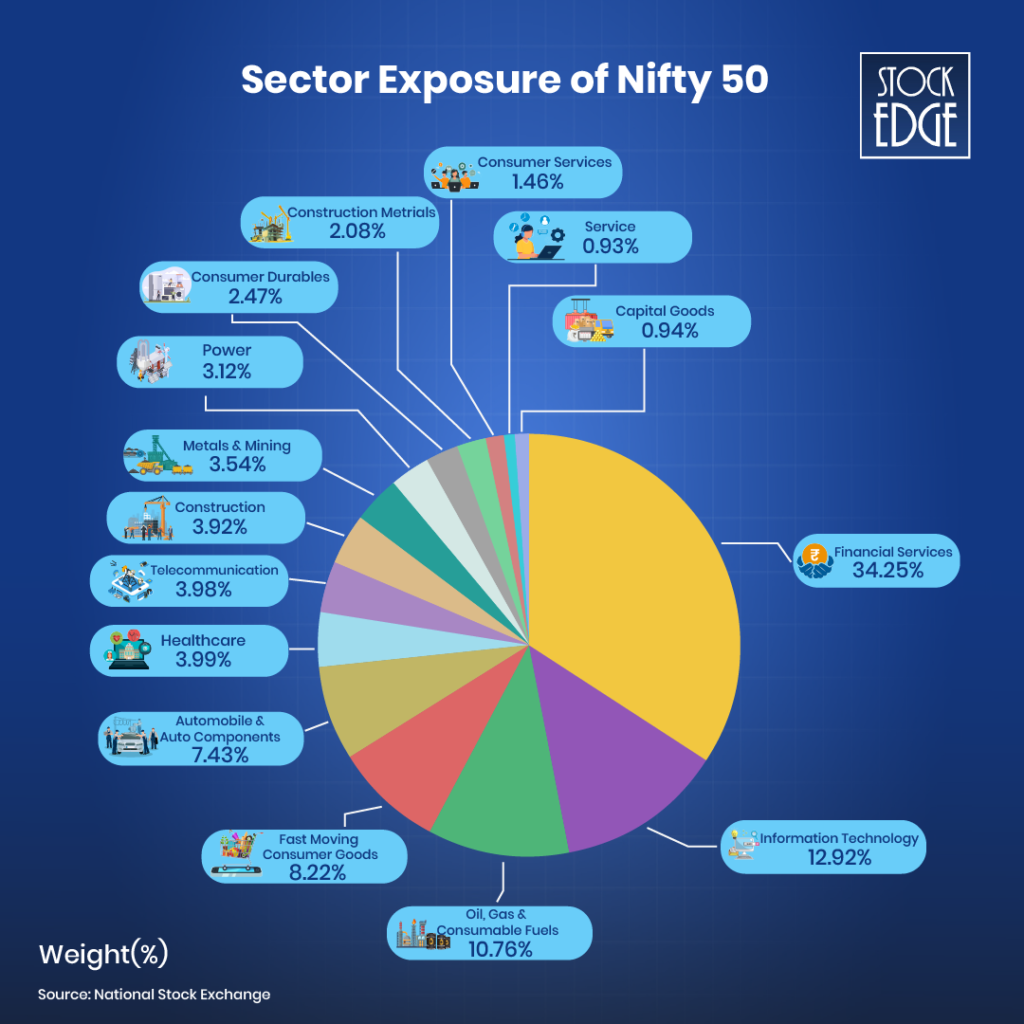

Now, understand the role of Nifty 50 in the Indian Economy. Nifty 50 is the barometer of the Indian economy. It tracks the performance of the top 50 listed on the National Stock Exchange (NSE) of India. These 50 companies span across various sectors, making it a comprehensive indicator of the overall market sentiment and economic health. The Nifty 50 includes companies from sectors like financial services, IT, energy, pharmaceuticals, consumer goods, and more, making it a diversified representation of the Indian economy.

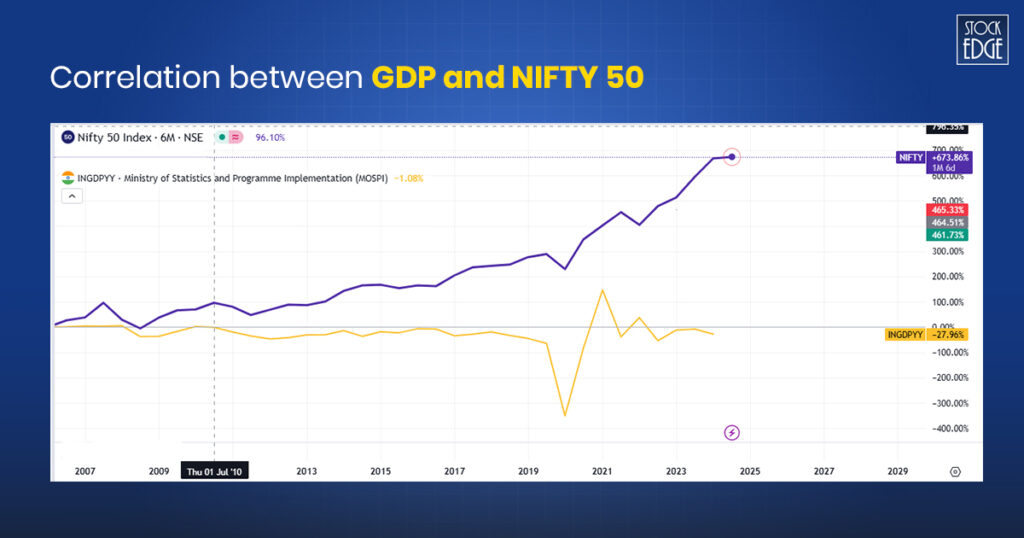

Global Journal of Management and Business has done a study to analyze the impact of Gross Domestic Products (GDP) on Stock Market Movement in India. According to them, the co-relation between GDP and NIFTY 50 is 0.970837, which means that there is a strong positive relationship between these two variables. In simple terms, if GDP increases, then NIFTY 50 also increases because of the correlation.

The above chart reflects how the Nifty 50 and GDP are connected. A purple line depicts the Nifty 50 Index, while a yellow line depicts the GDP. It clearly shows that when the Nifty 50 Index shows an upward trend, the GDP also tends to show an increase. Conversely, when the Nifty 50 Index declines, the GDP data also shows a downward trend.

Now understand: Are Nifty 50 stocks the great options to invest in?

Why Invest in Nifty 50 Stocks?

Before investing in Nifty 50 stocks, it’s important to understand why you should consider investing in these companies. Look out for the reason:

Portfolio Diversification

The Nifty 50 comprises companies across diverse sectors, ensuring your investments are not overly reliant on a single industry. This diversification minimizes risk and enhances the potential for stable returns. As of November 26, 2024, the Nifty 50 index has exposure to 15 sectors. Financial services (34.25%), information technology (12.92%) and oil, gas & consumable fuels (10.73%) are the highest-weighted sectors of the Nifty 50 index. On the other hand, capital goods (0.94%) and services (0.93%) are the sectors with the lowest weight in the index.

Stable Returns

Nifty 50 stocks are well-established companies with strong financials and a track record of stability. These companies often weather economic downturns better than smaller firms, making them attractive for long-term investors seeking consistent returns. Historically, the Nifty 50 has delivered steady growth, and its stable performance makes it an appealing option for both conservative and growth-focused investors.

