Table of Contents

Today we are going to discuss about Intellect Design Arena, which provides software products to retail, corporate banking, Insurance & Treasury. The Company is in a transition from a product company to a platform company.

The Story

Intellect is a Digital Financial Technology and Products Company catering to the Banking and Financial services institutions (BFSI) domain. They partner with these institutions to transform their business. They have a profound understanding of these Domains, and they have been working with these Global leaders for over three decades. Interims with unparalleled depth and span of functional richness– that helps to accelerate their client’s growth and transformation. As of today’s date, this is Intellect Design Arena share price.

They have flexible Business models that suit their customers’ differing investment and risk appetites. Their algorithmic delivery methodology is robust to ensure defect-free, on-time deliveries while being agile and sensitive to the dynamics of their Customers’ priorities.

Intellect’s customers include Banks- that cater to Retail or Corporate customers, Central Banks, Wealth Managers and Private Bankers, Card issuers, Capital Market participants such as Brokers, Custodians, Asset Managers, Insurance Carriers, Government enterprises and Retail chains.

The Business Model of Intellect Design Arena

They operate in three Business models:-

Traditional Product Sale Model: In this model, they license the Product to the Customer for use on-premise. The Customer pays them for Maintenance of the Product during the period of License. They also earn revenues in the Implementation of the Product and for any Customization carried out for the Customer. They also work with some Customers in supporting the Product and the Business throughout the License with the onsite presence of personnel / remote support.

Customer-Centric Partnership Model: They collaborate with the customers as their Strategic Technology partners and work on their Technology/ Business roadmap. As this blueprint is translated to action, they take on implementation/support roles for their Business or Operations transformation agenda. They are paid for their services apart from any Intellectual Property licenses that they may grant their clients for use in this transformation journey.

Cloud deployment/ Subscription based Revenues: For customers who do not wish to take on the Investment in Technology Infrastructure and the complexity of managing them, they offer their products and platforms on the Cloud deployment model – either in a unique hosting arrangement or through an independent Cloud Services provider. They receive revenues through Product licensing; Cloud set up, Hosting, Subscription revenues – either fixed or linked to Customers’ Business metrics.

Who are their competitors?

In Consumer Banking, their competitors are Mambu, Thought Machine, nCino, Temenos, Oracle Flexcube, Infosys Finacle and TCS Bancs. In Corporate Banking, they have Finastra, Bottomline Technologies, ACI, Reval competing against them, while in Treasury, it’s Finastra, Guava and Finacle. Finally, they compete with Guidewire, Duck Creek, and Carpe Data in Insurance.

Why do clients prefer them over their competitors?

1. Architectural superiority – They present a unified architecture that simplifies integration with other applications and the Ecosystem. Their architecture is open, Micro services based, Application programming interface led and Cloud-ready. This supports the Composability requirement of their Customers.

2. The depth and breadth of their Functionality – Owing to their long association with the Global leaders in the Financial space, their Products offer the maximum spread of functional richness, configurability and detailing. These are expressed in terms of User Journeys or Packaged Business Capabilities in their catalogues.

3. Ability to curate solutions specific to a Customer or Geography – They can observe the specific Customer’s User Journey or Market practice and curate solutions that best fit the scenario rather than pushing a generic product. This ensures a high fit to the requirement.

4. Their delivery promise – Their design thinking led delivery methodology is robust with defined Product Adoption Documents (iPADs), Product Walkthroughs, comprehensive Test scenarios and test cases and Deployment readiness checks while being agile enough to the dynamics of Customer’s Business priorities.

5. Their flexible Business models – Depending on the Customer’s appetite for Investment and managing the complexity of technology, they have flexible Business models for technology adoption. Almost all of their products are available on the on-premise or Subscription/ Cloud deployment model- with infrastructure hosted by Intellect or an independent vendor. Intellect also offers skin-in-the-game models, tying the cost to the Business growth metrics of the Customer.

6. Reference ability and Recognition – Most of their Products have # 1 or # 2 ratings and repeatedly figure in the Leadership Quadrants published by Global Analysts. Their Installed expanding base – of over 260 customers – provides them excellent reference ability for other Deal wins.

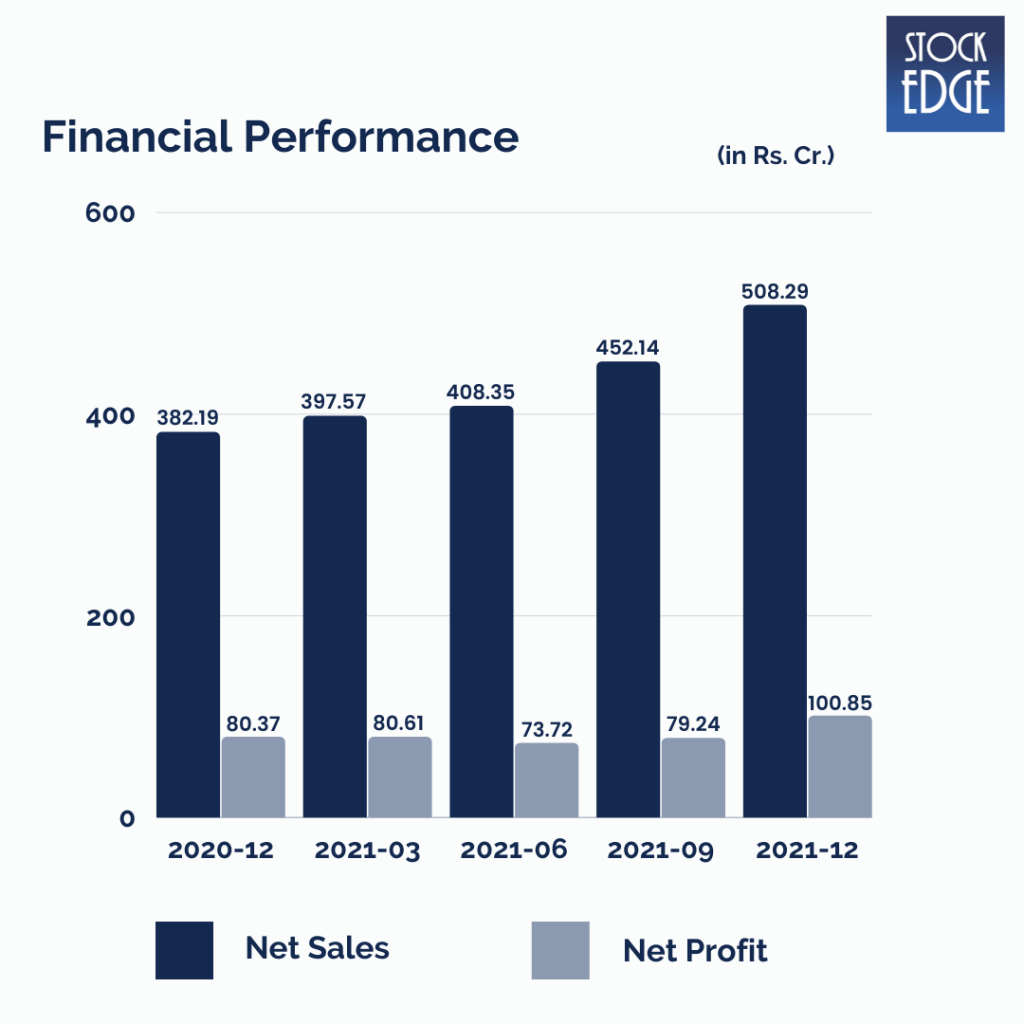

Let’s look at the Financials of Intellect Design Arena.

Intellect Design Arena’s net profit increased to Rs.100.85 cr for the 3rd quarter ended December 31, 2021 (Q3FY22) from Rs.80.37 cr in Q3FY21. The Company’s revenue from operations increased 33% to Rs. 508 crore, up from Rs.382 crore in the same quarter the previous year. The revenue growth was aided by license revenue. Cash and cash equivalent was Rs.433 cr at the end of the quarter.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Road Ahead

The transition of Intellect Design Arena from a product-based to a platform-based business is likely to improve the margin profile. The Company closed 29 deals in Q3FY22, including ten platform deals and 11 digital transformation deals. Intellect identified three levers for increasing margins: i) continued to win destiny deals; and ii) continued to win destiny deals (i.e., large-scale deals; the number of such deals has increased from 42 in Q3FY21 to 57 in Q3FY22). iii) A revenue mix that favours revenue from licences. iii) Pricing, i.e., they have already begun discussions with clients about raising prices.

However, as with such companies, there exist risks like a deceleration in bagging new deals and low margins that could impact the performance of the Company.

So we will have to wait and see how the Company develops from here on out.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!