Table of Contents

As the world shifts towards renewable energy, solar photovoltaic (PV) modules are at the forefront of this transformation. In fact, according to a recent IEA report, solar PV’s installed power capacity is set to surpass coal by 2027, making it the largest source of power globally.

But before moving ahead, let’s understand what a Solar PV module is.

A solar photovoltaic (PV) module, also known as a solar panel, is a device that converts sunlight into electricity.

One of the key players in this space is Waaree Energies Limited, which has its initial public offering open for subscription.

Many investors are wondering if this opportunity is worth their attention. In this blog, we’ll explore whether the Waaree Energies IPO is a smart investment choice.

Waaree Energies IPO is open for subscription from (21st Oct 2024) today onwards!

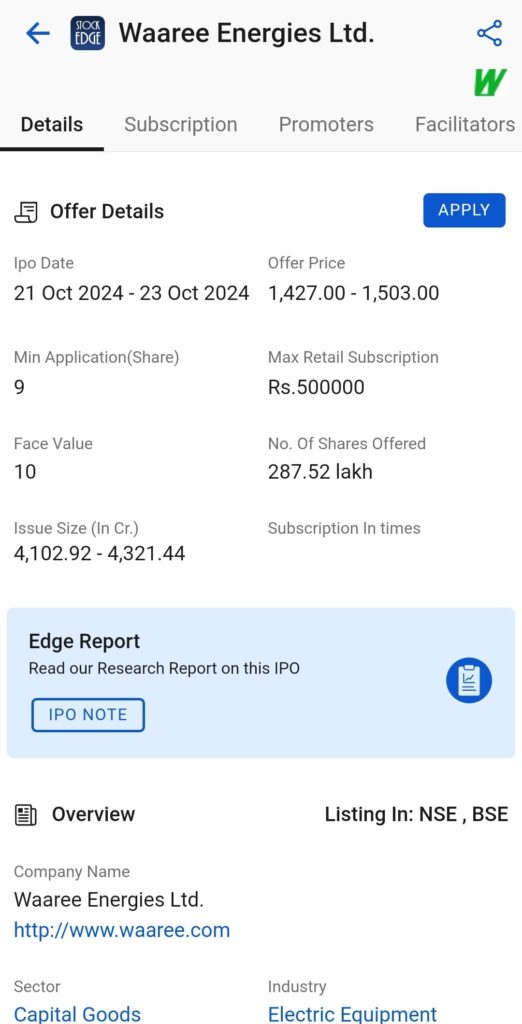

Waaree Energies IPO Details:

- IPO Open Date 21st October 2024, Tuesday

- IPO Close Date 23rd October 2024, Thursday

- Price Band ₹1427 to ₹1503 per share

- Lot Size 9 shares

- Face Value ₹10 per share

- Issue Size at upper price band ₹4321 crore (Fresh Issue ₹3600 crore and Offer For Sale ₹721 crore)

- Listing exchanges NSE, BSE

- Cut-off time for UPI mandate confirmation by 5 PM on October 23, 2024

The tentative timeline for the Waaree Energies IPO is as follows:

- Basis of Allotment 24th October 2024, Friday

- Initiation of Refunds (if not allotted) 25th October 2024, Monday

- Credit of Shares to Demat (if gets allotments of shares) 25th October 2024, Monday

- Listing Date 28th October 2024, Tuesday

About the Company

Waaree Energies Limited is the largest manufacturer of solar PV (photo voltaic) modules with an installed capacity of 12 GW (giga-watt) as of 30th June 2024. Post 30th June 2024, they established a solar module manufacturing facility of 1.3 GW in Noida through their subsidiary, IndoSolar Limited. The product portfolio consists of multicrystalline modules, monocrystalline modules, and TopCon (Tunnel Oxide Passivated Contact) modules, which are flexible modules that include bifacial modules and building integrated photo voltaic (BIPV) modules.

They operate one factory each located at Surat, Tumb, Nandigram & Chikhli in Gujarat and the IndoSolar facility in Noida, Uttar Pradesh. The company has a customer base both within and outside India. The company exports products to the United States, Canada, Italy, Turkey, Hong Kong and Vietnam.

You can check the order book of the company:

There are currently four different types of technologies used for PV module manufacturing, which are as follows:

- Multicrystalline technology: Multicrystalline technology involves using multiple crystals within a single solar cell, created by slicing very thin layers from silicon boules or ingots.

- Monocrystalline technology: Monocrystalline technology is an advanced method that enhances the efficiency of standard solar modules. Since the cells are composed of a single crystal, the electrons have more freedom to move, leading to significantly higher efficiency. They are considered high-end solar products, space-efficient, long-lasting, and sleek.

- TOPCon technology: TOPCon technology represents a significant advancement in the production of solar PV cells. It incorporates a thin tunnel oxide layer that passivates the surface, reducing recombination losses and enhancing the solar cell’s efficiency. By minimizing carrier recombination at the contact surface, they contribute to higher conversion efficiencies, thereby improving overall solar cell performance.

Solar Sector Outlook in India

India aims to enhance its presence across all stages of PV manufacturing over the next two to three years. Currently, India’s module manufacturing capacity stands at ~63 GW. Under the PLI scheme, the government of India allocated 50 GW of solar module manufacturing capacity with a cumulative support of ~₹18,500 crore.

Solar PV manufacturing capacity will reach 125 GW by FY29. It is anticipated that module manufacturing capacity will double by FY29, with ~25% of the capacity being fully integrated, and such integrated units are expected to emerge after FY25. India is projected to add ~175-180 GW of solar capacity between FY25 and FY30. The average module price will be $0.22/Wp (watt-peak). This capacity expansion presents an estimated market opportunity of ~$38 billion during that period.

- Government Initiatives: The Indian government has taken significant steps to promote the growth of the solar sector, implementing policies and initiatives designed to boost domestic solar power generation, manufacturing, and exports. Key initiatives include:

- Domestic Content Requirement (DCR): The DCR rule mandates the use of solar cells and modules manufactured in India to promote domestic production. Government schemes like the PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan) and grid-connected rooftop solar programs require DCR-compliant components to qualify for financial aid from central or state governments.

- Production-Linked Incentive (PLI) Scheme: The National Program on High-Efficiency Solar PV Modules offers incentives to manufacturers of solar PV modules and cells based on production output. Incentives are capped at ₹400 per watt for modules and ₹150 per watt for cells, aimed at encouraging domestic manufacturing of high-efficiency solar products.

- Approved List of Models and Manufacturers (ALMM): The ALMM initiative ensures the quality of solar installations in India by requiring developers and investors to use equipment exclusively from pre-approved vendors. This ensures that only trustworthy manufacturers supply PV modules and cells, improving the reliability and efficiency of solar installations.

- Basic Customs Duty (BCD): To further support domestic manufacturing, the Government of India imposed a 40% customs duty on solar modules and 25% on solar cells starting in April 2022. This measure aims to reduce dependency on imports and boost local production.

- India’s Solar Module Export Growth: In FY23, India saw a surge in solar module exports, driven by restrictions on Chinese solar products by various countries. This opened new opportunities for Indian manufacturers to meet the rising global demand for solar modules, significantly boosting export volumes.

- China Plus One Strategy: The China Plus One strategy encourages the diversification of supply chains away from China to other countries like India, Vietnam, Malaysia, and Thailand. This strategy is gaining momentum in the solar sector due to rising labor costs, political risks, and regulatory complexities in China. India stands to benefit from this trend, offering lower labor costs, favorable policies, and new market access

Through these initiatives, India is positioning itself as a global leader in solar power manufacturing and export, contributing to the worldwide shift towards sustainable energy sources. Read our blog to know the Top Solar Stocks to Invest in 2024.

Financial Performance

Now, let’s check out the financials of Waaree Energies IPO. It has demonstrated remarkable financial growth, with its revenue surging from ₹2,945.85 crores in FY22 to ₹11,632.76 crores in FY24, marking a nearly fourfold increase over three years.

