Table of Contents

In this week’s blog, we discuss what is perhaps India’s biggest IPO ever — the LIC IPO.

The Story

At a time when the stock market is dancing to the tune of Russia-Ukraine headlines and rising inflation around the world, India’s largest insurance company has filed its draft red herring prospectus for its IPO.

By selling a 3.5% stake, Life Insurance Corporation of India could be one of the largest stock in India by market cap, ensuring an entry into major indices, e.g., Nifty-50 and Sensex.

Why there is such hype for LIC’s IPO?

According to our analysis, Life Insurance Corporation of India sells nearly 3/4th of all individual policies sold in India. The government is well aware of this, and as a result, they are attempting to tap into the customer base to generate buying interest in the IPO.

We have a logical explanation for the hype: in India, life insurance is primarily purchased as a savings and investment product rather than a protection product.

Given the size of the IPO, the awareness for insurance is also going to increase. And as a result, the demand for insurance products will increase, which will benefit the private insurers as well, & thereby increasing the profitability of the life insurance companies.

Indian Insurance Industry

According to IBEF, India’s insurance industry comprises 57 insurance companies. Twenty-four are life insurers, while the remaining 34 are non-life insurers. Life Insurance Corporation of India is the sole public-sector life insurer.

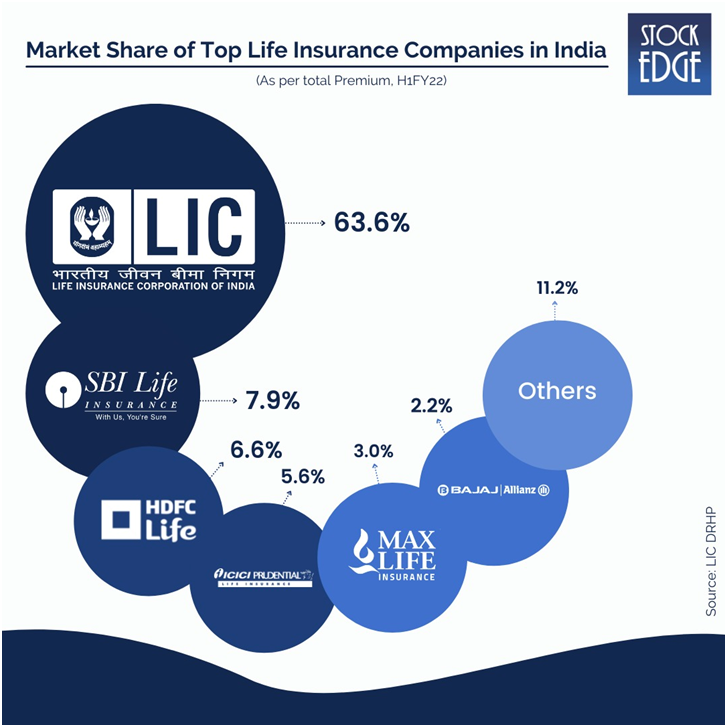

Since the deregulation of the Indian insurance sector in 1999, the market share of Life Insurance Corporation of India has declined dramatically due to the entry of private players.

Life Insurance Corporation of India holds a 63.6% market share by total life insurance premium in India; its premium grew at just 9% CAGR from FY16 to FY21 when private insurers grew at 18% in the same period. The reasons for this low growth include less use of corporate agents/bancassurance distribution (which private insurers such as HDFC Life, SBI Life, Max Life, etc., have used to their advantage to cross-sell to bank customers), as well as a high reliance on individual agents, along with rising acceptance of private life insurers as they have become more established over time, and a low presence in unit-linked insurance plans (ULIPs).

The Amendment that changed LIC’s embedded value!

When we buy an insurance cover for our vehicle each year, the agent asks us a simple question—what do you think is the value of it! In insurance parlance, it is the insured’s estimated value or IEV.

And the same question is asked to Life Insurance Corporation of India. “What is the IEV of LIC?”

To get to that that no., the Govt. has offered a change in how the largest life insurer distributes the surplus it receives from its business between the policyholders and its shareholders.

Let us try to understand the nature of the changes.

Until March 31, 2021, LIC had a single profit basket into which it transferred 5% of the entire premium it earned (from both participating and non-participating policies), i.e. it was a single life fund. This basket was built based on the assumption that of every Rs.100 a policyholder pays to LIC, Rs.5 shall be considered a profit and kept aside accordingly. The rest was kept to pay out insurance claims to the policyholders.

But now, the LIC’s profit basket has been split into two, based on the nature of the policy people bought from it.

Other than ULIPs, which are market-linked policies, LIC and other life insurance companies sell two types of policies. These policies are classified based on the nature of benefits the insured wants.

Non-Participating Plan

Basically, it is a life insurance plan that offers a guaranteed sum assured to the policyholder. Under these plans, bonuses and dividends are not offered to the policyholder.

Participating Plan

Under a participating life insurance plan, which is also known as “with-profits plan”. Insurer shares the profits with the policyholder in form of businesses or dividends. Now, if you are a risk-taker, you may decide to keep the payouts linked to the company’s performance in terms of the profit it earns every year. For both types of policies, the payouts are made from the profit basket of the company.

Budget FY21 wrote in a provision under which this treatment had to be changed. The change brought in was as follows. LIC has to maintain two profit baskets from FY22. In the case of participating plans, the treatment of profits shall continue to be 5% of the total surplus paid to shareholders, rising to 10% by 2025. In the case of non-participating plans, the shareholder claims shall increase to 100%.

