In 2026, investing through mutual funds for SIP is no longer just a convenient option. It has become a core wealth-building strategy for Indian investors navigating volatile markets, high valuations, and shifting interest-rate cycles.

But the real question is where to invest.

In this blog, we explore the mutual fund industry’s growth, how to choose the best SIPs, and the top funds for 2026.

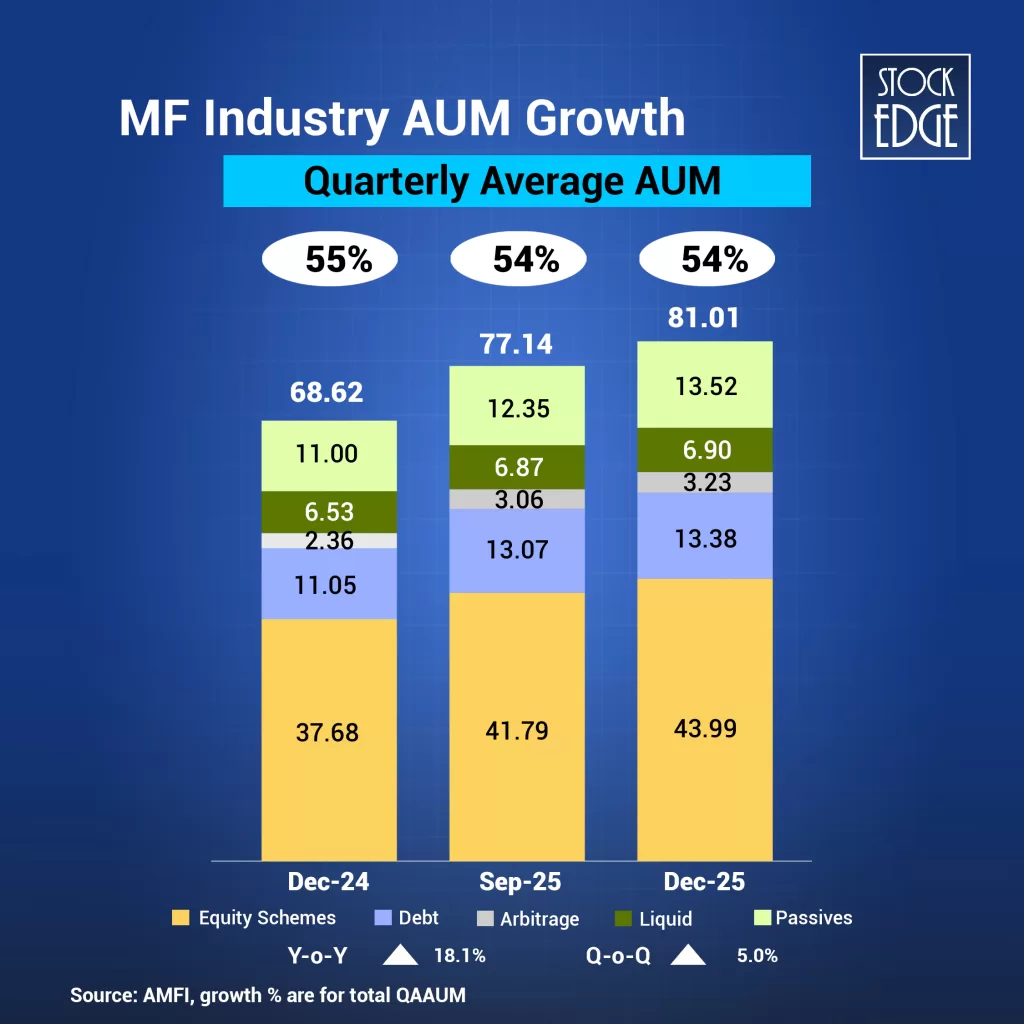

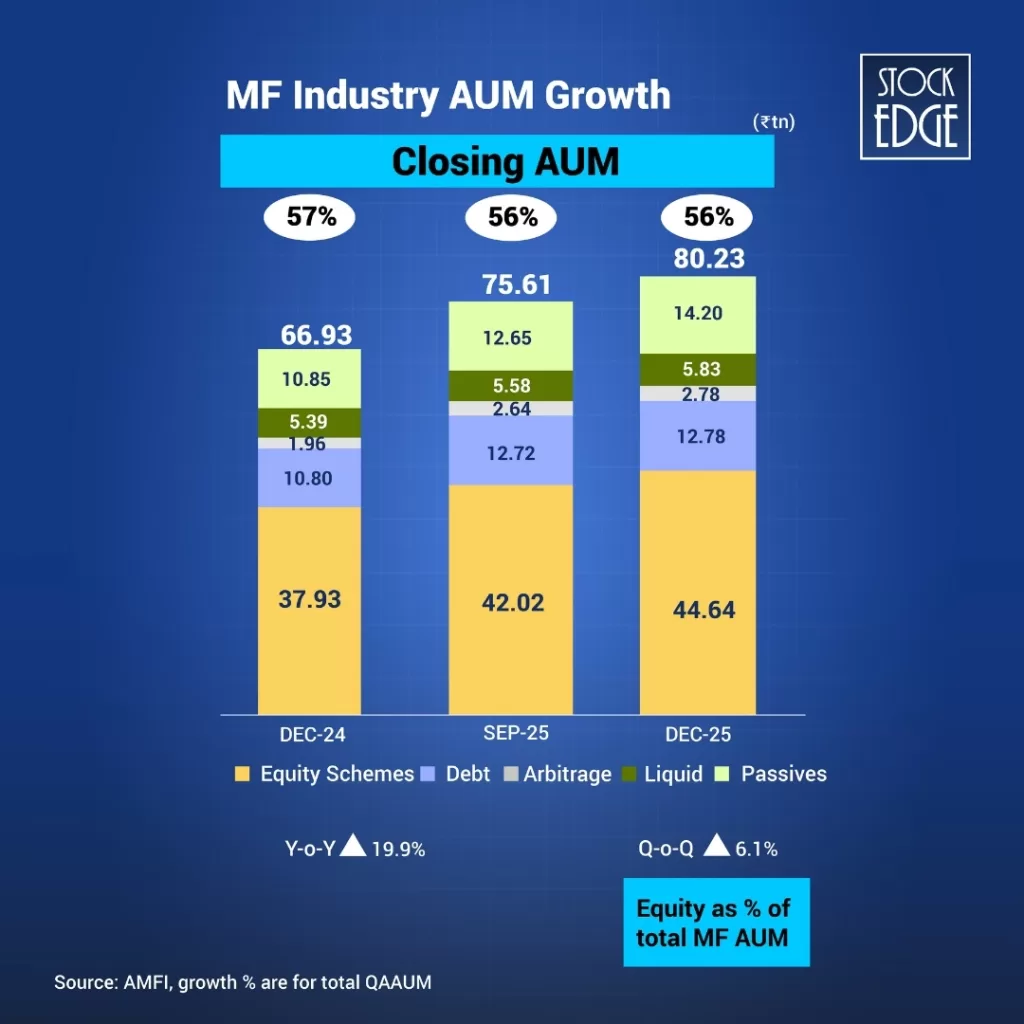

Mutual Fund Industry AUM Growth

The Indian mutual fund industry has grown rapidly over the last decade. As of December 2025, the Average Assets Under Management (AAUM) of the Indian Mutual Fund Industry stood at ₹ 81,99,191 crore.

And the Assets Under Management (AUM) for the month was slightly higher at ₹ 80,23,379 crore.

To put this growth in perspective, the industry managed only ₹12.75 lakh crore in 2015, which means the size of the industry has increased more than six times in just 10 years.

Even in the last five years alone, AUM has nearly tripled, rising from ₹30 lakh crore in 2020 to ₹80.23 lakh crore in 2025. This steady expansion shows how more Indians are trusting mutual funds as a long-term investment option.

