Table of Contents

Are you a bike enthusiast? Even if you are not, you must have heard about the iconic bike Royal Enfield Bullet that is dominating our Indian roads. But did you know? This is a British motorcycle company. They built its first motorcycle in a small town in England named Enfield in 1901. However currently the brand is now wholly owned by the Indian multinational automotive company Eicher Motors Limited.

In 1994, the brand Royal Enfield was taken over by the Eicher Group of India. The company was listed on the BSE and the national stock exchange in September 2004 and has been a part of India’s benchmark index, Nifty 50, since April 1, 2016. From this date onwards, the share price of Eicher Motors jumped nearly 108%, hitting lifetime highs on December 4, 2023, at ₹4180 per share. Apart from Eicher Motors stock, there are other stocks which are part of the Nifty 50 index. Read this blog to find out how to invest?

The dream of owning a Royal Enfield is rooted deep in the hearts of many Indians. To achieve that dream, why not invest in Eicher Motors stock?

Eicher Motors Ltd. – Company Overview

Eicher Motors Limited is a multinational automotive company involved in the production of motorcycles and commercial vehicles. The company has a broad presence, and Royal Enfield, is a dominant player, holding a 90% market share in the middleweight motorcycle segment (ranging from 250 cc to 750 cc). Royal Enfield operates in more than 60 countries and has five subsidiaries spread across various continents.

On an international scale, Eicher Motors Limited’s retail network comprises 1,157 touchpoints, including 207 exclusive stores and over 950 multi-brand outlets (MBOs). Within India, the company operates 2,059 retail outlets, consisting of 1,090 large stores and 969 studio stores. Furthermore, Eicher Motors Limited has a substantial manufacturing capacity, capable of producing 1.2 million units annually.

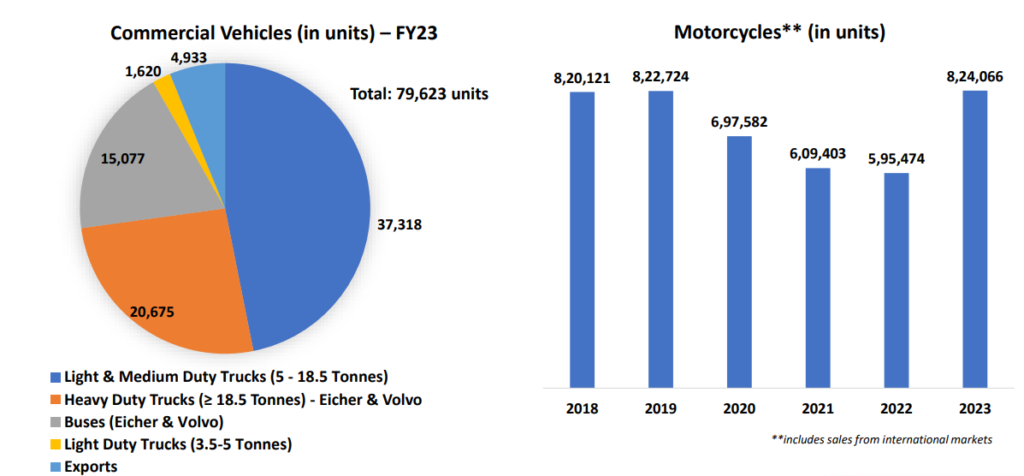

Eicher Motors has also been engaged in the production of trucks and buses since 1985. The company made significant strides in the Indian commercial vehicle market, and its position was reinforced when Volvo became an equity partner in 2008. This collaboration led to the formation of VE Commercial Vehicles Limited (VECV), a joint venture between Eicher Motors (holding approximately 54.4% stake) and Sweden’s AB Volvo.

Check out the sales figures of both its commercial vehicles and motorcycle segment reported by the company as of FY23.

Sector Outlook – Automobile Industry

As per the data provided by the Society of Indian Automobile Manufacturers (SIAM), the two-wheeler industry (domestic) recorded sales of 1,58,62,087 units (v/s 1,35,70,008 units in 2021-2022), and exports sales were 36,52,122 units in 2022-2023 (v/s 44,43,131 units in 2021-2022). The two-wheeler EV retail Industry on VAHAN reached 7.18 lakh units FY23, up from 2.3 lakh units in FY22, which is a 3x growth YoY.