Long-Term Growth

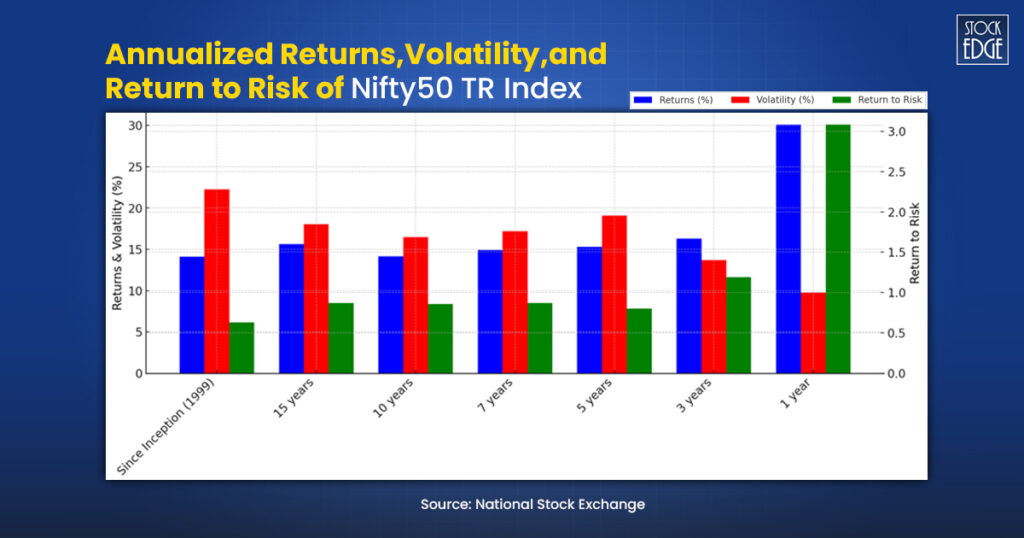

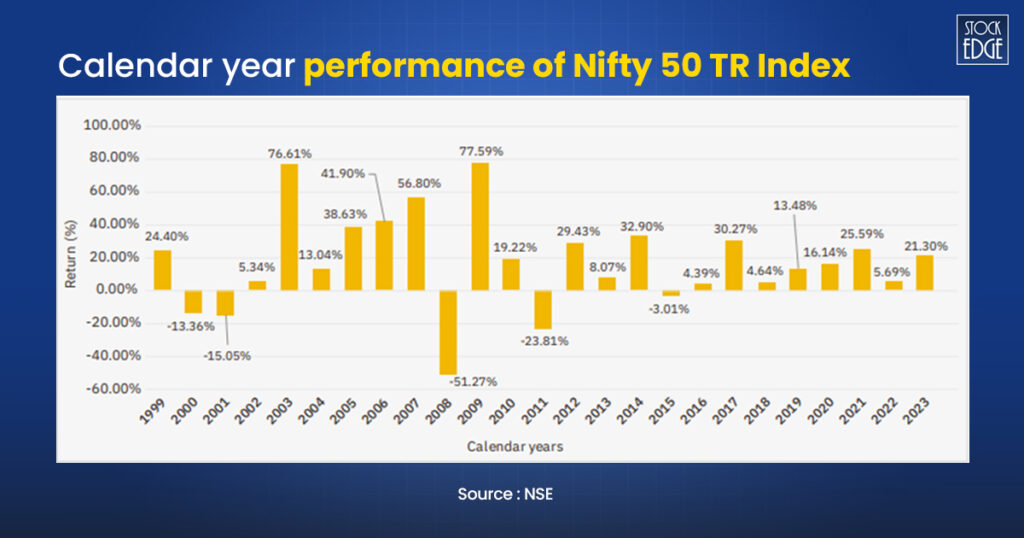

The Nifty 50 index is composed of companies that are leaders in their respective industries. These companies are well-positioned for long-term growth, both within India and globally. Since June 30, 1999, the Nifty 50 Total Return (TR) index has delivered annualized returns of 14.10% with annualized volatility of 22.25%. TR index assumes dividends are reinvested in the index and hence represents both Price Return (PR) and Dividend return.

Now, let’s dive into the top 10 Nifty 50 Stocks that can be added to your watchlist.

Top 10 Nifty 50 Stocks to Watch

Now that we understand the importance of the Nifty 50 let’s dive into the top 10 Nifty 50 stocks that can be a key part of your investment strategy.

Reliance Industries Limited (RIL)

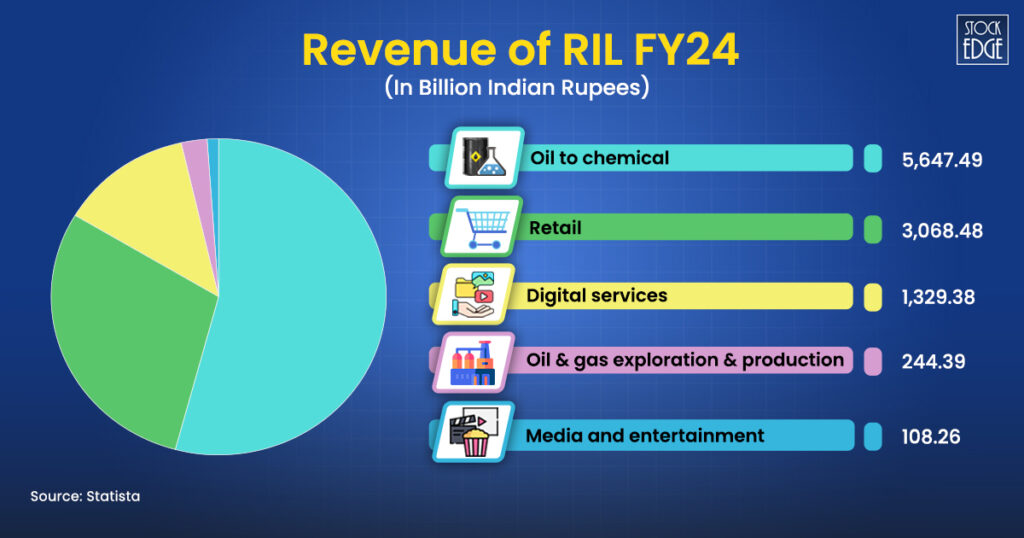

There are 12 companies that have been present in Nifty 50 since its inception, and one of them is Reliance. It has diverse businesses that include energy, petrochemicals, natural gas, retail, telecommunications, mass media, and textiles. Reliance Industries Limited reported its highest revenue from the oil to chemical business in the financial year 2024. This value amounted to over 5.6 trillion Indian rupees.

Now, let’s check out its Key Strengths

Key Strengths

Let’s look at the key strengths of various segments of Reliance Industries Ltd.

