Table of Contents

What Are Gold ETFs and Why Invest in Them?

For centuries, Indians have had a strong inclination towards Gold, mainly as a currency or a medium of exchange. Gold has been a symbol of wealth, power and prestige for many religions and cultures.

Gold Exchange Traded Funds, or Gold ETFs, have become the most popular investment choice for savvy investors looking to diversify their portfolios, hedge against inflation, and protect their wealth from market volatility.

Gold ETFs are exchange-traded funds that track the domestic price of gold bullion having 99.5% purity. Fund managers either hold physical Gold or trade in derivatives. These are passive instruments reflecting the fair price of Gold.

There are around 18 ETFs that mirror the price of Gold. But with so many options available, how do you choose the best ones?

In this blog, we spotlight the five best Gold ETFs in India that have consistently delivered impressive returns. Backed by solid data, we’ll explore their past performance, management quality, and liquidity, along with key benefits that set them apart from other investments.

Discover why these top-performing Gold ETFs could be the shining stars in your portfolio and how recent tax changes make them even more appealing.

Benefits of Investing in Gold ETFs

Apart from the physical Gold, Gold ETFs also offer many benefits to investors over investing in physical gold. Some of them are listed below:

Liquidity

Gold ETFs offer high liquidity to investors, as they can be easily bought and sold on the stock exchange during a trading session at a prevailing price. On the other hand, physical gold is illiquid and usually takes a longer time to convert in cash, usually three to seven days. Selling physical gold especially in jewelry form is also a big challenge in India.

In comparison with traditional investment instruments like fixed deposits, bonds and government savings schemes which come with a pre-fixed lock-in period, gold ETFs do not come with a lock-in period and can be sold anytime on stock-exchanges.

Cost-Effective

Gold ETFs are cost-effective and affordable to small investors. Investors can start by investing in 1 unit of Gold (equivalent to 0.01 to 1 gram of Gold). The price of gold ETFs begins from as low as ₹50, whereas physical Gold requires a large amount of money.

For example: Gold BeES is available in 0.01 gram of Gold on stock exchanges and currently trading at a price of ₹63.

Additionally, there are no making charges when you invest in gold ETFs. Owning physical Gold comes with storage and security concerns. Gold ETFs eliminate these worries as investors do not need a locker to store the metal physically.

Transparency

Gold ETFs offer a transparent and real-time price to investors. The purity of the gold ETFs is guaranteed, and each unit is backed by physical gold with 99.5% purity.

With gold ETFs, there are no hidden charges, such as making charges, storage charges, etc. Physical Gold is also subject to wealth tax, value-added tax and sales tax, which is not valid for gold ETFs.

Diversification

Gold ETFs reduce risk during market fluctuations. Diversifying a small portion of the total gold portfolio helps deal with market volatility.

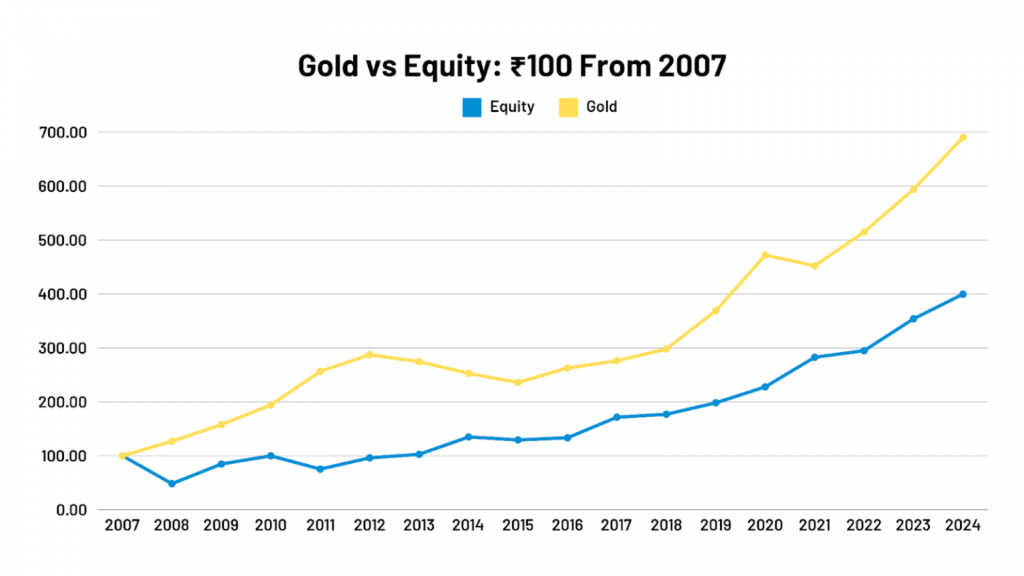

As per historical data, precious metals like gold and silver tend to have a low correlation with other asset classes like stocks and bonds, so investing in gold ETFs and silver ETFs can help investors reduce the overall risk of their investment portfolio. It also offers a hedge against the downside risk of equity markets.