How to Identify the Best SIP for You?

Before choosing a mutual fund, understand who you are as an investor. It’s not about chasing returns; it’s about matching your investments to your goals, time horizon, and risk capacity. Skipping this step is one of the biggest beginner mistakes.

Focus on three key factors:

1. Investment Horizon – How long you can stay invested:

- Short-Term (0–3 yrs): Capital protection is key.

- Medium-Term (3–5 yrs): Some growth with moderate stability.

- Long-Term (5+ yrs): Wealth building; tolerate market swings for higher returns.

2. Investment Style – Your approach to growth vs stability:

- Aggressive: High growth, equity-focused, comfortable with volatility.

- Moderate: Balance between growth and stability, typically hybrid funds.

- Conservative: Capital preservation, income-focused, low-volatility options.

3. Risk Tolerance – How you handle market ups and downs:

- Very High / High: Can accept sharp swings, see volatility as opportunity.

- Moderate: Mild ups and downs are manageable.

- Low / Very Low: Prefer smooth returns, avoid losses even at the cost of growth.

Investing without understanding your own profile is like boarding a train without knowing the destination.

Your investment horizon, style, and risk tolerance form the foundation of fund selection. Only after defining these should you start analyzing which mutual funds are appropriate for you.

List of the Best SIP Mutual Funds for 2026

Following are some of the most popular mutual funds for SIP across different fund categories:

Equity Fund

Parag Parikh Flexi Cap Fund

Parag Parikh Flexi Cap Fund is a flexi-cap equity scheme that invests across large, mid, and small caps without restrictions on market cap. It aims for long-term capital appreciation through a diversified portfolio.

Launched on May 24, 2013, the fund has an AUM at ₹1,33,309 crore and an expense ratio of 0.63%. Since inception, it has delivered 19.22% returns, significantly outpacing benchmark averages.

Top holdings include HDFC Bank Ltd., Power Grid Corp of India Ltd., ICICI Bank Ltd., Coal India Ltd., and Bajaj Holdings reflecting a mix of financials, utilities, and energy stocks. The fund carries a very high risk rating and is suited for investors seeking long-term wealth creation with broad market exposure.

ICICI Prudential Value Fund

This fund is a value-oriented equity scheme that invests in undervalued stocks with sound fundamentals to generate long-term capital appreciation.

It was launched on January 1, 2013 and currently has AUM of around ₹61,272 crore with an expense ratio of 0.96%.

Top portfolio holdings include ICICI Bank Ltd., Reliance Industries Ltd., HDFC Bank Ltd., Infosys Ltd., and ITC Ltd., reflecting exposure to financials, energy, technology, and consumer stocks. The fund has a moderate risk rating with superior risk-adjusted returns in the value category.

Mirae Asset Large & Midcap Fund

This is a large & mid-cap equity scheme designed to balance stability and growth by investing in both large- and mid-cap companies.

The fund has an AUM of ₹43,766 crore and a low expense ratio 0.57%. It has delivered 21.14% since inception.

Top holdings include HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., State Bank of India, and ITC Ltd. This scheme has a medium-to-high risk profile and is suitable for investors seeking diversified equity exposure for long-term growth.