Retail

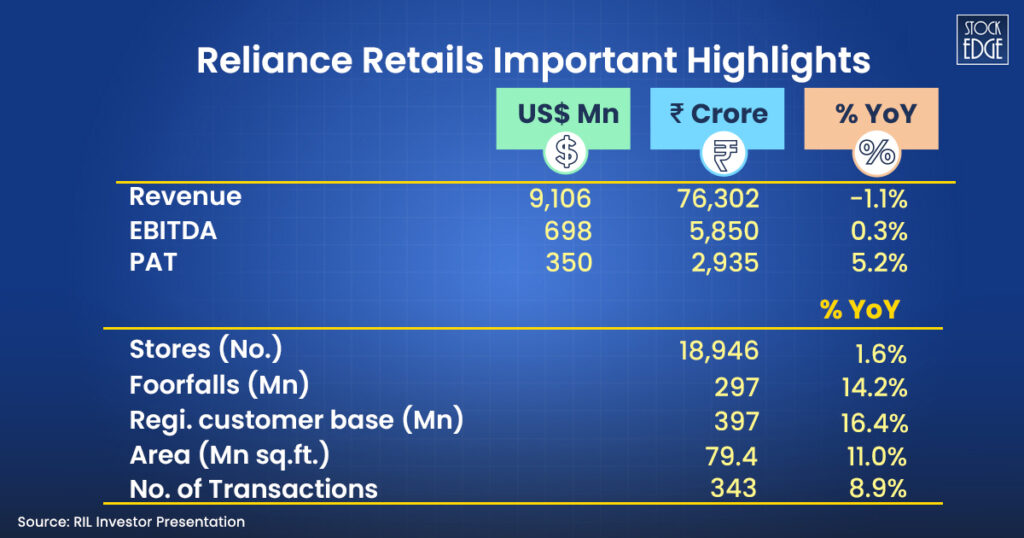

Reliance Retail has expanded its portfolio with acquisitions like Sephora India, Superdry, and Metro India. Consumer Electronics saw growth in Reliance Digital and MyJio stores, which was supported by the resQ service expansion and new commerce initiatives like JioMart Digital.

In Fashion and Lifestyle, AJIO expanded its catalogue with over 600 brands, launched new formats like ‘Swadesh’ for traditional crafts, and introduced the youth-focused ‘Yousta’ brand. Grocery retail achieved steady growth, integrating Metro India’s operations and collaborating with over 125 brands for campaigns like ‘SMART Bazaar Chaliye.’

Consumer Brands expanded through a multi-channel model, focusing on indigenous and affordable products. It launches new products across brands, including Campa, Independence, Maliban, Ravalgaon, etc.

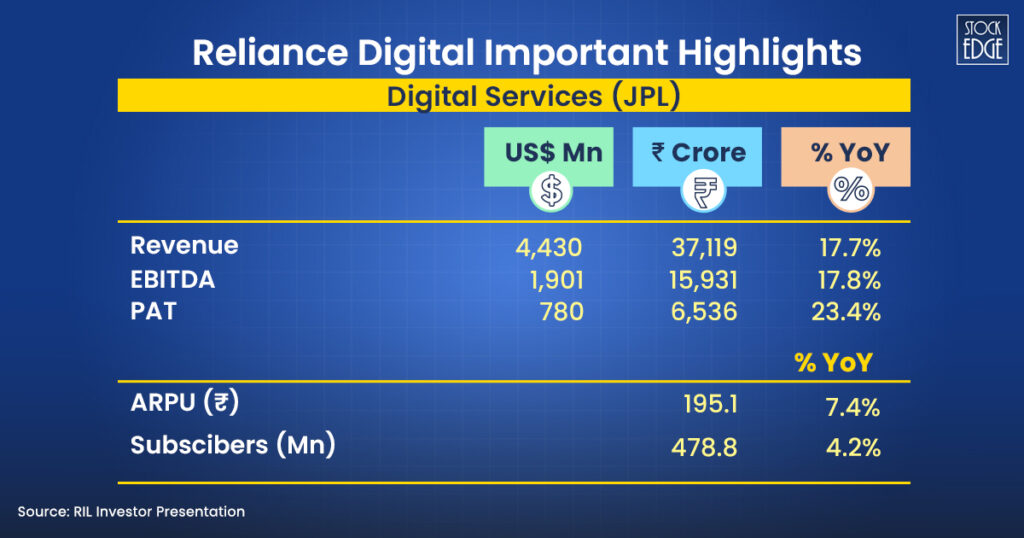

Digital Services

In FY 24, Jio True5G expanded, with 108 million users and advanced tech like VoNR and Quantum-Safe security. JioAirFiber also expanded the fixed broadband market, connecting ~12 million premises and launching in 5,900 towns. It strengthened its enterprise connectivity presence across BFSI, government, and SMB sectors while signing significant deals in Cloud, CPaaS, and IoT services. Jio filed 1,255 patents in innovations like 6G, IoT, and AI, launching products like JioBharat and JioSpaceFiber.

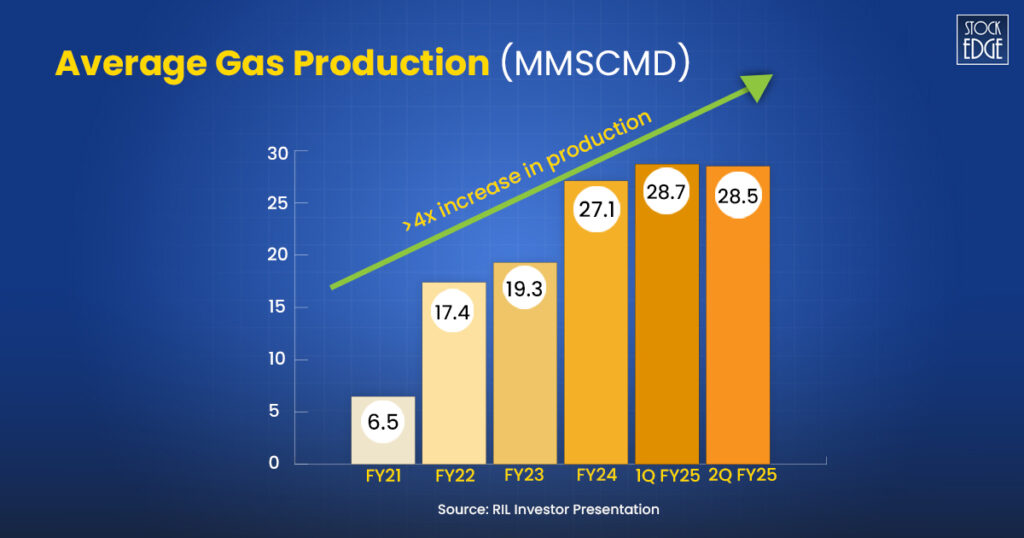

Oil & Gas

In Q2 FY25, the oil & gas business revenue declined by 6% YoY to ₹6,222 crore, mainly on account of lower price realization, partly offset by an increase in gas and condensate volumes in Krishna Godavari Dhirubhai 6 (KG D6) and CBM (coal bed methane) field. The current rate of production is ~28.1 MMSCMD of gas and ~21,000 bbl/day of oil/condensate.