The company’s net profit trajectory is even more impressive, soaring from ₹79.65 crores in FY22 to ₹1,274.38 crores in FY24—a 14-fold rise. In FY24, Waaree Energies maintained a strong net profit margin of 10.96%.

Despite a significant expansion of its equity base, the company achieved a robust Return on Equity (ROE) of 30.26% in FY24, surpassing the previous year’s figure. This underscores Waaree’s ability to generate substantial shareholder returns even as its equity base grew.

In addition, the company posted a Return on Capital Employed (ROCE) of 26.29% in FY24, reflecting the efficient use of its resources. Although this figure is slightly lower than FY23, it remains a solid indicator of the company’s overall resource management.

Now, let’s look at the key fundamental parameters of Waaree Energies IPO and how it compares with its peer company, Premier Energies Limited, in this competitive landscape.

Waaree Energies Ltd. holds a market share of 17% in solar module installed capacity, while Premier Energies Limited accounts for 9%. Waaree Energies has a lower market cap of ₹43,179 crore as compared to its peer but generates significantly higher revenue at ₹11,398 crore. Waaree’s EBITDA margin is slightly lower at 13.8%, but it boasts a stronger PAT margin of 11.0%, reflecting better profitability. Waaree’s P/S ratio is 3.8x, suggesting a more conservative valuation compared to Premier Energies. Compared to its peers, it appears relatively attractive, suggesting potentially undervalued stocks. However,

Objectives of the Issue

Waaree Energies IPO proposes to utilize the net proceeds of ₹2,775 cr towards a 6 GW addition of ingot wafer, solar cell and solar PV module manufacturing facility. Further, they will fund ₹610 cr through internal accruals and ₹5,518 cr through debt towards the same facility.

They have a clear objective of expanding their lending business, but can it live up to the expectations of its shareholders? Only time will tell. There is no such investment in the market that is risk-free. Let’s assess the risk factors for Waaree Energies IPO.

Risk Factors

Here are the risks that are highlighted for Waaree Energies IPO:

- The company’s revenue from operations relies heavily on a small number of customers. The loss of any of these key customers or a reduction in revenue from them could significantly impact their business.

- Their export sales expose them to risks and uncertainties in different international markets. In FY24, export sales accounted for 57.6% of the total revenue, out of which 57.1% was from the USA.

- The company obtains a significant portion of its raw materials from China. In FY24, they imported 90.4% of their total purchases, and China contributed 54.1% to the total imported goods. They do not have long-term purchase commitments or guaranteed purchase quantities with suppliers.

- A decline in the price of solar PV modules could negatively affect their operational results. In March 2024, module prices reached $0.11 per watt, a 43% decrease year over year. The sharp decline was mainly due to the excess supply in China and low upstream components, including polysilicon.

- The company’s capacity utilization was low, at ~40% in FY24. However, the company aims to reduce operating costs and enhance capacity utilization and plant performance by investing in advanced technology and modernizing manufacturing facilities.

Should you subscribe to Waaree Energies IPO?

Waaree Energies Limited manufactures solar PV modules with a manufacturing capacity of 12 GW. It focuses on backward integration by setting up solar cell plants and technology advancement by moving towards more efficient modules.

The company is the largest player in the Indian Solar PV industry. With strong sector tailwinds, it is well-positioned to capitalize on future growth opportunities. Any slowdown in the US may tamper with growth, but the valuation seems reasonable.

Before you decide to invest, it’s crucial to have a strong understanding of the potential risks and rewards involved. In this blog, we’ve presented a detailed overview of both the benefits and possible drawbacks associated with participating in the initial public offering (IPO) of Waaree Energies Ltd. Our team of experts at StockEdge has assessed the Waaree Energies IPO and provided a Good rating. Additionally, we’ve compiled a comprehensive IPO Note that dives deep into the company’s financial standing and SWOT analysis, offering thorough analysis to provide you with a more profound insight into the company’s prospects.

StockEdge has a different section on IPO under the Explore tab, where you can see the list of upcoming IPOs, ongoing and recently listed IPOs.

Join StockEdge Club, where our team of research analysts will be dedicated to solving your query related to investments, trading or IPOs.

Happy investing!