The reasons were clear and simple, since the dues to the policyholders can be estimated accurately; any accrual after making allowance for that payout is a profit for the company and therefore belongs entirely to the shareholders.

What is the magnitude of the impact?

By the earlier norm, the present value of the future profits was around Rs 1.05 trillion as of March 31, 2021. However, after applying the new norm, it rises five times to Rs 5.5 trillion as of September 30, 2021.

Making allowances for future options and guarantees, hedging risks and others, the management can claim that their IEV is Rs 5.39 trillion. In other words, this is the embedded value of LIC.

The valuer assumes that the Life Insurance Corporation of India will shift toward non-participating policies, as it is currently doing. As a result, there will be more accrual to the second basket, where shareholder interest will be 100%.

According to Milliman Advisors’ report to the department of disinvestment and asset management, “the increase IEV is due to the shareholders’ interest in the non-participatory funds increasing to 100 percent following the Board of Directors of the Corporation’s decision on 8 January 2022 for the bifurcation of the single policyholders fund into participating and non-participatory funds”.

Road Ahead

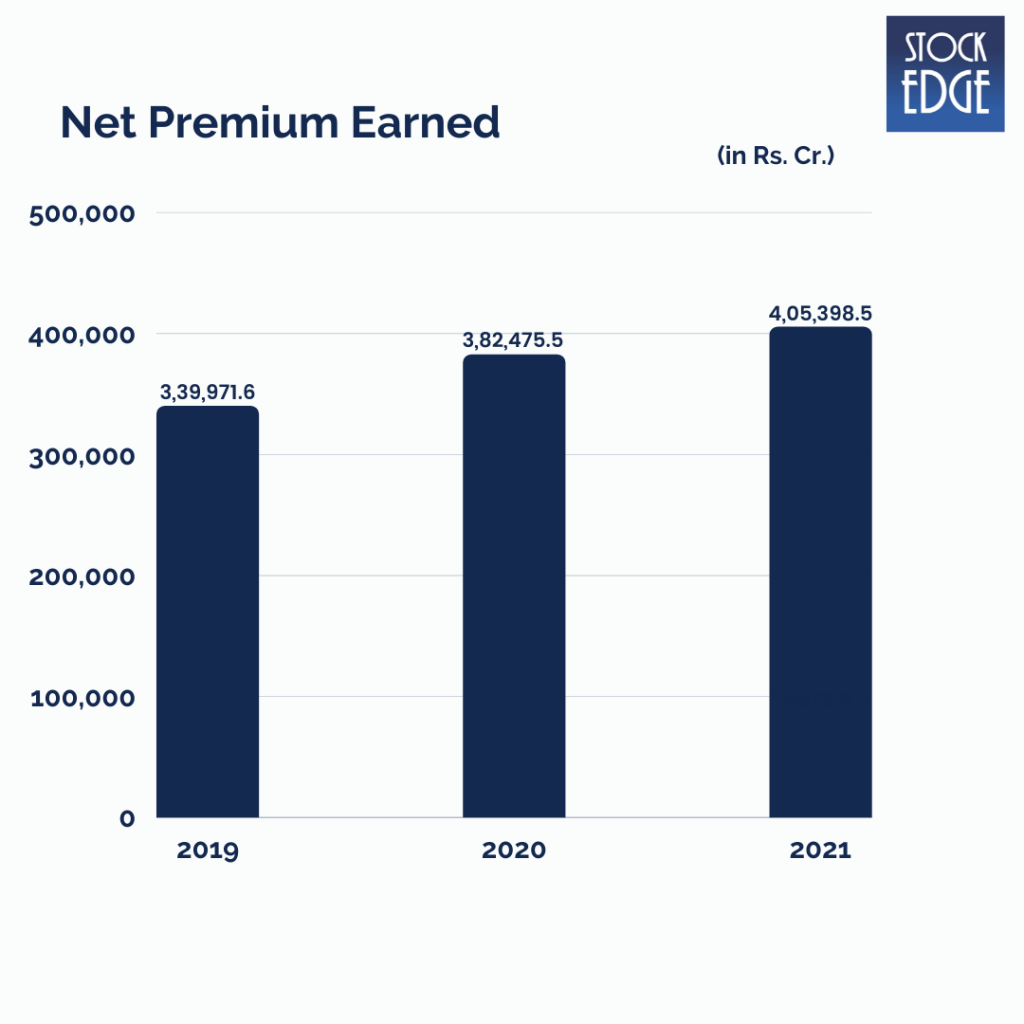

After going through the DRHP, one thing is for sure the future looks bright for the life insurance industry. But with time, the regulations will change, and the industry will evolve concerning the business and customer interaction.

The application of the Internet of Things in the Indian insurance market has expanded beyond telematics and customer risk assessment. In India, there are currently over 110 InsurTech start-ups.

Demographic factors such as a growing middle class, a young insurable population, and a growing awareness of the need for protection and retirement planning will help Indian life insurance grow.

So there you have it. The LIC IPO will be another monumental moment in the country’s insurance’s ecosystem. We’ll know soon enough how the IPO will perform; until then, we wish the company all the best.

Stay tuned to our Edge Report section to get the full detailed analysis of Life Insurance Corporation of India’s IPO, which will be very soon uploaded by subscribing to our StockEdge premium plans.

You can also keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing.