Table of Contents

India has been growing at an exponential rate for the past few years. The government has been spending money on building infrastructure for the nation on a large scale. Infrastructure is an excellent space to invest your money in. However, if you would like to have a proxy investment on this theme, the cement sector can be one of your logical bets.

Cement plays an essential role in the construction of a wide range of infrastructures, encompassing transportation networks, water and power supply structures, dams, roads, housing developments, and industrial plants.

Now, imagine you are making your dream house. You will definitely buy the best materials to build your dream house. Similarly, if you are investing in the cement sector, you will invest in the best cement stock, right?

Surprisingly, the no. 1 cement company and one of the top manufacturers of cement in India is Ultratech Cement. Therefore, investing in Ultratech Cement shares could be your top choice of investment.

In today’s blog, we will analyze why Ultratech cement shares could be a profitable bet for your portfolio. So, without further ado, let’s deep dive into the company overview, its financials and more to get a comprehensive understanding of not only the company but also the cement sector.

Ultratech Cement Ltd. Company Overview

Before we get to know the company, here is a fun fact! The No. 1 cement company, which we all know as Ultratech Cement, was established by the Larsen & Toubro group of companies and was called L&T Cement. Later, in 2004, L&T sold its cement division to the Aditya Birla Group, and voila, Ultratech Cement emerged, becoming the largest manufacturer of grey cement, ready mix concrete, and white cement in India.

As the leading cement manufacturer in India, Ultratech Cement stands as the flagship company of the Aditya Birla Group, boasting an impressive installed capacity of around 126.95 million metric tonnes per annum (MTPA) within India and a global capacity of approximately 131.45 MTPA.

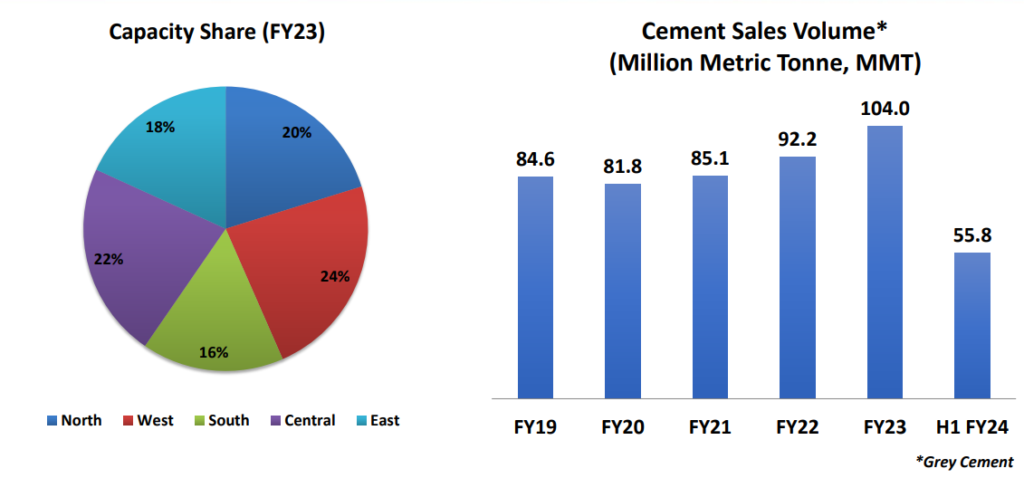

Here are the details of the cement-producing plants’ capacity across India.

In April 2022, the company expanded its portfolio by acquiring RAK Cement Company, which specializes in white cement and construction materials. It has an extensive network of over 30,000 dealers and 64,000 retailers as of March 31, 2023. Ultratech Cement maintains a widespread presence throughout the country, supported by robust logistics infrastructure.

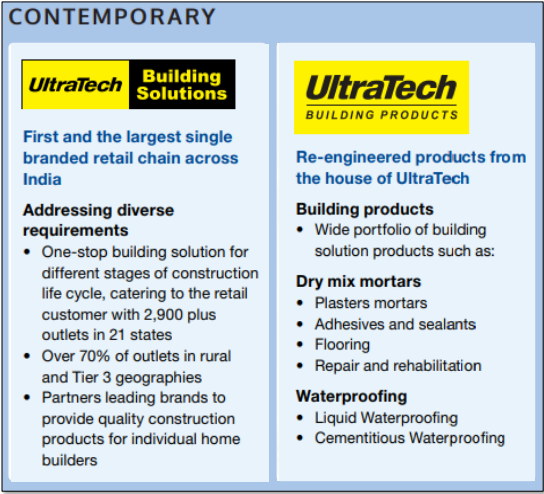

The company offers a wide range of innovative solutions that cater to various aspects of construction, from foundation to finish. Its products are distinguished based on conventional and contemporary products and services.

Sector Outlook – Cement Industry

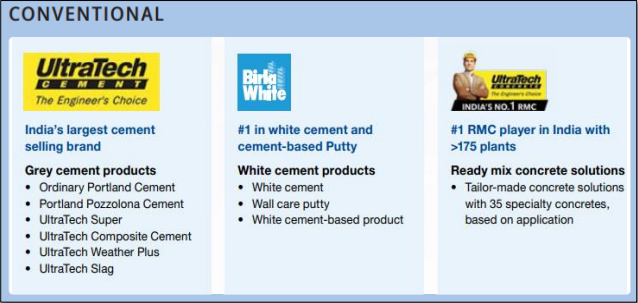

The outlook for India’s cement sector is optimistic, fueled by the government’s ambitious plans for economic growth and infrastructure development. It ranks second globally in cement production, and India’s 7% global share presents significant expansion opportunities. Despite being the second-largest producer, the per capita consumption at 242 kg indicates substantial room for growth. The Union Budget 2023-24 allocates substantial funds for the Ministry of Road Transport and Highways, with a 33% increase in capital investment outlay to ₹10 lakh crore. Initiatives like PM Gati Shakti and the National Infrastructure Pipeline, along with the Bharatmala project, highlight the strong demand for cement in the construction sector, reinforcing a positive outlook for the industry.

Take a look at our country’s position as top cement producer in the world:

Source: Statista

Financial Highlights

Analyzing financial statements such as income statements, balance sheets, and cash flow statements helps investors assess the company’s ability to generate returns, manage debt, and sustain growth, enabling informed and prudent investment choices.

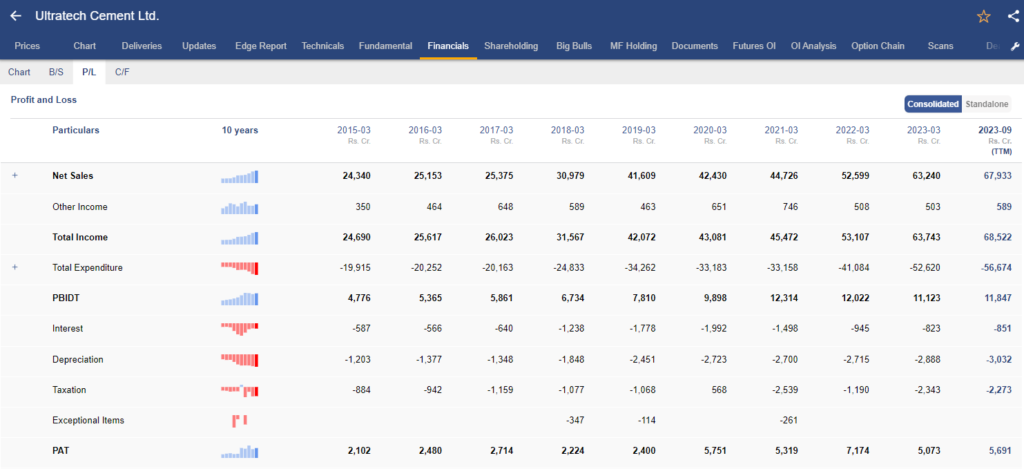

Income statement of Ultratech Cement Ltd.