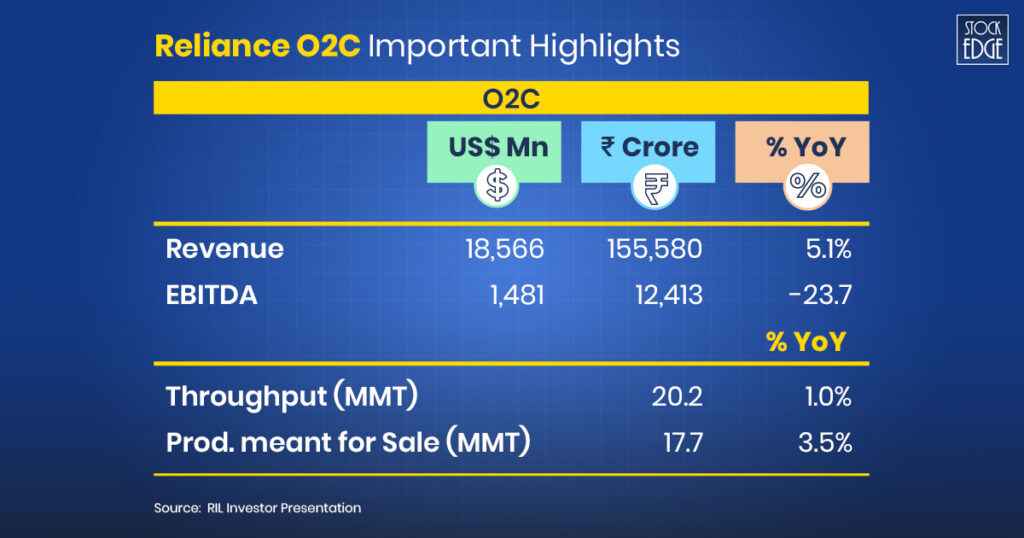

Oil to Chemicals (O2C)

The Oil-to-Chemicals (O2C) business at Reliance Industries produced 30% of India’s domestic gas in FY 2023-24. It encompasses a diverse portfolio of transportation fuels, polymers, elastomers, intermediates, and polyesters, with deeply integrated refineries and petrochemical units. . Transportation fuels saw growth in domestic demand despite weak global margins, with gasoline, gasoil, and jet fuel cracks declining due to geopolitical tensions.

Check out our Edge Reports to understand the company’s financials

Tata Consultancy Services (TCS)

Tata Consultancy Services (TCS) began trading on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on August 25, 2004. The following day, it was included in the NIFTY 50. TCS is an IT services company and a part of the Tata Group.

It has a complete portfolio of offerings – grouped under consulting and service integration, application services, digital transformation services, cloud services, engineering services, cognitive business operations, and products & platforms.

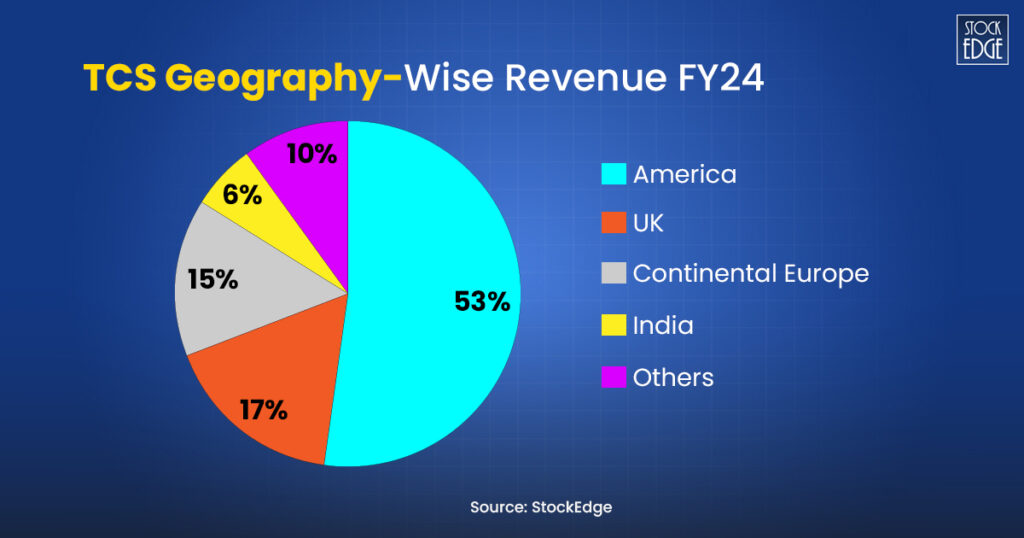

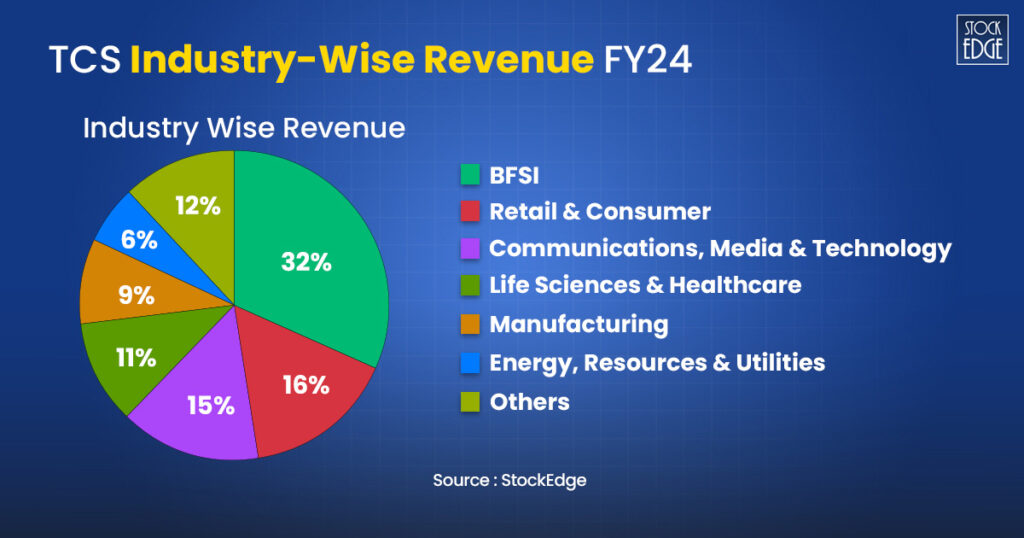

TCS’s geographic footprint covers North America, Latin America, the United Kingdom, Continental Europe, Asia-Pacific, India, Middle-East and Africa. TCS considers industry verticals as its primary go-to-market business segments. The key vertical clusters are Banking, Financial Services and Insurance (BFSI), Retail and Consumer Business, Communications, Media and Technology (CMT), Manufacturing, Life Sciences and Healthcare and Others. The last category includes Energy, Resources and Utilities, Public Services and others.

Key Strengths

The sales in FY24 stood at ₹2,40,893 crore, a growth of 6.9% YoY. In Q2 FY25, contribution to revenue from the various segments was as follows: BFSI (Banking, Financial Services and Insurance) ~32%, Consumer Business 16%, Life Science & Healthcare 11%, Manufacturing 9%, Communication & media 15%, ENRU (Energy, Resource & Utilities) 6% and Regional markets & others ~12%.

The company continued to witness an uncertain geopolitical macro environment & overall slower demand scenario. However, they demonstrated stable performance on account of their diversified portfolio, signs of recovery in the banking vertical, and strong performance in growth markets.

According to Brand Finance, Tata Consultancy Services’ brand value grew by 476% from 2010 to 2020, which is the highest percentage growth in the IT services industry. During the quarter, the majority of the growth was led by AI Cloud, Cyber Security and TCS Interactive.

Clients continued to prioritize areas like customer acquisition, modernizing digital core, including ERP (enterprise resource planning) platforms and improving enterprise observability, regulatory compliance and security posture. While discretionary spending was impacted, clients continued to invest and see improved outcomes using AI and Gen-AI. AI Cloud continued to see momentum in AI and Gen-AI with over 600 new engagements. Clients continued to spend money on cybersecurity services. Ransomware, Governance, and Compliance are significant areas of growth.

HDFC Bank

HDFC Bank was listed in the Nifty 50 index on November 8, 1995. It is the largest private sector bank with a total business (loans + deposits) of over ~₹48.4 lakh crore (post-merger). The bank has a pan-India presence. The Reserve Bank of India (RBI) has declared HDFC Bank as a domestic systemically significant bank (DSIB), highlighting its significance in the Indian banking industry.

The bank has amalgamated with its parent business HDFC Ltd, a housing finance behemoth with an AUM of around ₹7 lakh crore, effective July 1, 2023. This merger has resulted in a substantial financial conglomerate that is likely to profit from HDFC Ltd’s low operational cost ratios, cheaper funding costs from HDFC Bank, increased cross-sell opportunities, and the elimination of holding company discounts. The bank offers a wide range of financial services, including commercial and investment banking for wholesalers and branch banking for retailers.

After the merger, the key HDFC Bank subsidiaries included HDFC Securities, HDB Financial Services, HDFC Asset Management Co. Ltd, HDFC ERGO General Insurance, HDFC Capital Advisors, and HDFC Life Insurance Co. Ltd. In the space of asset management and life insurance, the company’s subsidiaries are amongst the leading players.

Key Strengths

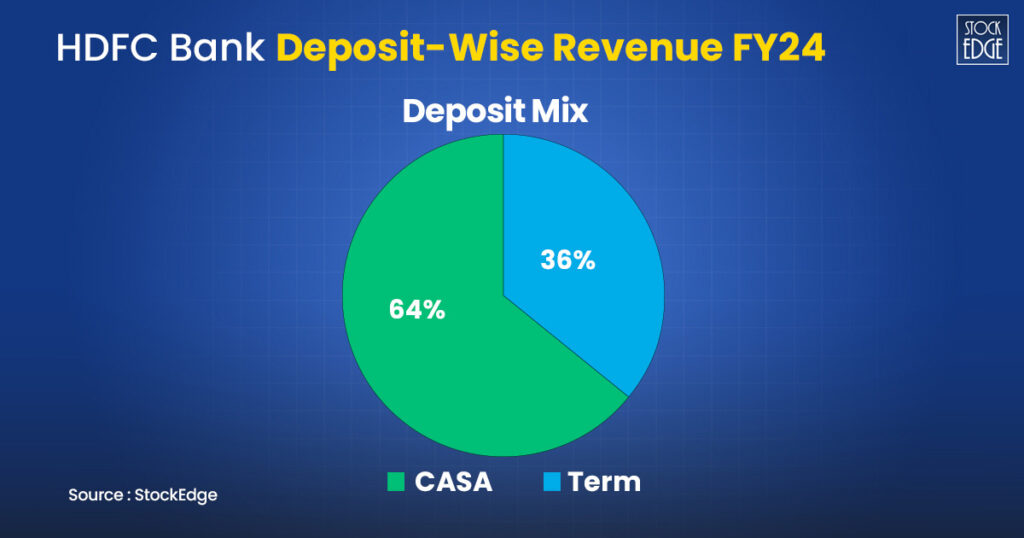

The merger of HDFC Bank and erstwhile HDFC Limited presents an opportunity to create enhanced value for stakeholders through alliance, operational efficiency improvements and an expanded suite of financial products. HDFC Bank has demonstrated strong growth in Q2 FY25, with key metrics showcasing its resilience and strategic focus. The bank’s Net Interest Income (NII) surged by 11.2% YoY, reaching ₹37,588 crore, driven by improved margins. Its Net Profit also saw a solid increase of 7.6% YoY, standing at ₹18,627 crore. Retail banking continued to be a significant growth driver, with domestic retail advances up by 11.3% YoY, particularly in retail mortgages and personal loans. The bank’s deposit growth was robust, rising by 15.1% YoY, which led to a reduction in the credit deposit ratio to 99.8%. HDFC Bank also managed to improve its Cost to Income Ratio, which declined by 43 bps QoQ to 40.6%, highlighting operational efficiency. While there was a slight uptick in asset quality, with GNPA and NNPA ratios edging up, the bank remains well-capitalized with a strong liquidity position. Looking ahead, HDFC Bank expects to grow its loan book below industry levels in FY25 but anticipates aligning with the industry in FY26 and outpacing it by FY27.

To know more about the company’s financial performance, read our Edge Reports.

Infosys Limited

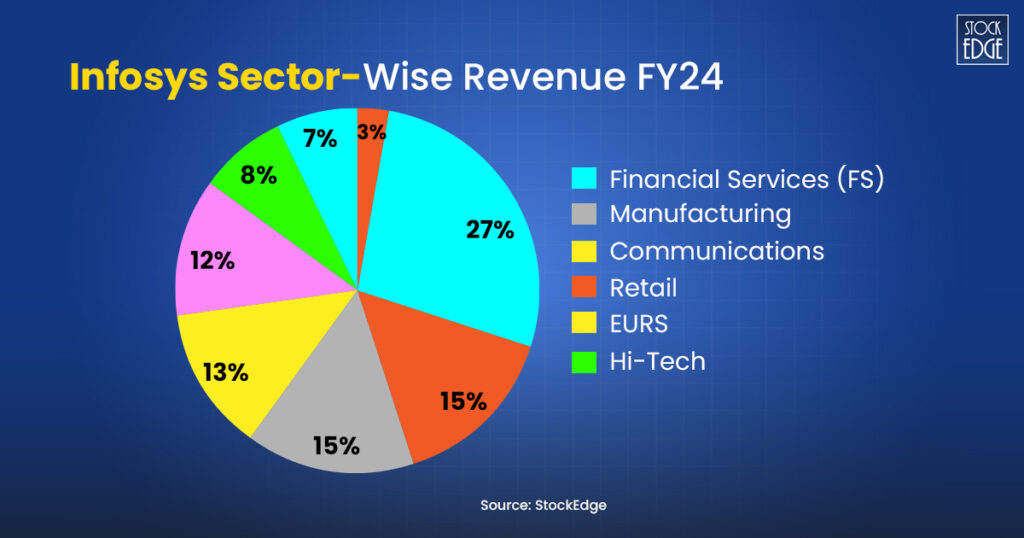

Infosys was listed on the Nifty 50 index on October 7, 1998. It is a prominent provider of consulting, technology, outsourcing, and next-generation digital services, helping clients in over 56 countries develop and implement digital transformation plans. It is India’s second largest information technology (IT) services company. The company’s revenues are mostly derived from IT services, which include software development and related services, maintenance, consulting and package implementation, software product and platform licensing, and other next-generation technologies such as AI and Gen-AI.