The Criteria for Selecting the Best Gold ETFs

With more than 18 ETFs tracking India’s domestic gold price, it is essential to understand how you select the right fund that will optimize the returns and, in turn, the portfolio returns.

Here are a few selection criteria to consider before investing in an ETF:

Expense Ratio

Asset Management Companies (AMC) incur certain costs in the day-to-day management of the fund. These costs refer to the expense ratio charged by the fund manager.

Total Expense Ratio (TER) represents the total annual fees charged by the fund. Investors should look for ETFs that have a low expense ratio. A lower expense ratio will generate higher returns in the long run.

Comparing the TER across all Gold ETFs can help identify the most cost-effective options.

Tracking Error

Tracking error is a factor to measure how closely an ETF follows the index to which it has a benchmark. In simple terms, a Tracking error is the difference between the performance of an ETF and the index it replicates (here, it is a domestic Gold price).

A high tracking error means the fund’s return is likely to deviate more from its benchmark’s performance resulting in low returns. Investors should look for best Gold ETFs that have low tracking errors that will mirror gold prices more accurately. You can check the data on the AMFI website or the Fund’s Factsheet released by AMCs.

Pro Tip: The inflows/outflows into the fund and the minimum cash position required to meet redemption requests are the main factors that affect the tracking error.

Liquidity Aspect

As ETFs are bought and sold on stock exchanges, liquidity is a crucial aspect. Investors should check the daily traded volume data on the stock exchanges, along with the bid-ask spread, to ensure smooth order-matching.

High liquidity in an ETF will allow you to cater for any sudden financial needs instantly. It will make sure the ETFs are traded quickly without significant price impact.

Also, check how the Gold ETF has performed in different market conditions to see how strong and reliable it is.

Performance History

It is an important criterion to check the past performance of the fund. Although historical returns do not guarantee future returns, reviewing past performance gives a significant insight into the fund’s ability to generate similar returns across different market conditions.

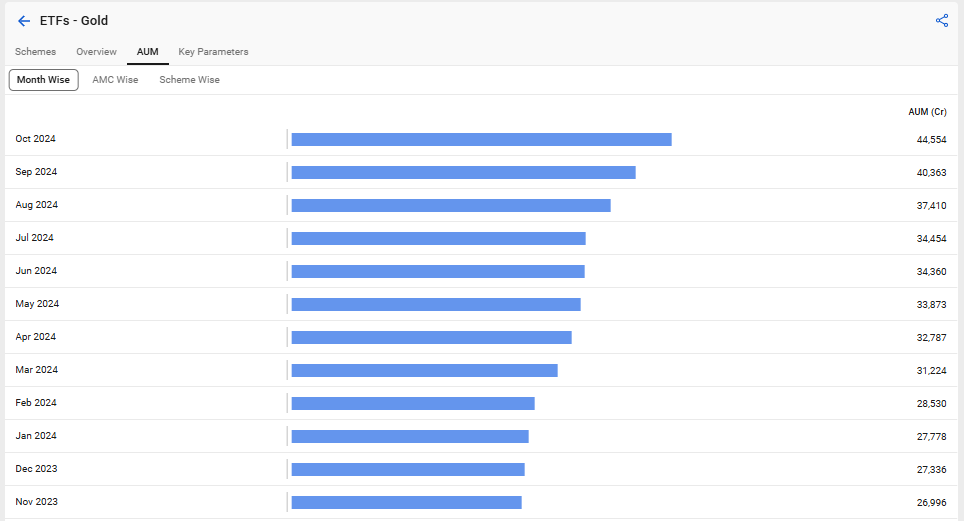

Also, look at how many assets the ETF has; a better asset under management and a strong track record give more reliability to the AMC’s brand.