The income statement, commonly known as the profit and loss statement, gives you an understanding of its financial performance, such as its sales growth, profitability, etc.

At StockEdge, we have organized the income statement in a way that will help you analyze it with ease rather than going through the conventional way of downloading the documents from the stock exchanges, which could be time-consuming and tiresome to many.

In the above image, you can see the annual income statement of Ultratech Cement Ltd. Every detail is in front of your eyes, starting from the top-line sales figures to the bottom-line Net profit of the company.

Sales Growth

In FY23, the consolidated sales were at ₹62,240 cr, an increase of ~21 % YoY, despite Cement prices being under pressure since the end of May 2022 and due to weak demand, prices fell further in the monsoon season. In the first and second quarters of FY 2024, there was a year-on-year growth of 20% and 15% in domestic sales volume, respectively. The total sales volume for the first half of FY24 reached 56.65 million tons. Rural sales constituted 63% of the trade, experiencing a 15% growth during the quarter.

EBITDA Growth

In FY23, EBITDA stood at ₹10,620 cr, a decrease of – 7.8 % YoY. Despite increased sales, the growth was restrained by elevated operating costs. This was attributed to a notable surge in power and fuel expenses, coupled with higher prices for crucial raw materials such as slag and fly ash.

PAT Growth

In FY 23, the Profit After Tax (PAT) amounted to ₹5,069 crore, reflecting a YoY decline of 29.3%. The effective tax rate for FY23 was 31.6%, contrasting with the 14.2% recorded in the corresponding period the previous year. The shift was primarily attributed to a one-time gain of ₹535 crore in Q3 FY22 related to tax adjustments for earlier years.

However, PAT during H1 FY24 stood at ~₹2,963.4 cr, which is an increase of ~26% on a YoY basis.

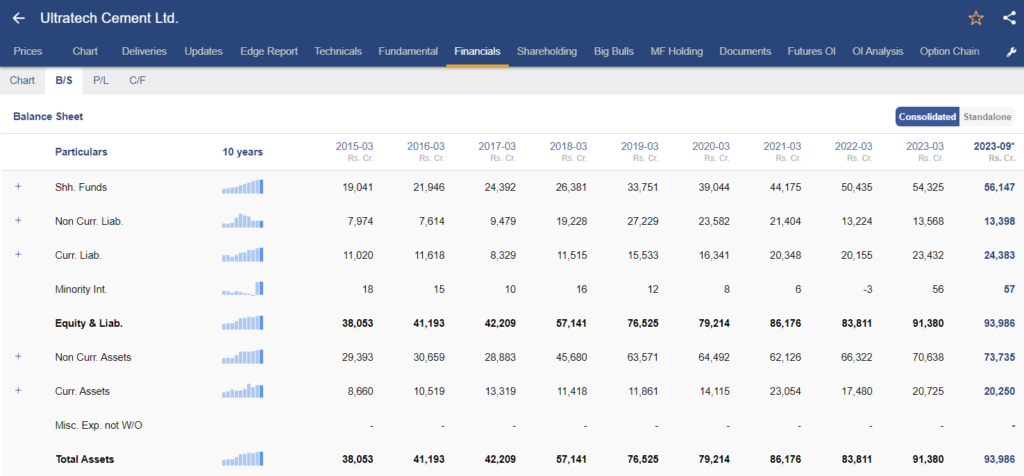

Balance Sheet of Ultratech Cement Ltd.

The balance sheet follows the accounting equation: Assets = Liabilities + Equity. It provides a company’s financial position, stability, and overall health.

In the above image, you can see the balance sheet of Ultratech Cement Ltd. It provides an overview of the financial position as on date. What are the assets and liabilities of the company? Liabilities of a company can be both short term and long term.

In FY23, the net worth of the company stood at ~₹54,325 cr, and long-term & short-term borrowings stood at ~₹5,356 cr & ~₹4,544 cr.