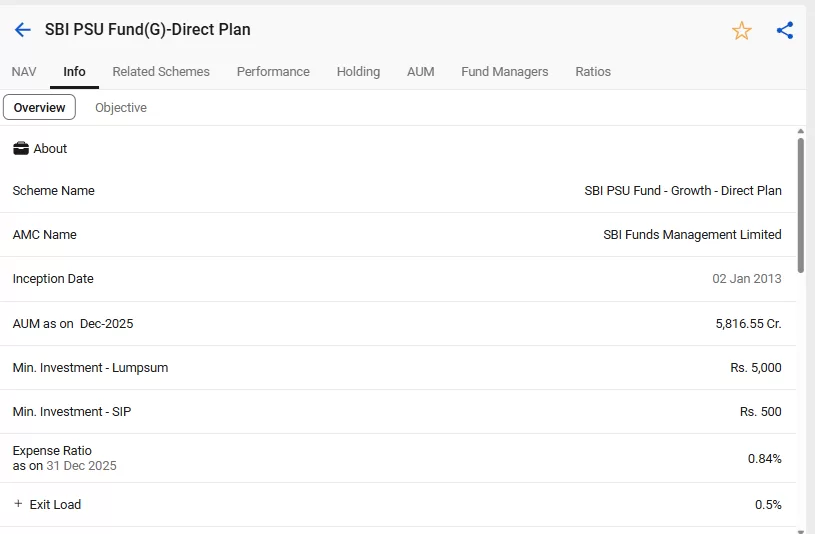

SBI PSU Direct Plan

The SBI PSU Fund – Direct Plan (Growth), launched on January 1, 2013, is a thematic equity fund focused on public sector undertakings (PSUs). It aims to provide long-term capital appreciation by investing primarily in government-owned companies.

The fund’s performance is closely tied to government policies, PSU reforms, and economic cycles, making it sensitive to changes in the broader macroeconomic environment.

As of December 31, 2025, the fund has an AUM of ₹5,816 crore and follows the BSE PSU TRI as its benchmark.

The top holdings include State Bank of India, Power Grid Corporation of India Ltd., GAIL (India) Ltd., and Bharat Electronics Ltd., reflecting its PSU focus.

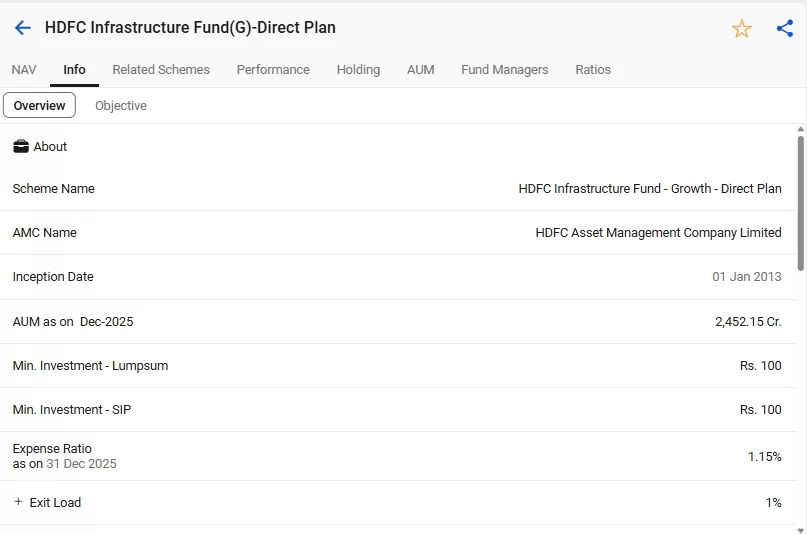

HDFC Infrastructure Direct Plan

HDFC Infrastructure Direct Plan Growth is a thematic scheme that seeks long‑term capital appreciation by investing predominantly in companies engaged in or expected to benefit from the growth and development of infrastructure.

As of December 31, 2025, it manages an AUM of ₹2,452 crore and tracks the BSE India Infrastructure Total Return Index.

Since its inception, the scheme has delivered an average annualised return of 12.28%, reflecting solid long‑term performance in its category.

Thematic Funds are suitable for investors with a high risk appetite, long investment horizons of 7 years or more, and a clear understanding of thematic investing. It works best as a satellite allocation within a diversified equity portfolio rather than as a core holding.

ICICI Prudential India Opportunities Fund

This scheme is an equity thematic fund that focuses on special situations such as corporate restructuring, Government policy and/or regulatory changes, companies going through temporary unique challenges and other similar instances.

Launched on January 15, 2019, the fund has AUM ₹34,779 crore and an expense ratio of 0.66%. It has delivered 22% returns since inception.

The portfolio is heavily tilted toward large caps (71.66%), with top holdings such as Axis Bank Ltd., ICICI Bank Ltd., Infosys Ltd., Reliance Industries Ltd., and Larsen & Tourbo It carries a very high risk profile and can be appropriate for investors looking for opportunity-driven equity returns over the long term.

Hybrid Fund

HDFC Balanced Advantage Fund

This fund is a dynamic asset allocation hybrid fund that aims to generate long-term capital appreciation while managing downside risk by actively shifting between equity and debt based on market valuations.

The fund has grown into one of the largest schemes in its category with an AUM of around ₹1.08 lakh crore (as of Dec 31, 2025). The expense ratio is ~0.73%, and an exit load of 1% applies if more than 15% of the invested units are redeemed within one year.

Since inception, the fund has delivered ~15% annualised returns. Key equity holdings include HDFC Bank, ICICI Bank, Reliance Industries, Bharti Airtel, and State Bank of India, supported by a diversified debt portfolio.

This scheme is suitable for investors seeking long-term growth with lower volatility compared to pure equity funds.

ICICI Prudential Equity & Debt Fund

This is an aggressive hybrid fund that invests primarily in equities while maintaining exposure to debt instruments to provide stability and income.

The fund has an AUM of ₹49,641 crore (as of Dec 31, 2025). It has an expense ratio of 0.92%, with an an exit load of 1% applies if more than 30% of the invested units are redeemed within one year.

This fund is suitable for investors looking for long-term capital growth with some downside protection from debt exposure.

Debt Fund

ICICI Pru Medium Term Bond

It is a debt mutual fund designed to generate income with moderate risk and liquidity by investing in a mix of medium-term bonds and money market instruments. It aims to balance yield, safety, and liquidity over time.

As of 31st december, the fund has an AUM of around ₹5,708 crore and a direct plan expense ratio of 0.74%. It carries an exit load of 1% if units in excess of 10% of the investment are redeemed within one year.

Since inception, the scheme has delivered ~8.5% annualised returns.

SBI Liquid Fund

It is a debt mutual fund that aims to provide attractive returns through an actively managed portfolio of high-quality debt securities of varying maturities.

It adjusts duration and credit exposure based on interest rate expectations and market conditions to balance yield and risk.

The fund has an AUM of around ₹4,468 crore (as of Dec 31, 2025) and an expense ratio of 0.19% for the direct plan.

Read: Important Mutual Fund Ratios to make your analysis process smoother.

Conclusion

When investing in mutual funds for SIP, it is essential to use a SIP calculator to choose the best scheme that best aligns with your risk tolerance level and minimum investment amount.

You can go for pure equity funds if you are comfortable with a high-risk portfolio, or you can opt for a hybrid fund if you want to take a more balanced risk.

Short-term debt funds are especially ideal for conservative investors who seek high liquidity.

In addition to the annualised returns of a fund, consider factors like past performance, sectors covered, expense ratio, and exit load and determine whether they are in line with your financial goals.

Also, it is advisable to spread out your investment over multiple funds rather than invest in one scheme to lower portfolio risk.

Get deeper fund insights on StockEdge.

Frequently Asked Questions

1. Can I stop or change my SIP anytime?

Yes, SIPs are flexible; you can pause, modify, or stop them anytime without any penalty.

2. Is SIP better than lump sum investment?

SIP helps average purchase cost and reduce market timing risk, making it suitable for volatile markets, while a lump sum works better when markets are clearly undervalued.

3. Are SIP investments tax-free in India?

No, SIPs are not tax-free; taxation depends on the type of mutual fund and the holding period.

4. Are SIPs completely risk-free?

Although SIPs are relatively safer than other stock market instruments, they have their fair share of risk. Their returns depend upon the performance of the underlying stocks and how well the fund managers handle asset allocations and market fluctuations.