The Top 5 Gold ETFs in 2024-25

Here is a list of the 5 best gold ETFs for investment in the Indian Stock Market: (all data as on 27th-Nov-2024)

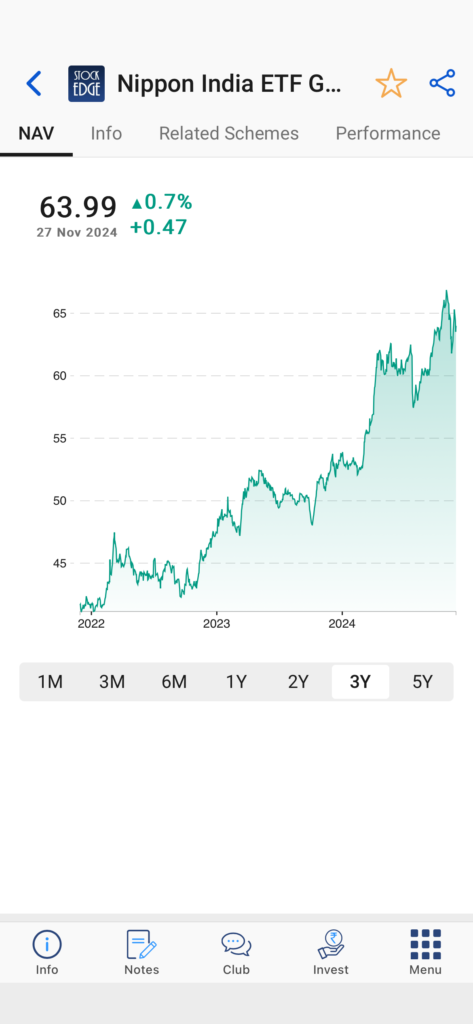

Nippon India ETF Gold BeES

Fund Name: NIPPON INDIA ETF GOLD BEES

SYMBOL: GOLDBEES

NAV: Rs.63.99

AUM: Rs.15,248 crore

Expense Ratio: 0.81%

Tracking Difference: -0.99%

Volume: 125.59 Lakhs

Risk: High risk

Minimum lump sum investment: Rs.10,000

The fund has given annual returns of 22.45% in 1 year and 13.88% p.a. in 5 years time frame.

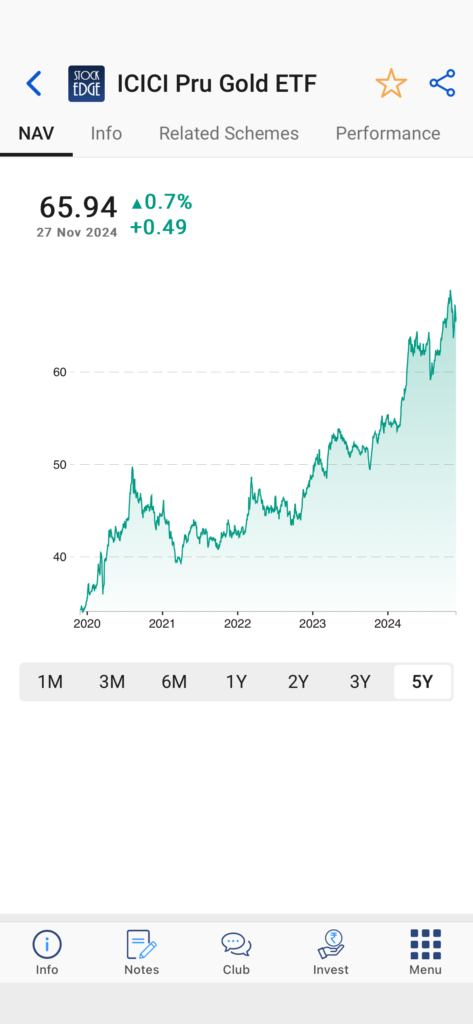

ICICI Prudential Gold ETF

Fund Name: ICICI Pru GOLD ETF

SYMBOL: GOLDIETF

NAV: Rs. 65.94

AUM: Rs. 5531 crore

Expense Ratio: 0.50%

Tracking Difference: -1.10%

Volume: 15.15 Lakhs

Risk: High risk

Minimum lump sum investment: Rs.5,000

The fund has given annual returns of 22.67% in 1 year and 13.98% in 5 years time frame.

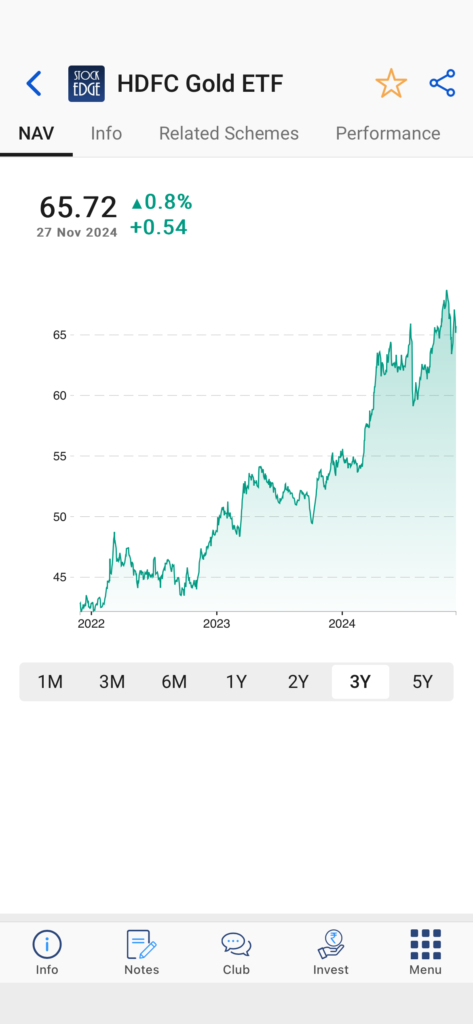

HDFC Gold ETF

Fund Name: HDFC Gold ETF

SYMBOL: HDFCGOLD

NAV: Rs. 65.72

AUM: Rs. 6615 crore

Expense Ratio: 0.59%

Tracking Difference: -0.90%

Volume: 24.70 Lakhs

Risk: High risk

Minimum lump sum investment: Rs.5,000

The fund has given annual returns of 22.65% in 1 year and 13.97% in 5 years time frame.

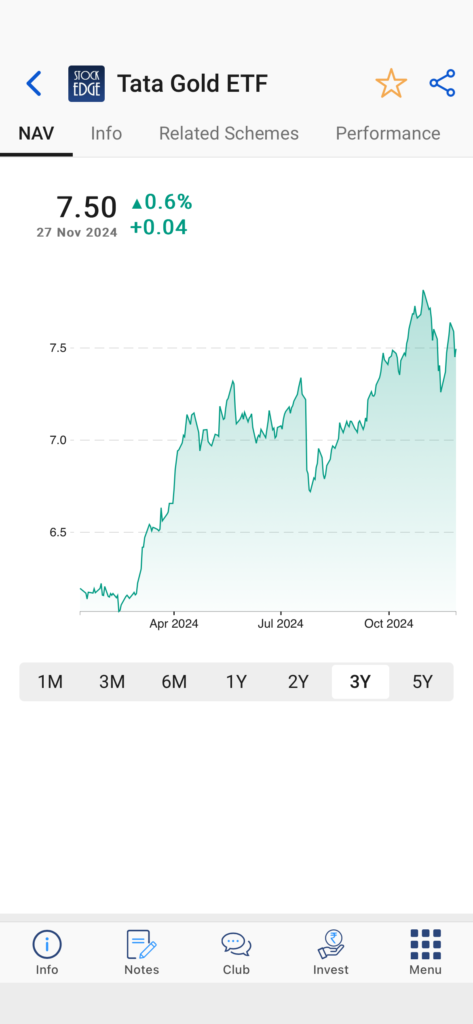

Tata Gold ETF

Fund Name: TATA GOLD ETF

SYMBOL: TATAGOLD

NAV: Rs.7.49

AUM: Rs. 254 crore

Expense Ratio: 0.38%

Tracking Difference: -2.28%

Volume: 54.50 Lakhs

Risk: High risk

Minimum lump sum investment: Rs.100

The fund began operations on 12th Jan 2024 and has given returns of 21.49% since its inception.

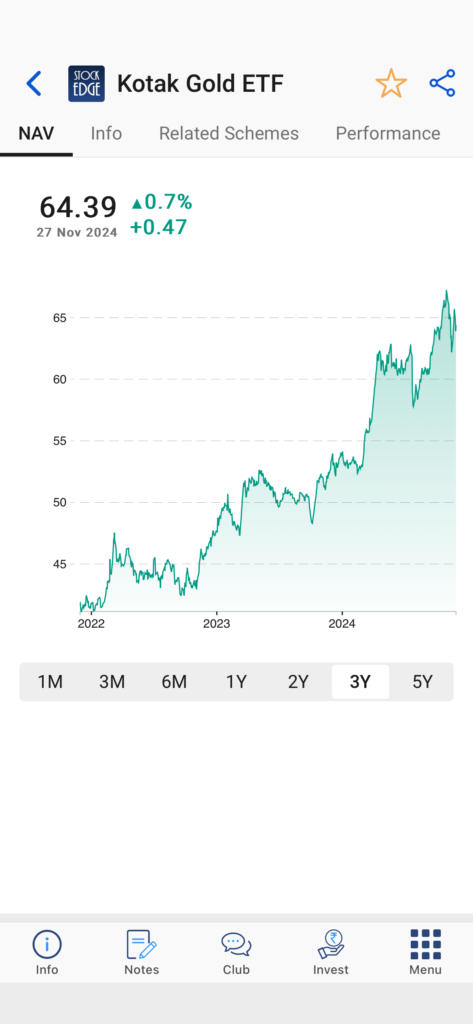

Kotak Gold ETF

Fund Name: Kotak Gold ETF

SYMBOL: GOLD1

NAV: Rs. 64.38

AUM: Rs. 5319 crore

Expense Ratio: 0.55%

Tracking Difference: -1.08%

Volume: 9.05 Lakhs

Risk: High risk

Minimum lump sum investment: Rs.100

The fund has given annual returns of 22.63% in 1 year and 14.08% in 5 years time frame.

Tax Upshot on Investing in Gold ETFs

For effective financial planning, understanding the tax structure is one of the most crucial aspects.

In the Union Budget 2024, there has been a significant relief for taxation in Gold ETFs.

The table below shows the comparison of old taxation and new taxation post-Union Budget 2024 for both short-term capital gains and long-term capital gains.

| Asset Type | Holding Period (STCG) | Taxation(STCG) | Holding Period (LTCG) | Taxation(LTCG) |

| Old Rule | ||||

| GOLD ETFs (Before 1st April, 2023) | Less than 36 months | Slab Rates | More than 36 months | 20% (with indexation) |

| GOLD ETFs (After 1st April, 2023) | Always short-term | Slab Rates | Always short-term | Slab Rates |

| New Rule (2024) | ||||

| GOLD ETFs (Before 1st April, 2023) | Up to 12 months | Slab Rates | More than 12 months | 12.50 % |

| GOLD ETFs (After 1st April, 2023)* | Up to 12 months | Slab rates | More than 12 months | 12.50 % |

* GOLD ETFs (After 1st April, 2023) will be effective from April 1,2025.

Gold ETFs are non-equity instruments, and the new taxation is now at par with equity taxation, with LTCG tax charged at 12.5% when held for more than 12 months.

However, in the case of physical Gold or gold mutual funds, the holding period has now been reduced to 24 months from 36 months to consider for Long-Term Capital Gains. To learn more about the new tax structure of mutual funds, click here.

This tax changes in the Union Budget makes Gold ETF more attractive apart from the benefits offered by the ETFs like ease and convenience of investing in ETFs.

The Final Notes

Investing in Gold ETFs is an intelligent way to diversify your portfolio, protect against inflation, and reduce the impact of market ups and downs. However, it’s important to do your own research and consult a financial planner for the proper asset allocation.

Gold ETFs provide an easy and affordable way to diversify your investments and achieve your financial goals. By looking at the top-performing Gold ETFs in India and checking factors like performance, management, and liquidity, you can make better investment choices. Recent tax changes have also made Gold ETFs a more attractive option for investors seeking to diversify their portfolios.

FAQ’s (Frequently Asked Questions)

How do I buy Gold ETFs?

Gold ETFs are traded on the stock exchange ( NSE or BSE) just like stocks. To invest in Gold ETF, investors must have a demat account with a stockbroker.

Why should I invest in Gold ETFs instead of physical gold?

Gold ETFs are cost-effective, provide transparency and are more liquid than physical gold. Gold ETFs are also tax efficient and offer a hedge against other asset classes. However, if you want to buy Gold for ornamental use, then physical Gold is preferred.

Are Gold ETFs safe investments?

In comparison with physical Gold, Gold ETFs are safer options as they come with 99.5% purity and protect investors from theft. Gold ETFs have tight regulations and can be purchased on exchanges on a real-time basis.

Can I redeem my Gold ETF for physical gold?

No, you cannot redeem a Gold ETF for physical Gold. Instead, you can buy and sell gold ETFs just as you would trade in stocks in exchange for cash.

What are the costs associated with Gold ETFs?

The costs associated with Gold Exchange Traded Funds (ETFs) include brokerage fees, expense ratios, STT tax, and Depository (DP) charges.

Can Gold ETFs lose value?

Prices of Gold ETFs are directly linked to the domestic price of Gold. Any fall in the value of Gold will directly affect the ETF price. Hence, gold ETFs can lose or gain value based on the fall and rise in gold prices.