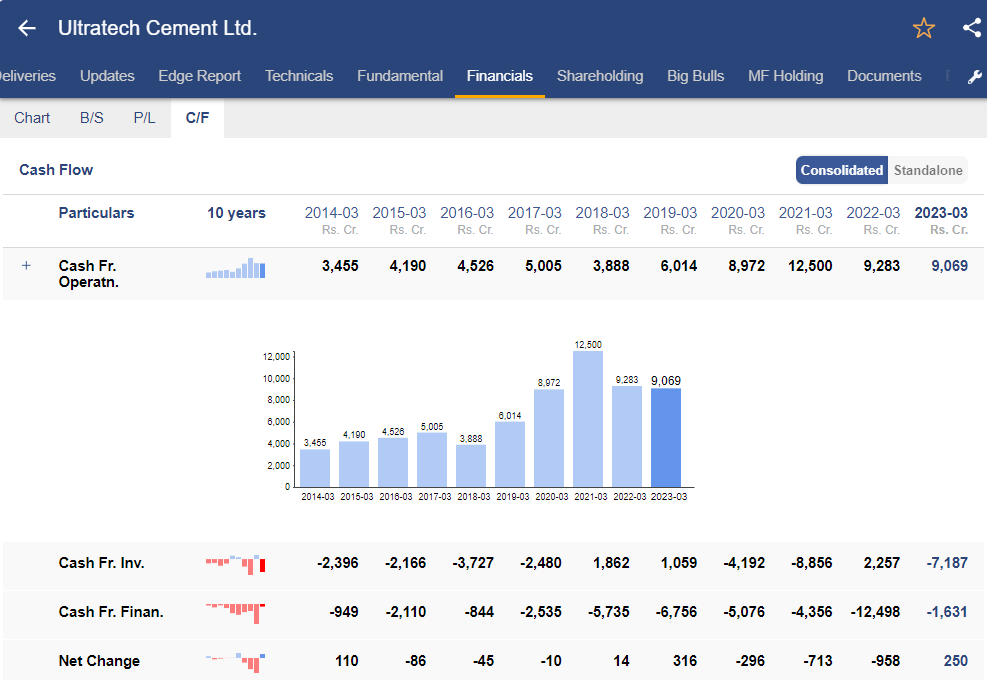

Cash Flow Statement of Ultratech Cement Ltd.

A cash flow statement provides a summary of how a company generates and uses cash over a specific period of time. It has three different sections:

- Operating cash flow statement

- Financing cash flow statement

- Investing cash flow statement

Out of these the most important one being the cash flow from operations as it provides you with an understanding of how the company generated cash from its core business operations. A positive cash flow from operation signifies that the company has generated higher cash revenue than its expenditure.

In FY 2023, the net cash flow from operations (CFO) amounted to approximately ₹9,069 crore. The movement in working capital was primarily influenced by a rise in trade payable and other liabilities totalling ₹1,868 crores, coupled with an increase in trade receivables amounting to ₹752 crores.

Meanwhile, the cash outflow from investing activities (CFI) in FY23 was around ₹7,187 crore, driven by a net purchase of investments (~₹563 crore) and the net purchase of property, plant & equipment (~₹6,106 crore).

Cash flow from financing activities (CFF) experienced an outflow of approximately ₹1,631 crore, attributed to dividend payments of ₹1,091 crore and interest charges of ₹701 crore.