The commercial vehicle sales (domestic) in 2022-2023 were 9,62,468 units v/s 7,16,566 units in 2021-2022, exhibiting a rise of 34% YoY. The Indian commercial vehicles industry showed promising growth supported by a steady recovery in the economy and rising industrial activity.

Financial Highlights

Analyzing financial statements such as income statements, balance sheets, and cash flow statements helps investors assess the company’s ability to generate returns, manage debt, and sustain growth, enabling informed and prudent investment choices.

Income statement of Eicher Motors

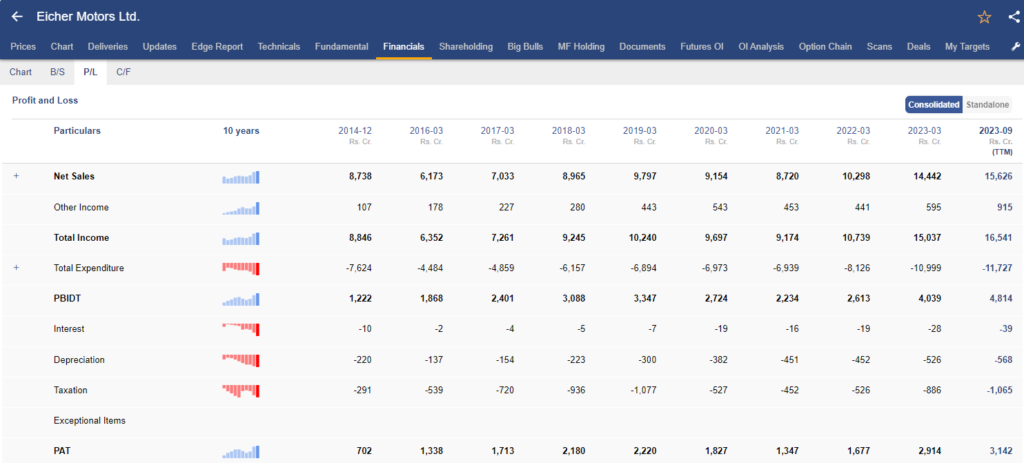

The income statement, commonly known as the profit and loss statement, gives you an understanding of its financial performance, such as its sales growth, profitability, etc.

At StockEdge, we have organized the income statement in a way that will help you analyze it with ease rather than going through the conventional way of downloading the documents from the stock exchanges, which could be time-consuming and tiresome to many.

In the above image, you can see the annual income statement of Eicher Motors. Every detail is in front of your eyes, starting from the top-line sales figures to the bottom-line Net profit of the company.

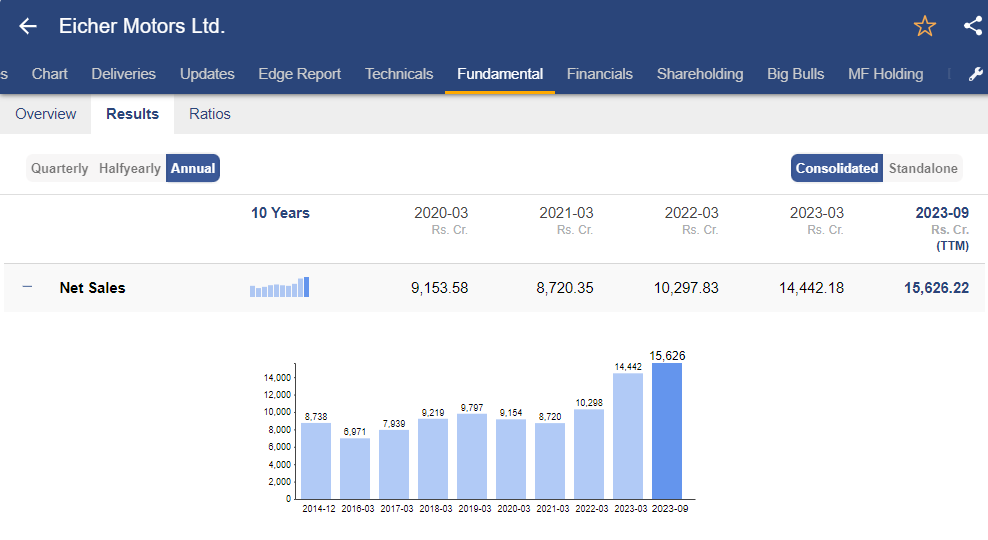

Sales Growth

In FY 2023, the company reported sales of ₹14,442 crore, marking a significant 40% year-on-year increase. Royal Enfield demonstrated robust performance, with motorcycle sales reaching 824,066 units, and the company achieved a noteworthy milestone of over 100,000 export shipments during the year.