Key Strengths

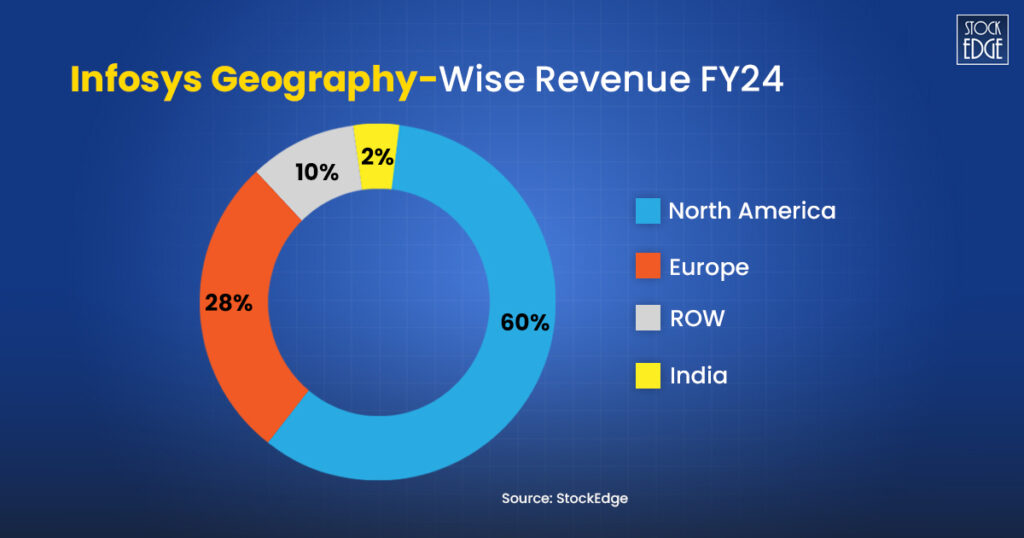

The company acquired in-Tech Holding on 18th April 2024 for €450 million. It is a leading Engineering R&D service provider focused on the German automotive industry and develops solutions in e-mobility, connected & autonomous driving, EVs, off-road vehicles and railroads. In-tech offerings include system design, methodical consulting, advanced electronics platform development, validation of automotive-specific software & hardware systems, infotainment, and others. During the quarter, the operating margin contracted by ten bps on a YoY basis and was flat QoQ. The margins were flat QoQ despite higher variable pay and acquisition costs due to operational efficiency and Project Maximus levers. Tailwinds of 80 bps were from Project Maximus, ten bps impact from favourable currency movement, which was offset by ~30 bps headwind of acquisition-led cost owing to amortization of intangible assets and 60 bps from higher variable pay. In FY24, the revenue contribution by geography was: North America 60%, Europe 28%, Rest of the world (ROW) 10% and India 2%. Europe’s growth was robust due to the impact of acquisitions.

To learn about the company’s deal, client matrix, and future outlook, read our Edge Reports.

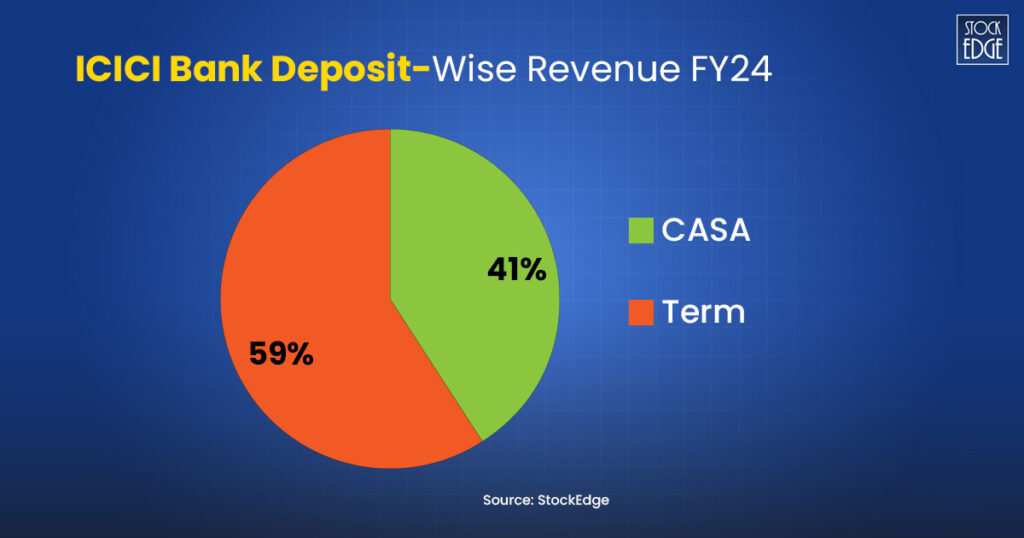

ICICI Bank

ICICI Bank is also one of the 12 companies listed on Nifty 50 since its inception. It is India’s second largest private sector bank, with a loan book size of Rs 12.2 lakh crore. The bank has a pan-India presence with 6,523 business centres, 17,190 ATMs and Cash Recycling Machines, and 570 Insta Banking Kiosks across the country. ICICI Bank has its feet in various other financial services segments like life insurance, general insurance, broking, etc, via its subsidiaries and has a meaningful presence in each of these business lines.

Since the past few quarters, the bank has been amongst the top performers when compared to its large peers in terms of operational show and overall business growth. The bank’s liability profile has improved significantly, capitalization levels are healthy, PCR is strong, and the contingency buffer is ~₹13,100 crore, providing comfort over a good earnings trajectory.

Key Strengths

In Q2 FY25, the bank posted advances growth of 15% YoY and 4.4% QoQ to ₹12.77 lakh crore. Retail loans increased by 14.2% YoY and formed 53% of total advances, while Business Banking loans registered a strong growth of 30% YoY. Within the retail space, mortgage and vehicle loans were up 13.2% YoY and 8.4% YoY, respectively, while personal loans and credit cards showed robust growth of 17.3% YoY and 27.9% YoY respectively. On a sequential basis, personal and credit card growth was slower than total loan growth. Domestic corporate books were up around 11.8% YoY and formed 20.6% of total loans. In Q2 FY25, the asset quality improved on an overall basis as the GNPA and NNPA ratio declined by 21 bps and one bps to 2.04% and 0.45%, respectively.

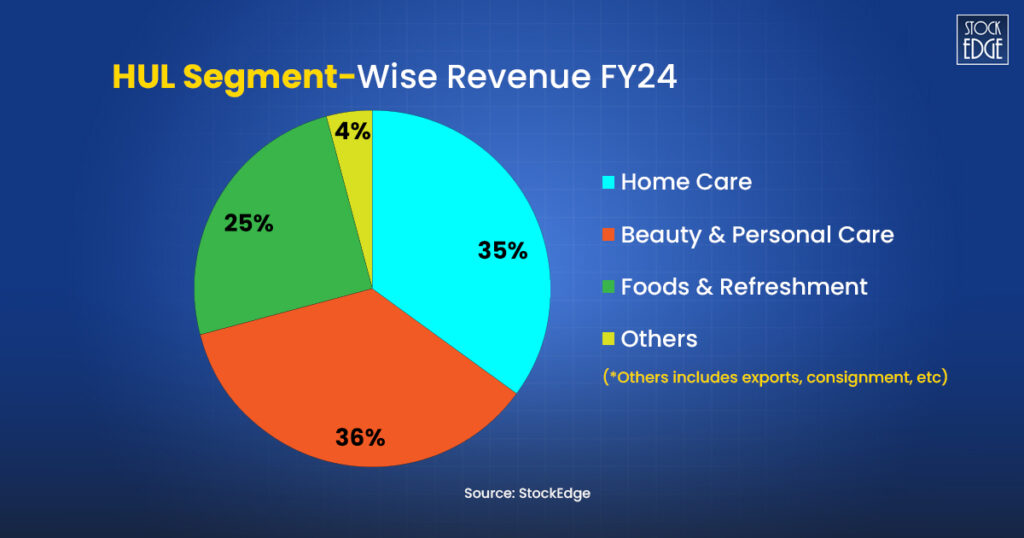

Hindustan Unilever Limited (HUL)

Hindustan Unilever Limited (HUL) is also one of the 12 companies listed on Nifty 50 since its inception. It is the largest FMCG (Fast Moving Consumer Goods) company in India and is the subsidiary of Unilever PLC, a British-Dutch multinational company. The company will report its performance under four segments and will bifurcate the Business & Beauty segment into two independent business segments, namely Beauty & Wellbeing and Personal Care. The management is looking to drive growth by focusing on product innovation & premiumisation, a broad-based portfolio and efficient cost savings & pricing strategy.

It has 19 brands reporting over ₹1,000 cr each annually. These 19 brands account over 80% of the company’s turnover in FY24. A few of its prominent brands are LUX, Surf Excel, Vim, Lifebuoy, Dove, Glow & Lovely, Pond’s, Vaseline, Clinic Plus, Sunsilk, Indulekha, Lakme, Pepsodent, Axe, Brooke Bond, BRU, Kwality Wall’s, Knorr, Kisan and others. In 2020, it acquired GlaxoSmithKline Consumer Healthcare Limited (GSKCH) at a total equity value of ₹40,242 cr. It has acquired brands like Horlicks, Viva, Maltova, and Boost, which are foraying into the wellness segment.

Key Strengths

On a standalone basis, revenue from the sale of products was ₹15,319 crore, led by 3% YoY UVG (underlying volume growth). USG (underlying sales growth) stood at 2% YoY. In Q2 FY25, revenue reported was ₹5,737 crore with USG of ~8% YoY and high single-digit UVG. Growth was driven by fabric wash and household care. Growth in the volume of fabric wash was in the high-single digits, led by premiumization and market development actions.

The board approved the separation of the ice cream business as it is a high-investment and low-margin business. The portfolio restructuring is expected to enable the active business to continue with greater flexibility. It contributed ~3% to the overall industry. The route of the separation shall be decided by the end of FY25. Its online Kirana application, Shikhar, has 14 lakhs onboarded stores, with 70% transacting monthly. The company calibrated price actions as it expects the price inflation to continue. However, if the commodity prices remain sticky to current levels, the price growth shall be a low-single-digit in the near term.

To know more about the company’s growth prospects, read our Edge Report.

Bajaj Finance

Bajaj Finance was added on 29 September 2017 in Nifty 50. It is a diversified NBFC that is primarily engaged in the financing business. It is located at 4,145 locations throughout the country, with 2,576 in rural/smaller towns and villages. It focuses on three areas: consumer finance, small and medium-sized business (SME) finance, and commercial lending. It serves more than 38 million customers around the country.

Regardless of a change in regulatory measures by the RBI, which increased risk measures on consumer credit from 100% to 125% during the year, the company remains well capitalised, with a capital-to-risk weighted asset ratio (CRAR) of 22.52% as of March 31, 2024, placing it among India’s best-capitalised large NBFCs.

Key Strengths

Bajaj Finance Limited showcased robust growth in Q2 FY25, with a 27.7% YoY increase in revenue to ₹17,090 crore and a 13% rise in net profit to ₹4,014 crore. The company achieved a 29% YoY growth in Assets Under Management (AUM), reaching ₹3.73 lakh crore, driven by strong performance in SME lending, Urban B2C, and commercial lending, which grew 29%, 33%, and 26% YoY, respectively. Loans against securities surged 38% YoY, and new loans booked rose by 14% to 96.9 lakh. Customer franchise expanded to 9.2 crore, supported by the addition of 39.8 lakh new customers in the quarter. Bajaj Finance also bolstered its distribution network, adding 43 new locations and 8,600 touchpoints while maintaining a comfortable liquidity buffer of ₹20,196 crore.

Bharti Airtel

Bharti Airtel was added on 1 March 2004 in Nifty 50. It is one of the leading global telecommunications companies and operates across multiple segments, including mobile services, broadband, digital TV, and enterprise solutions. It boasts a strong presence in India, Africa, and South Asia. Airtel serves a diverse customer base of over 500 million and offers a comprehensive range of services, including voice, data, digital solutions, and financial services. The company is also known for its extensive investments in network infrastructure, 5G readiness, and digital transformation initiatives.

Key Strengths

Bharti Airtel showcased significant strengths in Q2 FY25, with revenue growth of 12% YoY and a remarkable 98.4% surge in net profit, driven by robust performance in both India and Africa. In India, the company demonstrated operational efficiency with an improved EBITDA margin of 54.8% and a strong operating free cash flow of ₹11,035 crore. Its ARPU rose to ₹233, reflecting effective tariff revisions and a higher contribution from smartphone data customers, who now account for 75% of the mobile user base. Airtel’s strategic investments in 5G and fixed wireless access (FWA) paid off, with a notable expansion of its 5G network to a customer base of 10.5 crore and FWA customer additions of 5.83 lakh. The broadband and home services segments also maintained momentum, with customer additions and a 17.3% YoY revenue increase in the latter. In Africa, the company sustained double-digit revenue growth of 20.8% YoY in constant currency terms, reflecting strong regional execution.

To know more about the company’s financials, read our Edge Report.

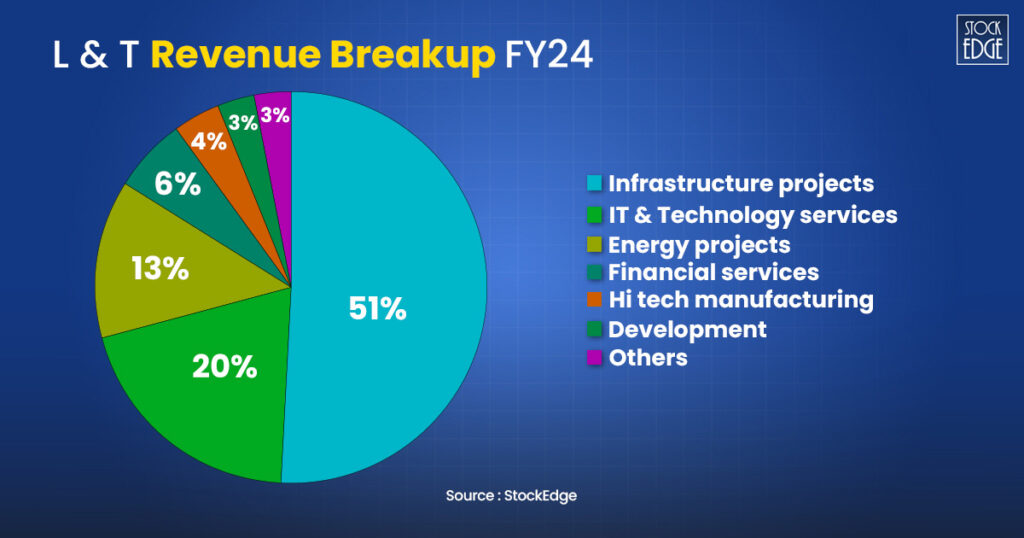

Larsen & Toubro Ltd. (L&T)

Larsen & Toubro (L&T) is one of Asia’s largest vertically integrated Engineering & Construction (E&C) conglomerates, with a strong market position across segments such as infrastructure, power, hydrocarbons, heavy engineering, defence engineering, information technology, technology services, metallurgical & material handling, and machinery & industrial products.

It addresses critical needs in key sectors like Hydrocarbon, Infrastructure, Power, Process Industries and Defence; for customers in over 30 countries around the world. The company’s manufacturing presence extends across eight countries in addition to India. L&T is engaged in core, high-impact sectors of the economy, and its integrated capabilities span the entire spectrum of ‘design to deliver’.

As of 31st March 2024, the L&T Group comprises 105 subsidiaries, 5 associate companies, 15 joint ventures and 35 jointly held operations.

Key Strengths

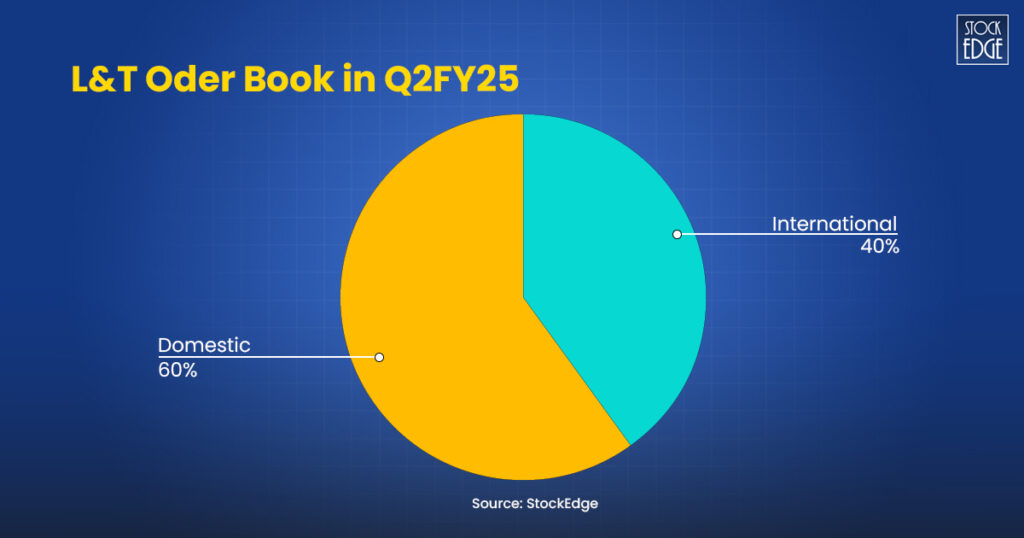

Larsen & Toubro (L&T) was added to Nifty 50 since its inspection. demonstrated robust strengths in Q2 FY25, achieving a 20.6% YoY revenue growth to ₹61,555 crore, supported by rapid execution in its projects and manufacturing (P&M) portfolio and a 52% contribution from international revenue. Its diversified portfolio, including renewable energy, precision engineering, and data centres, continues to evolve with strategic investments, such as the electrolyzer factory expansion and the inauguration of the L&T Semiconductor Technologies development centre.

The company’s ₹5,10,402 crore consolidated order book, with 40% international orders, reflects a strong project pipeline across critical sectors. Its proactive focus on emerging sectors, such as renewable energy and semiconductor technology, coupled with a steady order inflow and an emphasis on timely execution, positions L&T for sustained growth and profitability.

Asian Paints

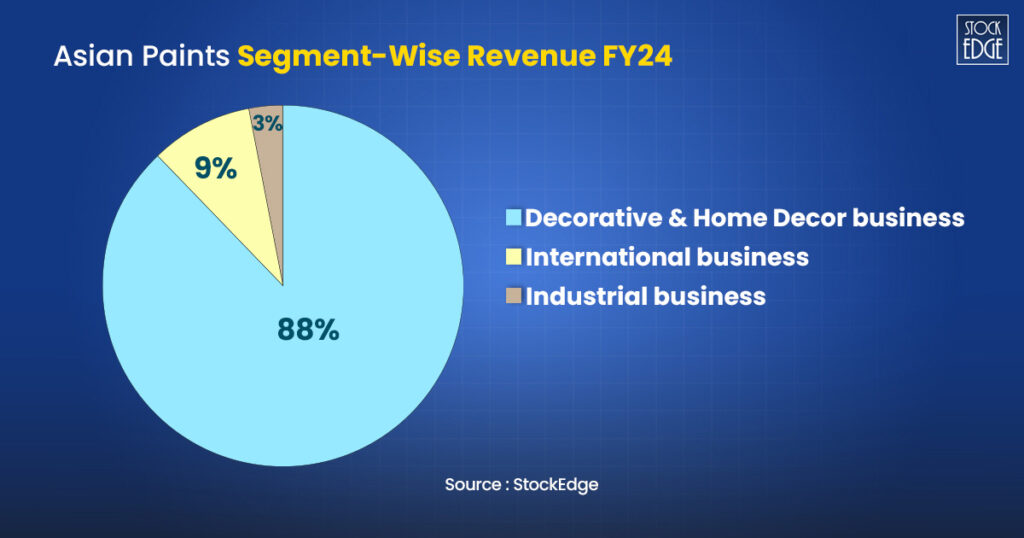

On 27 April 2012, Asian Paints was added to Nifty 50. Asian Paints Ltd, headquartered in Mumbai, Maharashtra, is a leading Indian multinational paint company specializing in decorative and industrial paints. The company has an extensive portfolio, offering interior and exterior wall finishes, adhesives, waterproofing solutions, enamels, and wood finishes. It also operates through joint ventures, PPG Asian Paints Pvt. Ltd. (PPG-AP) for automotive, marine, and packaging coatings, and Asian Paints PPG Pvt. Ltd. (AP-PPG) for industrial protective coatings, powder coatings, and road markings. Beyond paints, Asian Paints has diversified into home décor, offering modular kitchens, wardrobes, bath fittings, decorative lighting, wall coverings, furniture, and waterproofing solutions, enhancing its product ecosystem.

Key Strengths

The company’s strengths lie in its robust manufacturing and distribution capabilities. With 27 in-house facilities across 15 countries and an annual decorative paint manufacturing capacity of 22,00,000 kilolitres in India, Asian Paints ensures a seamless supply chain. Its expansive network of over 1,65,000 touchpoints across India enables deep market penetration. The brand’s focus on innovation is evident in its advanced product launches, including waterproofing solutions with long warranties and a repository of over 5,300 colour shades. Additionally, its international footprint and strong presence in emerging markets underline its global competitiveness. Asian Paints’ diversification into the home décor segment and ongoing investments in backward integration and advanced product ranges further solidify its leadership in the market.

Conclusion

Now, understand how these 50 stocks were selected. This is not a one-time thing. The index is reviewed on a semi-annual basis in March and September using 6-month average data as of January 31 and July 31, respectively. It represents the country’s top 50 blue-chip companies across various sectors. The weight of each stock in the index is based on its free-float market capitalization.

Over the past 25 years, the Nifty 50 Total Returns (TR) Index has demonstrated a mix of positive and negative returns, reflecting the evolving dynamics of the Indian economy and global markets. This journey hasn’t been without challenges, such as the significant volatility observed during the 2008 global financial crisis, a period that tested the resilience of even the strongest portfolios. However, the Nifty 50 TR Index showcased a remarkable recovery, bouncing back strongly in the years that followed.

Read our blog to know more about All About NIFTY50, Components of NIFTY50, and How to Invest in it

This performance trajectory underscores the Nifty 50’s long-term growth potential, resilience in the face of adversity, and its role as a barometer of India’s economic strength. For investors, this track record highlights the importance of a disciplined, long-term approach to capitalize on the index’s inherent strengths.

Investing in Nifty 50 stocks is more than a financial decision. Companies that are part of Nifty 50 are not only pillars of the economy but also trusted names that offer unparalleled stability and growth opportunities for your portfolio.

Happy Investing!

Read Also : Top 10 Mutual Funds for SIP: Best Bets for 2024-2025