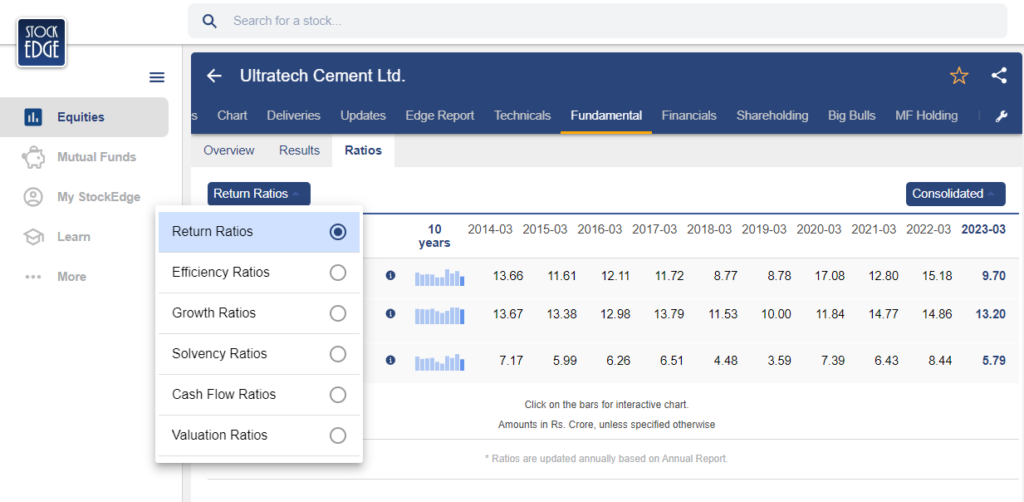

Ratio Analysis of Ultratech Cement Share

Ratio analysis of a company involves evaluating a company’s financial performance by examining certain ratios which are derived from its financial statements. It makes easy comparing the financial performance to its industry benchmarks or competitors.

Ratio has different classifications like profitability ratios, solvency ratios, return ratios and more as you can see in the image below, you can analyze all such ratios directly from StockEdge.

Here are the return ratios of the Ultratech Cement Shares, starting with the two most important ratios which are ROE and ROCE.

What is ROE and ROCE?

ROE is a profitability ratio that measures the company’s ability to generate net income as a percentage of shareholders’ equity, whereas ROCE assesses the efficiency of a company in utilizing its total capital, including both equity and debt.

Return on Equity (ROE)

The ROE of the company has been volatile over the years. In FY23, the net worth of the company stood at ₹54,325 cr, and the net profit saw a significant decline, thus impacting the ratio in FY23.

Return on Capital Employed (ROCE)

In FY23, capital employed saw an increase. However, PBIT saw a decline on a YoY basis. Thus impacting the ROCE. Whereas, in FY22, capital employed for the company stood at ~₹63,656 cr and earnings before interest and tax was ~₹9,307 cr. The decrease in capital employed was mainly due to a reduction in borrowing from ₹13,548 cr to ₹5,303 cr. This was mitigated by an increase in other equity, mainly general reserve and retained earnings.

Debt to Equity Ratio (D/E Ratio)

Over the years, the company has been trying to tone down its overall debt, which is evident in its Debt to Equity ratio, which is currently down to 0.18x as of FY 23 from its peak of 0.89x in FY 19.

Price to Equity Ratio

The Price-equity ratio is a valuation metric that helps you assess the relative value of a stock by comparing its market price to its earnings. The P/E ratio of Ultratech Cement share is at a TTM PE multiple of 50.2x, which is not even the highest among its peers, considering it is a market leader in cement manufacturing.

Management Quality & Shareholding Pattern

The management prioritizes sustainable growth as a fundamental aspect of its business ethics, emphasizing the reduction of carbon footprints, conservation of natural resources, and the implementation of energy-efficient measures. As one of the founding members of the Global Cement and Concrete Association, the company maintains a commitment to cost leadership by enhancing operational efficiency through savings on key inputs and strengthening its logistics infrastructure.

The company embraces digitization as part of its strategy to deliver value to both internal and external stakeholders. The company also plans to upgrade existing facilities with modern technology and new processes while increasing capacity to seize opportunities in expanding markets.

Coming to the shareholding pattern of Ultratech Cement share, you can check it from the StockEdge App itself.

As of September 30, 2023, the promoters held a 59.96% share in the company. During Q2 FY24, Foreign Institutional Investors (FIIs) saw an increase in their stake, rising from 15.82% in Q1 FY24 to 16.65%. Conversely, Domestic Institutional Investors (DIIs) reduced their stake in the company to 15.09% in Q2 FY24, down from 15.99% in Q1 FY24.

These shifts indicate dynamic investor interest in Ultratech Cement shares, with FIIs and DIIs adjusting their positions. In contrast, promoters hold a steady stake. The overall changes suggest continued confidence in Ultratech Cement shares from both domestic and foreign institutional investors.

Future Outlook of Ultratech Cement share

Ultratech Cement anticipates a revival in cement demand in the upcoming quarters, driven by increased government-led infrastructure and housing projects. The company is committed to achieving 100% renewable energy by FY50, targeting a green energy mix of 36% by FY25. While coal prices remain robust, pet coke has softened, and fuel costs are expected to ease in the near term. However, caution is advised due to potential fuel cost fluctuations with Chinese demand affecting the market. The company’s proactive approach to monitoring fuel costs and maintaining a normal inventory of 45 days demonstrates its prudent risk management.

Case Study on Ultratech Cement

We have a case study report prepared by our team of analysts. This fundamental report on Ultratech Cement Share provides you with a detailed analysis of the company as well as how it stands among its competitors.

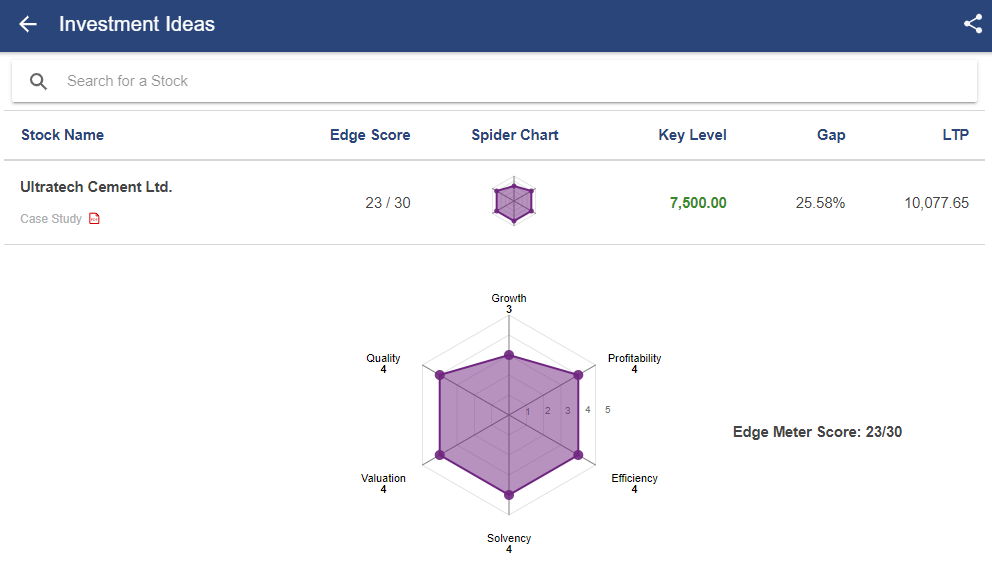

As you can see, Ultratech Cement Share has rating based on 6 parameters:

- Growth

- Quality

- Profitability

- Efficiency

- Solvency

- Valuation

Based on the above parameters, Ultratech Cement scored 23/30. Read the case study report of Ultratech Cement Share.

Conclusion

Ultratech Cement shares showcase a promising investment outlook within the Nifty 50 index. The company’s strategic focus on sustainability, capacity expansion, and responsiveness to market dynamics positions it for growth. Anticipated revivals in cement demand and the commitment to renewable energy underscore the company’s resilience and adaptability. While challenges, such as fuel cost fluctuations, warrant careful consideration, Ultratech Cement’s proactive risk management and robust growth strategies make it an intriguing prospect for investors seeking exposure to the dynamic cement industry.

Looking for more such investing opportunities in large-cap stocks of Nifty 50, you may read our previous blog on Infosys Stock Analysis: A Heavyweight IT Stock

Happy Investing!