Additionally, the non-motorcycle business revenue in FY 23 was ₹2,041 crore, while international markets contributed ₹2,080 crore. The company successfully maintained its market share in global regions and aims to extend its presence in new international markets further. Also, there are several product launches planned for the coming years.

EBITDA Growth

In FY 2023, Eicher Motors witnessed a notable 59% year-on-year growth in EBITDA, reaching ₹3,444 crore. This increase was attributed to a year-on-year decline in significant cost components, including the cost of raw materials consumed, employee benefits expenses, and other expenses, coupled with a rise in sales. The company’s robust performance in domestic markets further contributed to its overall profitability.

PAT Growth

In FY 2023, the net profit surged to ₹2,599 crore, reflecting a substantial 61% year-on-year increase. This growth can be attributed to an elevated contribution from the share of profit of the joint venture, VE Commercial Vehicles Limited, as well as a reduction in depreciation costs.

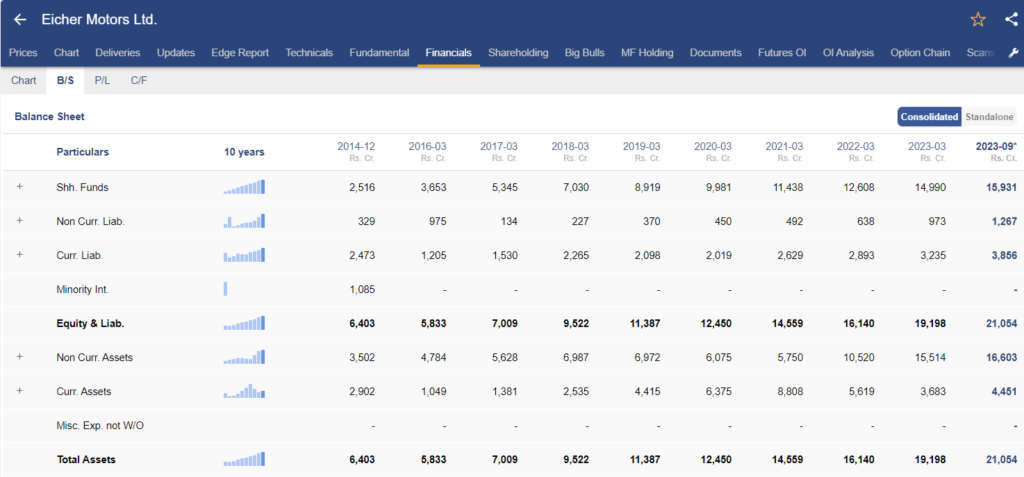

Balance Sheet of Eicher Motors

The balance sheet follows the accounting equation: Assets = Liabilities + Equity. It provides a company’s financial position, stability, and overall health.

In the above image, you can see the balance sheet of Eicher Motors. It provides an overview of the financial position as on date. What are the assets and liabilities of the company? Liabilities of a company can be both short term and long term.

As of 30th Sep 2023, long-term borrowings and short-term borrowings were ₹151 cr and ₹118 cr, respectively, whereas the company’s fixed assets and long-term investments were 3,048 cr and 12,490 cr, respectively.

A prudent company will always have a reasonable level of debt relative to their fixed assets.

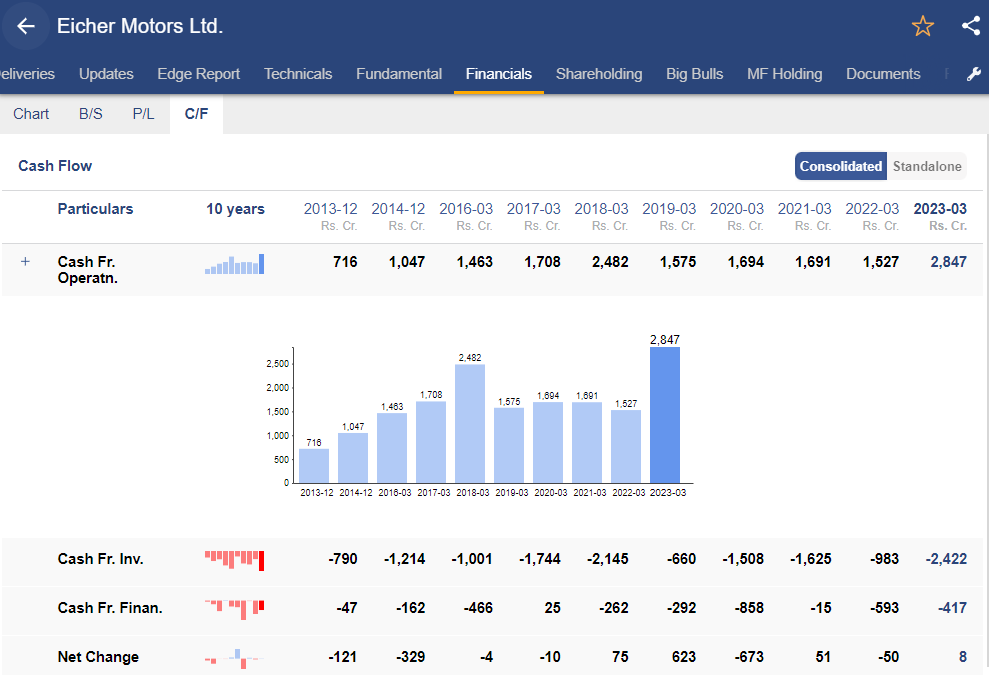

Cash Flow statement of Eicher Motors

A cash flow statement provides a summary of how a company generates and uses cash over a specific period of time. It has three different sections:

- Operating cash flow statement

- Financing cash flow statement

- Investing cash flow statement

Out of these the most important one being the cash flow from operations as it provides you with an understanding of how the company generated cash from its core business operations. A positive cash flow from operation signifies that the company has generated higher cash revenue than its expenditure.

In FY23, cash flow from operations reached ₹2,847 crore, experiencing growth due to working capital adjustments and an increase in profits.

Cash outflow from investing activities amounted to ₹2,422 crore, primarily driven by the purchase of debt mutual funds (net) at ₹3,585 crore, partially offset by maturity proceeds from fixed deposits amounting to ₹1,948 crore.

Cash outflow from financing activities stood at ₹417 crore, with the majority of this outflow allocated to dividend payments.

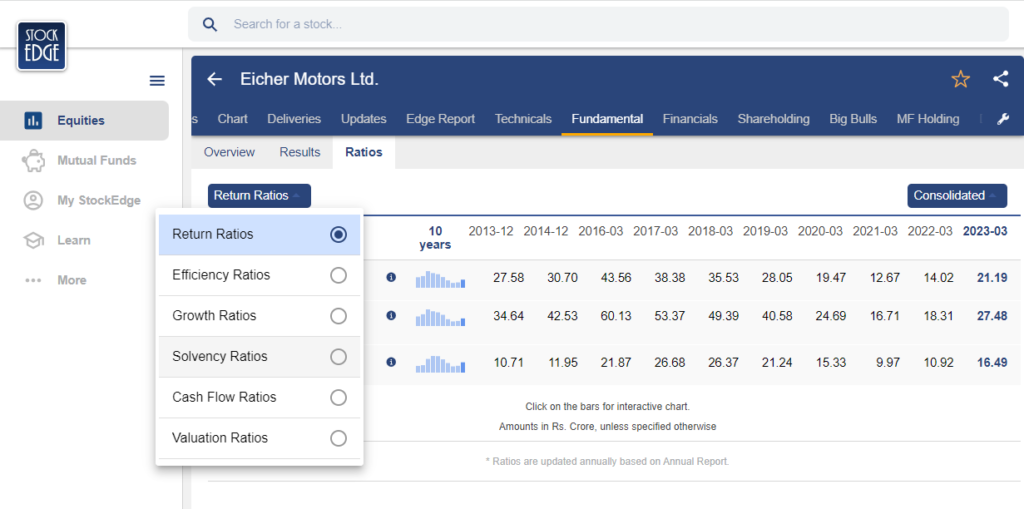

Ratio Analysis of Eicher Motors

Ratio analysis of a company involves evaluating a company’s financial performance by examining certain ratios which are derived from its financial statements. It makes easy comparing the financial performance to its industry benchmarks or competitors.

Ratio has different classifications like profitability ratios, solvency ratios, return ratios and more as you can see in the image below, you can analyze all such ratios directly from StockEdge.

Here are the return ratios of the Eicher Motors stock, starting with the two most important ratios which are ROE and ROCE.

What is ROE and ROCE?

ROE is a profitability ratio that measures the company’s ability to generate net income as a percentage of shareholders’ equity, whereas ROCE assesses the efficiency of a company in utilizing its total capital, including both equity and debt.

Return on Equity (ROE)

In FY23, the company’s Return on Equity (ROE) witnessed significant growth, reaching 21%. This expansion can be attributed to increased net profit during the fiscal year. While the ROE has generally maintained a healthy status, it experienced a decline in the past couple of years, primarily due to an increase in financial investments.

Return on Capital Employed (ROCE)

In FY23, the company experienced a substantial increase in Return on Capital Employed (ROCE), driven by a rise in Profit Before Interest and Taxes (PBIT). The significant expansion in ROCE can be attributed to higher capacity utilization and effective cost optimization strategies, contributing to the company’s sustained profitability in both the motorcycle (Royal Enfield) and commercial vehicles segment (VECV).

Debt to Equity Ratio

The Debt-to-Equity Ratio is a financial metric that assesses a company’s leverage by comparing its total debt to shareholders’ equity. Eicher Motors have a debt-to-equity ratio of only 0.01. As of 30th Sep 2023, long-term borrowings and short-term borrowings was ₹151 cr and ₹118 cr, respectively.

Price to equity (P/E) Ratio

As of now, the company is trading at a Trailing Twelve Months (TTM) Price-to-Earnings (PE) multiple of 30.97x. Royal Enfield remains dedicated to the global expansion of the middleweight motorcycling segment. The company is actively pursuing an extensive growth strategy by expanding its retail presence both in India and international markets, supported by a series of new product launches.

Management Quality & Shareholding Pattern

Siddhartha Lal serves as the Managing Director and CEO of Eicher Motors Limited, overseeing the successful turnaround of Royal Enfield and the Commercial Vehicles segment.

Vinod Aggarwal, Managing Director & CEO of VE Commercial Vehicles Ltd, has held various management roles at Eicher, including CFO from 2005 to 2009.

B. Govindarajan, the CEO at Royal Enfield and Wholetime Director on Eicher Motors’ board, has been with the company for over 23 years, leading various roles and serving as COO at Royal Enfield since 2013.

Coming to the shareholding pattern of Eicher Motors stock, you can check it from the StockEdge App itself.

As of Q2 FY24, the Promoters hold a 49.16% stake in the company. During the same period, Foreign Institutional Investors (FIIs) reduced their stake from 30.28% in Q1 FY24 to 28.89% in Q2 FY24, while Domestic Institutional Investors (DIIs) increased their stake from 10.11% in Q1 FY24 to 10.57% in Q2 FY24.

Future Outlook of Eicher Motors Stock

Royal Enfield maintains its global leadership in the mid-size motorcycle segment (250 cc – 750 cc) and has become the top midweight brand in the U.K. With a market share of 8% in the Americas, 9% in the Asia Pacific, and 9% in the EMEA region, the company has a robust product lineup, including the recently launched Royal Enfield Shotgun and the 2023 Bullet 350 in India. International retail sales are thriving.

In the pursuit of sustainable mobility, the company delivered electric buses and entered agreements with prominent e-commerce and mobility firms for the supply of approximately 1,000 electric trucks and buses. The entire range of buses and trucks has transitioned to BS VI OBD II standards. To meet the demands of the growing e-commerce industry, the company is expanding its footprint in the truck segment by introducing new variants.

Case Study on Eicher Motors

We have a case study report prepared by our team of analysts. This fundamental report on Eicher Motors provides you with a detailed analysis of the company as well as how it stands among its competitors.

As you can see, Eicher Motors stock has rating based on 6 parameters:

- Growth

- Quality

- Profitability

- Efficiency

- Solvency

- Valuation

Based on the above parameters, Eicher Motors stock scored 23/30. Read the case study report here.

Conclusion

In conclusion, Eicher Motors exhibits a robust financial performance, evidenced by its impressive YoY growth in sales, net profit, and EBITDA. The company’s strategic focus on both the motorcycle and commercial vehicles segments, particularly the global leadership in the mid-size motorcycle category, underscores its diversified market presence. The leadership team, led by Managing Director and CEO Siddhartha Lal, has effectively steered the company’s turnaround. With a strong emphasis on sustainability and innovation, as seen in the electric vehicle initiatives and product launches, Eicher Motors positions itself well for future growth. However, investors should remain vigilant about market dynamics and the global economic landscape.

You can also read our earlier blog on investment opportunity in Asian Paints

Happy Investing!